NASDAQ is the world’s largest electronic stock exchange, operating entirely online, which increases transparency and shortens trading time. This article will help you understand what NASDAQ is, its history, how it works, and why NASDAQ attracts investors.

What is NASDAQ?

NASDAQ explained

NASDAQ (National Association of Securities Dealers Automated Quotations) is the second largest stock exchange in the United States, after the New York Stock Exchange (NYSE). NASDAQ is the world’s first and largest electronic exchange, where stocks of leading technology companies such as Apple, Microsoft, Google, Amazon, Meta (Facebook), Tesla… are listed.

Unlike the NYSE, the NASDAQ operates entirely on an electronic platform. This makes the buying and selling of stocks quick, transparent, minimizes human intervention and optimizes transaction costs.

- Visit the website of NASDAQ Stock Exchange: https://www.nasdaq.com/

>>See more:

- What is the NYSE? Understanding the New York Stock Exchange

- Market Cap Stocks: What They Are and Why They Matter for Investors

- What is Stock Liquidity? Why It’s Important for Investors

- Primary vs Secondary Market: Key Differences Explained

History of the NASDAQ

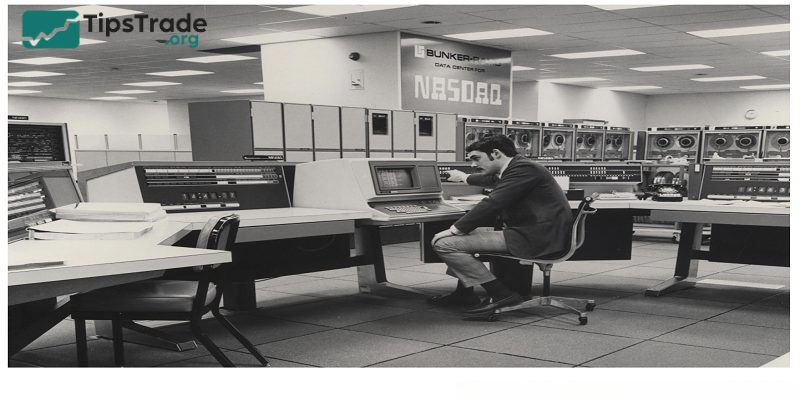

Nasdaq was founded in 1971 by the then National Association of Securities Dealers (now known as FINRA). At first, Nasdaq was just a quotation system, also known as an electronic ticker of the buy and sell price, but they began to be added to trading systems.

In 2002, Nasdaq became a fully independent and publicly traded company.

In 2006, it was registered by the SEC as a national securities exchange.

In 2007, Nasdaq merged with the Scandinavian exchange group OMX to become the Nasdaq OMX group.

Nasdaq does not have and never has had a physical trading floor. This became a big problem for the exchange in 1995 when large companies like Microsoft threatened to leave. No trading floor meant no physical presence and, more importantly, no place for media networks to broadcast during the trading day.

The whole Nasdaq thing was solved in 2000 with the construction of a giant 10-story tower on the corner of 43rd and Broadway in New York City, called MarketSite, complete with video screens, a full television studio, and a doorbell. But the actual trading remained electronic.

How many companies are on the NASDAQ?

There are more than 3,000 companies publicly traded on the Nasdaq stock exchange. To be part of the Nasdaq Composite Index, a company must be exclusively listed on the Nasdaq market, so some companies are left out of the index.

The companies range from Magnificent 7 tech giants like Apple and Meta to smaller companies like 1-800-Flowers.com. While the Nasdaq includes companies from all industries, tech is by far the most represented sector.

How does NASDAQ work?

Nasdaq operates as an electronic, dealer-based market, where trades are executed through a network of market makers instead of a centralized location like the New York Stock Exchange (NYSE). Here’s an overview of how Nasdaq works:

- Electronic trading: Nasdaq was the first exchange to introduce electronic trading, which means that buy and sell orders are matched electronically without the need for physical trading floors. This automated system enables faster and more efficient trade execution.

- Market makers: In the Nasdaq system, market makers are essential to maintaining liquidity and stability. These are firms or individuals responsible for buying and selling a specific stock at the quoted bid and ask prices. They stand ready to buy or sell shares to ensure smooth trading and to narrow the spread between the bid and ask prices. There can be multiple market makers for a single stock, promoting competition and better pricing.

- Bid-ask spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) is known as the bid-ask spread. Market makers profit from this spread by buying at the bid price and selling at the ask price.

- Listing requirements: Companies that wish to list their securities on Nasdaq must meet specific financial and regulatory requirements, such as a minimum number of shareholders, market capitalization, and financial disclosures. These requirements ensure the quality and credibility of the listed companies.

- Trading hours: Nasdaq is open for trading between 9:30 am and 4:00 pm Eastern Time, with additional pre-market and after-hours trading sessions available for investors.

How to list scrips on NASDAQ?

In order for a company to be listed on the Nasdaq, it must comply with the following regulations and meet the following conditions:

- At least 100,000 public float shares

- Total assets of at least 4,000,000 USD

- Minimum equity of USD 2,000,000

- At least two dealers/market makers

- The minimum bid price for the company’s shares is $3.

- Market value of freely transferable shares of at least 1,000,000 USD

- Registered with the U.S. Securities and Exchange Commission (SEC)

The application review process can take up to six weeks. Once approved, the company will be listed on one of three markets:

- Global select market: Includes international companies and U.S. stocks, classified based on market capitalization. Companies that qualify for this tier must meet Nasdaq’s strict standards. Companies in the Global Market tier are reviewed annually by Nasdaq’s Listing Review Department and, if qualified, may be promoted to the Global Select Market tier.

- Global market: Considered a market for mid-cap companies, including stocks listed in the US and internationally.

- Capital market: Formerly known as the SmallCap Market by Nasdaq, it includes a large list of smaller capitalization companies.

Key indexes of the NASDAQ exchange

In addition, NASDAQ is not only a stock exchange but also has important indexes that reflect the market situation:

- NASDAQ Composite: It is a composite index of all stocks listed on the NASDAQ, including more than 3,000 companies. It is one of the most important stock indexes, especially for investors interested in the technology sector.

- NASDAQ-100: The index includes the 100 largest non-financial companies on the NASDAQ. The stocks in the NASDAQ-100 are often leading technology companies such as Apple, Microsoft, Google, Amazon, Tesla…

- NASDAQ Financial-100: The index includes the 100 largest financial companies on the NASDAQ, including banks, insurance companies, investment funds…

These indexes help investors track the performance of technology and financial companies and the entire NASDAQ market as a whole.

Why does NASDAQ attract investors?

NASDAQ is an attractive stock exchange for investors thanks to the following advantages:

- Large scale, high liquidity: NASDAQ has about 4,000 listed companies, with a total market capitalization of about 30 trillion USD, ensuring good liquidity for investors.

- Focus on technology companies: NASDAQ is the listing place of the world’s leading technology corporations, providing attractive investment opportunities for those who want to participate in the development of this industry.

- Fast and transparent transaction system: NASDAQ uses a fully electronic trading system, allowing buy and sell orders to be matched quickly in milliseconds. The Market Maker mechanism ensures high liquidity, reducing the difference between buying and selling prices. All transactions are displayed transparently in real time, helping investors access accurate information.

- In line with modern investment trends: As the world moves towards digitalization, NASDAQ becomes an ideal destination for investors who love technology stocks.

Conclusion

NASDAQ is one of the largest and most prestigious stock exchanges in the world, focusing on many leading technology companies. With advantages in investment opportunities, index balance and the ability to limit risks. Read articles about Stocks knowledge of Tipstrade.org through the following articles!

See more: