Price action is a trading method that is simple yet effective. So, what is price action, and should you trade using the price action method? Let’s explore this trading method together in the article below.

What is price action?

What is price action? Price action is a fundamental trading method that any trader needs to know. In simple terms, this method is based on the fluctuations of an asset to make decisions. In price action trading, traders only focus on candlestick charts and information related to price movements as the basis for decision-making, completely ignoring indicators. The person who first laid the foundation for this method is the legendary Japanese speculator – Munehisa Homma.

Advantages and disadvantages of the price action trading method

Advantages of the price action method

- Simple and easy to use: What is price action is a straightforward analysis and trading method. Traders do not need to rely on technical indicators that require complex calculations. Instead, they observe and make decisions based on changes in candlestick patterns on the chart. Moreover, price action signals are relatively easy to identify and trade.

- No lag: This method relies on price charts, which are continuously updated daily and hourly. As a result, traders can quickly anticipate market trends and make timely, well-informed decisions.

- Stimulating critical thinking: When using what is price action, traders actively evaluate the market and make their own trading decisions rather than mechanically depending on indicators. This allows them to demonstrate their skills in observation, analysis, and market judgment.

Disadvantages of the price action method

- Subjective in nature: What is price action can be an advantage for experienced traders but a drawback for beginners, as all decisions depend heavily on the trader’s personal interpretation.

- Not absolutely accurate: In highly volatile markets, relying solely on price movements to make decisions can easily lead to mistakes. In cases of price manipulation, traders may be misled and face potential losses.

- More time-consuming: This approach requires more time to monitor and understand market movements, which can be a disadvantage for many traders.

Analysis tools in price action

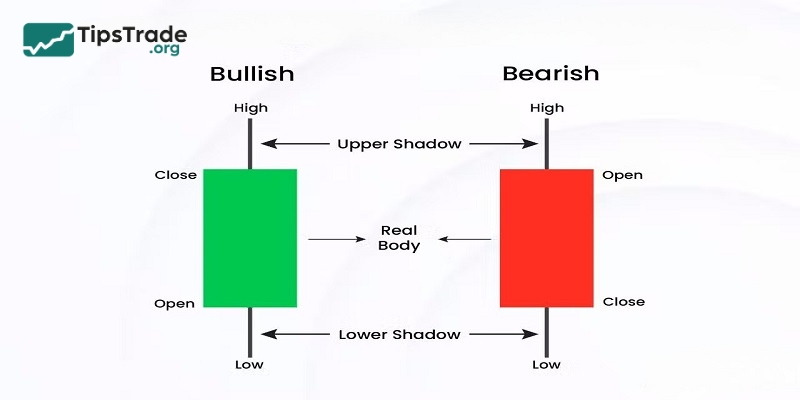

Based on a single candlestick

In a candlestick chart, a single candle can provide information about the opening price, closing price, highest price, and lowest price during a trading session. Furthermore, the color of the candle, the length of the body, and the wicks can all reflect the trends of buyers and sellers in the market.

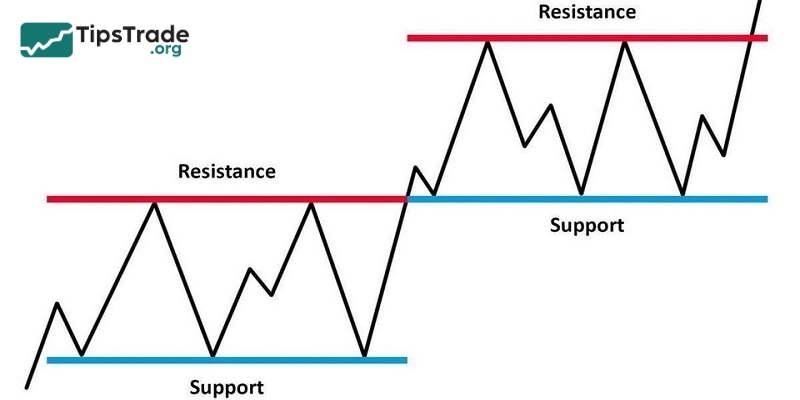

Support and resistance

Identifying support and resistance zones on a price chart helps investors find price ranges where the price shows signs of reversing or slowing down before continuing the trend. In the price action method, investors often choose these areas to trade.

When the price reaches the resistance zone, it will reverse downwards or stall. Investors may consider selling their assets.

When the price drops to the support level, it will either reverse and increase or stabilize. Investors can consider entering a buy order.

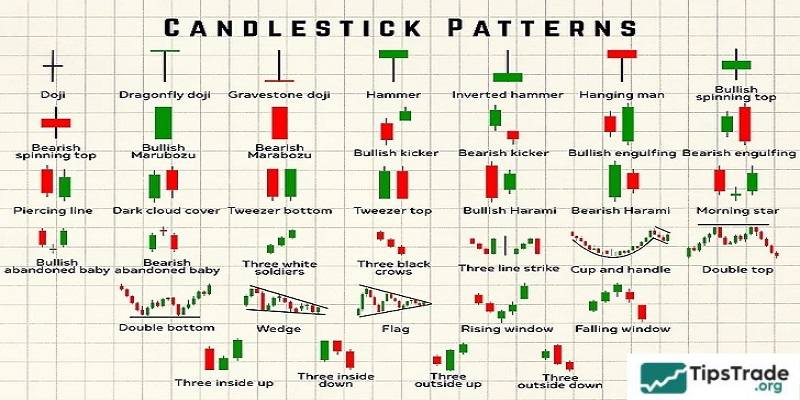

Candlestick patterns

Traders can observe candlestick patterns to gain deeper insight into market behavior and better predict price trends. Some candlestick patterns can signal potential price reversals, helping traders make timely decisions and avoid losses. Examples include Doji, Hammer, Shooting Star, Pin Bar, and others.

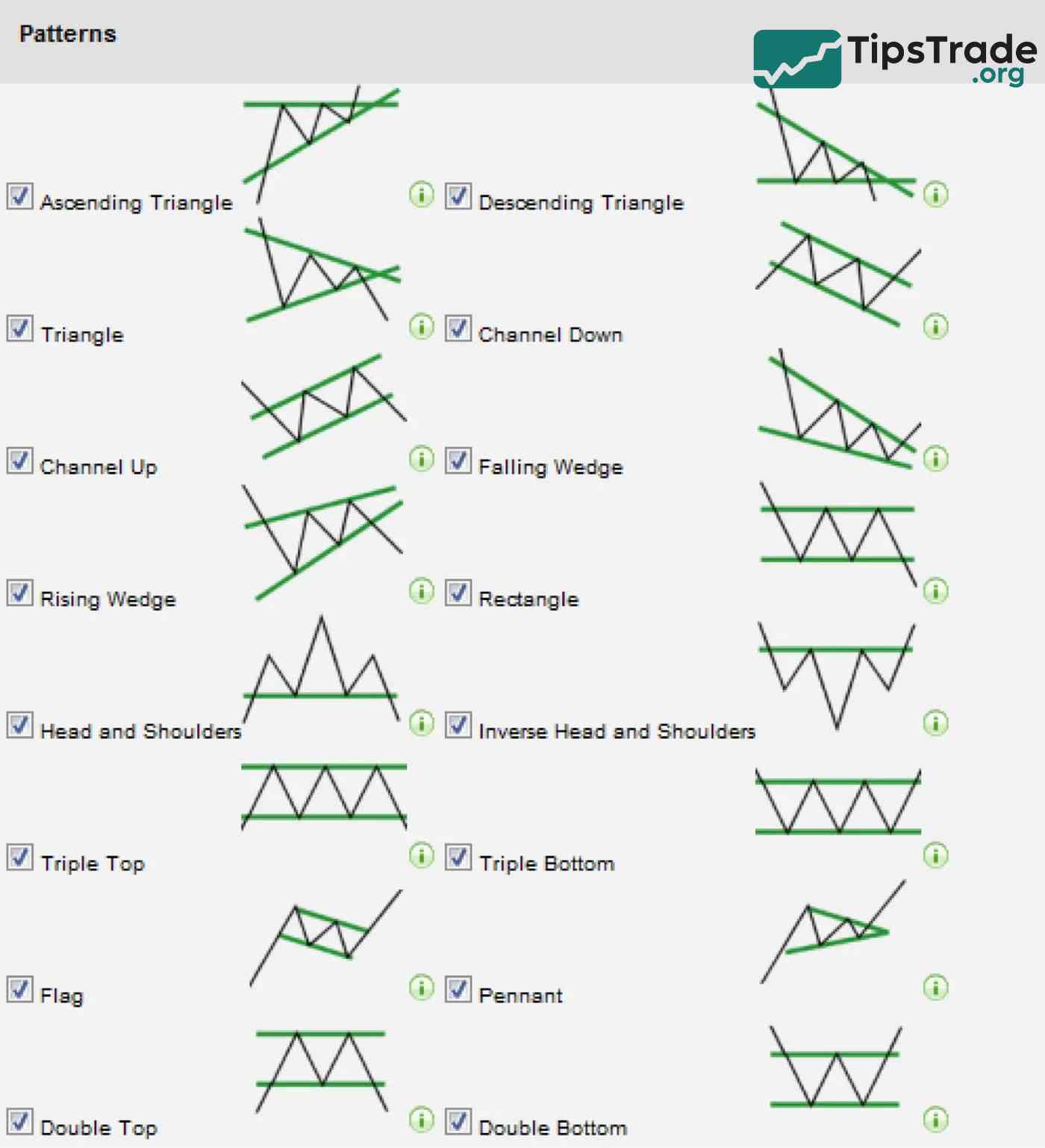

Chart patterns

By combining multiple candlesticks over a certain period, traders can identify chart patterns. Based on these patterns, traders can assess market sentiment and anticipate future price movements. Examples include the Head and Shoulders, Cup and Handle, Double Top, and Double Bottom patterns.

Some price action trading strategies

The price action trading method is quite popular, but not everyone trades successfully. Therefore, we will share with you some of the most effective trading tips using this method:

Pullback trading

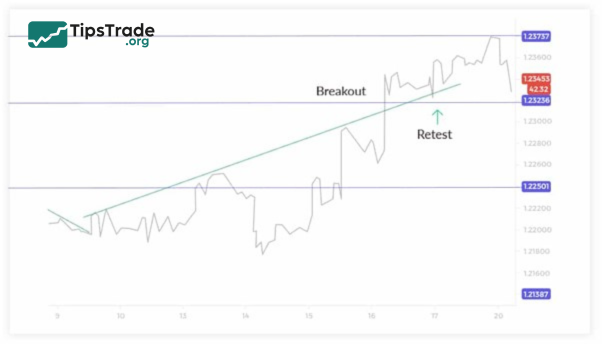

This is the trading method that most investors are choosing – trading based on the Pullback strategy. This means that investors will execute trades based on price corrections that go against the main trend of the market, while also retesting resistance or support zones. Specifically:

- Identify important support and resistance zones

- Wait for the price to break through that area

- Wait for the price to pull back and retest

- Enter the trade and wait

Trading with reversal candlestick pattern strategies

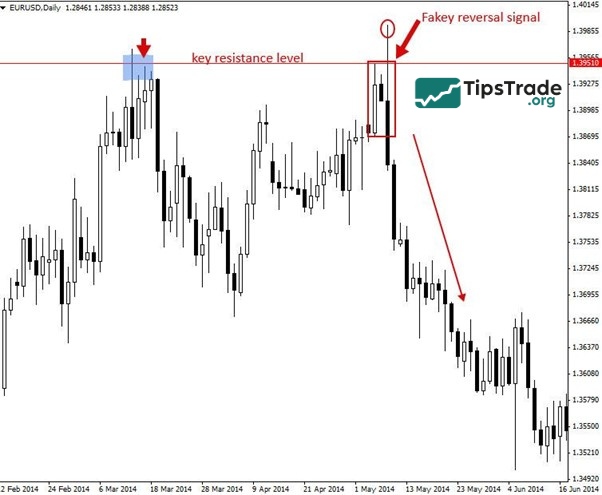

The next strategy commonly favored by traders is reversal price action trading. The key principle is to accurately identify support and resistance levels in order to gain a price advantage and enter trades at the most optimal price points. Specifically, the process includes:

- Identify important support and resistance zones

- Wait for the price to reach and react at those support or resistance zones

- Wait for a reversal candlestick pattern to appear

- Enter the order and wait

Breakout trading

In trading, what investors are most likely looking forward to is a breakout trade. At that time, the market marked a completely new trend, breaking away entirely from the current sideways trend. And the two ways investors trade breakouts are as follows:

Enter the trade immediately after a successful breakout, when the price line crosses the support or resistance level. The market after the breakout has a clear trend: either a strong increase or a deep decline. To be more certain, investors need to patiently wait for the price line to break out of the trendline before they will find higher profit opportunities. Specifically:

- Successful breakout, the price line crosses the resistance line from bottom to top. The investor placed a buy order at the breakout point.

- Breakout successful, the price line cuts the support line and heads downwards. The investor placed a sell order at the intersection point.

Investors should watch for signal retests and avoid false breakouts.

Steps to trade using price action

To build an effective and detailed trading strategy, you should follow a basic trading process using the price action method as outlined below:

Step 1: Define your trading style

Price action signals often appear quite infrequently, so this method is generally more suitable for medium or long-term traders rather than scalpers.

Step 2: Build a trading system

To create a trading system, traders should prepare the following two key elements in advance:

- Trading instruments: Any asset class that is influenced by supply and demand, as well as the interaction between buyers and sellers.

- Timeframes: Higher timeframes such as H1, H4, D1, or W1 are well suited for the price action approach. Note that closely observing price movements on the chart is essential in order to identify the right moments to place trades.

Step 3: Develop a trading strategy

First, traders need to identify key support and resistance levels on price charts, and it is especially recommended to determine the yearly high and low levels. Next, identify the current price trend and recognize chart patterns to make informed trading decisions. Finally, traders execute trades, set take-profit targets, and place stop-loss orders.

Step 4: Capital management and risk control

This step must be carried out throughout the entire process of building and operating a trading system. It is extremely important, as it determines capital allocation, position sizing, stop-loss levels, and profit-taking strategies.

Notes when trading with price action

To become a good trader with this method, you need to truly love and seriously study, continuously practice. What is price action leans towards clarity and simplicity, based on the visual information that can be seen on the chart.

- Avoid relying too heavily on technical indicators, as they can clutter your analysis and easily distract you. Instead, focus on price action to better understand overall market conditions.

- Continuously learn to thoroughly understand chart patterns and candlestick formations, especially advanced candlestick patterns. Mastering these patterns will help you make more accurate judgments when candlesticks appear around key support and resistance levels.

- Analyzing charts across multiple timeframes can help you identify support and resistance zones more accurately. This is a crucial factor throughout the entire analysis and decision-making process.

- Replace indicators whenever possible and keep them only when truly necessary. Make sure you understand the purpose of each indicator you are using and try to substitute them with price action tools whenever feasible.

- Regular practice is the key to improving your ability to recognize patterns and optimize your trading strategies. With consistent practice, you will develop sharper observation skills, choose the right tools, and ultimately build a trading strategy that suits your own style.

Some frequently asked questions (FAQs)

- Which markets can price action be applied to?

Price action can be applied across various markets such as Forex, stocks, commodities, and more.

- Which candlestick patterns are important in price action?

There are three main types of price patterns: continuation patterns, bullish reversal patterns, and bearish reversal patterns.

- Is the price action method suitable for beginners?

The price action method is NOT suitable for beginner traders.

With the content that Tipstrade.org shares in the article, we hope it has answered all the questions about what is price action and related information. Wishing you success in the investment field with an effective price action strategy!