What is margin CFD? In the modern financial world, margin CFD is a popular tool allowing retail investors to access major markets with modest capital. However, behind the allure of massive profits lie hidden risks that can “wipe out” an account in the blink of an eye if not properly understood. This article breaks down every aspect of margin CFD, from the definition and mechanics to advanced risk management strategies!

What is margin CFD?

What is margin CFD – Margin CFD refers to the amount of money a trader must deposit to open and maintain a position in Contract for Difference (CFD) trading. Instead of paying the full value of an asset, traders only need to provide a small percentage known as margin. This system allows traders to access larger positions using leverage, making CFD trading more flexible and capital-efficient.

In simple terms, margin acts as a security deposit required by the broker. While it enables traders to control larger positions with less capital, it also increases both potential profits and risks. Understanding how margin CFD works is therefore essential for anyone looking to trade CFDs effectively.

Read more:

- What is CFD? Contracts for Difference Explained for Beginners

- Explore the Top 10 best CFD brokers for maximum profit

- Common Types of CFD Cost and How They are Calculated

- Common CFD Asset Types and How to Choose the Right One for Traders

Why is margin important for CFD traders?

What is margin CFD plays a key role in CFD trading because it determines how much exposure traders can take in the market. By using leverage, traders can amplify their buying power, allowing them to access opportunities that would otherwise require significant capital. However, margin also directly impacts risk management. If the market moves against a position, losses can accumulate quickly, potentially leading to margin calls or forced liquidation.

How margin CFD works

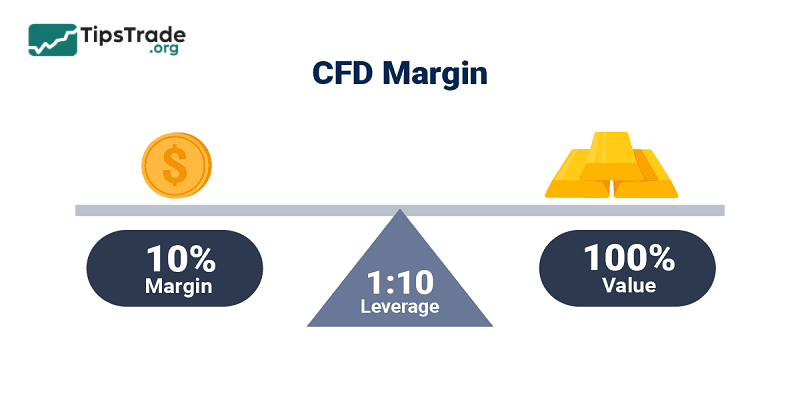

Basic mechanism of margin CFD: When opening a CFD position, traders must allocate a portion of their account balance as margin. This margin ensures that the broker is protected against potential losses. The relationship between margin, leverage, and position size is straightforward: higher leverage means lower margin requirements but greater risk exposure.

- For example, with a leverage ratio of 1:100, a trader only needs to deposit 1% of the total trade value as margin. The remaining value is effectively borrowed from the broker, enabling traders to control larger positions.

Types of margin in CFD trading

What is margin CFD? When trading CFDs, there are two types of margin you should understand:

Initial margin

The Initial Margin, often referred to as the opening margin, is the amount of money required to open a new CFD position. This is expressed as a percentage of the total trade value and can vary depending on the asset being traded and the broker’s requirements. For instance, if a broker requires a 5% initial margin on a trade worth $10,000, the trader needs to deposit $500 to open the position.

Maintenance margin

The Maintenance Margin is the minimum amount of equity that must be maintained in the trader’s account to keep the position open. If the equity in the account falls below this level due to market movements, the trader will receive a margin call from the broker. The margin call requires the trader to either deposit additional funds or close out some positions to restore the account balance above the maintenance margin level.

For example, if the maintenance margin for a particular position is $300 and the equity in the account drops to $250, the trader must add $50 or more to meet the requirement. If not addressed promptly, the broker may forcefully liquidate the position to prevent further losses.

How to calculate margin CFD

To calculate your required margin on any position, you need to know its total size and margin requirement. Let’s say, for example, that you want to buy 25 UK 100 CFDs at 7,500 and the UK 100 has a margin factor of 5%:

- The total size of your position is (25 * 7,500) £187,500

- 5% of 187,500 is £9,375

- You need £9,375 in your account as margin

Benefits and risks of margin CFD

Margin can be a powerful tool when used wisely, but it can also expose you to various market risks. It’s vital to strike the right balance between opportunity and risk by setting clear goals and knowing your risk tolerance.

Benefits of using margin in CFD trading

- Leverage: Margin enables leverage, allowing you to open and maintain larger positions with less capital and boost potential returns on small price movements. However, as said, it also magnifies losses, making it a double-edged sword.

- Flexibility: Margin trading offers access to short-term trading opportunities for various assets, with low capital requirements.

- Diversification: Margin trading frees up capital, allowing you to spread it across other positions and asset classes.

- Portfolio liquidity: Margin trading lets you enter and exit positions quickly without dedicating all your funds to one single trade, but having more capital available once other opportunities arise.

Risks associated with margin CFD

- Higher risk of losses: Profits are amplified, so are losses- a leverage effect. Just as small price moves can boost returns, even slight adverse movements can lead to significant losses that sometimes exceed your initial margin.

- Margin calls: Falling below the maintenance margin triggers a margin call, which requests to add funds or close positions.

- Market volatility: Margin increases exposure to market volatility, with price swings significantly impacting your position and requiring more attentive risk management.

- Charges: Leveraged positions may incur overnight or funding charges that can accumulate over time, reducing potential profits, especially in longer-term trades.

Factors affecting margin requirements

What is margin CFD? Several factors influence the margin requirements for a particular trade:

- Security type: The type of security being traded affects the margin requirement. For instance, stocks typically have lower margin requirements than options or futures contracts.

- Market volatility: Highly volatile securities often have higher margin requirements due to the increased risk of price fluctuations.

- Brokerage firm policies: Individual brokerage firms may have their own margin policies, which can vary.

- Regulatory requirements: Securities and Exchange Commission (SEC) regulations set minimum margin requirements for certain types of securities.

Tips for managing margin CFD effectively

– Use proper risk management:

- Set stop-loss orders to limit potential losses.

- Maintain appropriate position sizing.

- Follow a risk-reward ratio that aligns with your trading strategy.

– Monitor margin level regularly: Keeping track of margin level helps traders avoid margin calls. Monitoring equity and free margin ensures sufficient funds are available to maintain positions during market fluctuations.

– Avoid overleveraging: Using excessive leverage is one of the most common mistakes among beginner traders. Lower leverage can help maintain account stability and reduce the risk of forced liquidation.

Conclusion

What is margin CFD? This is a sharp financial tool that offers life-changing opportunities for those who know how to tame it, but it is equally ready to punish those with a lack of knowledge. The key to success is not just predicting market direction – it is how strictly you manage your margin. Wishing you successful investments!

See more: