Warren Buffett once said: “Never put all your eggs in one basket”. However, with Forex leverage, you can use one egg to buy an entire basket of eggs. But how can you do that safely? Let’s explore together with Tipstrade.org!

What is forex leverage?

Forex leverage is a financial tool that allows traders to control a trading volume much larger than their actual capital. Thanks to leverage, traders can amplify their profit potential from small market fluctuations. However, leverage also simultaneously increases the level of risk.

>>Read more:

- What is Forex? The Complete Guide for Beginners

- What is Pip in Forex? Accurate calculation guide for traders

- Forex spread: How It Affects Your Trading Costs and Profitability

- What is forex trading? A detailed guide to forex trading from A – Z

How does forex leverage work?

Forex leverage operates based on the principle of margin. This means you only need to use a small portion of your capital to open a position with a value much larger.

When using forex leverage, the required margin amount will be calculated based on the leverage ratio you choose and the lot size you open.

For example: You have a capital of $100,000 and want to trade 1 standard lot of the EUR/USD pair (equivalent to $100,000):

- With a leverage of 1:1, you need to deposit $100,000

- With a leverage of 1:10, you only need to deposit $10,000

- With a leverage of 1:100, the deposit amount decreases to $1,000

The higher the leverage used, the smaller the deposit amount, but the potential risk also increases.

How to calculate forex leverage

Forex leverage is calculated using the formula: total value of trade / margin required.

To help you understand better, let’s look at two specific examples below:

- Case 1: Trading without forex leverage

You have $1,000 in your account and use the entire amount to open a position worth exactly $1,000.

=> In this case, the forex leverage you are using is: 1,000 / 1,000 = 1, which means a leverage of 1:1

Here, you are not using forex leverage, and the profit or loss will fluctuate according to your actual capital.

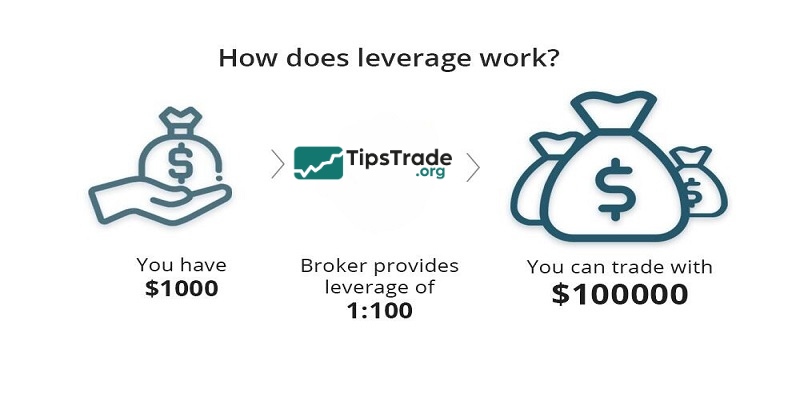

- Case 2: Trading with forex leverage

You only have $1,000 but want to trade with a volume of $100,000 (equivalent to 1 standard lot).

=> In this case, the leverage you use is: 100,000 / 1,000 = 100, which means a leverage of 1:100.

This means you only need to deposit $1,000 to control a position worth $100,000. This is how forex leverage helps traders amplify their purchasing power, but it also increases risk if there is no good risk management strategy in place.

Benefits and risks of using forex leverage

Here are the benefits and risks that you need to be aware of before applying forex leverage in trading:

Benefits of using forex leverage

- Increase profitability: Forex leverage allows traders to trade with larger volumes than their actual capital. As a result, profits can increase if the market trend is predicted accurately.

- Low cost: You can start trading with a small amount of capital. Leverage helps open large positions without needing to use the entire amount.

- Flexibility in capital management:Leverage allows you to allocate capital to multiple different trades. This supports a variety of strategies and optimizes investment efficiency.

Risks to consider when using forex leverage

- High financial risk: Leverage helps amplify profits, but it also increases losses if the market moves against you. This risk is particularly high during periods of strong market volatility.

- Interest rate costs: When holding positions overnight, you may incur swap fees. These fees are higher if you use significant leverage for an extended period.

- Risk of account burnout: If risk is not managed properly, high leverage can quickly lead to account burnout if risk management is not effective.

Should you use high leverage in forex?

Forex leverage does not change the level of price volatility in the market, but when you use high leverage, the size of the position you open will be larger, increasing the ratio of profit/loss on the actual capital you invest.

This allows you to achieve profits, but at the same time also increases the risk of losses if the market moves against your predictions. Therefore, leverage needs to be used cautiously and in accordance with each individual’s risk management.

For example, with the currency pair EUR/USD:

- Suppose you have a capital of $1,000 and use a leverage of 1:100. In that case, you can open a standard lot of 1, equivalent to 100,000 units of EUR/USD (assuming a price of $1).

- Suppose you have a capital of $1,000 and use a leverage of 1:200. In that case, you can open a maximum of 2 lots, equivalent to 200,000 units of EUR/USD, without needing to add more capital.

High leverage can provide an advantage for traders if used appropriately, compared to just using low leverage. However, the choice of leverage level needs to align with each individual’s financial capacity, experience, and risk tolerance.

How to use forex leverage without burning your account

Using leverage in forex can bring significant profit potential, but it also comes with increased risks. To limit risks, you need to keep in mind some important notes when using leverage such as:

- Set stop loss to limit losses

- Control the trading volume (lot size) to match your capital

- Choose a leverage ratio that is suitable for your experience and investment goals

Conclusion

Forex leverage is an essential tool in foreign exchange trading, but it is only effective when used responsibly and with discipline. By combining knowledge, skills, and caution, traders can maximize the potential of leverage, turning it into a competitive advantage in this volatile financial market. Wishing you success!

>>Read more: