What is forex CFD? It is a Contract for Difference that enables investors to profit from both rising and falling markets by opening buy or sell positions. Forex CFD is a popular financial instrument that allows traders to speculate on price movements of currency pairs without owning the underlying asset. Understanding forex CFD is essential for anyone looking to access the dynamic currency market with flexible trading options and leverage.To learn more detailed information, including strategies and insights, visit tipstrade.org.

What is Forex CFD in trading?

When CFDs are applied to the foreign exchange market, we get Forex CFDs. Instead of buying or selling actual currencies, you trade a contract based on the movement of currency pairs like EUR/USD or GBP/JPY.

Difference from traditional forex trading:

- Traditional forex involves direct exchange of currencies.

- Forex CFD involves trading a contract that mirrors currency price changes.

Why it matters for beginners: Forex CFDs provide an easier entry point, requiring less capital while giving access to leverage and the ability to trade in both rising and falling markets.

How Does Forex CFD Trading Work?

Price movements in currency pairs

Forex CFDs revolve around currency pairs. A pair consists of a base currency (the first) and a quote currency (the second). For example, in EUR/USD:

- EUR is the base currency.

- USD is the quote currency.

If EUR/USD rises, the euro strengthens against the dollar. If it falls, the dollar strengthens.

Traders profit by predicting these movements correctly. Economic news, interest rate changes, and global events are key drivers of price action.

Long vs Short positions in Forex CFD

In Forex CFD trading, you can take two types of positions:

- Long (Buy): You expect the base currency to rise against the quote currency. Example: Buying EUR/USD when you expect the euro to appreciate.

- Short (Sell): You expect the base currency to fall against the quote currency. Example: Selling EUR/USD when you expect the euro to weaken.

What is leverage in Forex CFD?

Leverage is the ability to control a large position with a small deposit (margin). For example:

- With 1:30 leverage, a deposit of $100 lets you trade $3,000 worth of currency.

Benefits:

- Higher potential returns with small capital.

Risks:

- Losses are magnified just as quickly as profits.

- Margin calls can occur if losses exceed your available funds.

>>Read more:

- What is Forex? The Complete Guide for Beginners

- What is forex trading? A detailed guide to forex trading from A – Z

- What is Pip in Forex? Accurate calculation guide for traders

- Essential Forex Orders every trader must know

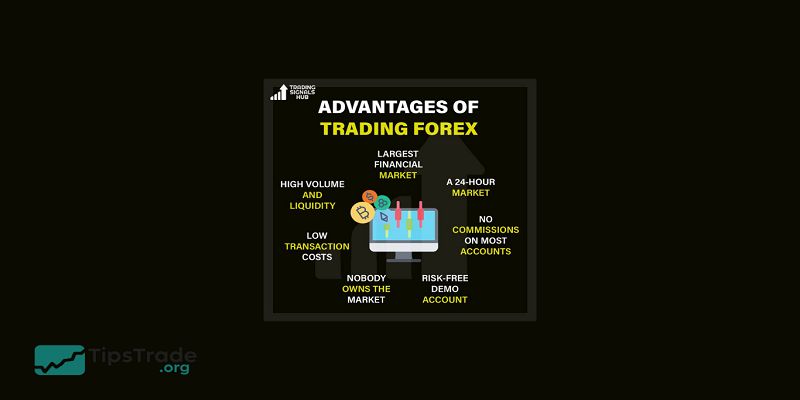

Advantages of Forex CFD Trading

Accessibility for beginners

- Start with small capital.

- Most brokers offer demo accounts for practice.

Hedging currency risk

- Forex CFDs can be used to offset risks in international investments or foreign holdings.

Profit opportunities in rising and falling markets

- Long or short trading flexibility.

- No need to wait for markets to rise.

Wide range of currency pairs

- Major pairs (EUR/USD, GBP/USD, USD/JPY).

- Minor and exotic pairs for advanced strategies.

Risks of Forex CFD Trading

What makes Forex CFD risky?

- Forex markets are volatile; small price changes can cause significant losses.

- Broker risks: spreads, hidden fees, or unreliable platforms.

Impact of leverage

- Magnifies profits and losses.

- Can lead to rapid account wipeout if risk is unmanaged.

Psychological challenges

- Fear and greed often drive beginners to overtrade.

- Lack of patience and emotional discipline can hurt performance.

Common mistakes by beginners

- Not using stop-loss orders.

- Risking too much capital on one trade.

- Ignoring swap fees or spreads.

- Overtrading without a clear strategy.

Forex CFD vs Traditional Forex Trading

Key differences

- Traditional forex: Direct ownership of currencies.

- Forex CFD: Derivative contract tracking price changes.

Cost structure

- Spreads: The difference between buy and sell prices.

- Commission: Some brokers charge per trade.

- Swap fees: Charged for holding positions overnight.

Which one is better for beginners?

- Forex CFDs are more flexible and accessible.

- Traditional forex may be less risky due to lower leverage, but requires more capital.

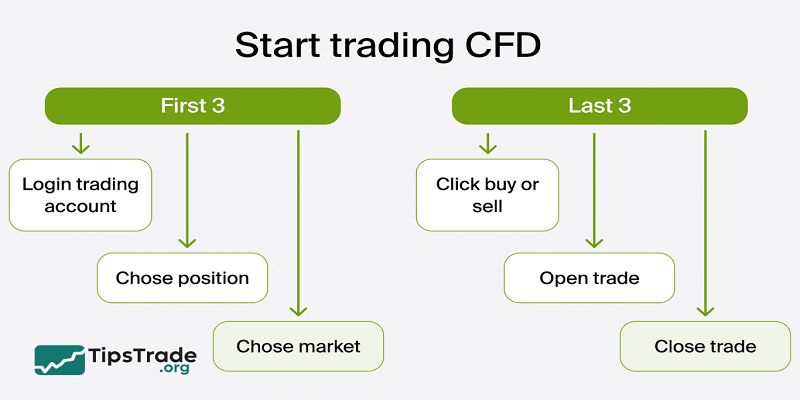

How to Start Trading Forex CFDs

Choosing a reliable Forex CFD broker

- Regulation and licenses.

- Low spreads and transparent fees.

- Trading platforms: MT4, MT5, or proprietary apps.

- Good customer support.

Setting up a demo account

- Practice risk-free with virtual money.

- Learn to use trading platforms and test strategies.

Developing a Forex CFD strategy

- Decide between scalping, day trading, or swing trading.

- Use technical and fundamental analysis.

- Always include risk management in your strategy.

Risk management tools

- Stop-loss and take-profit orders.

- Position sizing based on account balance.

- Avoid using maximum leverage.

Popular Strategies in Forex CFD Trading

Technical analysis

- Indicators: Moving Averages, RSI, MACD.

- Chart patterns: Head and Shoulders, Triangles, Double Top/Bottom.

Fundamental analysis

- Economic indicators: GDP, inflation, employment data.

- Central bank interest rate decisions.

- Political events and global news.

Combining both methods

- Use fundamentals to determine the trend.

- Use technicals for precise entry and exit points.

Best Practices for Beginners in Forex CFDs

- Learn the basics thoroughly before investing real money.

- Always start with a demo account.

- Set realistic profit goals.

- Never risk money you cannot afford to lose.

- Stay disciplined and control emotions.

Future of Forex CFD Trading

- Growing popularity worldwide as more retail traders enter forex.

- Technological advances: AI, automated trading, mobile platforms.

- Stricter regulations to protect retail investors.

- Increasing role of Forex CFDs in diversified portfolios.

Conclude

Forex CFD provides an accessible way to profit from currency fluctuations without the need to trade the actual currencies, but traders must be aware of the risks involved and implement proper risk management strategies to protect their investments.