What is Forex? In recent years, along with the investment channel in cryptocurrency, forex trading has become one of the top choices for many traders. Forex is a truly vast playground with many reasons that make you dream of becoming a real Forex trader. In the article below, Tipstrade.org will provide you with the necessary information about “what is forex”. Let’s get started!

What is Forex?

What is Forex? Forex, also known as FX, is short for Foreign Exchange, which means currency exchange. This is where the currency exchange activities of countries take place. Forex is considered the largest financial market in the world. This market has high liquidity with a trading volume of about 6 trillion USD per day.

Features of the Foreign Exchange Market

After understanding the concept of “What is Forex“, let’s explore the main characteristics of this billion-dollar market:

- High liquidity: It is the largest financial market in the world, with daily trading volumes reaching thousands of billions of USD (approximately 7.5 trillion USD/day as of early 2025 and expected to reach 8 trillion USD by the end of the year), allowing for easy buying and selling.

- 24/5 trading: Continuous operation from Monday to Friday, due to global financial centers (London, New York, Tokyo, Sydney) operating in different time zones.

- No centralized exchange: Forex is an over-the-counter (OTC) market, with trades conducted through a network of banks, financial institutions, and brokers.

- Currency pair trading: Currencies are traded in pairs (e.g., EUR/USD, USD/JPY), with exchange rates based on supply and demand.

- High leverage: Brokers offer high leverage ratios (e.g., 1:100), allowing investors to trade large volumes with small capital, but the risks are also high.

- Continuous volatility: Exchange rates change continuously due to the influence of economic, political, interest rate factors, and global news.

- Low transaction costs: The spread (the difference between buying and selling prices) is usually low, especially for major currency pairs.

- Diverse participants: Includes banks, investment funds, individual traders, multinational companies, and central banks.

- Influenced by macro factors: Events such as inflation, unemployment, monetary policy, or geopolitical instability have a strong impact on exchange rates.

- High risk: Due to significant volatility and leverage, Forex investment requires good knowledge and risk management.

How Forex works?

The Forex market operates based on the exchange of currency pairs. Each currency pair consists of a base currency and a quote currency. For example, in the EUR/USD pair, EUR is the base currency and USD is the quote currency. The value of the currency pair represents the amount of quote currency needed to purchase one unit of the base currency.

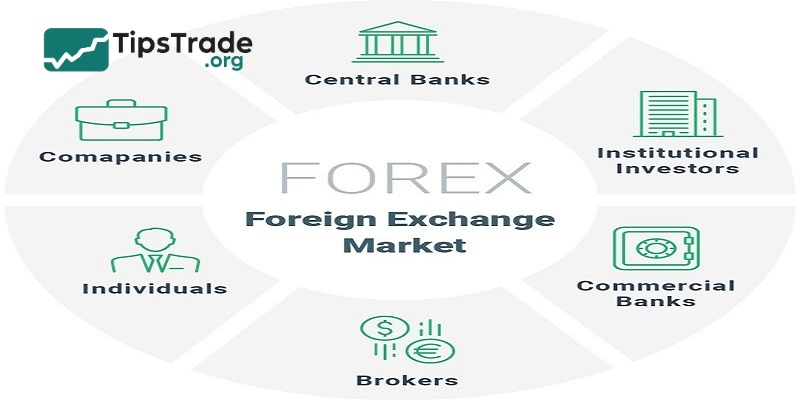

Major participants in the Forex market

The forex market has many participants, such as:

- Commercial banks: Facilitate currency exchange for businesses, individuals, and other financial institutions.

- Companies: Companies engaged in trade and international business need to conduct foreign exchange transactions to import and export goods and services.

- Governments: Central banks and treasuries participate in the forex market to manage foreign exchange reserves and stabilize the country’s economy.

- Central banks: Participate in controlling monetary policy, interest rates, and regulating the money supply.

- Individual traders: Retail traders and speculators participate to profit from currency fluctuations.

- Hedgers: Organizations such as exporters and importers use the forex market to hedge against currency volatility.

- Brokerage firms: They act as intermediaries, facilitating customer transactions and providing access to the market.

- International organizations: Organizations may participate in the forex market to implement policies and provide financial support.

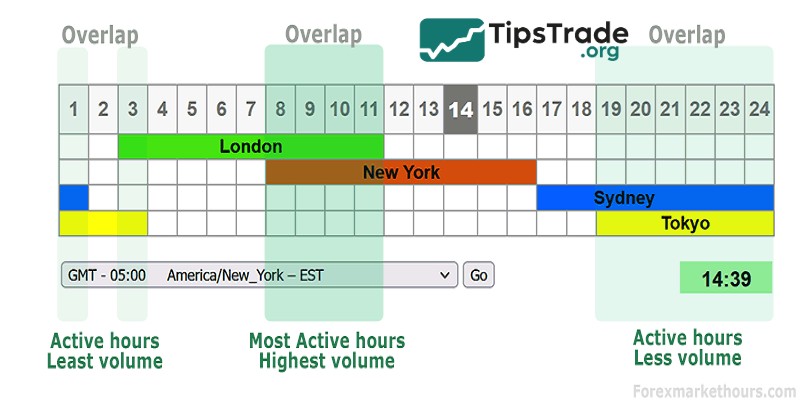

Forex market trading sessions

The Forex market is divided into four main trading sessions:

- Sydney session (or Australian session): Opens first, with light activity.

- Tokyo session (or Asian session): Focuses on currency pairs related to JPY.

- London session (or European session): The most active session, accounting for a large portion of trading volume.

- New York session (or American session): Strong trading, especially with currency pairs related to USD.

Advantages and disadvantages of the Forex market

The forex market has many advantages and disadvantages. Understanding these can help traders make informed decisions about participating in the market.

Advantages

The Forex market offers several attractive benefits for traders:

- High liquidity: As mentioned, the ability to enter and exit trades easily with low costs is a significant advantage.

- 24/5 operation: The flexibility of trading hours suits many time zones and personal schedules.

- Relatively low trading costs: Compared to other markets (such as stocks with various fees), Forex trading costs mainly consist of spreads or a small commission.

- Leverage capability: Although it carries high risk, leverage allows you to start with a small capital and has the potential to earn significant profits from relatively small price movements.

- Easy access: With the development of online trading platforms, anyone with an internet connection and a small amount of capital can start trading.

- Opportunities to profit in both directions: You can make a profit when prices rise (by buying) or when prices fall (by short selling). This means you have trading opportunities in all market conditions.

Disadvantages

Although there are many benefits, Forex trading carries significant risks that you need to understand before participating:

- High leverage risk: This is the biggest risk for retail traders. Leverage can amplify profits but can also quickly magnify losses. You could lose your entire initial investment in a short time if you do not manage risk carefully.

- Market volatility risk: Exchange rates can fluctuate sharply and unexpectedly due to economic events, political issues, or sudden news. These fluctuations can go against your position.

- Interest rate risk (Rollover/Swap): When you hold a position overnight, you may have to pay or receive a fee/interest (called swap or rollover) depending on the interest rate differential between the two currencies in the pair and the type of position (buy or sell). This fee can accumulate and become a significant cost if you hold the order for a long time.

- Counterparty/exchange risk: You are trading through a Forex exchange. Risks can arise if the broker is not reputable, faces financial issues, or engages in fraudulent behavior. Choosing a regulated exchange by reputable authorities is extremely important.

- Psychological risk: Emotional pressure (fear, greed) can lead to poor trading decisions, going against the plan, and causing losses.

- Complexity: Although it may seem simple, understanding and analyzing the Forex market requires knowledge of macroeconomics, technical analysis, and effective risk management skills.

How to start Trading Forex?

Joining the Forex market is not difficult, but it requires clear knowledge and strategy. Below are the basic steps to get started:

Step 1: Equip yourself with basic knowledge about forex

This is the most important step and cannot be overlooked. Do not rush to open a real account if you do not fully understand:

- What is forex and how it works.

- Basic terms (Pip, Lot, Spread, Leverage, Margin, Stop Loss, Take Profit…).

- Major currency pairs, minor and cross currency pairs, as well as their characteristics.

- Types of market analysis (Technical Analysis and Fundamental Analysis).

- Concepts of risk management and capital management.

You can learn forex knowledge through:

- Reading books and articles: There are many free and paid books about forex available online.

- Participating in reputable forex courses: Select courses with structured content from experienced individuals.

- Watching tutorial videos: YouTube has a vast resource on forex.

- Searching for reputable forex communities and forums: Learn from the experiences of those who came before (but be cautious of “guaranteed profit” offers).

Step 2: Choose a reputable forex broker

Choosing which forex broker to trade with is extremely important, as it directly affects your trading and the safety of your capital. Criteria for selecting a reputable broker:

- License and regulation: The broker must be licensed and regulated by reputable financial authorities around the world (e.g., FCA in the UK, ASIC in Australia, CySEC in Cyprus…). This ensures that the broker operates transparently and complies with investor protection regulations.

- Spread and trading fees: Compare spreads and other types of fees (commission fees, overnight swap fees…). Choose a broker with competitive costs.

- Trading platform: The broker provides popular and user-friendly platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or the broker’s own platform. The platform needs to be stable and offer many analytical tools.

- Trading products: The broker offers a variety of currency pairs, metals, energy, indices… so you have many options.

- Deposit/withdrawal methods: Diverse, convenient, and fast.

- Customer support: Quick and professional support, especially if there is support in Vietnamese, that would be even better.

- Reviews and feedback: Look for reviews from other traders on reputable forums and websites.

Step 3: Open a trading account

After choosing a forex broker, you will register for an account.

- Demo account: It is mandatory to use a Demo account first. This is an account that uses virtual money provided by the broker, allowing you to trade in real market conditions without losing real money. Treat the Demo account like real money to train your mindset. Do not trade Forex Demo with too large an amount that causes you to trade without discipline.

- Live account: Only open a live account when you feel confident with the Demo account, have a basic trading strategy, and understand risk management. Start with the smallest capital possible to get used to the psychological pressure of trading with real money.

Step 4: Develop a trading strategy

Developing a Forex trading strategy is the process of creating a detailed and systematic plan to make trading decisions in the foreign exchange market. It is not about trading randomly based on emotions or vague predictions, but rather based on a set of predefined rules and conditions.

In simple terms, a Forex trading strategy is a “map” and “guide” that helps traders know:

- When to enter a trade (buy or sell): Based on what specific signals or market conditions?

- When to take profit (Take Profit – TP): At what price level should the trade be closed to realize profits?

- When to cut losses (Stop Loss – SL): At what price level should the trade be closed to limit losses when the market moves against the prediction?

- What volume to trade: Based on account size and acceptable risk level (Money Management).

- Risk management: How to protect capital and avoid account depletion?

Developing a Forex trading strategy is a necessary and foundational step for anyone who wants to trade successfully and sustainably in this market. It is the process of building a rule-based trading system that helps traders approach the market professionally and with discipline.

Step 5: Start trading

Use trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or Ctrader to place buy/sell orders. Start with a small capital and gradually increase as you gain experience.

Tips for successful Forex trading

- Patience and discipline are the keys: Forex trading requires patience to wait for good opportunities and discipline to stick to the trading plan, without letting emotions take control.

- Don’t believe in promises of “huge” profits: The Forex market is not a risk-free quick wealth tool. Anyone promising unrealistic profits is likely a scam.

- Always learn and improve: The market is always changing. Continuously learn new knowledge, analyze your trades, and adjust your strategy when necessary.

- Only invest money you can afford to lose: Never use borrowed money or savings for important goals (like buying a house, buying a car…) to trade Forex. The risk of losing capital is real.

Conclusion

The article above contains all the knowledge related to “What is Forex”. Forex is a financial market with the potential to generate profits but also comes with risks. Mastering the basic knowledge is an important first step to help you trade more effectively. Before you start, take the time to thoroughly research and build a strategy that aligns with your investment goals. Wishing you success!