Drawdown Forex is an important tool in evaluating and controlling investment strategies. So what is Drawdown Forex? How can it be determined? What level of Drawdown is considered good? Let’s explore in this article!

What is Drawdown Forex?

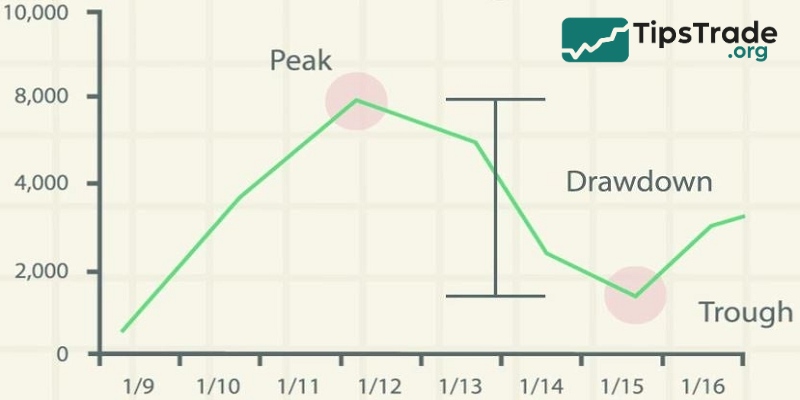

Drawdown Forex is a term used to refer to the largest decline in a trader’s account. Or Drawdown Forex is the amount of money that has decreased the most from the highest peak to the lowest trough over a certain period of time. Typically, drawdown forex is expressed as a percentage (%).

>>Read more:

- What is Forex? The Complete Guide for Beginners

- Forex Capital Management Tips: The Key To Success For Professional Traders

- What is forex leverage? How to use leverage without burning your account

- Forex spread: How It Affects Your Trading Costs and Profitability

Common types of drawdown in Forex

Drawdown Forex refers to the level of decline during an investment process and is not calculated in just one way based on the peak and trough of capital; instead, it varies depending on the type, and the Drawdown ratio will have different calculation methods. Specifically, Drawdown Forex is divided into four common types as follows:

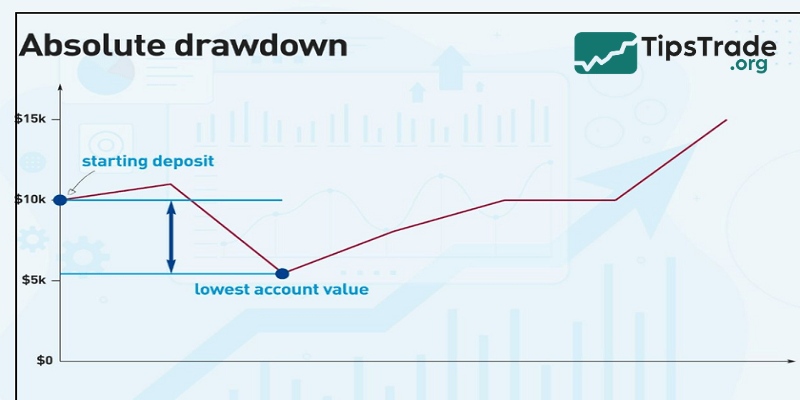

Absolute Drawdown (ADD)

Absolute Drawdown is a concept that represents the level of loss calculated from the initial capital deposited into the account down to the lowest capital level. This metric is expressed as the absolute monetary loss (USD/EUR/…) rather than as a percentage (%).

The value of the Absolute Drawdown index will change each time the account reaches a new low that is lower than the previous low.

Additionally, this indicator, if it increases, indicates that the traders are losing that much compared to the initial capital amount.

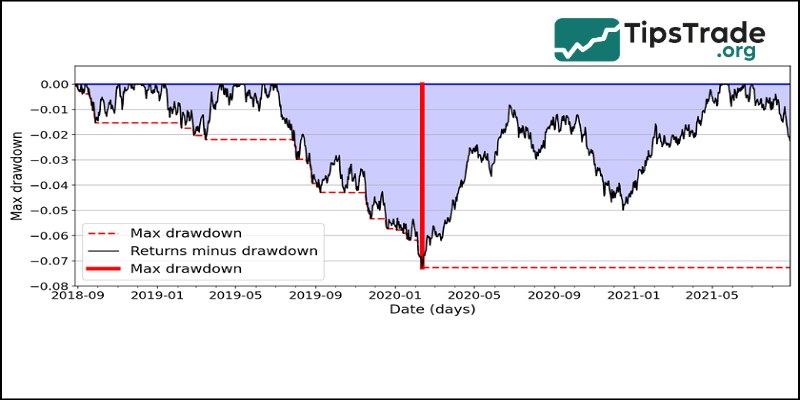

Maximal Drawdown (Max DD)

(Max DD) Maximum Drawdown is the maximum loss from the highest equity peak ever reached to the next lowest equity trough, that is, the equity trough must be formed after the equity peak. The unit of measurement of this Max DD indicator is also an absolute amount.

Maximum Drawdown shows the largest loss amount of the account during the investment process, so it usually represents a greater level of risk than Absolute Drawdown.

If traders know how to cut losses properly, the possibility of Maximum Drawdown is very low. On the contrary, if there is no appropriate loss-cutting rule during the trading process, the possibility of the account being in Maximum Drawdown is very high.

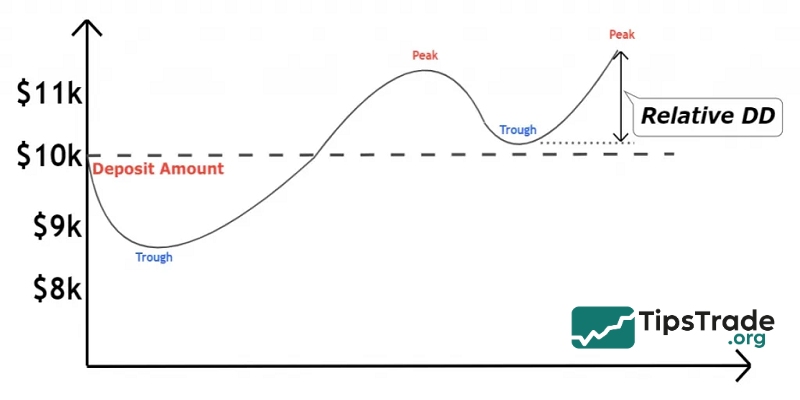

Relative Drawdown (RDD)

Relative Drawdown is the loss ratio of Maximum Drawdown compared to the initial capital, the unit of this indicator is percentage %.

RelativeDrawdown = Maximum Drawdown / Maximum Capital Peak

With the percentage of Relative Drawdown, traders will visualize whether their account is at a high or low risk level more easily than looking at an absolute number.

Most traders usually use Relative Drawdown more than Maximum Drawdown and Absolute Drawdown more than Absolute Drawdown.

Daily Drawdown

This is essentially the Relative Drawdown, but it is calculated over a period of one day. Scalping or Intraday traders can use Daily Drawdown to closely monitor orders that have not met the requirements and need to be extended.

>>See more:

- What is forex trading? A detailed guide to forex trading from A – Z

- What is Forex Technical Analysis and How Important is it?

- Forex strategy: Top 10 most effective strategies for beginners

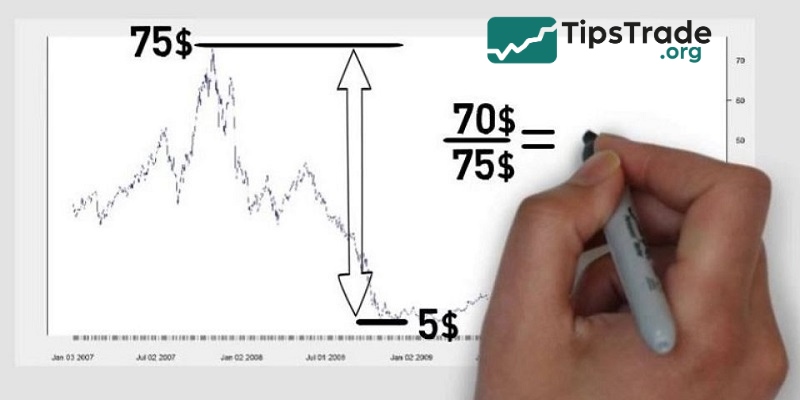

How to calculate Drawdown Forex

Drawdown is usually calculated as a percentage of the previous equity. The Drawdown Ratio is calculated as follows:

Drawdown Ratio (%) = Maximum Capital Drawdown / Investment Capital at Peak

In there:

The maximum capital loss in the Drawdown period will be calculated by the formula: Capital bottom – Capital peak

For example:

The investor started with an investment capital of 10,000 USD. The market went in the right direction as predicted, so at one point the account increased to 16,000 USD. After a period of time going in the right direction and the investor did not cut losses in time, the account lost 8,000 USD. The market then recovered but a little and ended at 12,000 USD.

Accordingly, the highest peak of the capital is 16,000 and the lowest bottom is 8,000.

Therefore, the amount that the investor’s account has lost is: 16,000 – 8,000 = $8,000.

=> Drawdown ratio = (8,000/16,000) x 100% = 50%.

The importance of Drawdown Forex in trading

In Forex trading, traders use the DrawDown ratio to determine the stop point after a certain trade. This helps them grasp their current situation and control to avoid receiving heavy losses.

Calculating Drawdown helps traders avoid losses and manage capital. The goal of calculating Drawdown is to determine the current trading position to know whether to continue maintaining or change the position to avoid losses.

In addition, traders can also use the Drawdown ratio to evaluate the effectiveness of their previous transactions. If this ratio is high, it means that the loss is large, investors need to optimize their investment strategy. Conversely, a low Drawdown ratio means that trading activities are effective.

What are acceptable Drawdown Forex levels?

The lower the Drawdown Ratio, the more effective the previous trade was. Because the lower the ratio, the less likely the investor is to lose their account. However, this efficiency depends on the investor’s goals and risk tolerance.

The normal Drawdown rate should not exceed 20%. Because, the higher the rate, the lower the investor’s ability to recover capital. Therefore, if the Drawdown rate of the previous transaction is higher than 20%, the trader should review and optimize the trading strategy in the market.

Limitations of the Drawdown ratio

Most of the current trading system reviews show the drawdown index at closing orders compared to the initial balance. According to research, this index does not accurately reflect the nature of the trading system.

Suppose a trader has an account of $1,000 and makes a trade that reduces the account to $500, equivalent to a 50% loss, but does not close the trade. Fortunately, the market recovers and the investor cuts the loss at $50. At this time, the system records a drawdown (DD) of 5%. This makes the system evaluation inaccurate. Therefore, to evaluate whether a trading system is good or not, traders should look at the equity drawdown instead of the balance drawdown.

How to control Drawdown in Forex trading

– Limit the maximum drawdown number for the account

Depending on the following factors, each person can consider the acceptable drawdown level for the account:

- Funds, demo account or cent

- Trading experience

- Order holding time

Normally, the higher the capital, the lower the Drawdown limit should be or the order holding time per day can be higher than 1 week.

When the Drawdown number is exceeded, you should build or adjust the trading system. If the Drawdown rate has not improved, the trader needs to review the strategy. Once it is stable, the trader can set a penalty for each time the Drawdown exceeds the limit.

– Drawdown limit for each transaction

You can also apply a loss limit for each order of only 1-1.5% of the total capital of the account. Thus, if you lose 5 consecutive orders, you will only stop Drawdown at 5-7.5% instead of putting all into one order.

To apply this type of trading, you need to strictly follow Stop Loss, use moderate leverage and appropriate trading volume.

Conclusion

By mastering the concept of Forex Drawdown, traders not only know how to assess risks but can also build more flexible and effective trading strategies. Moreover, forex drawdown analysis also helps traders detect weaknesses in their strategies, thereby making timely adjustments to improve performance. All of this knowledge and skills will help traders be more confident when facing market fluctuations, creating a sustainable development path and long-term success.