Chaikin Money Flow (CMF) is a technical indicator used by many investors to identify buying and selling pressure and find reasonable entry points. So, what exactly is Chaikin Money Flow? How is it calculated? And how can you trade effectively using this indicator? All these questions will be answered in today’s article by Tipstrade.org. Let’s find out together!

What is Chaikin Money Flow?

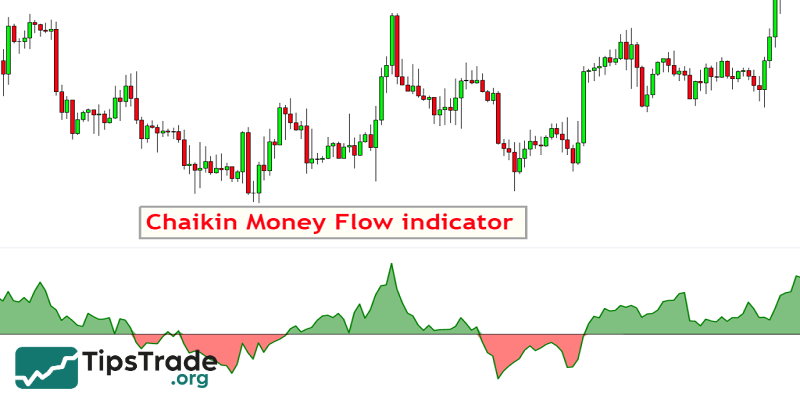

The Chaikin Money Flow (CMF) is a technical analysis tool developed by Marc Chaikin that measures buying and selling pressure in financial markets. The indicator is based on the trading volume and closing price of an asset over a certain period of time. The CMF oscillates around zero, with positive values indicating dominant buying pressure and negative values indicating selling pressure. The CMF helps investors identify market trends and make appropriate trading decisions.

CMF is calculated using Money Flow Volume (MFV), which is a combination of price and trading volume. MFV is calculated by taking the average of the asset’s high, low, and closing price, then multiplying it by the trading volume. The result of MFV shows the level of money flowing into and out of the asset. The absolute value of CMF helps confirm or doubt the current price action and can be used to predict the future trend of the asset.

>>See more:

- How to Use the Momentum Indicator when Trading

- How to calculate and use the MFI indicator in technical analysis

- Top 5 Best Types of Volume Oscillators (VO) Trader Should Know

- What is volume trading? Effective trading strategies based on volume

How to calculate Chaikin Money Flow

The Chaikin Money Flow indicator is calculated by adding the accumulation/distribution line for a specific trading period.

The formula for calculating the CMF is quite complex. Let’s try to simplify the formula and divide it into three easy steps:

- Step 1: We calculate the Money Flow Multiplier for each period

Money Flow Multiplier = ((Close – Low) – (High – Close)) / (High – Low)

- Step 2: We calculate the Money Flow Volume by multiplying the Money Flow Multiplier with the period’s volume

Money Flow Volume = (Money Flow Multiplier) x Volume

- Step 3: We calculate the Chaikin Money Flow by dividing the specified period sum of Money Flow Volume by the specified period sum of the volume

Chaikin Money Flow = (Specified Period Sum of Money Flow Volume) / (Specified Period Sum of Volume)

What does the Chaikin Money Flow indicate?

Below are the factors that the Chaikin money flow indicator shows, making many investors decide to apply it in stock trading.

Identifying the main market trend

Investors can determine the current trend of the stock market through the Chaikin Momentum Indicator. When the Chaikin line crosses above or stays above the zero level, it indicates that buying pressure is dominating the market. Conversely, when the Chaikin line crosses below or stays below zero, it signifies that selling pressure is taking over.

Identifying stock buying points

By using the Chaikin Momentum Indicator, investors can identify the right time to buy stocks during recovery phases or within a specific trend:

- When the Chaikin momentum line crosses above the zero level: investors may start buying stocks.

- When the Chaikin momentum line falls below the zero level: investors should consider taking profits.

Detecting divergence and predicting market reversals

Divergence is a sign of a potential reversal, often occurring when the indicator movement is not synchronized with the price. A bearish divergence appears when the price forms higher highs while the Chaikin indicator forms lower highs. On the other hand, a bullish divergence occurs when the price makes lower lows while the CMF indicator forms higher lows.

However, like other indicators, when using the Chaikin indicator, investors should avoid trades that go against the main trend. For example, a bearish divergence appearing during an uptrend. Counter-trend trades are usually more complex and riskier than trend-following trades.

How to apply the Chaikin Money Flow indicator in stock trading?

The Chaikin Money Flow (CMF) indicator is widely used by stock investors to support their trading decisions. CMF provides insights into the movement of money flow related to a specific stock, helping investors assess market sentiment and predict potential price trends.

One of the most common applications of CMF is using it as a confirmation signal. When a stock’s price is rising and the CMF also increases while staying in the positive zone, it is considered a strong buy signal, as it indicates that money is flowing into the stock. Conversely, if the price rises but the CMF decreases and remains in the negative zone, it could serve as a warning signal of an upcoming correction.

In addition, CMF can also be used to identify potential support and resistance levels. When the CMF forms a bottom and begins to rise again, it often suggests that the stock price is approaching a key support level. On the other hand, when the CMF forms a peak and starts to decline, it may indicate an approaching resistance level. Therefore, CMF can be highly useful in identifying critical price zones for placing buy or sell orders.

Pros and cons of Chaikin Money Flow indicator

Pros:

- A great indicator for spotting divergences on the chart

- Works well during trending market conditions

- Good at confirming the direction of the main trend

- Excellent at confirming the strength of the main trend

Cons:

- In a choppy market, many false signals are generated around the zero level

- CMF value is not accurate when big gaps occur on the market

- Chaikin Money Flow does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other tools

- Used with lower settings, CMF can produce numerous whipsaws if not used correctly

- Unreliable on smaller time frames like M1, M5 or M15

- Lagging indicator, as it follows the price

Final thoughts

In summary, the Chaikin Money Flow (CMF) indicator is an important tool that helps investors assess buying and selling pressure in the stock market, enabling them to make trading decisions based on an analysis of cash flow into and out of the market. Hopefully, this article has provided you with useful information about CMF, which will help you improve your cash flow analysis and investment strategies accurately. Wishing you successful investments!

See more: