What is a Forex order? They are divided into many different types and have their own specific purposes. Understanding and mastering the various types of Forex orders is the key to optimizing profits and minimizing risks. In this article, we will explore each common type of order, how they work, and practical application tips. Let’s get started!

What is a Forex Order?

A Forex Order is a request that a trader sends to a broker to execute a buy or sell action on a specific currency pair in the foreign exchange market.

All types of orders in forex will be sent through forex trading platforms such as MT4, MT5, cTrader, or other platforms. These orders are used to open or close positions on currency pairs. During this process, traders can set specific price levels or other conditions to achieve the desired price.

Simply put, a forex order is a tool that helps you make decisions to buy or sell in the market. These orders will require the market to automatically execute actions on your behalf. For example: buy the EUR/USD pair when the price drops to a certain level, or take profit when the price rises to the target.

>>Read more:

- What is Forex? The Complete Guide for Beginners

- What is Pip in Forex? Accurate calculation guide for traders

- What are exchange rates? How to read and analyze rates in Forex

- Top 10 best forex currency pairs to trade in 2025

The benefit of using Forex Orders in trading

When trading forex, knowing how to place orders correctly is a key factor that helps you invest effectively. Below are the advantages of placing orders in forex trading:

- Reduces pressure during times of strong market volatility.

- No need to constantly monitor the screen, as trades can be executed automatically based on the established conditions.

- Can pre-determine entry and exit points.

- Orders help traders adhere to the strategies set, reducing emotional trading.

Types of Orders in Forex

In the forex market, understanding the types of orders in forex will help you minimize risks and trade more effectively. Below are the basic types of orders in forex trading:

Market Order

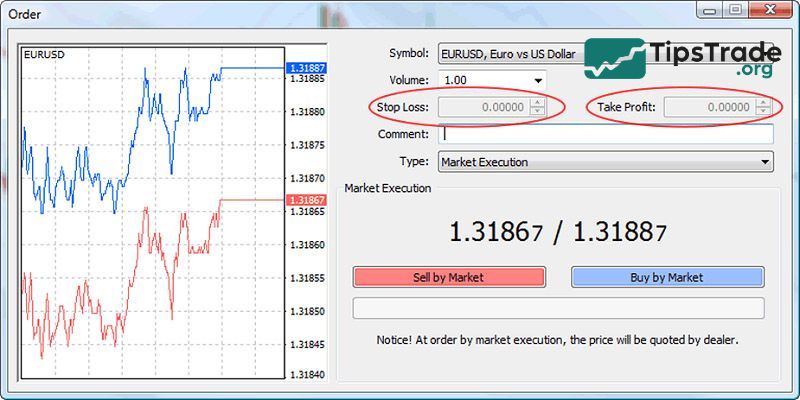

A Market Order is the most basic type of order in forex. When you place this order, the trade is executed immediately at the current market price. This is an ideal choice when you want to enter or exit a position quickly.

For example: In the illustration above, you can see the EUR/USD pair being offered by the exchange with two prices: 1.3186 (BID price) and 1.3188 (ASK price). If you place a market order at this moment, your order will be executed at one of the two price levels above:

- If you want to buy (BUY) the EUR/USD pair at the current moment, the platform will sell it to you at the Ask price of EUR/USD = 1.3188. You will click on BUY, and your trading platform will immediately execute the buy order at that exact price.

- If you want to sell (SELL) the EUR/USD pair at the current moment, the platform will buy it from you at the Bid price of EUR/USD = 1.3186. This order will be executed immediately.

Of course, whether you enter a BUY or SELL order, you will still incur a spread fee for the platform. Here, if you enter 1 lot, you will lose about 2 USD to the platform.

Advantages

- High execution speed: Orders are executed immediately, without waiting.

- Suitable for highly volatile markets: When prices move quickly, market orders ensure you don’t miss opportunities.

Disadvantages

- No control over the exact price: In volatile market conditions (for example, during major news events), the execution price may differ significantly from expectations. This phenomenon is called slippage.

When should it be used? Use a market order when you need to enter a position immediately, such as when you detect a strong breakout signal or need to exit a position to cut losses quickly.

Pending Order

A pending order is a type of order that allows traders to buy or sell at their desired price rather than the market price. By using this order, traders no longer have to constantly monitor price charts in front of their computers or worry about missing the opportunity to enter an order in time.

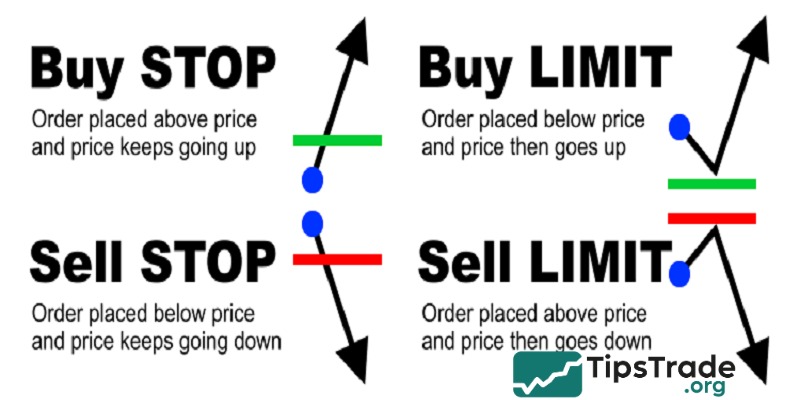

Currently, there are a total of 6 pending orders in the market, of which 4 orders are supported on the MT4 platform including Sell Limit, Buy Limit, Sell Stop, Buy Stop, and 2 orders are supported on MT5 including Buy Stop Limit and Sell Stop Limit.

Details about each type of pending order will be shared by Tipstrade.org as follows:

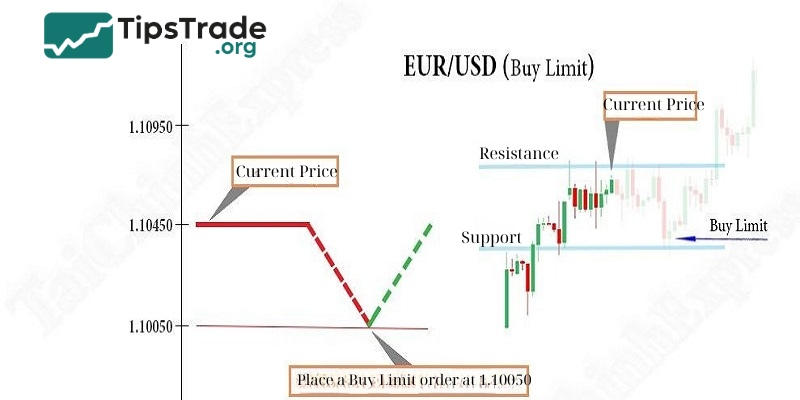

Buy Limit

Buy Limit is a pending buy order, set up when a trader expects to buy at a better, lower price than the current market price. Therefore, instead of placing a Market Order, the investor will place a Buy Limit order to wait for the price to drop to the bottom and prepare to reverse before proceeding with the purchase. When the price drops and reaches the order point, the buy position is automatically activated.

For example: You want to buy the EUR/USD pair. The current exchange rate is 1.10450. You think that the price will continue to decrease and you can buy it at a lower price. In that case, you would place a Buy limit order at a price lower than 1.10450, such as the illustrative example of 1.10050. The Buy limit order will be triggered if the EUR/USD pair price drops to 1.10050 or lower.

The limitation of a Buy Limit order is that sometimes you may miss the opportunity because the price may not drop further and instead go up immediately, or the price may drop a little but not to the level where you placed the Buy Limit order.

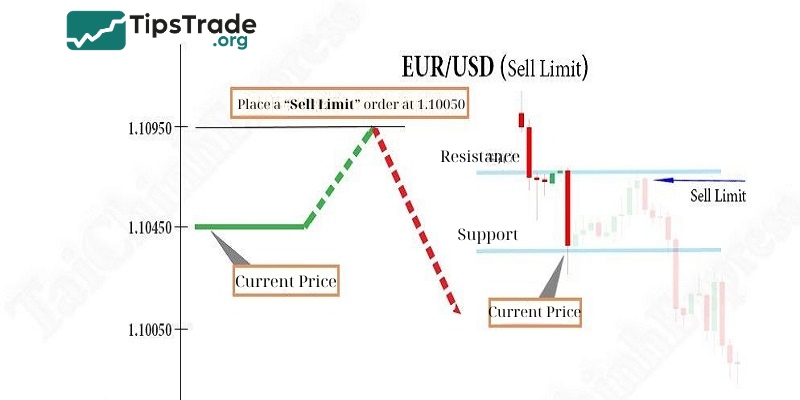

Sell Limit

Sell Limit is a pending sell order, set up when a trader expects the price to rise higher than the current price before it decreases. When the price reaches the order point, the sell position will be automatically opened, and the trader will earn a higher profit compared to placing a Market Order.

For example: You want to sell the EUR/USD pair. The current exchange rate is 1.10450, and you expect that you can sell at a higher price later. In that case, you will place a Sell Limit order at a price higher than 1.10450, for example, at 1.10950. The Sell Limit order will be triggered if the exchange rate of the EUR/USD pair reaches 1.10950 or higher.

The limitation of using a Sell limit order is that sometimes you may miss the opportunity to sell because the price may not increase further or may not reach the level you set to sell before going down.

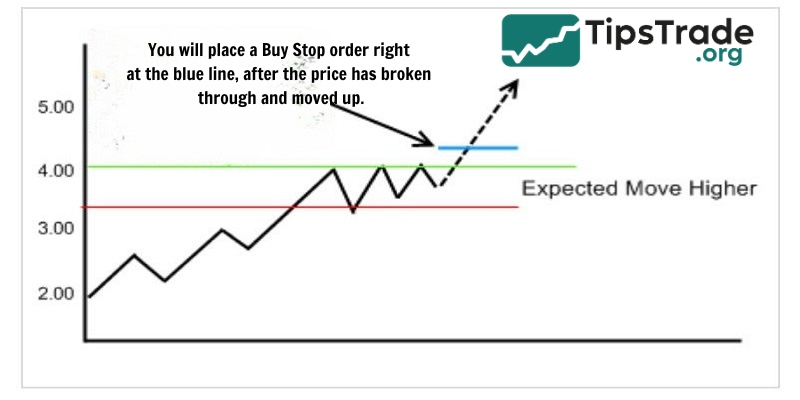

Buy Stop

Buy Stop is a pending buy order at a price higher than the current market price. You place this order because you want to ensure that the market is actually rising before deciding to buy. When the price reaches the level you set, the Buy Stop order will become a market order and will be executed at the next available price.

For example:

Let’s assume the gold chart currently shows the price at 1336.08 USD and is in an upward trend. However, the price of gold is near resistance at a price of 1341.43.

At this time, there are many traders following the price of gold. Once the gold price breaks thru this resistance zone, the price will continue to rise very strongly because there is usually a very large trading volume every time the price breaks thru an important price zone.

Taking advantage of this opportunity, traders are ready to wait for the price to break through the resistance level and Buy. However, not every trader has a lot of time to constantly monitor the market. At this point, a Buy Stop order will solve the problem. If the gold price truly breaks through, the Buy Stop order will be executed and run like a normal Buy order.

Sell Stop

A Sell Stop is a pending order to sell when the price is triggered below the current price. A Sell Stop order is used when traders are unsure whether the price will go up or down. So they want to wait and see if the price breaks through the support level to confirm the next trend before entering a trade.

At that point, the market is likely to reverse or continue its new downtrend, and traders have the opportunity to capitalize on the trend as soon as it forms.

Conversely, if the price doesn’t decrease as predicted and the order can’t be filled, the trader won’t incur any risk of losing money either.

For example:

Assuming you want to sell the USD/CHF pair and this currency pair is currently trading at a price of 1.0019. You expect the price to drop and decide to sell when the price falls to 0.9995.

The current price = 1.0019 is greater than the predicted price to enter a Sell Stop = 0.9995. Therefore, you place a Sell Stop order and wait for the system to automatically execute the order when the price reaches 0.9995 without having to sit continuously in front of the computer to monitor the chart.

Buy Stop Limit

Buy Stop Limit is a stop limit buy order. This is a combination of two orders: Buy Stop and Buy Limit. In this case, the Buy Stop point is considered the trigger point for the Buy Limit order. When placing a Buy Stop Limit order, if the market price reaches the Buy Stop point, the Buy Limit order will be activated. If the price does not reach the Buy Stop point, the Buy Limit order will not be activated. Therefore, traders can achieve higher profits while still mitigating risks when the price moves against the trend.

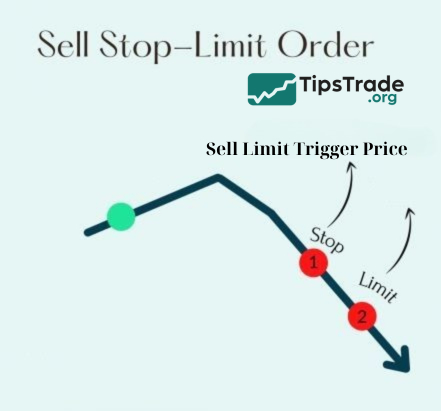

Sell Stop Limit

A Sell Stop Limit is a sell stop limit order. This is a combination of the Sell Stop and Sell Limit orders. When the price reaches the Sell Stop point, the Sell Limit order will be activated and automatically executed if the price reaches the preset level. Traders use this order when they anticipate a sharp market decline, but to be certain, they will use a Sell Stop Limit order to open a short position if the price breaks through a key support level.

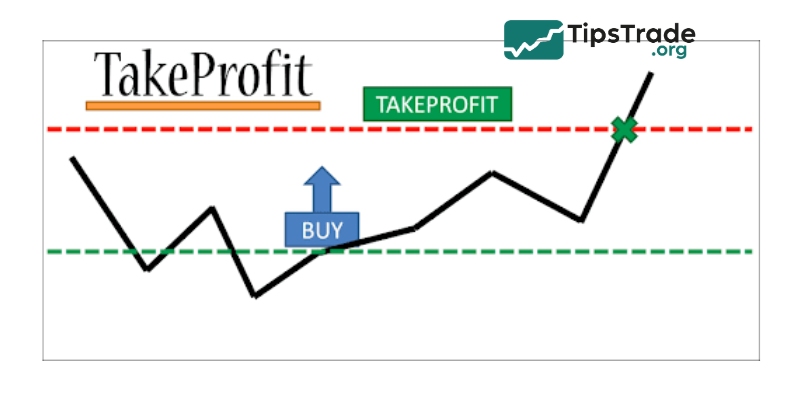

Take profit

Take profit is a type of order that helps traders secure profits when the market price reaches a desired level. Obviously, this occurs when the market trend unfolds as the trader expects.

For example: You place a Sell order for the GBP/USD pair at a Bid price of 1.30380. With this order, you intend to take profit at 100 pips. You set the Take Profit order at a price level of 1.29380. When the price moves in the predicted direction and drops to 1.29380, your order will automatically close. At that point, you will have made a profit of 100 pips.

Take profit should be understood as a principle of discipline in trading rather than a type of “order.” Because if a trader is too greedy and not consistent with their trading method, being “rejected” by the market is entirely possible. At this point, the trader not only has no profit but also incurs losses if they did not set this Take Profit order from the beginning.

Stop loss

A stop-loss order can be understood as a type of exit order used by traders to prevent losses from exceeding expectations when the market trend does not move in the trader’s desired direction.

For example: You place a buy order for the GBP/USD pair at the Ask price provided by the broker, which is 1.30385. With your risk tolerance level, you only allow this order to lose a maximum of 30 pips. You set the stop-loss for that order at the price level of 1.30085. When the market moves against your order and the price drops to 1.30085, your order will be immediately executed at that price, accepting a loss of 30 pips.

Just like Take-profit, Stop-loss is not just a simple “order” on the system. It’s also a useful risk management tool in your trading plan. No method can guarantee perpetual profit. Losses are inevitable, but whether the losses are small or large depends on your own skill in setting a Stop-loss. The Stop-loss order also helps eliminate emotional factors in entry decisions, allows for better control of trading positions, and protects traders from sudden, unfavorable market fluctuations.

Trailing stop

A trailing stop is a type of stop-loss order that follows the trend and is automatically adjusted, capable of moving in the same direction as the trading trend that the trader expects, and only stops when the market moves against you.

The trailing stop order differs from a traditional stop-loss order because it moves in the same direction as the prices of currency pairs. Therefore, this order will ensure profits for you. At the same time, unexpected risks are also significantly reduced.

For example:

Suppose you buy the EUR/USD currency pair and the next day, the EUR/USD price increases, and you have made a small profit of about 30 pips. You do not want to miss out on this pip gain, but you still have a bit of “ambition” and want to wait to see if the currency pair price will increase further.

At this point, you can set a Trailing stop order at the 30 pip price level to secure your profit. If the market continues to rise, the Trailing stop point will also increase accordingly. This will continue until the market changes direction and moves down, hitting the Trailing stop order.

How to choose the right type of Forex Order for your trading strategy

Choosing the type of order depends on your trading style and goals:

- Scalping: Use Market Order to enter trades quickly and Take Profit to secure small profits.

- Day Trading: Combine Limit Order and Stop Loss to control price and risk.

- Swing Trading: Trailing Stop and Stop Order are ideal choices to take advantage of larger trends.

- Position Trading: Limit Order and Take Profit help you patiently wait for better price levels.

Tips for using Forex Order types effectively

- Combine Stop Loss and Take Profit: Ensure a reasonable risk/reward ratio, for example 1:2 or 1:3.

- Monitor economic news: Avoid placing orders during times of high market volatility (such as interest rate announcements) to reduce slippage.

- Check the spread of the broker: A high spread can affect the effectiveness of Limit Orders or Stop Orders.

- Practice on a Demo account: Before applying on a real account, practice to familiarize yourself with each type of order.

Conclusion

Understanding and correctly using the different types of orders in forex is a crucial factor that helps you survive and thrive in the market. Each trade order has its own purpose and role. Therefore, choosing the right type of order will help you trade more effectively and professionally. Wishing all traders successful trading!