US IPO examples reveal key trends and successful strategies in the American financial market. Highlighting notable companies that have gone public, these examples help investors and businesses understand market dynamics and opportunities for growth. By focusing on prominent US IPOs, this discussion aims to provide valuable insights for those interested in investment and corporate financing. For a detailed understanding of these risks, you may also explore resources at Tipstrade.org which provide expert insights and comprehensive analysis on IPOs.

What Is an IPO and Why Does It Matter?

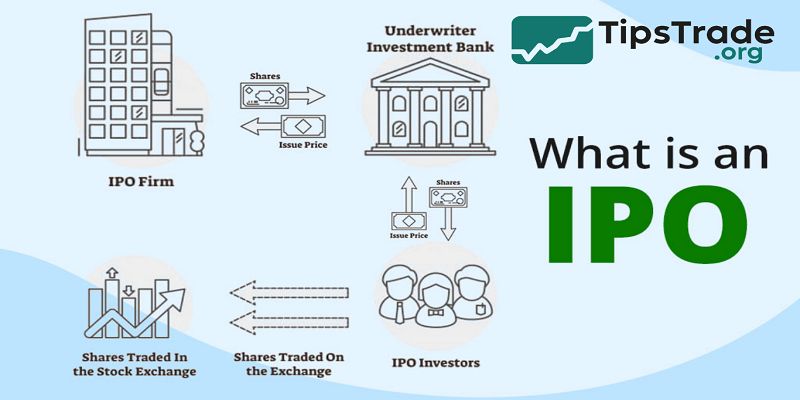

An IPO (Initial Public Offering) is when a private company sells its shares to the public for the first time, usually listed on exchanges like NASDAQ or NYSE. The process allows the company to raise capital, increase visibility, and provide liquidity for early investors.

Key benefits of going public:

- Access to capital: IPO proceeds help fund expansion, R&D, and acquisitions.

- Brand credibility: Being listed builds trust with consumers and partners.

- Liquidity for investors: Early shareholders can realize returns.

- Talent attraction: Public equity enables competitive stock-based compensation.

Challenges to consider:

- Regulatory compliance: SEC filing and reporting requirements are strict.

- Market pressure: Quarterly performance expectations increase volatility.

- Cost of IPO: Underwriting and legal fees can reach millions.

In essence, IPOs balance growth opportunities with market scrutiny.

Understanding successful and failed US IPO examples helps investors see what separates sustainable public companies from short-lived hype.

- What is the NYSE? Understanding the New York Stock Exchange

- Market Cap Stocks: What They Are and Why They Matter for Investors

- What is Stock Liquidity? Why It’s Important for Investors

- Primary vs Secondary Market: Key Differences Explained

Overview of the US IPO Market Landscape

The United States has historically been the most active IPO market worldwide. Between 2010–2024, thousands of companies went public, collectively raising over $800 billion in equity capital.

Industry distribution (approx.):

| Sector | Share of IPOs (2010–2024) | Notable Examples |

| Technology | 32% | Facebook, Snowflake, Airbnb |

| Healthcare & Biotech | 25% | Moderna, Ginkgo Bioworks |

| Financial Services | 10% | Robinhood, Coinbase |

| Consumer Goods | 9% | Peloton, Beyond Meat |

| Energy & Industrials | 7% | Rivian, Lucid Motors |

| Others | 17% | Assorted SPACs, REITs |

- The tech sector dominates due to its scalability and investor appeal.

- However, trends have shifted: the post-COVID era saw renewed interest in energy transition and biotech listings.

- The US market’s transparency, deep capital pools, and strong legal framework make it a magnet for global companies.

- Firms like Alibaba (2014) and ARM (2023) chose US listings to gain credibility and reach a wider investor base.

Famous US IPO Examples That Shaped the Market

Google (Alphabet) – The Benchmark for Modern IPO Success

Year: 2004 | Raised: $1.67 billion | Ticker: GOOGL

Google’s IPO is a textbook example of innovation meeting investor demand. Its Dutch auction method, rare at the time, allowed wider investor participation rather than exclusive allocations to institutions. The IPO valued Google at $23 billion, and within two decades, it became one of the world’s most valuable companies.

Key takeaways:

- Alternative pricing mechanisms can democratize access.

- Long-term value creation outweighs short-term volatility.

- Transparency and consistent innovation sustain post-IPO growth.

Today, Alphabet’s IPO remains a case study in sustainable scaling and is often referenced in MBA programs and financial literature.

Facebook (Meta Platforms) – A Rocky Start Turned Success Story

Year: 2012 | Raised: $16 billion | Ticker: META

Facebook’s IPO was one of the largest tech offerings in history, yet its debut was marred by trading glitches on NASDAQ and skepticism about monetization. The stock fell nearly 50% in its first months.

However, under Mark Zuckerberg’s leadership, Facebook pivoted strongly into mobile advertising and digital ecosystem expansion. By 2020, the company’s market cap exceeded $800 billion.

Lessons learned:

- Operational mishaps can temporarily overshadow fundamentals.

- Vision and strategic execution restore investor confidence.

- The post-IPO phase determines long-term credibility.

Uber – A Disruptive IPO With Volatile Returns

Year: 2019 | Raised: $8.1 billion | Ticker: UBER

Uber symbolized the “growth over profit” model. Despite heavy losses, investors valued its market dominance.

On debut, Uber’s valuation hit $82 billion, yet its shares initially underperformed.

The pandemic reshaped Uber’s business model, pushing diversification through Uber Eats and logistics services.

By 2023, Uber reported its first profitable quarter, proving adaptability is key.

Investor insight: IPO valuation should reflect long-term fundamentals, not just hype.

Airbnb – The Hospitality Revolution

Year: 2020 | Raised: $3.5 billion | Ticker: ABNB

Airbnb went public amid the COVID-19 pandemic, a time when travel was at historic lows. Yet the company’s brand power and adaptable business model drove massive investor interest. The IPO opened at $68 per share and closed the first day at $144, more than doubling.

E-E-A-T insights:

- Experience: Airbnb’s founders leveraged real-world travel community insights.

- Expertise: The company showcased solid data on host retention and market demand.

- Authoritativeness: Supported by reputable underwriters (Morgan Stanley, Goldman Sachs).

- Trustworthiness: Transparent communication during global uncertainty built investor trust.

Airbnb’s IPO stands as a modern success story of brand resilience and market timing.

Rivian – The Promise and Challenge of EV IPOs

Year: 2021 | Raised: $13.5 billion | Ticker: RIVN

Rivian’s IPO became the largest US listing since Facebook, driven by the electric vehicle boom. Backed by Amazon and Ford, the company achieved a staggering $100 billion valuation on debut — higher than Ford itself.

However, Rivian’s stock later dropped over 70% as production delays and supply-chain challenges hit performance.

Key takeaway:

Even strong investor enthusiasm can fade without execution. Sustainable manufacturing and revenue scaling determine an IPO’s long-term success.

Coinbase – Bringing Cryptocurrency to Wall Street

Year: 2021 | Listed via Direct Listing | Ticker: COIN

Coinbase’s debut was historic as the first major crypto exchange to list on NASDAQ. At its April 2021 launch, it reached a market cap of $85 billion, symbolizing crypto’s entry into mainstream finance.

While crypto volatility later hurt the stock, Coinbase’s IPO legitimized digital assets and inspired numerous blockchain-related listings.

Investor note:

The IPO illustrated how regulatory clarity and consumer trust are essential for emerging-tech companies.

What Makes a Successful US IPO?

After reviewing these examples, several common factors stand out:

Strong business fundamentals

- Companies with proven revenue models and predictable growth attract stable investor interest.

Clear market differentiation

- Unique products, scalable platforms, or defensible advantages (like network effects) drive long-term demand.

Timing and market sentiment

- Launching during bullish market phases — like 2020’s tech optimism — boosts valuations, while downturns can limit capital raised.

Transparency and compliance

- Meeting SEC standards, accurate prospectuses, and honest projections strengthen trust.

Leadership credibility

- Executives with vision and integrity help sustain investor loyalty post-IPO.

In short, success in the US IPO market comes from alignment between company fundamentals and investor expectations — not just marketing hype.

Lessons from Failed or Struggling IPOs

WeWork – The IPO That Never Was

- WeWork planned to go public in 2019 with a $47 billion valuation, but its filing exposed unsustainable business practices and weak governance.

- The IPO was withdrawn, and the company’s valuation collapsed by over 80%.

Lesson: Transparency and corporate governance are critical. A strong brand cannot compensate for flawed fundamentals.

Robinhood – Democratizing Finance but Facing Regulation

Year: 2021 | Raised: $2.1 billion | Ticker: HOOD

Robinhood’s mission to “democratize investing” appealed to retail investors. However, regulatory controversies and system outages during volatile markets hurt its reputation.

Lesson: A compelling narrative must be backed by operational resilience and compliance readiness.

Beyond Meat – A Volatile but Visionary IPO

Year: 2019 | Raised: $240 million | Ticker: BYND

Beyond Meat’s IPO was one of the most explosive, rising 163% on the first day. But limited production capacity and competitive pressures led to steep declines later.

Takeaway: Sustainability-driven companies must balance innovation with profitability.

How to Evaluate a US IPO Example (Investor Perspective)

Investors can use several metrics to analyze IPOs before investing:

Key metrics:

- Revenue growth rate (YoY)

- Profitability or loss trend

- Market capitalization vs peers

- Price-to-Sales (P/S) ratio

- Lock-up period expiration dates

- Insider ownership percentage

Due diligence checklist:

- Review the company’s S-1 filing on the SEC website.

- Compare valuation multiples with industry averages.

- Study underwriter quality and reputation.

- Check governance structure and risk disclosures.

- Assess post-IPO lock-up expiry impacts.

Pro tip: Diversify IPO exposure — avoid allocating more than 5–10% of your portfolio to a single new listing.

Trends Shaping the Future of US IPOs

The US IPO market continues evolving with macroeconomic and technological shifts.

Emerging trends:

- AI-driven companies dominate the pipeline (OpenAI, Anthropic, Databricks).

- Green and climate tech IPOs gain traction amid ESG investing.

- SPAC market correction refocuses attention on traditional IPOs.

- Regulatory tightening improves transparency and investor protection.

- Cross-border listings increase, as more foreign startups target NASDAQ/NYSE.

According to EY Global, the US IPO volume in 2024 rebounded 60% compared to 2023, signaling renewed investor appetite.

Conclusion

US IPO examples continue to influence the stock market and attract significant investor attention. Analyzing these examples sheds light on the factors that drive a successful initial public offering, including timing, valuation, and market conditions. Understanding these elements makes it easier to navigate future IPO opportunities with confidence.

See more: