Trend Analysis vs Fundamental Analysis explores two distinct approaches to evaluating financial markets and making investment decisions. Trend analysis focuses on studying historical price movements and patterns to predict future market behavior, while fundamental analysis examines economic indicators, company financials, and industry conditions to assess intrinsic value. Visit tipstrade.org and check out the article below for further information

What Is Trend Analysis?

Trend Analysis is the method of studying price movements to determine whether a market is moving upward, downward, or sideways. Instead of focusing on company earnings or economic reports, trend analysts focus almost entirely on charts and price history.

The theory behind it is simple: price reflects collective market psychology. When buyers dominate, price trends upward. When sellers dominate, price trends downward.

Professional traders often say “the trend is your friend”, because statistics show that markets spend more time trending than staying flat.

According to a study by the Chartered Market Technician Association, trending periods in major stock indices account for nearly 70% of total trading time. That means traders who identify trends early often have a statistical advantage over those who trade randomly.

Trend Analysis is especially popular in:

- Stock trading

- Forex markets

- Crypto markets

- Commodity futures (gold, oil, wheat)

>>See more:

- Trendlines in Technical Analysis: What They Are, How to Draw, and How Traders Use Them Effectively

-

Cyclical Trends: Understanding the Rhythms of Markets and Economies

-

Volume Analysis: Understanding Market Strength Through Trading Volume

How Trend Traders Apply It in Real Markets

A trend trader usually opens a chart and tries to identify whether price is forming higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend). They may use technical tools like:

- Moving Averages (MA 50 / MA 200)

- RSI, MACD, Trend Lines

- Volume analysis

- Breakout patterns

For example, during 2020–2021, Tesla and Bitcoin both displayed consistent uptrends. Many trend traders did not analyze Tesla’s profit margins or Bitcoin’s blockchain fundamentals — they simply followed momentum.

Anyone who bought dips within the trend likely earned profit even without understanding valuation.

Trend traders usually enter a position only when price confirms direction. They avoid guessing the bottom or top.

A practical example is a trader who waits for the S&P 500 to cross above its 200-day moving average before buying. This rule-based approach reduces emotional decision-making.

Pros & Cons of Trend Analysis

| Advantages | Disadvantages |

| Works well in strongly trending markets | Poor results in sideways/choppy markets |

| Useful for short-term trading | Requires fast decisions and discipline |

| Provides clear entry/exit signals | Can produce false signals |

| Supports automation and algorithms | Doesn’t measure business valuation |

| Used heavily in crypto and forex | News events can reverse trends |

Many professional traders automate trend strategies using algorithms or bots. Hedge funds like Renaissance Technologies and Two Sigma famously rely on quantitative trend-focused systems rather than fundamental research.

Their success proves that data-driven trend strategies can outperform human intuition.

Still, trend analysis is not magic. During periods of consolidation, price can move unpredictably, causing stop-loss hits and frustration for beginners. Real trend traders accept losses as part of the game.

What Is Fundamental Analysis?

While trend traders focus on charts, Fundamental Analysis (FA) focuses on the true value of a company or asset.

FA is widely used by investment banks, mutual funds, and value investors like Warren Buffett. According to Investopedia, over 80% of long-term institutional portfolios rely on fundamental research rather than technical indicators.

A typical FA process examines:

- Balance sheet

- Income statement

- Cash flow

- P/E ratio, P/B ratio, ROE

- Economic conditions and industry trends

- Competitive advantage (moats)

Instead of predicting price tomorrow, FA tries to understand long-term potential.

Key Components of Fundamental Analysis

Fundamental investors break down value into several factors:

- Company Financials

Revenue growth, profit margins, debt, and cash reserves indicate business strength. - Management Quality

Experienced leaders often grow companies faster—Tesla, Microsoft, and Apple all demonstrate this. - Economic & Industry Conditions

Interest rates, inflation, and sector growth affect stock performance. For example, when interest rates fall, growth stocks typically become more attractive. - Market Sentiment

Even strong companies can suffer if the industry faces negative public sentiment.

A practical example:

In 2023, chip manufacturers surged after AI adoption accelerated. Fundamental investors who analyzed demand growth in semiconductors profited months before retail traders noticed the trend.

Pros & Cons of Fundamental Analysis

| Advantages | Disadvantages |

| Ideal for long-term investing | Slow reactions to short-term market moves |

| Helps identify undervalued assets | Requires research, time, and financial knowledge |

| Used by Warren Buffett, BlackRock, JPMorgan | Can be wrong if market stays irrational |

| Works well for building wealth | Not suitable for fast day trading |

Key Differences Trend Analysis vs Fundamental Analysis

Although both methods help investors make decisions, they answer different questions:

| Category | Trend Analysis | Fundamental Analysis |

| Focus | Price movement & market psychology | Intrinsic business value |

| Timeframe | Short-term: days or weeks | Long-term: months or years |

| Tools | Charts, indicators, patterns | Earnings reports, ratios, economics |

| Skillset | Chart reading, discipline | Accounting, financial analysis |

| Best for | Traders | Investors |

| Weakness | Chop & volatility | Emotional markets, slow signals |

Timeframe Comparison

Trend analysis helps traders catch quick price swings. Fundamental analysis rewards patience. For instance:

- A trend trader might enter Apple stock for 2 weeks during a breakout.

- A fundamental investor might hold Apple for 10 years based on innovation and revenue growth.

Both can be correct at the same time. They simply have different goals.

Data Source Comparison

Trend analysis uses:

- price

- volume

- moving averages

- momentum indicators

Fundamental analysis uses:

- earnings per share (EPS)

- debt levels

- cash flow

- economic forecasts

Think of it like weather vs climate:

- Trend = weather right now

- Fundamental = climate long term

Which One Is More Accurate?

No method is perfect. Even the world’s best analysts lose money.

- Trend analysis works best in strong momentum markets (like crypto bull runs).

- Fundamental analysis works when stock price eventually matches real company value.

According to a Harvard Business Review study, combining both increases accuracy more than using either alone.

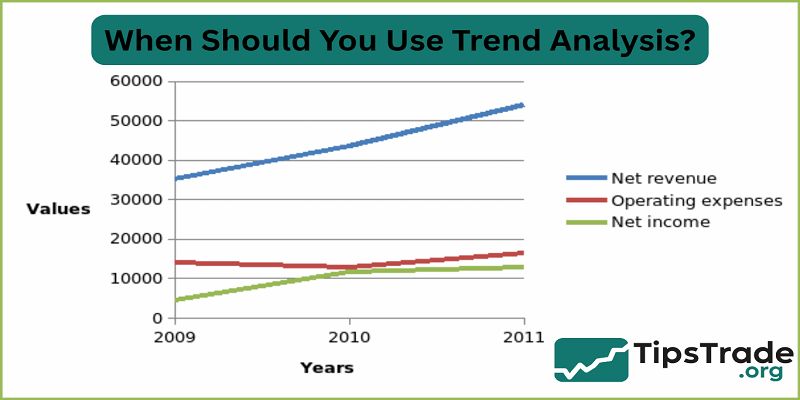

When Should You Use Trend Analysis?

Trend analysis is ideal in fast-moving markets:

- Day trading

- Swing trading

- Crypto volatility

- Forex momentum

- Commodity breakouts (oil, gold)

Practical example:

In 2020, gold broke resistance at $1,400 and entered a massive uptrend. Trend traders simply followed the movement and made gains without reading gold mining reports or interest rate data. The trend itself was enough.

Trend analysis also improves risk management. Stop-loss orders help traders exit quickly when the trend reverses. Many successful traders say:

“Small losses are okay. Big losses kill accounts.”

When Should You Use Fundamental Analysis?

FA is best for investors who prefer:

- Long-term wealth building

- Dividend growth stocks

- Stable, low-risk portfolios

- Retirement investing

Example:

In 2022, oil companies like ExxonMobil and Chevron increased profits because global oil prices surged. Fundamental analysts who followed supply, demand, and earnings reports bought early and profitably.

Some of the world’s richest investors — Buffett, Peter Lynch, Ray Dalio — built fortunes using fundamental research.

Conclusion

Trend Analysis vs Fundamental Analysis highlights the strengths and limitations of both methods, showing that combining these approaches can provide a more balanced and informed investment strategy. Understanding when to apply trend signals or fundamental insights plays a critical role in navigating market fluctuations effectively.

>>See more:

- Uptrend: Meaning, Signals, and How Traders Use It In Real Market Conditions

-

What are market trends? 3 ways to accurately identify market trends

-

Downtrend provides opportunities for traders to profit through short selling strategies

-

What Is a Sideways Trend? Definition, Causes, and How Traders Profit from It