Comparing TradingView vs MT5 reveals clear differences in functionality and target users, with TradingView excelling in charting and community features, while MT5 stands out as the leading choice for algorithmic trading and advanced backtesting. Let’s join Tipstrade.org in exploring each aspect in depth to discover the ideal trading platform that helps optimize strategies and enhance your investment performance!

TradingView vs MT5: An overview of the two “giants”

In the modern world of financial trading, choosing the right platform is a crucial stepping stone that determines an investor’s efficiency and success. Two of the most prominent names, often compared side by side, are TradingView vs MT5. Each platform has its own distinct strengths, catering to different trading styles and investment objectives.

What is TradingView? A playground for charts

TradingView emerged as a revolution in the field of technical analysis, operating entirely on a web-based platform. This brings exceptional flexibility, allowing traders to access charts and analytical tools from any internet-connected device, from desktop computers to smartphones, without the need to install complex software. According to TradingView’s own statistics, the platform attracts millions of users each month, highlighting its strong appeal.

The core strength of TradingView lies in its advanced HTML5 charting system, which is smooth, highly responsive, and extremely customizable. Users can take advantage of hundreds of built-in technical indicators, professional drawing tools, and powerful filters. Moreover, TradingView stands out thanks to its proprietary programming language, Pine Script. Pine Script is designed so that even non-programmers can easily create custom indicators or trading strategies, a point often mentioned in comparative analyses by Forex Tester.

Another distinguishing factor behind TradingView’s reputation is its social trading feature. It is not just an analytical tool, but also a massive social network for traders. Users can share ideas and analyses, follow experts, and learn from a global community. This collaborative environment fosters the development of knowledge and skills, an area where MT5 still falls short.

See more:

- TradingView vs MT4 in 2026: Which Platform Is Right for You?

- MT4 vs MT5 Comparison – Which Platform Should Traders Choose?

- Explore top 5 best indicators TradingView

- How to Install MT5 on Any Device: Complete Guide 2026

What is MetaTrader 5 (MT5)? Technical power for trading systems

MetaTrader 5, developed by MetaQuotes Software Corporation, is the successor and upgraded version of the legendary MT4. MT5 is a comprehensive trading platform specifically designed for order execution, account management, and especially algorithmic trading. Compared to MT4, MT5 expands the range of tradable assets to include stocks and futures, in addition to Forex and CFDs.

The true strength of MT5 lies in its automated trading capabilities through Expert Advisors (EAs). EAs are trading robots programmed using MQL5, a powerful object-oriented programming language with a structure similar to C++. MQL5 enables traders and developers to build sophisticated trading strategies, fully automating both market analysis and order execution.

In addition, MT5’s Strategy Tester is an extremely powerful backtesting tool. It allows EAs to be tested on historical data with high accuracy, simulating real market conditions to evaluate a strategy’s performance before deploying it on a live account. Although MT5’s interface may appear somewhat dated and less intuitive compared to TradingView, in terms of execution performance and technical depth for automated trading, it remains the gold standard in the industry.

Core differences: TradingView vs MT5

To make the right choice, we need to dive deeper into a direct comparison of the most important features of both platforms. The differences are not only in the interface, but also in the underlying design philosophy and core purpose of use. Understanding these aspects will help you determine which platform will best support your trading approach.

User Interface & Experience (UI/UX)

TradingView clearly holds an advantage in terms of a modern user interface and an intuitive user experience. Its web-based design is clean, streamlined, and easy to navigate, even for beginners. The HTML5 charts are not only visually appealing but also extremely smooth when interacting, zooming in and out, or switching between timeframes.

In contrast, MT5 features a more functional than aesthetic interface. It has a somewhat classic look and can feel overwhelming to new users due to the large number of windows and options. However, for experienced traders who are already familiar with it, MT5’s interface is highly efficient, allowing them to customize their workspace and quickly access the tools needed for order execution and position management. This difference reflects the philosophy of each platform: TradingView focuses on the charting and analytical experience, while MT5 prioritizes trade execution performance.

Charting & Analysis

This is the area where TradingView truly shines. The platform offers an almost limitless set of drawing tools and technical indicators. TradingView’s public library contains thousands of indicators and strategies created by users using Pine Script, providing a vast resource for exploration and learning. The ability to compare multiple charts on a single screen, perform multi-timeframe analysis, and save layouts to the cloud are major advantages.

MT5 also delivers a powerful suite of technical analysis tools, with 38 built-in indicators, 44 graphical objects, and support for up to 21 timeframes. However, MT5’s indicator library is less extensive, and installing custom indicators is more complex. While it is sufficient for most technical analysts, MT5 cannot match TradingView in terms of diversity, flexibility, and ease of use of charting tools.

Automated Trading (EAs) & Backtesting

In this area, MT5 clearly holds the upper hand. The platform is built from the ground up to support algorithmic trading. The MQL5 language allows the creation of Expert Advisors (EAs) and custom indicators with highly complex logic. MT5’s multi-threaded Strategy Tester is a professional backtesting tool, enabling fast and accurate optimization of strategy parameters on historical data. This is an indispensable tool for any systematic trader.

- How to Backtest on MT5: The Ultimate Guide for 2026

- What is MT5 EA? Guide on how to install and use MT5 EA in detail

TradingView also offers backtesting capabilities through its Strategy Tester, which is seamlessly integrated with Pine Script. It is well suited for quickly testing ideas and simple strategies. However, it lacks the depth, speed, and advanced simulation options available in MT5. TradingView does not support EAs in the same way as MT5; therefore, if your focus is on building and deploying fully automated trading robots that run 24/7, MT5 is the irreplaceable choice.

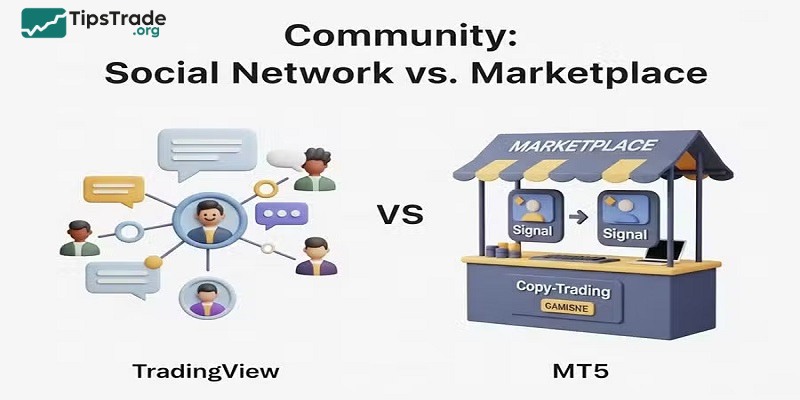

Social Trading & Community Features

TradingView has built the largest trading community in the world. Users can publish trading ideas and scripts, and receive feedback from millions of other traders. The Streams feature allows users to follow live analysis sessions. This environment facilitates learning, knowledge sharing, and inspiration, which many traders, especially beginners, find very helpful.

MT5, on the other hand, is a more individual-focused platform. While it has a strong MQL5 community where developers can exchange and trade EAs, it lacks the kind of direct social interaction built into the platform that TradingView offers. MetaTrader places greater emphasis on providing tools for individual traders rather than creating a space for them to connect with one another.

Compatibility & Accessibility

TradingView wins in terms of access flexibility. As a web-based platform, it allows users to log in and use all features from any browser on Windows, macOS, Linux, as well as on mobile devices. All data and layouts are synchronized in the cloud.

MT5 is primarily a desktop software application for Windows. Although versions are available for macOS, iOS, and Android, the desktop version remains the most fully featured. The requirement to install software can be a minor barrier, and syncing settings across devices is not as seamless as with TradingView.

Head-to-Head: TradingView vs MT5 scoring table

To help you easily visualize the differences between TradingView vs MT5, Tipstrade.org has compiled the important criteria into the comparison table below:

| Feature | MetaTrader 5 (MT5) | TradingView |

| Platform Type | Installed software (desktop-first) | Web-based platform (web-first) |

| User Interface | Functional, classic | Modern, intuitive, user-friendly |

| Charting Tools | Powerful, comprehensive | Superior, diverse, highly customizable |

| Automated Trading | Very strong (Expert Advisors) | Limited, mainly via alerts/webhooks |

| Backtesting | Advanced, multi-threaded, optimized | Basic, fast, integrated with Pine Script |

| Programming Language | MQL5 (complex, powerful) | Pine Script (easier to learn) |

| Social Features | Limited (MQL5 community) | Very strong (social trading network) |

| Broker Integration | Supported by most Forex/CFD brokers | Expanding, but still more limited |

| Cost | Free (via brokers) | Freemium (limited free version, paid plans available) |

| Best Suited For | Algorithmic traders, systematic traders | Technical analysts, discretionary traders |

Which platform should you choose? Is TradingView or MT5 right for you?

After a detailed analysis, the final question remains: which platform should you choose? The answer lies in how you define yourself in the trading world. Are you an artist seeking perfection on charts, or an engineer building automated trading systems?

When should you choose TradingView?

You should prioritize TradingView if you fall into one of the following groups:

- Pure Technical Analysts (The Chart Artist): If you spend most of your time drawing trendlines, identifying chart patterns, and experimenting with a wide range of indicators, TradingView’s superior charting tools are made for you.

- Beginners: A user-friendly interface, abundant educational resources from the community, and easy access to paper trading make TradingView an ideal starting point.

- Traders who need flexibility: If you frequently move around and need access to charts across multiple devices (office computer, personal laptop, tablet), TradingView’s web-based platform is the perfect choice.

- Those seeking ideas & community learning: If you want to explore other traders’ analyses, discuss strategies, and stay updated with new ideas, TradingView’s social features are an invaluable asset.

When should you choose MetaTrader 5?

MT5 will be the optimal choice if you are:

- Algorithmic traders: If your passion is building, testing, and deploying automated trading robots (EAs), no platform can match the power of MT5’s MQL5 language and Strategy Tester.

- High-frequency traders: MT5 is optimized for execution speed and stability, which is critical for strategies that require fast and precise order execution.

- Traders who need advanced order types: MT5 supports more complex pending orders such as Buy Stop Limit and Sell Stop Limit, providing greater control over trade entries.

- Traders looking for a free, all-in-one broker solution: Most brokers offer MT5 for free, fully integrated for live and demo trading without any additional platform fees.

Conclusion

The showdown between TradingView vs MT5 has no absolute winner. Instead, it highlights the diversity and specialization of tools designed to support traders. The final choice is not about finding the better platform, but about finding the one that best aligns with your personality, trading style, and trading goals.

See more: