Top Index Funds represent the cornerstone of passive investing, offering everyday investors a low-cost way to mirror the performance of major market benchmarks like the S&P 500. These funds have surged in popularity due to their simplicity, diversification benefits, and historical ability to outperform most actively managed alternatives over the long term. By tracking broad indices, they eliminate the need for stock-picking expertise while minimizing fees that can erode returns. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Index Funds and Why Are They Popular?

Index funds are investment funds designed to track the performance of a specific market index, such as the S&P 500, Total Stock Market Index, or a Bond Market Index. Unlike actively managed funds, index funds do not attempt to beat the market. Instead, they aim to replicate market returns as efficiently as possible.

From an experience-based perspective, investors who use index funds often report lower stress levels during market volatility. Because the strategy is rules-based and long-term focused, there is less temptation to trade frequently or react emotionally to market news.

Research from Morningstar consistently shows that low-cost index funds outperform the majority of active funds over 10–20 year periods, especially after fees. This reliability is a key reason why index funds dominate retirement accounts, robot – advisor portfolios, and institutional investment strategies.

How Index Funds Work

Index funds operate using a passive investment strategy. The fund holds securities in the same proportion as the underlying index, rebalancing only when the index changes.

Key characteristics include:

- Rule-based portfolio construction

- Low portfolio turnover

- Minimal trading costs

Because decisions are automated, index funds avoid common behavioral biases such as overconfidence or market timing errors. In long-term portfolio reviews, this mechanical discipline often results in more consistent outcomes compared to actively managed alternatives.

Why Index Funds Outperform Most Active Funds Over Time

Multiple studies, including SPIVA scorecards, show that over 80% of actively managed funds underperform their benchmarks over long periods. The main reasons include higher fees, trading costs, and increasing market efficiency.

Index funds benefit from:

- Lower expense ratios

- Reduced tax drag

- Broad diversification

Over decades, these small advantages compound significantly, making index funds one of the most effective tools for long-term wealth building.

Criteria Used to Rank the Top Index Funds

Not all index funds are equally effective. Evaluating the “top” index funds requires more than looking at recent performance.

Expense Ratio and Cost Efficiency

The expense ratio is one of the most important predictors of long-term performance. Index funds with expense ratios below 0.10% consistently rank higher in long-term studies.

Lower costs mean:

- More returns stay invested

- Less performance drag over time

According to Vanguard research, even a 0.50% difference in annual fees can result in tens of thousands of dollars less in retirement savings over 30 years.

Market Coverage and Diversification

Top index funds provide broad exposure across sectors, industries, and geographic regions. Diversification reduces reliance on any single stock or market segment.

Common diversification levels include:

- U.S. total market

- International developed markets

- Emerging markets

- Bonds and fixed income

Broader coverage generally leads to more stable long-term returns.

Tracking Accuracy and Fund Size

Tracking error measures how closely a fund follows its index. Large, well-established funds typically have lower tracking error due to liquidity and efficient management.

Large fund size also signals:

- Investor trust

- Operational stability

- Lower bid-ask spreads (for ETFs)

Fund Provider Reputation

- Reputable providers such as Vanguard, Fidelity, and BlackRock (iShares) have long track records of managing low-cost index funds.

- Their scale allows them to keep costs low and tracking accuracy high.

Top Index Funds for Long-Term Investors

Rather than naming specific ticker symbols, long-term investors typically focus on categories of index funds that consistently deliver reliable outcomes.

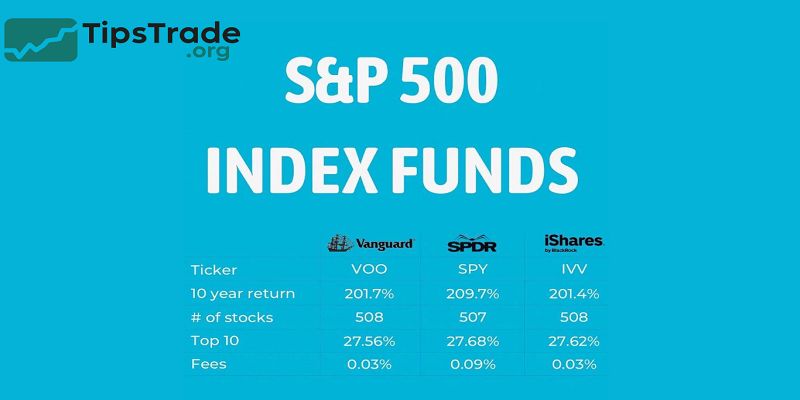

Best S&P 500 Index Funds

S&P 500 index funds track 500 of the largest U.S. companies and represent approximately 80% of total U.S. stock market value.

Why they rank highly:

- Exposure to industry-leading companies

- Strong historical performance

- Excellent diversification

These funds are often used as a core holding in long-term portfolios.

Best Total Stock Market Index Funds

Total stock market index funds provide exposure to large-, mid-, and small-cap stocks in a single fund.

Benefits include:

- Maximum diversification

- Reduced overlap with other funds

- Simplicity for one-fund portfolios

In portfolio reviews, these funds are commonly recommended for investors who want “own the entire market” exposure.

Best International Index Funds

International index funds track stocks outside the U.S., including developed and emerging markets.

Advantages:

- Geographic diversification

- Reduced home-country bias

- Exposure to global economic growth

Research shows that international exposure can reduce long-term portfolio volatility when combined with U.S. equities.

Best Bond Index Funds

Bond index funds track broad fixed-income markets, including government and corporate bonds.

They are commonly used to:

- Reduce portfolio volatility

- Generate income

- Balance equity risk

For retirement-focused investors, bond index funds often increase in allocation as time horizon shortens.

Top Index Funds for Beginners

Beginners benefit most from simplicity and clarity.

Simple, Low-Cost Index Funds

Funds with:

- Low expense ratios

- Broad diversification

- Clear investment objectives

These characteristics reduce complexity and help new investors stay consistent.

One-Fund Portfolio Options

- Target-date funds and balanced index funds combine stocks and bonds in a single product.

- These options are frequently used in retirement accounts due to automatic rebalancing and simplicity.

Index Funds vs ETFs for Beginners

- While ETFs trade intraday, index mutual funds trade once per day. For beginners focused on long-term investing, the difference is minimal.

- Simplicity often matters more than flexibility.

Comparing the Best Index Funds

| Category | Market Coverage | Cost Level | Best For |

| S&P 500 Index | Large-cap U.S. stocks | Very low | Core growth |

| Total Market Index | Entire U.S. market | Very low | One-fund portfolios |

| International Index | Global stocks | Low | Diversification |

| Bond Index | Fixed income | Low | Stability & income |

How to Choose the Right Index Fund for Your Portfolio

Choosing the right index fund depends on personal goals, not hype.

Based on Investment Goals

- Growth-focused investors prioritize equity index funds

- Income-focused investors emphasize bond index funds

Clear goals lead to better fund selection and discipline.

Based on Time Horizon

- Longer time horizons allow for higher equity exposure. Shorter horizons benefit from more conservative allocations.

Based on Risk Tolerance

- Risk tolerance determines how much volatility an investor can emotionally withstand. Index funds simplify this decision by offering predictable exposure.

Common Mistakes When Choosing Index Funds

Even with index funds, mistakes happen.

Chasing Short-Term Performance

- Past performance does not predict future results. Long-term consistency matters more.

Ignoring Fees and Taxes

- Small cost differences compound significantly over time.

Overlapping Index Funds

- Owning multiple funds that track similar indexes reduces diversification benefits.

Index Funds vs ETFs – Which Is Better?

Index mutual funds and index ETFs both track indexes, but differ in structure.

Structural Differences

- ETFs trade intraday and may offer tax advantages. Mutual funds offer simplicity and automatic investing.

Which Option Fits Which Investor

- ETFs: flexible, tax-efficient

- Mutual funds: simple, long-term focused

Both can be effective depending on investor preferences.

Conclusion

Top Index Funds stand out as reliable vehicles for building wealth steadily, backed by decades of data showing their edge in cost-efficiency and market-matching returns. Whether you’re a beginner seeking broad exposure or a seasoned investor optimizing your portfolio, funds like Vanguard’s VTI or Fidelity’s ZERO offerings provide accessible paths to long-term growth. Ultimately, incorporating these into your strategy demands discipline and patience, but the rewards—compounded gains without the hassle—make them indispensable in today’s markets.