In an increasingly competitive trading landscape, choosing the right TradingView strategy can make a decisive difference in your performance and long-term profitability. In this article, we will explore the top 5 most powerful TradingView strategy picks for 2026, helping you identify robust approaches that align with modern market conditions and evolving trader needs!

Why TradingView is the “holy grail” for trading strategies

Before jumping into the details, it is essential to understand why the global trading community prioritizes this platform.

- The power of Pine Script: TradingView’s proprietary programming language has entered more optimized versions, allowing the integration of On-chain data, market sentiment, and even AI directly into charts.

- High transparency: Strategies shared in the “Community Scripts” section often come with open-source code. This allows users to check for “repainting” – a critical factor for survival in trading.

- Backtesting ecosystem: With just a few clicks, you can test a strategy’s performance against 5-10 years of historical data instantly.

See more:

- What is TradingView? A Platform Providing Visual Charts for Traders

- Top Powerful TradingView Features Every Trader Should Know

- Guide to using TradingView chart for beginners

- How to Sign Up TradingView Account? Step-by-Step Guide

Top 5 most powerful TradingView strategy picks

Below is a list of the Top 5 most powerful TradingView strategy picks for traders in 2026:

Trend following strategy

Strategy description: This strategy focuses on identifying and following the current market trend. Traders buy when the trend is bullish and sell when the trend is bearish, aiming to capitalize on sustained market movements.

How to implement on TradingView:

- Using Moving Averages: Add SMA and EMA lines to the chart to identify the primary trend.

- MACD indicator: Use MACD to detect changes in trend strength, direction, momentum, and timing.

- Drawing trend channels: Use channel-drawing tools to identify support and resistance levels within the current trend.

Counter-trend trading strategy

Strategy description: This strategy aims to exploit market reversal points. Traders buy when the market is oversold and sell when it is overbought, anticipating an upcoming reversal.

How to implement on TradingView:

- RSI (Relative Strength Index): Helps identify overbought and oversold market conditions.

- Bollinger Bands indicator: Use Bollinger Bands to detect prices that deviate excessively from the standard range.

- Candlestick analysis: Apply candlestick patterns such as the Hammer and Shooting Star to identify potential reversal points.

Swing trading strategy

Strategy description: Swing trading focuses on capturing short-term price swings within a longer-term trend. Traders typically hold positions from several days to a few weeks to take advantage of price fluctuations.

How to implement on TradingView:

- Using Fibonacci Retracement: Identify potential support and resistance levels based on Fibonacci ratios.

- Stochastic Oscillator indicator: Helps determine potential buy and sell points during short-term swings.

- Volume analysis: Monitor trading volume to confirm the strength of the current trend.

Scalping trading strategy

Strategy description: Scalping is a short-term trading strategy that focuses on executing multiple small trades within a short period to profit from minor price movements.

How to implement on TradingView:

- Using minute charts: Monitor short timeframes such as 1–5 minutes to quickly spot trading opportunities.

- Short-term RSI and MACD indicators: Use faster versions of these indicators to identify quick buy and sell signals.

- Strict risk management: Set clear stop-loss and take-profit levels to protect capital and secure profits.

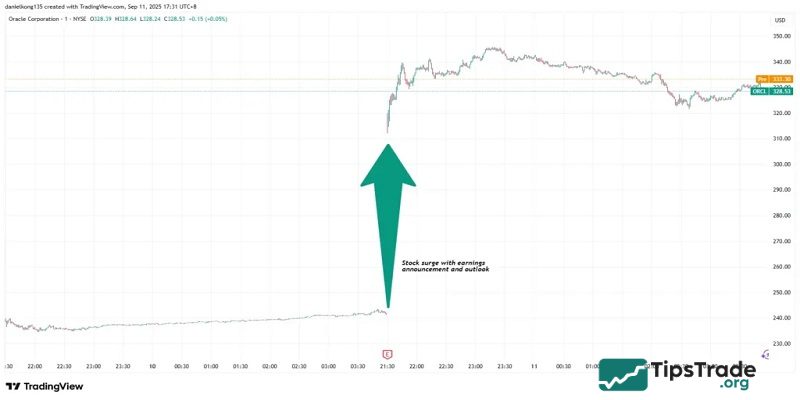

News trading strategy

Strategy description: This strategy capitalizes on price volatility caused by economic, political, or major events that impact the market.

How to implement on TradingView:

- Monitoring the economic calendar: Use TradingView’s economic calendar to stay updated on important events that may affect the market.

- Market sentiment analysis: Use sentiment indicators such as the Fear & Greed Index to better understand investor psychology.

- Setting alerts: Create price alerts to react quickly to news-driven market movements.

How to find and install strategies accurately

You don’t need to be a programmer to use these strategies. Just follow these steps:

- Open chart: Select the currency pair or stock you are interested in.

- Indicators menu: Click the “fx” icon on the toolbar.

- Community scripts: This is where the “treasures” are hidden. Type the strategy name (e.g., “Scalping trading strategy” or “Counter-trend trading strategy”).

- Check likes: Prioritize scripts with tens of thousands of likes and frequent updates.

Some notes when using strategies on the TradingView platform

No matter how popular a strategy is, the market always finds a way to challenge you. Remember:

- There is no “holy grail”: Every algorithm has drawdown periods. The key is to survive them.

- Risk management: Never risk more than 1-2% of your account on a single trade.

- Backtest and forward test: Test the strategy on a Demo account for at least one month before using real capital.

Frequently asked questions about TradingView strategy

- Do I need to pay to use these strategies? Most community scripts on TradingView are free. However, some authors offer “Invite-only” versions with advanced features that may require a subscription.

- Why am I losing money using the same strategy as others? Successful trading stands on three pillars: Strategy (10%), Risk Management (30%), and Trading Psychology (60%). You might be lacking discipline or proper position sizing.

- How can I create custom trading strategies on TradingView? You can use TradingView’s Pine Script programming language to build custom indicators and trading strategies. TradingView also provides extensive documentation and detailed tutorials to help you get started.

- Can I share my trading strategies with the TradingView community? Yes. TradingView encourages traders to share their ideas and strategies with the community. You can publish your charts and analyses on the community page to receive feedback and learn from other traders.

Conclusion

Above are the Top 5 most powerful TradingView strategy picks for 2026 that we would like to introduce to you. Hopefully, with the information shared above, you will be able to choose a suitable trading strategy for yourself. Wishing you success on your trading journey!

See more: