In Forex, just one small mistake can make a trader lose everything. That is why Forex account protection is something you can not ignore. In the article below, Tipstrade.org will share with you practical tips to help you minimize risks, optimize transactions and keep your capital safe. Let’s get started!

Why forex account protection is essential

If you have researched What is Forex, surely you already know that this is a financial market with the largest and most dynamic trading scale in the world today. Accordingly, the daily trading volume in the foreign exchange market can exceed 7,500 billion dollars and operates non-stop day and night. This is a place that opens up many attractive profit-making opportunities for traders, but also contains certain risks.

- High liquidity helps traders enter/exit orders easily.

- Big leverage allows traders to trade with small capital.

However, these two factors are a “double-edged sword”. If a specific and effective risk management strategy is not developed, traders can quickly face losses.

An emotional trade order, without a stop loss, plus a sharp price movement – that alone is enough to destroy an account in minutes.

Therefore, forex account protection is not an optional choice but a vital factor that helps you maintain stability and be able to survive long-term in the market.

>>See more:

- Forex Risk Limits – A Complete Guide for Traders

- Top 8 Forex Trading Mistakes Beginners Make & How To Avoid Them

- Forex Regulatory Organization: Understand It For Safer Trading

- Forex Capital Management Tips: The Key To Success For Professional Traders

Common risks that threaten your forex account

Understanding the common risks that threaten your forex account below will help traders protect their Forex accounts more effectively:

Market volatility & emotional risk

When trading happens too quickly, traders can easily fall into a state of emotional imbalance. Common behaviors such as rushing to recover losses, revenge trading or wanting to increase order volume when winning easily cause traders to lose discipline. From there, they cannot protect their Forex account.

Excessive use of leverage tools

Leverage is often likened to a “double-edged sword”. When used correctly, traders can take advantage of it to maximize their capital. On the contrary, if they abuse this tool too much, just a slight fluctuation can wipe out your account. And one of the common reasons that easily leads to burning a trader’s account comes from using leverage without a clear stop loss.

Not measuring trading probability

Opening a trading position without any clear advantage is nothing more than a risky gamble. Therefore, to increase the probability of success in finding an entry point to more than 50%, it is recommended that traders use two popular analysis methods: technical and fundamental.

Increasing trading volume based on emotion

Actions such as increasing the lot after several consecutive winning or losing orders without a control system,… are the reasons why your Forex account is “eroded” quickly.

The advice is to maintain a stable trading volume within the acceptable risk range. Only when you can prove a long-term profitable streak with real data should you consider changing the position size.

Top security tips to protect your forex account

After learning the reasons why you need to forex account protection, and the risks you need to anticipate when trading in the above content, below are effective strategies to help protect your Forex account safely:

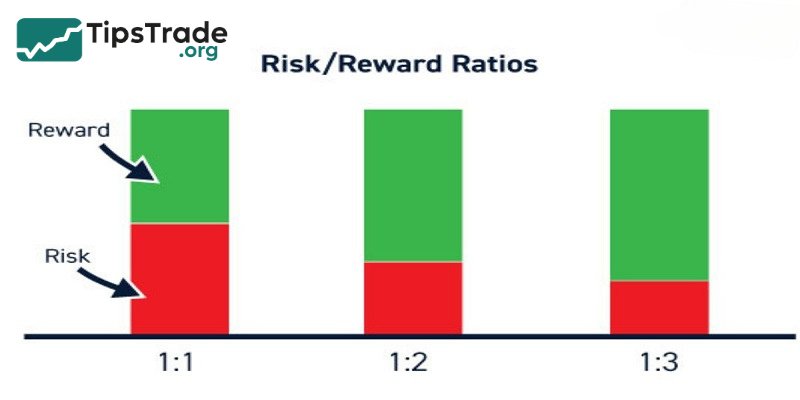

Set a reasonable risk-to-reward ratio for each trade

Do not risk more than 2% of account capital per trade is a common rule that you need to follow.

Assuming you have $5,000, it is best to risk $100 per trade. This ensures that even if you lose 50 trades in a row, you still have some capital left in your account to improve your trading strategy later.

Use Stop Loss orders with discipline

Not setting a Stop Loss means you are leaving your forex account at the mercy of market fluctuations. During times of high volatility in the forex market, it can wipe out your entire account if there is no predetermined maximum loss.

On the other hand, stop loss should be set based on technical analysis and not decided by emotions. And the key is to respect this principle, not move the stop loss when the price goes against the expected direction.

Distinguish clearly between speculation and gambling

The line between strategic speculation and gambling is often blurred by many traders. The key difference lies in risk management: the calculated speculator always knows in advance how much he can lose and is willing to accept it. This is how he protects his Forex account with reason instead of emotion.

Keep a trading journal

For each trading session, you should write down everything: from the reason for placing the order, the emotions when trading, the results,… Thereby, you will have a full basis to have a more objective view of yourself. This method is especially effective in identifying bad habits – factors that silently erode your Forex account.

Forex account protection tools for traders

Here are some trading tools that make it easier for traders to protect their Forex accounts:

Trading volume calculator

For example, Position Size Calculator is a software that helps traders determine how much order volume is reasonable with an acceptable level of risk. Thanks to that, traders will limit the situation of placing orders with too much volume, putting pressure on the trading account.

Automated Stop Loss or Trailing Stop

Trailing Stop order is a Forex account protection tool that allows the stop loss to be adjusted according to the price direction, helping traders to preserve part of the profit while still maintaining the position. When using Stop Loss and Trailing Stop in parallel, traders can now protect their Forex account more effectively even in situations of unexpected market fluctuations.

FAQs about forex account protection

What should a new trader do first to protect their Forex account?

New traders need to remember one thing: how to maintain an account for a long time is more important than making quick profits. Therefore, you should pay attention to how to manage risks effectively, place orders with small volumes first and then gradually increase them. In particular, you should only participate in the market when you have a clear trading system.

Should traders use high leverage in Forex trading?

If you are a new trader, do not have much experience in trading, then using a high leverage ratio is not recommended. Remember that “leverage is a double-edged sword”. It can help you amplify profits, but it is also a dangerous factor that causes many accounts to “burn out” in a moment. Choosing a low leverage level will help you increase the ability to protect your forex account.

When should a trader stop trading?

In case you have just experienced many losing orders, or your mood is affected by anger and desire to recover losses, know when to stop. Entering the market with negative emotions is the number one enemy of effective account capital management.

Conclusion

The Forex market is unforgiving to those who lack discipline. To be successful, you need to prioritize forex account protection before thinking about profits. Hopefully, the tips to forex account protection shared above will be the foundation for you to build a more sustainable and safer trading strategy. Good luck!