The Three white soldiers candlestick is one of the most reliable signal patterns in the market. However, not everyone truly understands its signs or how to identify it correctly. If you feel the same way, let’s join Tipstrade.org in taking a closer look at its meaning and how to trade using this candlestick pattern below.

What is the Three white soldiers candlestick?

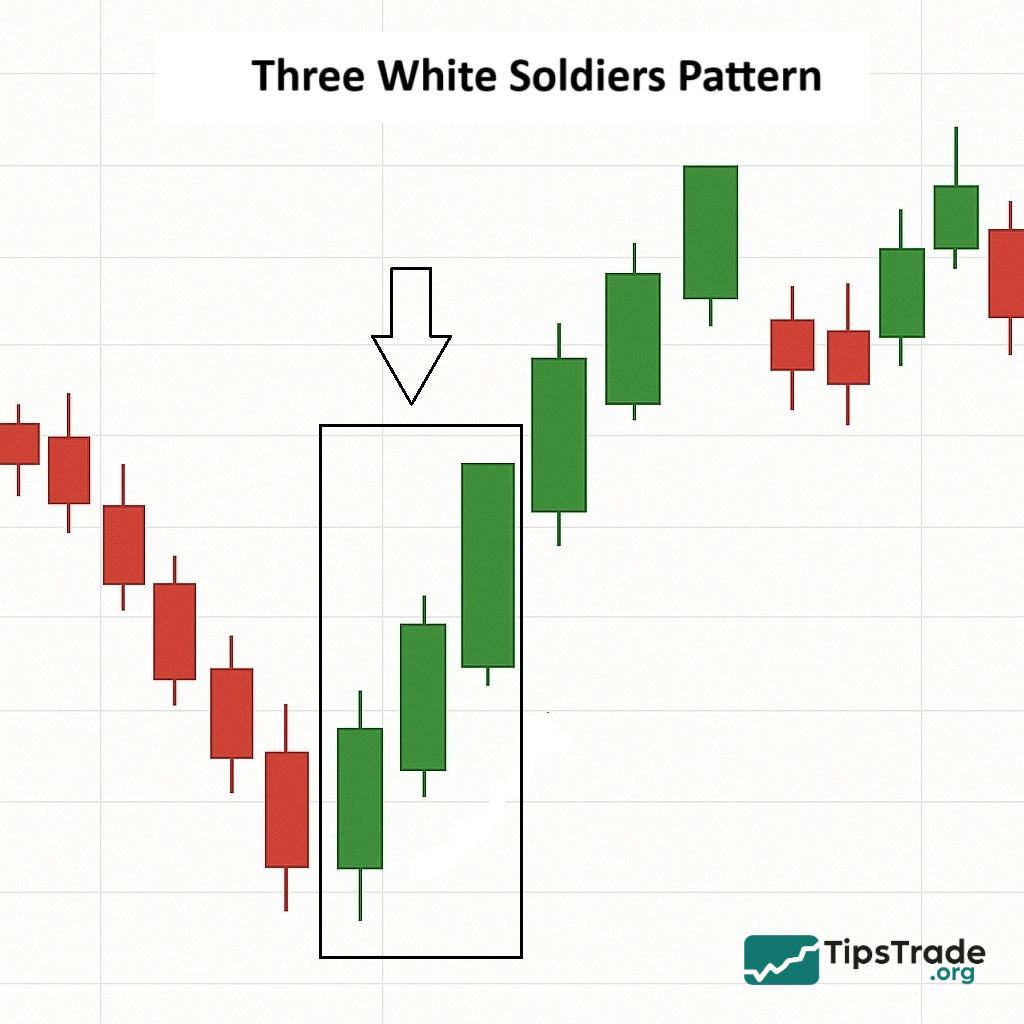

The Three white soldiers candlestick is a strong bullish candlestick pattern that typically appears after a downtrend. This pattern consists of three consecutive long bullish candles, with each candle opening higher and closing significantly higher than the previous one.

The image of the three candles resembles three soldiers steadily marching forward, clearly reflecting the strength and momentum of the market. It signals a shift in investor sentiment from pessimism to optimism. Traders often view this pattern as an indication of a reversal from a downtrend to an uptrend, or as confirmation of an existing bullish move.

Understanding and applying the Three white soldiers candlestick gives traders what can be likened to “three steadfast allies” on the trading battlefield, helping to boost confidence and open up more profit opportunities.

See more:

- Learn to trade Bearish Engulfing candlestick effectively

- What Is a Morning Star Candlestick & How to Trade It

- Three Black Crows Candlestick – What It Is And How To Trade It

- Dark Cloud Cover Candlestick and Profitable Trading Strategies Investors Should Know!

Identifying characteristics of the Three white soldiers candlestick

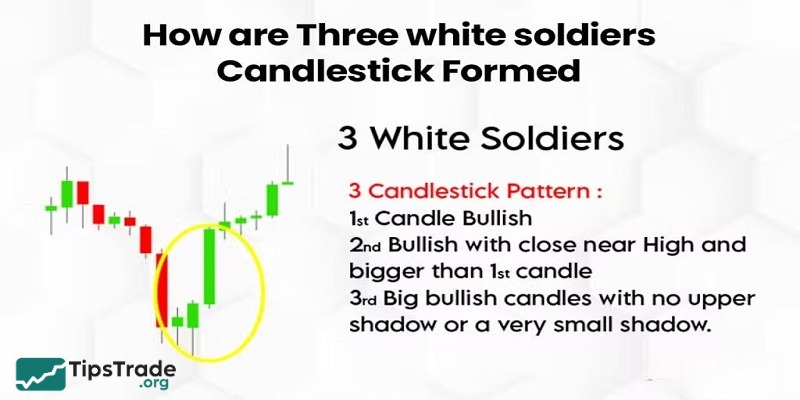

The Three white soldiers candlestick on a price chart looks like three resilient soldiers steadily marching forward, representing the overwhelming strength of the buyers. This is a bullish candlestick pattern, characterized by three consecutive long bullish candles, each of which opens and closes higher than the previous one.

Specific features:

- First soldier: Starting the upward momentum with a strong candle, closing near the peak, signaling the return of the buyers.

- Second soldier: Continuing the momentum, opening higher than the previous closing level and continuing to close near the peak, strengthening the trend’s power.

- Third soldier: Complete the formation, open the door higher again, and close the door near the top, confirming the dominance of the buyers and strengthening expectations of a trend reversal.

Conditions for pattern confirmation:

- Three consecutive bullish candles.

- The opening and closing prices of each candle are higher than the previous candle.

- All three candles have long bodies, with short shadows above and below (indicating overwhelming buying pressure).

The Three white soldiers candlestick indicates that market sentiment has shifted strongly from pessimism to optimism, signaling a potential upward trend. The more “soldiers” that are strong, the higher the probability of success in trading.

Example illustrating the Three white soldiers candlestick

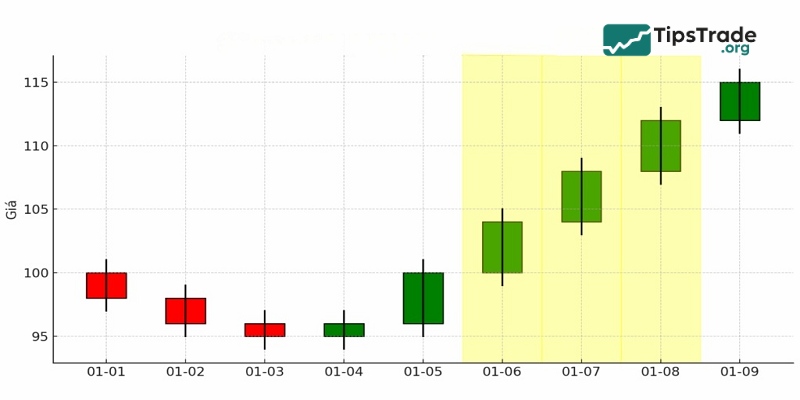

Suppose that on the price chart of stock XYZ, after a prolonged downtrend, prices continuously form new lows, reflecting a highly pessimistic market sentiment. However, at a strong support level, the Three white soldiers candlestick appears:

- Day 1 (First soldier): A long bullish candle forms and closes near the session high, indicating that buying pressure is beginning to emerge.

- Day 2 (Second soldier): The second bullish candle opens higher than the previous day’s close and again closes near the high, reinforcing confidence that buyers have taken control of the market.

- Day 3 (Third soldier): The third bullish candle opens higher once more and closes near the high, completing the “three white soldiers” formation and confirming the potential bullish reversal.

If this pattern is accompanied by steadily increasing trading volume across all three sessions, its reliability is further strengthened. Investors may view this as a signal to open long positions, place a stop loss below the low of the first candle, and anticipate the formation of a new uptrend.

This is a chart illustrating the Three white soldiers candlestick: three consecutive long green candles prominently marked with a yellow background, appearing after a downtrend and signaling the potential for a bullish reversal.

Another example: For stock CP, a similar pattern also appears. On the first trading day, the price opens at $25.9 and closes at $26.4. On the second day, the price opens at $26.5 and closes higher at $26.8.

On the third day, the market continues to show strength by opening at $26.8 and closing firmly at $27.2. This sequence of three consecutive bullish candles indicates a clear reversal signal, suggesting that traders may consider opening long positions as a new uptrend begins to form.

How to trade the Three white soldiers candlestick

Trading based on the Three white soldiers candlestick is like embarking on a journey through a lush green forest, where three “soldiers” accompany you and guide you toward a land of opportunity. These three consecutive bullish candles signal a potential trend reversal, giving traders a clear advantage. Let’s explore how to identify entry and exit points when trading with the Three white soldiers candlestick pattern.

Identifying entry point

- Pattern recognition: Identify three consecutive long bullish candles, with each opening near the previous candle’s close and closing progressively higher, forming a step-like upward structure.

- Volume confirmation: The signal becomes more reliable if volume increases with each candle, reflecting strong buying pressure.

- The third soldier: The third bullish candle acts as confirmation. A strong candle suggests that the newly forming uptrend is likely to be sustainable.

Identifying exit point

- Taking profits wisely: Just as any journey needs rest stops, take profits at predefined target levels or when the trend shows signs of weakening. A risk-to-reward ratio of 2:1 is commonly considered a prudent strategy.

- Using a trailing stop: Think of a trailing stop as a compass that helps you stay on course. Gradually move the stop-loss level higher to protect profits as the trend continues, while limiting risk if the market reverses.

Notes when using the Three white soldiers candlestick

Although the Three white soldiers candlestick is often considered a strong bullish signal, traders should keep the following points in mind to trade it effectively:

- Avoid chasing prices when the pattern looks “too perfect”: If all three candles are excessively long, price may have risen too quickly, leading to an overbought condition. In such cases, the risk of a short-term pullback is high.

- Consider trading volume: The pattern is more reliable when accompanied by increasing volume across the three candles. Conversely, if volume is low, the likelihood of a successful reversal is less certain.

- Identify the formation location: The Three white soldiers candlestick works best after a prolonged downtrend or following a consolidation phase. If it forms in the middle of a strong uptrend, it may represent only a short-term rally.

- Combine with other tools: Use additional indicators such as RSI, MACD, or moving averages (MA) to confirm the signal. For example, if the RSI moves out of the oversold zone and the MACD crosses upward, the pattern’s reliability is further enhanced.

- Risk management: Always place a stop loss below the first candle of the pattern to protect against failed reversal signals.

Combining the Three white soldiers candlestick with other indicators

To increase the reliability of signals, the Three white soldiers candlestick should not be used in isolation. Combining it with other technical analysis tools helps reduce noise and strengthen trading decisions:

Three white soldiers pattern with RSI

- If the Three white soldiers candlestick appears as the RSI has just exited the oversold zone (below 30), the bullish signal becomes more reliable.

- Conversely, if the RSI is already in the overbought zone (above 70), traders should be cautious due to the high risk of a short-term correction.

Three white soldiers with Moving Average Convergence/Divergence (MACD)

- The pattern becomes stronger if the MACD simultaneously crosses above the signal line or the histogram turns positive.

- This provides additional confirmation that buyers are gaining control of the market.

Three white soldiers with Moving Average

- When the Three white soldiers candlestick forms above or right at the support area of the MA50 or MA200, it reinforces the likelihood of a sustainable bullish reversal.

- If it appears below key moving averages, traders should wait for further confirmation before entering a trade.

Three white soldiers with Volume

- Along with the three bullish candles forming at the end of the downtrend, it is also important to look for the volume data. If the volume is increasing then this confirms that the short sellers are exiting and long traders are entering the market.

- However, if the volume is low then this clearly means that the candles are formed only because the short sellers booking profit in the market and the reversal is false.

In summary, the Three white soldiers candlestick is most effective when supported by confirmation signals from RSI, MACD, moving averages, and trading volume. This approach helps traders reduce risk and improve the probability of success.

How do the Three white soldiers and Three black crows candlesticks differ?

In technical analysis, candlestick patterns are like the “language” of the market, with each pattern reflecting a different psychological state. Among the most notable are Three white soldiers and Three black crows – two opposing candlestick formations, much like day and night.

- Three white soldiers: This pattern consists of three consecutive long bullish candles, each opening higher and closing higher than the previous one. It reflects the overwhelming strength of buyers and signals a potential uptrend. The formation resembles a powerful army advancing steadily, gradually reinforcing optimistic market sentiment.

- Three black crows: In contrast, the Three black crows pattern is made up of three consecutive long bearish candles, each opening lower and closing lower than the previous one. It indicates seller dominance, reflects pessimistic sentiment, and warns that a downtrend may continue. The image of “three black crows” conveys gloom and serves as a cautionary signal of downside risk.

In essence, Three white soldiers symbolize a bullish reversal or the strengthening of an uptrend, while Three black crows signal a bearish reversal or the continuation of a downtrend. Distinguishing and understanding these two patterns helps traders make more informed decisions in a highly volatile financial market.

Here is a brief comparison table between the Three white soldiers model and the Three black crows:

| Criteria | Three White Soldiers | Three Black Crows |

|---|---|---|

| Number of candles | Three consecutive long bullish candles | Three consecutive long bearish candles |

| Typical formation location | Usually after a downtrend or a consolidation phase | Usually after an uptrend or near a market top |

| Meaning | Buyers dominate, signaling a potential uptrend | Sellers dominate, signaling a potential downtrend |

| Market psychology | Shifts from pessimism to optimism | Shifts from optimism to pessimism |

Limitations of using the Three white soldiers candlestick

Although it is considered one of the strongest bullish signals, the Three white soldiers candlestick also has several limitations that traders should be aware of before applying it in trading:

- Overbought signals: Three consecutive bullish candles, especially when the candle bodies are unusually long, can push the market into an overbought condition. In such cases, the likelihood of a short-term pullback or profit-taking increases significantly.

- Prone to false signals: If the pattern forms without meaningful trading volume, the bullish signal may lack strength and can easily be reversed.

- Reduced reliability in the middle of an uptrend: The Three white soldiers candlestick is more reliable when it appears after a downtrend or a consolidation phase. If it forms in the middle of a strong uptrend, it may simply reflect temporary enthusiasm rather than signal the start of a new trend.

- Should not be used in isolation: Like many candlestick patterns, Three white soldiers only represent part of the overall market picture. Without confirmation from other tools (such as RSI, MACD, moving averages, or support/resistance levels), traders may make inaccurate decisions.

- Does not define exit points: This pattern mainly provides entry signals but does not clearly indicate take-profit or stop-loss levels. Therefore, traders need to combine it with their own risk management strategies.

Conclusion

Above, Tipstrade.org has introduced you to the Three white soldiers candlestick and some trading guidelines for this pattern. Hopefully, the information above will help you learn more about how to use and trade more effectively with one of the most reliable candlestick patterns in the market.

See more: