Stock market technology plays a crucial role in shaping modern financial markets. It drives efficiency, transparency, and speed in trading activities. This technology enables investors to access real-time data, execute trades instantly, and manage portfolios seamlessly. Understanding stock market technology is essential for both individual investors and institutions to stay competitive in today’s fast-paced market environment. Visit tipstrade.org and check out the article below for further information

Algorithmic and High-Frequency Trading (HFT) in the Stock Market

Definition and Growth of Algorithmic Trading

- Algorithmic trading (also called algo trading) refers to the use of computer programs that automatically execute trades based on predefined criteria — such as price, timing, or volume.

- These algorithms eliminate emotional bias and can process vast amounts of data within milliseconds.

- According to a 2024 Statista report, algorithmic trading accounted for over 70% of U.S. equity trading volume.

- This surge reflects how institutional investors and hedge funds rely on automation to achieve precision and speed.

- Retail traders, too, increasingly access simplified algo – based tools through online platforms like Interactive Brokers or Meta Trader 5.

- For example, during market volatility, algorithms can detect micro-price movements and execute hundreds of trades in seconds — a task impossible for humans.

- This efficiency, however, comes with new forms of systemic risk.

How HFT Impacts Liquidity and Volatility

- High-frequency trading (HFT), a subset of algorithmic trading, uses powerful computers to place a large number of orders at extremely high speeds.

- HFT firms provide market liquidity, narrowing bid-ask spreads and improving execution efficiency for most traders.

- However, studies by the Bank for International Settlements (BIS) suggest that HFT can amplify short-term volatility, especially during flash crashes or data-driven market shocks.

- The infamous 2010 “Flash Crash,” where the Dow Jones dropped nearly 1,000 points in minutes, demonstrated how automated systems can interact in unpredictable ways.

- Still, regulators like the U.S. SEC and ESMA (Europe) continue to improve circuit breakers and market safeguards to prevent such incidents.

- The balance between speed, stability, and fairness remains an ongoing challenge in the evolution of market technology.

Regulatory and Ethical Considerations of Algorithmic Trading

While algo trading boosts efficiency, it also raises questions about transparency and fairness. Regulators worldwide — including the SEC, FCA (UK), and MAS (Singapore) — have introduced frameworks to ensure algorithms do not manipulate markets.

Key ethical issues include:

- Market manipulation: Algorithms can unintentionally create false signals or exploit microstructure inefficiencies.

- Access inequality: Smaller firms may lack the technology or infrastructure to compete with large HFT players.

- Accountability: Determining liability when an algorithm causes a market disruption remains complex.

Overall, policymakers encourage responsible innovation — allowing technological progress while maintaining investor protection and market integrity.

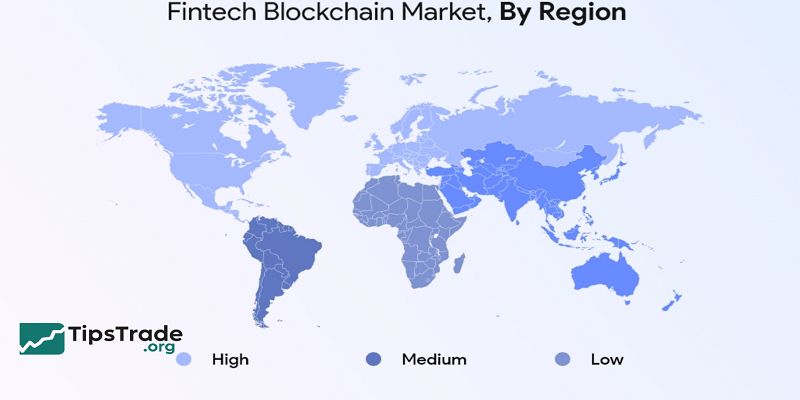

Fintech, Blockchain, and Digital Platforms in Equity Markets

Blockchain Applications: Clearing, Settlement, and Tokenization

- Blockchain technology — the decentralized ledger system behind cryptocurrencies — is also revolutionizing how equities are issued, traded, and settled.

- Traditionally, stock settlement could take two to three days (known as T+2).

- With blockchain, transactions can be validated and settled almost instantly, reducing counterparty risk and operational costs.

- In 2023, NASDAQ piloted blockchain-based settlement for private securities, while DTCC (Depository Trust & Clearing Corporation) explored distributed ledger technology (DLT) for real-time clearing.

- Tokenization — converting traditional shares into digital tokens — allows fractional ownership and 24/7 trading accessibility.

- This innovation promises transparency and efficiency but still requires regulatory clarity, especially regarding investor rights and cross-border transactions.

Online Trading Platforms and the Democratization of Trading

- Fintech innovation has brought Wall Street to the smartphone.

- Platforms like Robinhood, etoro, and Webull have lowered entry barriers, enabling millions of retail investors to trade stocks commission-free.

- According to FINRA’s 2024 investor report, nearly 60% of new U.S. retail investors began trading during or after the pandemic — primarily using mobile apps.

- These tools combine intuitive design with real-time analytics, social trading features, and AI-powered recommendations.

- However, accessibility also introduces behavioral risks, such as overtrading and herd behavior driven by social media hype.

- Regulators continue to push for better investor education and clearer risk disclosures on these digital platforms.

Robo-Advisors, Mobile Apps, and Social Trading

- Robo-advisors like Betterment and wealthfront use algorithms to automate portfolio management.

- These platforms analyze an investor’s goals, risk tolerance, and timeline, then allocate assets accordingly — often at a fraction of traditional advisory costs.

- Social trading platforms such as etoro allow users to mirror strategies of successful traders, creating a “crowd-driven” investment ecosystem.

- Meanwhile, apps like Sofi Invest integrate budgeting, saving, and investing in a single dashboard.

- These fintech solutions exemplify how technology enhances accessibility and personalization.

- Yet investors must remain cautious — algorithmic advice cannot fully replace human judgment, especially during uncertain markets.

AI, Big Data, and Analytics in Stock Market Technology

Using Alternative Data for Stock Insights

- Big data has transformed investment analysis. Hedge funds and institutional investors increasingly rely on alternative data — such as satellite images of retail parking lots, social sentiment from X (Twitter), or web traffic — to predict earnings trends before official reports.

- Research by PwC (2024) estimates that over 45% of financial firms now integrate alternative data into their decision-making.

- These insights help traders anticipate demand shifts, evaluate consumer behavior, or gauge supply chain disruptions faster than traditional methods.

- However, success depends on data quality, timeliness, and context.

- Poorly curated data can mislead models and produce inaccurate forecasts, emphasizing the need for expert interpretation.

Artificial Intelligence & Machine Learning in Trading and Forecasting

- AI and machine learning (ML) are the backbone of modern trading systems.

- They identify patterns invisible to human analysts, enabling predictive modeling for stock prices, volatility, and portfolio optimization.

For instance:

- JP Morgan’s LOXM uses ML to optimize trade execution for institutional clients.

- BlackRock’s Aladdin platform integrates AI to manage portfolio risk across trillions in assets.

- AI sentiment analysis tools like Accern and Sentifi process millions of news and social posts to detect emerging trends.

However, AI models are not infallible. Overfitting, data bias, and lack of transparency (“black-box models”) can produce false confidence. Responsible AI in finance must include continuous monitoring, explainable algorithms, and ethical oversight.

Risks and Challenges Data Bias, Cybersecurity, and Over-Automation

Technology’s benefits come with vulnerabilities. Financial institutions are prime targets for cyberattacks, given the sensitive data and funds they handle. In 2024, the World Economic Forum ranked cyber risk among the top three global financial threats.

Other challenges include:

- Data bias: AI systems trained on skewed data may produce discriminatory or inaccurate outputs.

- Systemic risk: Excessive reliance on automation may lead to synchronized algorithmic behaviors during crises.

- Operational risk: Hardware failures or connectivity issues can halt entire trading systems.

- To mitigate these, firms invest in resilient infrastructure, multi-layer cybersecurity, and hybrid oversight — combining human expertise with machine precision.

Technology’s Impact on Market Structure and Investor Behaviour

Market Structure Changes: Electronic Exchanges and Dark Pools

Technology has reshaped how trades are matched and executed. Traditional exchanges like NYSE and NASDAQ now operate as electronic platforms capable of processing millions of orders per second.

Meanwhile, dark pools — private exchanges for institutional trading — allow large orders without immediate market impact. While they enhance liquidity for big players, they also reduce transparency for retail investors.

Regulators continuously review these systems to ensure fairness and prevent potential manipulation. Transparency in order routing and execution quality remains a top priority.

Behavioural Changes: Retail Investor Access and Social Media Influence

Social media platforms such as Reddit (WallStreetBets) and X (formerly Twitter) have changed how retail investors communicate and coordinate. The GameStop short squeeze of 2021 highlighted how online communities can move markets collectively — an unprecedented phenomenon in financial history.

Retail investors today demand real-time access, low fees, and democratized information. Platforms that integrate AI-driven insights or gamified features appeal to younger demographics but can also encourage speculative behavior.

Investor education, transparency, and responsible design are crucial to prevent the blending of trading and entertainment into “financial gambling.”

Technology-Driven Risk Factors: Cyber-Attacks and System Outages

The global stock market depends on highly interconnected digital systems. A single glitch or cyberattack can disrupt billions in trades. For example, in 2023, a technical outage at the London Stock Exchange temporarily froze trading across multiple blue-chip stocks.

Financial firms now prioritize:

- Cybersecurity investment: Multi-factor authentication, encryption, and AI-based intrusion detection.

- Redundant systems: Backup servers and fail-safe protocols for critical operations.

- Regulatory compliance: Frameworks like ISO 27001 and NIST for cybersecurity standards.

Investors should remain aware that even the most advanced systems are not immune to disruption — diversification and awareness remain the best defenses.

The Future of Stock Market Technology & What Investors Should Know

Emerging Trends: Web3, DeFi, and Tokenized Equities

- The next wave of innovation lies in Web3 — a decentralized internet powered by blockchain and smart contracts.

- In the stock market context, DeFi (Decentralized Finance) platforms enable peer-to-peer trading without intermediaries.

- Projects like Polymesh and tZERO are pioneering tokenized equities, allowing investors to buy fractional shares globally.

- This model offers 24/7 accessibility, reduced fees, and transparent ownership records.

- However, integration with traditional markets requires legal frameworks, custody solutions, and interoperability between centralized and decentralized systems.

How Investors Can Prepare: Tools, Education, and Portfolio Adaptation

To thrive in this evolving environment, investors should:

- Embrace technology: Use AI-powered tools for portfolio tracking and risk assessment.

- Prioritize education: Learn basic coding or data literacy to understand algorithmic behavior.

- Diversify portfolios: Combine tech-exposed assets (e.g., fintech ETFs) with traditional holdings.

- Stay updated: Follow credible financial tech sources like Bloomberg Technology, CB Insights, and Finextra.

As technology accelerates, adaptability becomes a competitive advantage for every market participant.

Ethics, Regulation, and Governance in Future Tech-Enabled Markets

The convergence of finance and technology raises new governance challenges. Policymakers must ensure innovation aligns with investor protection, data privacy, and systemic stability.

Future regulation will likely emphasize:

- Algorithmic accountability — ensuring code transparency and auditability.

- AI governance — ethical use of predictive systems in trading.

- Cross-border collaboration — harmonizing digital asset laws globally.

As markets evolve, maintaining public trust through robust oversight will be vital to the sustainable growth of financial technology.

Conclusion

Stock market technology continues to transform how trading and investment decisions are made. It enhances market accessibility and reduces barriers for all participants. As technology advances further, it will bring more innovations that improve market stability and investor confidence. Embracing these technological developments is vital for anyone involved in the stock market to achieve success.