Stock exchange is a regulated marketplace where securities such as stocks, bonds, and derivatives are bought and sold in a systematic and transparent manner. Stock exchange plays a vital role in the economy by enabling companies to raise capital for growth and operations while providing investors with liquidity and a platform for price discovery. Through this article, let’s explore the details more deeply together at tipstrade.org

What is a Stock Exchange?

- A stock exchange is an organized marketplace where securities such as stocks, bonds, and derivatives are traded.

- It functions as a meeting point for investors who want to buy and sell ownership stakes in companies.

- Unlike informal markets, stock exchanges operate under strict regulations to ensure fair pricing, transparency, and investor protection.

- It is important to differentiate between a stock exchange and the Over-the-Counter (OTC) market.

- While exchanges like the New York Stock Exchange (NYSE) or NASDAQ provide centralized platforms with standardized rules, OTC trading takes place directly between parties without a centralized system.

- OTC is often less transparent and involves higher risks but can be useful for smaller or less liquid securities.

- Some of the world’s most well-known exchanges include the New York Stock Exchange (NYSE), the NASDAQ, the London Stock Exchange (LSE), and the Tokyo Stock Exchange (TSE).

- These platforms not only facilitate billions of dollars in trades daily but also set global benchmarks for corporate governance and financial disclosure.

History and Evolution of Stock Exchanges

- The history of stock exchanges dates back to the 17th century, when the Amsterdam Stock Exchange was established in 1602.

- It was created by the Dutch East India Company to allow investors to buy and sell shares of the company, making it the world’s first official stock exchange.

- As global trade expanded, other nations followed suit.

- The London Stock Exchange emerged in 1801, and the New York Stock Exchange was founded in 1792 with the signing of the Buttonwood Agreement.

- These early exchanges played a crucial role in financing industrial revolutions, railways, and large-scale infrastructure projects.

- In the 20th century, exchanges transitioned from open outcry trading floors to electronic systems.

- The NASDAQ, launched in 1971, became the first fully electronic stock market and revolutionized how trades were executed.

- Today, most stock exchanges use digital platforms that enable high-frequency trading, algorithmic transactions, and global participation.

- The evolution of stock exchanges reflects broader economic changes: from colonial trade to industrial capitalism, and now to digital globalization.

- Their history shows how financial markets have continually adapted to new technologies and investor needs.

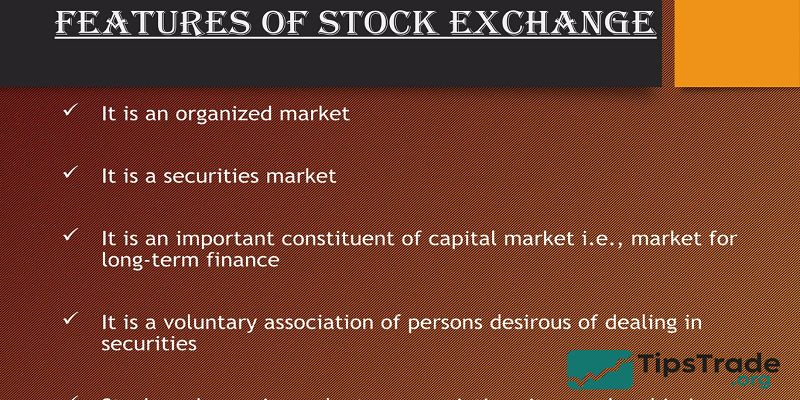

Functions of a Stock Exchange

Stock exchanges perform several vital functions that drive both corporate growth and national economies:

- Capital raising for businesses: Companies can issue shares to the public, raising money for expansion, research, or debt repayment.

- Liquidity for investors: Investors can easily buy or sell their shares, knowing there is an active market. Liquidity makes investing more attractive compared to private ownership.

- Fair pricing and valuation: Exchanges use transparent mechanisms like auctions or electronic matching to determine share prices. This ensures fair valuation based on supply and demand.

- Regulation and transparency: Exchanges impose rules on listed companies, requiring them to publish financial reports and adhere to governance standards. This builds investor trust.

- Economic development: By channeling savings into investments, stock exchanges help fund innovation, create jobs, and stimulate GDP growth.

In essence, a stock exchange is not just a marketplace but also a regulator, a price discovery mechanism, and a catalyst for economic prosperity.

How a Stock Exchange Works

The operation of a stock exchange may seem complex, but it follows a structured process:

- Listing of shares: Companies must meet strict requirements to list their shares. This includes financial audits, disclosures, and regulatory approvals. Once listed, their shares can be traded by the public.

- Trading process: Investors place buy and sell orders through brokers or online platforms. Orders are then matched using auction systems or electronic algorithms.

- Market participants: Traders (individuals), brokers (licensed intermediaries), and institutional investors (mutual funds, pension funds, hedge funds) all interact on exchanges.

- Order matching: Exchanges use systems that prioritize price and time. For example, the highest bid meets the lowest ask in real time.

- Clearing and settlement: After a trade, the exchange ensures that money and securities are exchanged securely, reducing counterparty risk.

This process makes trading seamless, fair, and accessible. While technology has automated much of the system, the fundamental principle remains: connecting those who need capital with those willing to invest.

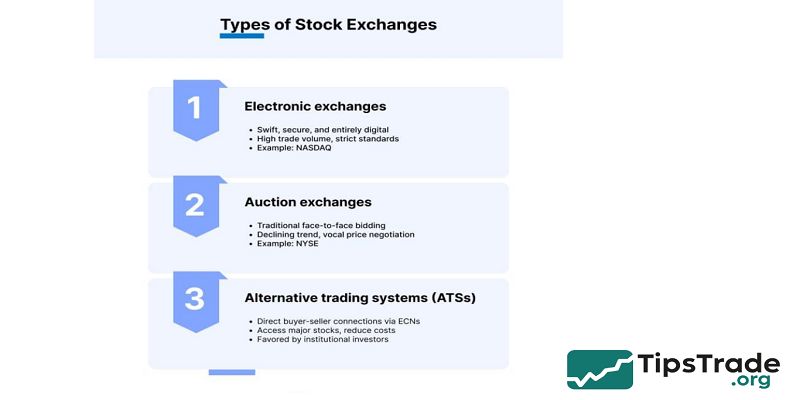

Types of Stock Exchanges

Stock exchanges can be categorized in different ways:

- National vs. International Exchanges: National exchanges like the BSE in India primarily serve domestic markets, while global exchanges like the NYSE attract international companies and investors.

- Traditional vs. Electronic Exchanges: Traditional exchanges used physical trading floors (e.g., NYSE’s iconic bell), whereas electronic exchanges like NASDAQ operate entirely online.

- Centralized vs. Decentralized: Centralized exchanges have strict regulations and centralized order books, while decentralized or peer-to-peer platforms are emerging in the blockchain era.

These categories highlight how stock exchanges have adapted to different market needs, from serving local economies to becoming global hubs for technology and innovation.

Investors today can choose from a variety of exchanges depending on their risk appetite, investment goals, and technological preferences.

Major Global Stock Exchanges

The world’s leading stock exchanges dominate global finance:

- New York Stock Exchange (NYSE): The largest exchange by market capitalization, hosting giants like Apple, Microsoft, and Coca-Cola.

- NASDAQ: Known for technology companies such as Tesla, Amazon, and Meta. It pioneered electronic trading and remains the hub for innovation-driven firms.

- London Stock Exchange (LSE): One of the oldest, it plays a crucial role in connecting European and international markets.

- Tokyo Stock Exchange (TSE): The heart of Asian markets, featuring companies like Toyota and Sony.

- Hong Kong Stock Exchange (HKEX): A gateway to Chinese companies seeking global investors.

Each exchange has unique strengths, regulatory environments, and investor bases. Together, they form an interconnected system that influences global capital flows, economic policies, and investment strategies.

Stock Exchange and the Economy

- The relationship between stock exchanges and national economies is profound. When markets perform well, they encourage investment, consumer spending, and business confidence.

- For example, rising stock indexes often signal economic growth, boosting investor sentiment.

- Stock exchanges also channel household savings into productive investments.

- Instead of money lying idle in banks, it funds companies that innovate, hire workers, and expand.

- This process accelerates GDP growth and improves living standards.

- Additionally, stock exchanges influence monetary and fiscal policy.

- Governments and central banks monitor exchange performance to gauge economic health.

- For instance, a sharp market decline may prompt interest rate cuts or fiscal stimulus.

In short, stock exchanges serve as economic barometers. They reflect and shape growth, making them critical to both policymakers and private investors.

Benefits of Stock Exchanges

Stock exchanges deliver multiple benefits across different stakeholders:

- For businesses: Access to capital, increased brand visibility, and credibility from being listed.

- For investors: Opportunities to earn returns, diversify portfolios, and enjoy liquidity.

- For governments: Tax revenues from capital gains and corporate profits, along with enhanced financial stability.

A listed company often gains trust among customers, suppliers, and employees. Investors benefit from transparency and liquidity, while governments use strong exchanges to promote economic growth.

This triple benefit shows why stock exchanges remain a cornerstone of financial development worldwide.

Risks and Challenges of Stock Exchanges

Despite their advantages, stock exchanges also face challenges:

- Market volatility: Prices fluctuate due to economic events, geopolitical tensions, or investor psychology.

- Speculative bubbles: Irrational buying can inflate asset values, leading to crashes like the 2008 financial crisis.

- Technological risks: Cyberattacks, system failures, or unethical practices in high-frequency trading can destabilize markets.

- Accessibility issues: Smaller investors may find it harder to compete with institutions that have advanced tools and information.

While stock exchanges strive to mitigate these risks with regulation and technology, no market is risk-free. Responsible investing and diversification remain the best defenses for participants.

The Future of Stock Exchanges

The future of stock exchanges is being shaped by innovation and global trends:

- Digitalization and blockchain: Distributed ledger technology can make trading faster, cheaper, and more secure.

- Decentralized Finance (DeFi): Platforms without intermediaries challenge traditional exchanges, giving investors more autonomy.

- Sustainability and ESG investing: Companies are increasingly evaluated not just by profit but by their environmental and social impact.

- Globalization: Cross-border listings and international investors continue to integrate markets, reducing barriers.

These trends suggest that exchanges will evolve into smarter, greener, and more inclusive platforms. Yet, regulation and investor protection will remain key to ensuring trust and stability in the financial system.

How to Start Investing Through a Stock Exchange

For beginners, investing in a stock exchange can be rewarding if approached carefully:

- Open a brokerage account with a licensed provider.

- Choose a reputable exchange based on your investment goals.

- Research companies thoroughly before buying shares.

- Place buy or sell orders using trading platforms.

- Diversify and monitor your portfolio regularly.

New investors should start small, focus on long-term strategies, and avoid emotional trading. Reading annual reports, following market news, and using financial tools can enhance decision-making.

Common Misconceptions About Stock Exchanges

Many myths surround stock exchanges:

- “They are only for the rich” – False. With online platforms, even small investors can buy fractional shares.

- “Investing is gambling” – Investing involves analysis and strategy, unlike gambling, which is based purely on chance.

- “All exchanges are the same” – Each exchange has unique rules, regulations, and listed companies.

Understanding these misconceptions helps new investors approach markets with realistic expectations and avoid unnecessary fears.

Stock Exchange vs Stock Market

The terms “stock exchange” and “stock market” are often used interchangeably, but they are not identical.

- Stock Exchange: A specific marketplace where securities are traded, like the NYSE or NASDAQ.

- Stock Market: The broader system of financial markets that includes all stock exchanges, OTC markets, and other trading platforms.

Think of the stock exchange as a building or platform, while the stock market represents the overall network of exchanges and transactions worldwide. This distinction helps investors understand financial news more accurately.

Conclusion

Stock exchanges have shaped economies for centuries, providing a structured way to raise capital, invest, and build wealth. They reflect the pulse of global markets, influencing policies and connecting businesses with investors. Whether you are a beginner or an experienced investor, understanding stock exchanges is essential. By approaching them with knowledge, discipline, and long-term vision, you can turn them into powerful tools for financial growth.