SEC funds regulation, refers to the framework of laws, rules, and disclosure requirements that the U.S. Securities and Exchange Commission (SEC) applies to mutual funds, ETFs, hedge funds, private equity funds, and money market funds. These rules help ensure that investors receive accurate information, fund managers behave ethically, and financial markets remain fair. Understanding this regulatory framework is essential for fund managers, compliance teams, and individual investors. This article explains the legal foundations, compliance rules, disclosure forms, and real-world impacts of SEC regulations—using a clear, people-first approach designed to make even complex regulations easier to understand. Explore the detailed article at tipstrade.org to be more confident when making important trading decisions.

What Is SEC Funds Regulation?

SEC funds regulation refers to the full set of laws and administrative rules that govern investment funds operating in U.S. markets.

At its core, the SEC’s mission is to “protect investors, maintain fair and orderly markets, and facilitate capital formation.” To achieve this, the agency enforces regulations that require accurate disclosure, prevent fraud, and set standards for fund governance.

The scope of SEC regulations for investment funds covers several major areas:

- Fund registration

- Disclosure and reporting

- Management oversight

- Liquidity and risk management

- Marketing and advertising rules

- Anti-fraud and enforcement provisions

Fund managers often describe compliance as a continuous process rather than a one-time event.

For example, a mutual fund must update its prospectus annually, file routine reports such as Form N-PORT, and maintain internal controls that align with industry best practices. Institutional compliance officers note that failing to meet even “minor” requirements can result in fines or trading restrictions.

SEC oversight ensures that investors understand the strategies, risks, and costs associated with an investment before committing their money.

This framework has become increasingly important as fund structures and strategies grow more complex.

Legal Foundations Governing Investment Funds

The regulatory landscape for investment funds is rooted in several landmark U.S. laws enacted to restore trust after historical financial crises. These laws remain the backbone of today’s compliance framework.

Investment Company Act of 1940

The Investment Company Act (ICA) sets standards for fund registration, operational structure, reporting, and governance. It applies primarily to mutual funds, ETFs, and most publicly offered investment vehicles. Under the ICA, funds must:

- Register with the SEC

- Provide detailed financial disclosures

- Implement governance structures, including independent directors

- Maintain fair valuation practices

- Follow rules for conflicts of interest

The ICA introduced the principle that funds must operate “in the best interest of shareholders,” a standard still emphasized in SEC examinations.

Investment Advisers Act of 1940

This act regulates advisers that manage investment funds. It requires SEC registration, fiduciary standards, advertising rules, and compliance systems. Many enforcement actions today relate to:

- Undisclosed fees

- Inaccurate marketing claims

- Conflicts of interest

- Inadequate compliance oversight

Securities Act of 1933

This law ensures that all public offerings include accurate and complete disclosures. For funds, the primary output is the prospectus, a key document outlining:

- Investment strategies

- Risks

- Fees

- Performance reporting

- Operational policies

Key Statutory Requirements

Key statutory requirements across these laws include:

- Full and fair disclosure of fund risks and operations

- Registration with the SEC before selling shares

- Periodic reporting of holdings, performance, and risk metrics

- Governance standards, including independent oversight

- Anti-fraud provisions, ensuring no misleading claims

These requirements create a standardized framework that makes it easier for investors to compare different funds.

SEC Oversight Authority

The SEC maintains broad authority to:

- Conduct inspections

- Issue enforcement actions

- Require additional disclosures

- Suspend or revoke fund registrations

- Impose fines and penalties

Compliance teams often cite SEC examinations as the most intensive part of regulatory oversight.

The agency reviews marketing materials, disclosures, contracts, valuation methodologies, and cybersecurity practices. As a result, ongoing compliance is essential to avoid costly regulatory issues.

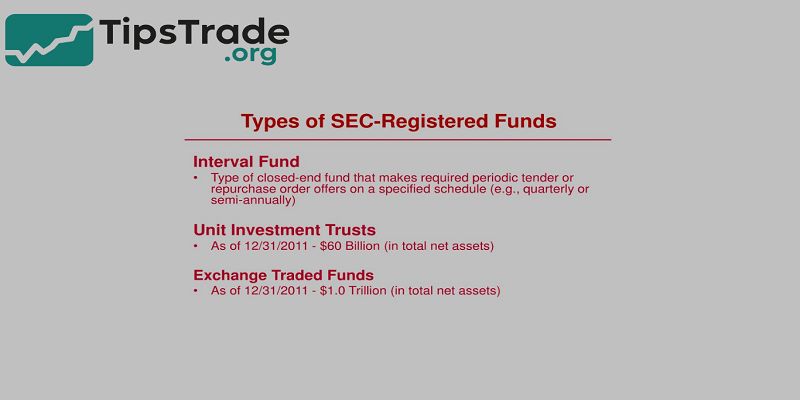

Types of Funds Under SEC Regulation

Mutual Funds

- Mutual funds are fully regulated under the Investment Company Act. They must register with the SEC, file annual and semiannual reports, maintain liquidity buffers, and follow strict diversification rules.

- Their disclosures must clearly explain risks, fees, and investment strategies.

- Mutual fund managers often highlight the operational burden associated with Form N-PORT, which requires detailed monthly reporting of portfolio holdings.

Exchange-Traded Funds (ETFs)

ETFs operate similarly to mutual funds but trade intraday on exchanges. In recent years, the SEC has approved more “rule-based” ETF structures, simplifying registration for certain index products.

Key regulatory focus areas include:

- Portfolio transparency

- Authorized participant (AP) processes

- Liquidity provisions

- Redemption mechanisms

Investors often appreciate ETFs for lower fees and higher tax efficiency—benefits supported by strong regulatory oversight.

Hedge Funds

Hedge funds are not registered as “investment companies” but their advisers must register under the Investment Advisers Act. This means hedge funds face:

- Anti-fraud rules

- Reporting requirements (e.g., Form PF)

- Custody rules

- Compliance policies and procedures

Because many hedge funds use derivatives or leverage, the SEC closely monitors risk exposure through periodic filings.

Private Equity Funds

Private equity funds are exempt from the Investment Company Act but regulated through adviser registration. The SEC monitors:

- Valuation practices

- Fee disclosures

- Conflicts of interest in portfolio management

- Co-investment allocations

Recent SEC actions have focused on transparency in management fees and portfolio charges.

Money Market Funds

Money market funds follow specialized liquidity and credit-quality requirements established after the 2008 financial crisis. Rules include:

- Daily liquidity minimums

- Limits on weighted average maturity

- Stress testing

- Stable-value or floating-NAV structures

These rules reduce systemic risk and protect short-term investors.

Core Compliance Requirements for Funds

Registration Requirements

Funds that fall under the Investment Company Act must file a registration statement describing:

- Investment objectives

- Risk factors

- Governance structure

- Fee breakdown

- Financial statements

The registration process ensures transparency before shares are sold to the public.

Disclosure & Reporting Requirements

Disclosure rules form the backbone of SEC funds regulation. Funds must provide:

- Annual and semiannual reports

- Prospectus updates

- Statement of Additional Information (SAI)

- Portfolio holdings

- Riskmetrics

Accurate reporting helps investors evaluate performance and risk. Studies from industry groups, such as the Investment Company Institute (ICI), show that clear disclosure increases investor confidence and reduces market volatility.

Fund Governance Rules

Governance rules require:

- Boards with independent directors

- Oversight of advisory contracts

- Approval of fees

- Monitoring conflicts of interest

Independent oversight is a key protection for retail investors.

Risk Management & Liquidity

Funds must establish policies covering:

- Liquidity risk management

- Stress testing

- Derivatives use

- Counterparty risk

- Valuation procedures

For example, liquidity rules require mutual funds to classify assets into liquidity buckets based on how quickly they can be sold.

Custody & Safekeeping

Funds must use qualified custodians to safeguard investor assets. Custody rules prevent:

- Misappropriation

- Incorrect asset handling

- Fraud

Audits of custody practices are routine during SEC examinations.

Anti-Fraud & Investor Protection

- Anti-fraud rules prohibit misleading statements, hidden fees, or inaccurate performance reporting.

- Enforcement releases show that many penalties result from marketing materials that overstate returns or hide risks.

SEC Forms Relevant to Funds

Form N-1A

Used by mutual funds and ETFs to register under the Investment Company Act. Requires detailed disclosure of:

- Investment objectives

- Fees and expenses

- Principal risks

- Historical performance

Form N-PORT

- A monthly and quarterly reporting form detailing portfolio holdings, risk metrics, and liquidity classifications.

- This data helps the SEC monitor market-wide liquidity risk.

Form N-CSR

Filed semiannually with shareholder reports, including:

- Financial statements

- Management discussion

- Notes to financials

Form PF

- Used by hedge funds and private equity advisers to report leverage, liquidity, and counterparty exposure.

- Regulators use this information to identify systemic risks.

Recent SEC Updates & Regulatory Changes

Recent regulatory changes reflect evolving risks in modern markets.

New Liquidity Rules

The SEC has tightened liquidity classifications for mutual funds and ETFs. New rules require:

- Revised liquidity buckets

- Stress testing

- Greater board oversight

- More frequent reporting

These updates help prevent “runs” during market stress.

Market Transparency & Reporting Initiatives

- Recent initiatives include expanded reporting for large advisers and enhanced audit requirements.

- The goal is to increase visibility into portfolio holdings and operational risks.

Cybersecurity Regulations

With increased cyber threats, the SEC now requires:

- Incident reporting

- Cyber risk policies

- Technology oversight

- Vendor risk management

Many compliance officers cite cybersecurity as the most challenging requirement, especially for smaller firms.

ESG Disclosure Rules

Funds using ESG strategies must now:

- Provide standardized disclosures

- Explain screening methods

- Outline data sources

- Describe risk management

These rules improve transparency and prevent “greenwashing.”

How SEC Regulation Impacts Investors & Fund Managers

SEC rules influence both operational processes and investment decision-making.

For Investors

Investor benefits include:

- Greater transparency

- More comparable data

- Reduced fraud risk

- Clearer fee structures

Studies from the CFA Institute show that transparent disclosures improve long-term investor outcomes.

For Fund Managers

Managers must invest heavily in:

- Compliance systems

- Documentation

- Internal controls

- Periodic reporting

These requirements increase operational costs, especially for smaller advisers. However, managers often note that strong compliance enhances investor trust and makes capital raising easier.

Common Compliance Challenges

Typical challenges include:

- Managing large volumes of data for Form N-PORT and PF

- Maintaining reporting accuracy

- Protecting systems against cyber threats

- Ensuring marketing materials remain accurate

- Implementing valuation controls

Compliance teams often describe the “data burden” as the most resource-intensive challenge.

Best Practices for Maintaining SEC Compliance

To maintain strong compliance, funds adopt the following best practices:

- Robust internal controls

- Documented compliance programs

- Employee training

- Third-party oversight

- Periodic independent audits

- Cybersecurity monitoring

Many firms use technology solutions to automate reporting and reduce human error.

Conclude

The regulation of SEC funds is essential for ensuring transparency, protecting investors, and maintaining the stability of financial markets. It requires funds to follow strict reporting and operational guidelines, including detailed disclosure of portfolio holdings, liquidity management, and risk metrics. These regulations foster investor confidence by promoting fair valuation, accountability, and the prevention of fraud or mismanagement within investment funds. Overall, SEC funds regulation helps create a secure and trustworthy investment environment.