Risks of Hedge Fund are often associated with high returns, complex investment strategies, professional fund managers, and alternative assets, but they also come with significant risks that are not always fully understood by investors. Unlike traditional mutual funds, hedge funds operate with greater flexibility, limited transparency, and higher leverage, which can amplify both gains and losses. For many investors, especially accredited and institutional investors, understanding the risks of hedge funds is just as important as evaluating their potential performance. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Hedge Funds and Why Do They Carry Higher Risk?

Hedge funds are privately pooled investment vehicles that use a wide range of strategies to generate returns across different market conditions. Unlike mutual funds or ETFs, hedge funds are typically available only to accredited or institutional investors, which allows managers to operate with fewer regulatory constraints. This flexibility is one of the main reasons hedge funds are considered higher-risk investments.

Hedge funds often invest in equities, bonds, derivatives, currencies, commodities, and illiquid assets, sometimes all at once. Strategies such as long-short equity, global macro, event-driven investing, and relative value arbitrage can be highly complex and difficult for investors to fully evaluate. In practice, this complexity increases model risk and execution risk, particularly during periods of market stress.

From an experience-based perspective, industry analysts often note that hedge fund risk is not just about volatility, but also about opacity and unpredictability. When strategies rely heavily on proprietary models or discretionary decision-making, investors may struggle to understand exactly how risk is being managed inside the fund.

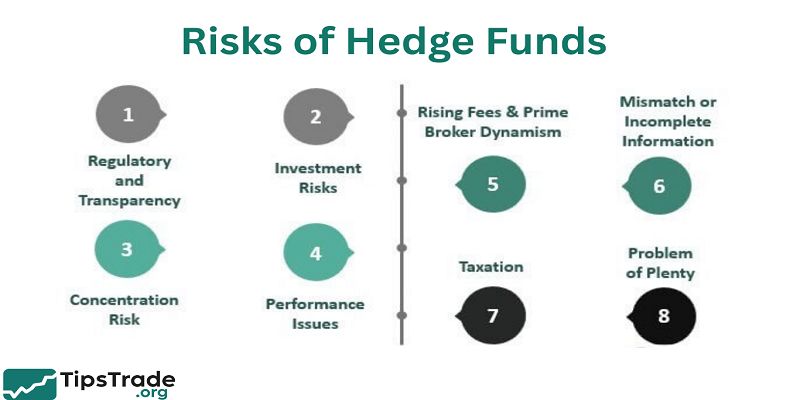

Risks of Hedge Funds

Market risk refers to the possibility that adverse market movements will negatively affect a hedge fund’s performance. While hedge funds often claim to be “market-neutral” or “hedged,” in reality, many strategies still maintain significant exposure to broader market forces.

During periods of heightened volatility—such as financial crises, interest rate shocks, or geopolitical events—correlations between asset classes tend to increase. Academic research has shown that during systemic events, diversification benefits can break down, exposing hedge funds to unexpected losses. This phenomenon was widely observed during the 2008 global financial crisis and again during the COVID-19 market shock.

Professional investors frequently point out that hedge funds may underestimate tail risk, especially when historical models fail to account for rare but severe events. Even funds designed to profit from volatility can experience losses if market conditions move faster than their risk management systems can respond.

Leverage Risk and Amplified Losses

One of the defining features of hedge funds is their ability to use financial leverage. Leverage allows funds to borrow capital to increase their market exposure, potentially boosting returns. However, leverage also magnifies losses, making it one of the most significant risk factors in hedge fund investing.

In practice, leverage can take many forms, including margin borrowing, derivatives exposure, and structured financing arrangements. While leverage may improve performance in stable markets, it can lead to rapid losses when asset prices move against the fund’s positions. Margin calls may force funds to liquidate positions at unfavorable prices, further exacerbating losses.

Historical examples illustrate this risk clearly. The collapse of Long-Term Capital Management (LTCM) in the late 1990s demonstrated how excessive leverage, combined with model-driven assumptions, can threaten not only a single fund but the broader financial system. From a trust perspective, investors often underestimate how quickly leverage can turn a small market move into a catastrophic drawdown.

Liquidity Risk and Lock-Up Periods

Liquidity risk arises when a hedge fund is unable to sell assets quickly or meet investor redemption requests without significant losses. Many hedge funds invest in illiquid securities, such as distressed debt, private credit, or complex derivatives, which may be difficult to value or exit during stressed markets.

To manage liquidity mismatches, hedge funds often impose lock-up periods, redemption gates, and side pockets. While these mechanisms protect the fund from forced selling, they also restrict investor access to capital.

From an investor’s experience, liquidity risk becomes most apparent during market downturns, precisely when access to cash is most needed.

Research from financial regulators has highlighted that liquidity risk is a major contributor to investor dissatisfaction and legal disputes. When asset values decline and redemption requests are delayed, trust between investors and fund managers can erode quickly.

Understanding these restrictions before investing is essential for maintaining realistic expectations.

Operational and Management Risk

Operational risk refers to failures in internal processes, systems, or human oversight. Hedge funds are often highly dependent on the skill and judgment of a small management team, which increases key-person risk.

If a lead portfolio manager leaves or makes a critical error, the fund’s performance can deteriorate rapidly.

Operational failures may include inadequate controls, weak governance, valuation errors, or technology breakdowns.

Industry reviews have shown that a significant number of hedge fund losses are linked not to market movements, but to operational weaknesses that were overlooked during due diligence.

From an expertise standpoint, professional investors emphasize the importance of evaluating a fund’s risk management infrastructure, including independent valuation, compliance oversight, and audit practices.

Strong operational frameworks help mitigate risk, but they cannot eliminate it entirely.

Transparency and Disclosure Risk

Hedge funds are not required to disclose the same level of information as publicly offered investment funds. This limited transparency creates information asymmetry between fund managers and investors. While managers may provide periodic reports, the level of detail often varies significantly across funds.

Valuation risk is a key concern, particularly when funds hold complex or illiquid assets. Without transparent pricing mechanisms, asset values may be based on internal models rather than observable market prices. This can lead to mispricing and delayed recognition of losses.

From a trustworthiness perspective, transparency risk does not necessarily imply misconduct, but it does increase uncertainty. Investors must rely heavily on the integrity and competence of the manager, which underscores the importance of due diligence and third-party verification.

Regulatory and Legal Risks

Hedge fund regulation varies significantly by jurisdiction. In the United States, hedge funds operate under exemptions from the Investment Company Act, while in Europe, managers are subject to the Alternative Investment Fund Managers Directive (AIFMD). In Asia, regulatory approaches differ across countries such as Singapore, Hong Kong, and Japan.

Regulatory risk arises when funds fail to comply with evolving rules related to reporting, investor protection, or cross-border marketing. Enforcement actions can result in fines, reputational damage, or even fund closures. Legal disputes with investors may also arise if disclosures are deemed insufficient.

Experts note that regulatory complexity is increasing globally, particularly around systemic risk monitoring and transparency requirements. Investors should recognize that regulatory changes can affect fund operations and returns, sometimes with little advance notice.

Counterparty and Systemic Risk

Hedge funds rely on a network of counterparties, including prime brokers, clearinghouses, and derivatives dealers. Counterparty risk emerges if one of these entities fails to meet its obligations. During periods of financial stress, counterparty defaults can cascade through the system.

Systemic risk refers to the potential for hedge fund failures to contribute to broader financial instability. While individual hedge funds may seem small, their interconnectedness and leverage can amplify shocks. Regulators and central banks have increasingly focused on hedge funds as potential sources of systemic risk.

From an experience-based review, institutional investors often evaluate hedge funds not only on standalone risk, but also on how they may behave under extreme market conditions. Stress testing and scenario analysis are commonly used to assess these risks.

Comparing Hedge Fund Risks vs Other Investments

Compared to mutual funds and ETFs, hedge funds generally exhibit higher complexity, lower liquidity, and greater reliance on manager skill. While mutual funds are designed for broad retail investors and emphasize diversification, hedge funds pursue absolute returns, often accepting higher risk in the process.

A comparative risk assessment highlights several key differences:

| Feature | Hedge Funds | Mutual Funds | ETFs |

| Regulation | Limited | Strict | Strict |

| Leverage | Common | Rare | Limited |

| Liquidity | Restricted | High | High |

| Transparency | Low | High | High |

This comparison helps contextualize hedge fund risk within a broader investment landscape, supporting informed decision-making.

How Investors Can Assess Hedge Fund Risks

Assessing hedge fund risk requires a structured due diligence process. Professional investors typically review offering documents, analyze historical performance, and evaluate risk management practices. However, past performance is not a reliable indicator of future results.

A practical due diligence checklist may include:

- Understanding the fund’s investment strategy

- Evaluating leverage and liquidity terms

- Reviewing governance and operational controls

- Assessing alignment of interests between managers and investors

From a trust perspective, investors are encouraged to seek independent advice and avoid relying solely on marketing materials. Comprehensive risk assessment helps align expectations with reality.

Are Hedge Funds Too Risky for Individual Investors?

Hedge funds are generally restricted to accredited investors due to their complexity and risk profile. Even for qualified investors, suitability depends on financial capacity, investment goals, and risk tolerance.

Experts often caution that hedge funds should represent only a portion of a diversified portfolio. Concentrated exposure to a single fund or strategy can increase vulnerability to unexpected losses. For many individuals, simpler investment vehicles may offer a more appropriate risk-return balance.

Ultimately, hedge funds are not inherently “too risky,” but they are inappropriate for investors who do not fully understand or accept their risks.

Conclusion

Risks of hedge funds extend far beyond simple market volatility. They include leverage risk, liquidity constraints, operational weaknesses, regulatory uncertainty, and systemic exposure. While hedge funds can offer diversification and alternative return sources, they also demand a high level of understanding and risk tolerance. For investors, the most important takeaway is not whether hedge funds are “good” or “bad,” but whether their risk profile aligns with personal or institutional objectives. Transparent evaluation, realistic expectations, and professional advice are essential components of responsible hedge fund investing.