Risks of ETFs have gained popularity among investors for their low costs, diversification, and liquidity. However, like any investment, ETFs carry risks that can affect returns and capital preservation. Understanding these risks is crucial for making informed investment decisions and developing strategies that align with your financial goals. This guide covers market, liquidity, tracking, structural, and sector-specific risks, along with strategies to mitigate them, providing investors with actionable insights. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

Understanding Risks of ETFs

Definition of ETF Risk

- ETF risk refers to the potential for investors to experience losses or underperformance relative to their expectations. These risks arise from factors such as market fluctuations, liquidity constraints, structural complexities, and operational inefficiencies.

- Experience example: A portfolio manager trading an emerging-market ETF noticed a temporary price drop of 7% due to local market volatility, highlighting the importance of understanding inherent ETF risks before investing.

- Understanding risk allows investors to make decisions consistent with their financial objectives and risk tolerance, reducing the likelihood of unexpected losses.

Why Understanding Risks Is Essential

- Comprehending ETF risks helps investors allocate capital wisely, avoid concentration in volatile sectors, and select appropriate ETFs for their portfolios.

- Expertise insight: Research from Morningstar indicates that investors who assess ETF risk metrics such as standard deviation, beta, and tracking error achieve better long-term risk-adjusted returns.

- Failing to understand these risks can lead to overexposure, higher costs, and missed investment opportunities.

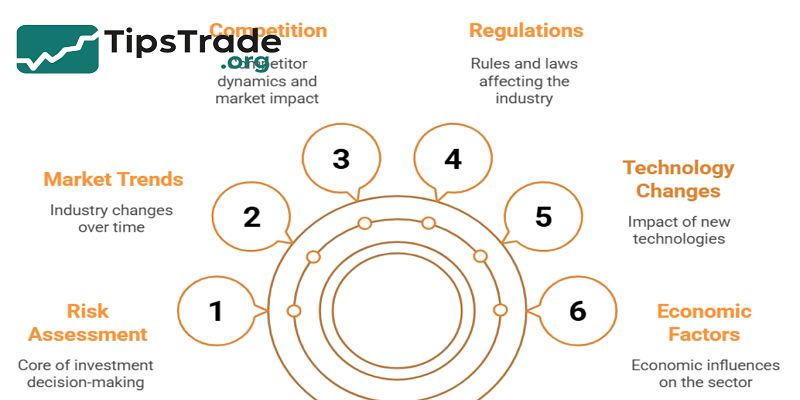

Overview of Potential Risk Categories

ETF risks can be broadly categorized into:

- Market and price risk

- Liquidity and trading risk

- Tracking error and benchmark risk

- Expense and structural risk

- Concentration and sector-specific risk

This classification helps investors systematically evaluate the suitability of ETFs for their portfolios.

Example: Diversifying across multiple ETFs from different asset classes reduces exposure to any single risk category.

Market and Price Risks

Equity Market Risk

- Equity ETFs are subject to market risk, meaning the value of the underlying stocks can fluctuate due to economic conditions, corporate earnings, and geopolitical events.

- Experience example: An investor holding a technology-focused ETF during a sector downturn experienced a 12% loss in three months, despite broad market gains.

- Understanding equity market risk helps investors plan asset allocation and consider hedging strategies.

Bond Market and Interest Rate Risk

- Bond ETFs face interest rate risk, as rising rates generally decrease bond prices. Example: A 10-year Treasury ETF may lose value when rates rise, affecting total returns.

- Expertise insight: According to Vanguard, long-duration bond ETFs exhibit higher sensitivity to rate changes, emphasizing the need to match ETF duration with investment goals.

Volatility Risk in Leveraged and Inverse ETFs

- Leveraged and inverse ETFs amplify daily returns, increasing volatility and potential losses.

- Experience example: During a volatile week, a 2x leveraged ETF tracking the S&P 500 lost 15%, whereas the underlying index fell only 7%.

- These ETFs are suitable for short-term trading but carry substantial risk for long-term investors due to compounding effects and market swings.

Liquidity and Trading Risks

Bid-Ask Spreads and Market Liquidity

- Liquidity risk arises when an ETF cannot be bought or sold at desired prices due to low trading volume. Wide bid-ask spreads increase implicit costs.

- Example: SPY, a highly liquid ETF, has spreads ~0.01%, while a small-cap emerging market ETF may have spreads exceeding 0.10%, increasing trading costs significantly. Selecting ETFs with high liquidity reduces these risks.

Market Impact of Large Trades

- Large orders in thinly traded ETFs can move market prices, causing unfavorable execution. Institutional traders use algorithmic strategies to mitigate market impact, while retail investors can stagger trades or use limit orders.

- Experience example: A retail investor splitting a $50,000 order across several transactions minimized price slippage in an illiquid ETF.

ETF Trading During Market Stress

- During periods of market turbulence, liquidity can dry up, spreads widen, and ETFs may temporarily trade at a discount or premium to NAV.

- Expertise insight: In March 2020, some bond ETFs traded 3–5% away from NAV, demonstrating liquidity risk in extreme conditions.

- Investors should understand these dynamics and plan accordingly.

Tracking Error and Benchmark Risks

What is Tracking Error

- Tracking error measures the deviation between an ETF’s returns and its benchmark index. A high tracking error indicates that the ETF does not accurately replicate the index.

- Example: An emerging-market ETF with frequent corporate actions and currency fluctuations might show a 0.5–1% tracking error annually.

Factors Causing Tracking Error

- Management inefficiencies

- Fund expenses

- Sampling of index constituents instead of full replication

- Currency fluctuations for international ETFs

Minimizing tracking error ensures that investors receive returns closely aligned with expectations.

How Tracking Error Affects Investor Returns

- Even small tracking errors can compound over time.

- Experience example: Over 10 years, a 0.3% annual tracking error in a global equity ETF led to a cumulative underperformance of 3%, emphasizing the importance of choosing ETFs with low tracking errors for long-term strategies.

Expense and Structural Risks

Expense Ratios and Hidden Costs

- Expenses reduce net returns. While low-cost ETFs have expense ratios below 0.10%, actively managed or niche ETFs can charge over 0.50%. Hidden costs include bid-ask spreads, trading commissions, and taxes.

- Example: Investing in a high-expense thematic ETF may erode long-term returns despite strong underlying performance.

Management and Operational Risks

- Operational risks include fund mismanagement, errors in portfolio execution, or administrative failures.

- ETFs rely on efficient creation and redemption mechanisms; failures in these processes can lead to pricing inefficiencies.

- Authoritative source: SEC.gov highlights that robust fund governance mitigates operational risk.

Synthetic vs. Physical ETFs and Counterparty Risk

- Synthetic ETFs use derivatives to replicate index performance, exposing investors to counterparty risk.

- Physical ETFs hold actual assets, reducing such exposure.

- Experience example: During the 2008 financial crisis, some synthetic ETFs faced counterparty issues, while physically-backed ETFs maintained stability.

Concentration and Sector-Specific Risks

Sector Concentration and Volatility

- ETFs concentrated in specific sectors, like technology or energy, may experience higher volatility.

- Example: A tech ETF declined 20% during a sector correction, even though the broader market was flat. Diversification across sectors mitigates this risk.

Geographic or Country-Specific Risks

- International ETFs carry currency, political, and economic risks. Emerging-market ETFs are particularly susceptible to sudden policy changes.

- Investors should assess country-specific risk exposure before investing.

Risk Management for Thematic ETFs

- Thematic ETFs targeting trends like AI or ESG may have concentrated holdings and high volatility.

- Experience example: An ESG ETF lost 15% when energy-heavy companies were divested, demonstrating the need to balance thematic exposure with diversification.

Strategies to Mitigate ETF Risks

Diversification Across Asset Classes

- Combine equity, bond, and commodity ETFs to reduce total portfolio risk.

- Example: A 60/40 equity/bond allocation reduces volatility and improves risk-adjusted returns.

Choosing Liquid ETFs with Low Spreads

- Prioritize ETFs with high assets under management (AUM) and average daily volume to minimize trading costs and execution risk.

Long-Term vs. Short-Term Trading Considerations

- Long-term holding reduces trading costs, tax impact, and exposure to short-term volatility.

- Short-term trading should be reserved for experienced investors aware of risks and costs.

Using Risk Metrics and Analytics Tools

- Leverage tools like Morningstar ETF risk analysis, Bloomberg, and brokerage analytics to assess beta, standard deviation, tracking error, and liquidity before investing.

Conclusion

ETFs provide flexibility, diversification, and cost-efficiency, but they carry multiple types of risk. Investors must understand market, liquidity, tracking, structural, and sector-specific risks and apply risk mitigation strategies to protect their portfolios. By combining careful ETF selection, diversification, and use of analytical tools, investors can optimize returns while managing potential downsides.