With the continuous development of technology, quantitative trading strategies are becoming increasingly popular in the financial investment community, especially among stock investors. Let’s explore popular quantitative trading strategies in the following article!

What are quantitative trading strategies?

Quantitative trading strategies, also known as “quant trading”, is a method of using algorithms and computer programs based on mathematical models to identify buying and selling opportunities in the stock market. Quantitative trading strategies are widely used in high-frequency trading for algorithmic analysis, arbitrage and automated trading for both individuals and institutions.

Quantitative trading strategies will include specific information about price and trading volume. From there, it will give the expected risk of the transaction and the expected profit level. Previously, investors mainly relied on experience and intuition when making decisions. However, with the age of data technology, quantitative trading strategies are considered a better approach to help investors make informed decisions.

Main components of a quantitative trading strategy:

- Data: Historical price data, trading volumes, and other financial metrics.

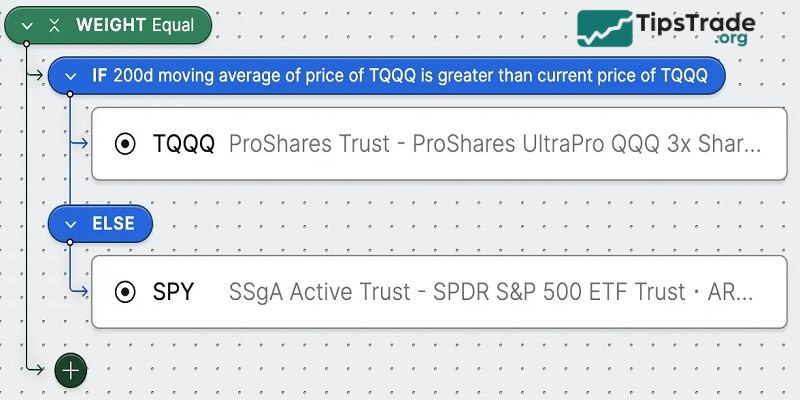

- Indicators: Metrics like MA (Moving Averages), RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) used to make trading decisions.

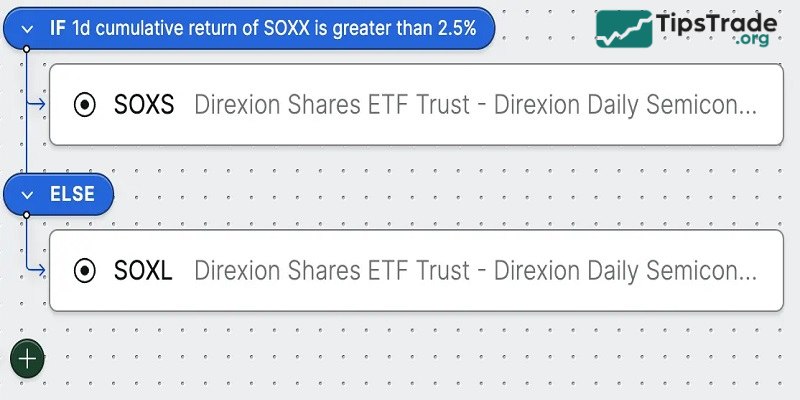

- Algorithms: Set rules for when to purchase/ sell based on indicators.

>>See more:

- Common Stock Risk Management Strategies for Investors

- Technical Analysis for Stocks: The Complete Guide for Modern Investors

- Fundamental Analysis Stocks: Everything Investors Need to Know

- Day Trading Stocks: Benefits, Risks, and Effective Investing Strategies

Popular quantitative trading strategies

Below is Top 6 quantitative trading strategies popular and effective, widely used by traders and institutions to optimize their trading performance:

Mean reversion strategy

This strategy is based on the assumption that asset prices tend to return to their historical average over time. Traders identify overbought or oversold securities based on statistical indicators such as Bollinger Bands or moving averages (MACD). When the price deviates significantly from the average, they open a position with the expectation that the price will reverse and return to the mean.

- For example: Buy a stock when its price falls deeply below the moving average.

Momentum strategy

Momentum strategies focus on tracking the price movement of an asset. Investors look to take advantage of assets that are trending strongly up or down in a certain direction. Using indicators such as RSI and moving average crossovers, they identify assets with high momentum and hold on to the trend until a reversal occurs.

- For example: Buy a stock that has been rising steadily for the past 3-6 months.

Statistical arbitrage

Statistical arbitrage involves identifying price discrepancies between correlated assets using mathematical models. This strategy typically pairs two securities and takes opposite positions: Buy undervalued assets and Sell overvalued assets. The goal is to profit when the prices of the two assets eventually converge.

- For example: Investors trade pairs like crude oil and energy stocks when the price relationship between them deviates from normal levels.

High-frequency trading (HFT)

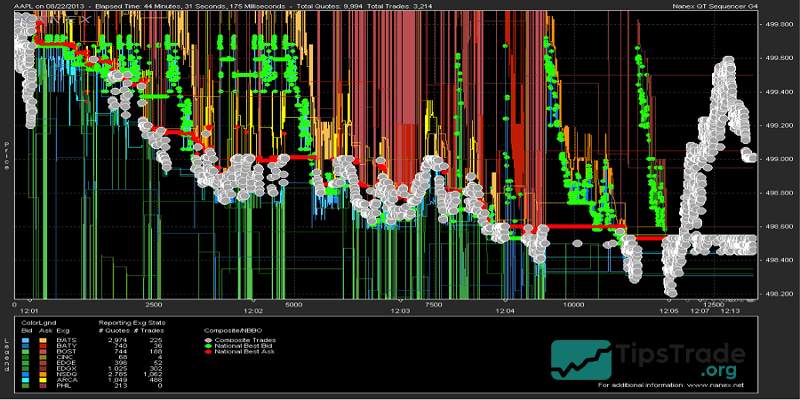

High-Frequency Trading (HFT) uses algorithms to execute large numbers of trades in extremely short periods of time. HFT strategies exploit tiny price deviations, the microstructure of the market, and arbitrage opportunities that exist in milliseconds.

- For example: Using an algorithmic system to profit from small price fluctuations between different exchanges.

Machine learning-based models

Modern quantitative trading leverages the power of machine learning to analyze massive amounts of data, identify patterns, and make predictions. These models are able to adapt to changing market conditions by learning from historical data. Common methods include neural networks, decision trees, and reinforcement learning.

- For example: Predicting future stock prices using historical price movement data combined with sentiment analysis from news.

Trend following strategy

Trend Following strategies focus on identifying and capitalizing on long-term price trends in various assets. Traders use tools such as moving averages, trendlines, and breakout patterns to open positions in line with the current market trend. Unlike momentum strategies, this approach emphasizes long-term stability rather than short-term volatility.

- For example: Take a trade when a stock breaks above its 52-week high.

How to create a quantitative trading strategy?

Formulation or identification of strategy

The first step is to find a strategy, explore market opportunities, and determine the appropriate trading frequency. Any quantitative trading plan begins with an in-depth research phase. This process includes:

- Build a strategy and evaluate whether it fits your current model.

- Collect the data needed to test the effectiveness of the strategy.

- Upgrade your strategy to maximize profits and minimize risks.

This helps individual investors determine their capital needs and understand how transaction costs affect their decisions.

Strategy backtesting

Backtesting techniques are profitable when applied to historical and out-of-sample data and work well in real markets. However, backtesting is not a surefire way to prove a strategy’s success, as it can be subject to a number of biases that need to be eliminated as much as possible.

Other factors to consider during validation include: access to historical data, transaction costs, and the choice of an appropriate validation method. Once a strategy is determined, historical data must be collected for testing. There are many different data sources, and their costs can vary depending on the quality of the data.

Execution system

An execution system is a method of executing trades based on a proposed trading strategy. Execution can be semi-manual or fully automated. The main concerns when building an execution system are interoperability with the broker and minimizing transaction costs.

Ideally, the mechanism for executing each trade would be automated, allowing investors to focus on researching and running higher frequency trading strategies.

Risk management

The final issue in quantitative trading is risk management. This includes risks related to technology and brokerage, such as the bankruptcy of a brokerage firm. In short, risk management covers all factors that can hinder trading activities.

The pros and cons of quantitative trading strategies

Pros of quantitative trading strategies

Quantitative trading strategies have many advantages as follows:

- High accuracy: Fear and greed are emotions that inhibit rational thinking, often leading to losses. For quantitative trading strategies, the emotional element and human subjective decisions have been removed from trading activities.

- Trading automation: With pre-programmed algorithms, the trading process is fully automated, saving investors time and effort.

- Ability to analyze large amounts of data: Machines have the ability to process and analyze huge amounts of data in a short time that humans cannot match. This helps quantitative trading strategies to discover potential trading opportunities that humans can easily overlook.

Cons of quantitative trading strategies

In addition, quantitative trading strategies also have some disadvantages such as:

- Technology dependent: Quantitative trading strategies require traders to invest in technology and infrastructure to increase accuracy in predicting the market.

- Risks from the model: If not optimized or not taking into account emerging factors, models can make erroneous trading decisions.

- Market volatility: During periods of high market volatility, quantitative trading strategies may underperform or give false trading signals.

Factors to become a professional quantitative trader

To become a professional Quantitative Trader, in addition to preparing financial foundations and system development tools, traders need the following knowledge and skills:

- Basic knowledge of statistics to be able to calculate the average value, standard deviation, regression line,…

- Professional knowledge related to computer usage, Excel software,…

- Practical knowledge of programming languages such as Java, C++, Perl, Python,…

- Understand how to build, customize systems and automation features.

- Understand data feeds and how to use them.

- Know how to exploit, synthesize, research and analyze data.

- Risk tolerance in investing and the personality of an entrepreneur.

- Have an innovative mindset, constantly learn and explore new strategies.

Conclusion

Quantitative trading strategies can bring huge profits but also carry many risks. Make sure you have a solid knowledge base and understand how to analyze before using this type. Also, don’t forget to update your knowledge through the articles on Tipstrade.org’s website to become a wise trader!

FAQs about quantitative trading strategies

How is quantitative trading different from algorithmic trading?

Quantitative trading and algorithmic trading are two different trading methods, specifically:

- Algorithmic trading focuses primarily on automating the order execution process. It focuses on how orders are placed quickly, efficiently, and with minimal human intervention.

- Quantitative trading focuses on building strategies, using math and data to determine what to trade and when.

In short, quantitative trading designs strategies, while algorithmic trading executes those strategies.

Many trading systems today combine both: quantitative models that detect opportunities, and algorithms that automatically execute trades.

What data is commonly used in quantitative trading strategies?

Price and trading volume are the two most commonly used data points in quantitative trading strategies. However, other data types such as market sentiment, inflation rates, interest rates, candlestick patterns, or technical indicators (RSI, MACD, etc.) can also be used in quantitative trading strategies.

Who uses quantitative trading?

Quant trading is used by a range of market participants:

- Hedge funds: Firms like Renaissance Technologies and Citadel use complex models to gain an edge in the market.

- Investment banks: They apply quant strategies for market making, risk management, and proprietary trading.

- Proprietary trading firms: These firms trade their own capital using fully automated systems and quant models.

- Retail traders: With access to online platforms, coding tools, and data, individual traders are increasingly exploring basic quant strategies.

Some common quantitative trading tools

Traders can develop and experience quant trading methods through several platforms such as QuantLib, Amibroker, Bloomberg Terminal, etc. Additionally, the trader’s home computer also needs to have a good configuration and be compatible with programming languages such as Python, C++, Java, etc.

See more: