Prop Firm Evaluation Tips is a topic of great interest to many traders looking to conquer the evaluation challenges of prop firms. Understanding the process, mastering risk management rules, and applying appropriate strategies not only helps you pass the test but also increases your chances of receiving significant trading capital. In this article, Tipstrade.org will provide you with actionable prop firm evaluation tips to help you navigate the process successfully.

What Are Prop Firm Evaluations?

Prop Firm evaluations are the testing phase that traders must pass before being granted a real trading account (funded account) from the company. The goal of this process is to assess whether the trader is capable of managing capital and adhering to a stable strategy.

>>Read more:

- What Is Prop Firm? Everything From A – Z Traders Need To Know

- Unpacking How Prop Firm Works For Professional Traders

- Prop Firm Benefits – Why More Traders Join Funded Programs

- Prop Firm Rules: The Complete Guide to Succeeding in Proprietary Trading

Benefits of Passing a Prop Trading Firm Evaluation

Passing a prop trading firm evaluation gives you access to larger trading capital without risking your own money. Instead of growing a small account, you can manage funded accounts ranging from several thousand to millions of dollars, significantly increasing your profit potential.

Most prop trading firms offer profit sharing ratios of up to 90%, allowing traders to retain the majority of their earnings.

In addition to profits, prop trading also offers professional career development opportunities, including access to advanced trading tools, mentorship programs, and data analysis to help improve trading strategies.

Since you are using the company’s capital instead of your own, you can focus on strategy and execution without the psychological pressure of losing personal money. Prop trading opens the door to higher level trading opportunities while minimizing financial risk.

Types of Prop Firm Evaluation Processes

Prop firms use a variety of evaluation models to test traders’ capabilities before granting them funded accounts. These models can range from quick challenges (7–10 days) to multi-step evaluations that test the ability to maintain consistent performance over the long term. The most common formats include:

Rapid Challenges

Some prop firms offer fast challenges, requiring traders to achieve profit targets within a short timeframe, often 7–10 days. These challenges assess the trader’s ability to trade under pressure while controlling risk.

- Suitable for: Highly skilled traders who can trade effectively within strict time limits.

- Risk Level: High – short timeframes often force traders to adopt a more aggressive trading style.

Rapid challenges offer a quick funding path, but they almost don’t allow for mistakes. Traders who cannot handle pressure or prefer a trading style with clear structure and discipline may find this form difficult.

One-Step Evaluation

The one-step evaluation process requires traders to achieve profit targets while strictly adhering to risk management rules. Unlike rapid challenges, this model focuses more on trading discipline rather than pure speed.

- Suitable for: Experienced traders who understand how to manage risk and are confident in their trading strategy.

- Risk Level: Medium – traders need to achieve profit targets, but often have more flexibility compared to fast challenges.

This model offers a faster funding path compared to a multi-step process, but it requires strong risk management skills – just one wrong transaction can lead to failure.

Two-Step Evaluation

The two-step evaluation process is the most common format used by prop firms. This model allows traders to showcase their skills across multiple stages, focusing on both profitability and risk management.

Phase 1: The trader must achieve their profit target while adhering to the loss limit (drawdown).

Phase 2: Testing for consistency over a longer period, to ensure the trader isn’t just relying on short-term luck.

- Suitable for: Beginners and intermediate traders seeking a clearly structured process.

- Risk Level: Lower compared to one-step challenges – the longer time allows traders to trade in a more controlled and disciplined manner.

The two-step challenges offer traders ample opportunities to adjust and demonstrate their ability to trade responsibly in the long run.

Three-Step Evaluation

The three-step evaluation process is less common but more rigorous, further extending the process of verifying the trader’s capabilities. This model aims to ensure that traders possess a long-term, consistently repeatable strategy before being granted access to a funded account.

Phase 1: Profitability and Risk Management Assessment.

Phase 2: Focus on assessing consistency over a longer trading period.

Stage 3: Applying additional requirements, often including regulations on profit stability or rules for scaling up trades.

- Suitable for: Traders who want to prove their ability to maintain long-term performance and build sustainable relationships with the prop firm.

- Risk Level: Low – prop firms often allow more time to demonstrate consistent growth.

Although this process takes longer, it helps prop firms identify traders who can maintain consistent performance in the long run.

Instant Funding

Some prop firms offer instant funding programs, allowing traders to start trading with the company’s capital without going through an evaluation process. Instead of having to complete a challenge, traders simply pay a one-time fee to gain access to a funded account with a profit-sharing ratio.

- Suitable for: Traders who want immediate access to capital without going through a multi-step evaluation process.

- Risk Level: Medium – does not require a challenge, but often comes with strict risk limits and specific profit withdrawal conditions.

The instant funding program offers a faster path to accessing a prop firm’s capital, however, traders should carefully consider fees, restrictions, and profit withdrawal policies before choosing a provider.

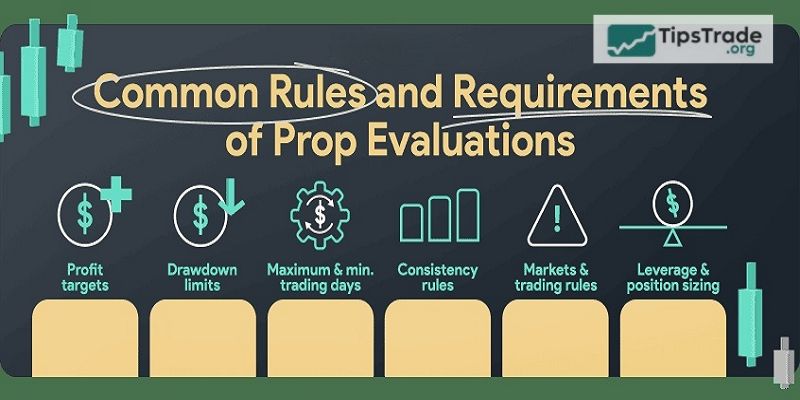

Common Rules and Requirements of Prop Evaluations

Passing a prop firm evaluation is not just about meeting profit targets – it’s also about adhering to risk management rules, demonstrating consistency, and following the company’s trading guidelines. Below are common rules and requirements of prop evaluations that traders need to know to pass the evaluation process and receive a funded account.

Profit Targets

The profit target is the percentage or minimum amount that a trader must achieve during the evaluation process. Most prop firms set profit targets in the range of 5% – 10% of the initial balance.

For example: With a profit target of 10% on a $100,000 account, the trader needs to generate a profit of $10,000 during the evaluation period.

However, achieving the target in just one trade is often not accepted. Many companies require traders to demonstrate consistent performance over multiple trades to prevent the use of high-risk strategies just to reach targets quickly.

Some prop firms even limit the maximum profit per trade to encourage steady growth rather than accepting excessive risk.

Drawdown Limits

Drawdown limits determine the maximum loss a trader can sustain before failing the evaluation process. This regulation helps ensure traders manage risk appropriately instead of trading recklessly to chase profits.

Common types of drawdown limits:

- Daily Drawdown: The maximum loss allowed in a single day. Exceeding this limit will result in immediate disqualification.

- Overall Drawdown: The total maximum loss allowed throughout the entire evaluation process. If the balance falls below this level, the trader will be disqualified.

- Trailing Drawdown: A dynamic loss limit that changes according to the profits achieved. When the account reaches a new peak, this limit can increase accordingly.

Example of Drawdown rules:

- 5% Daily Drawdown: A trader with an account of $50,000 must not incur a loss of more than $2,500 in a single day.

- 10% Overall Drawdown: The account balance must not drop below $45,000 at any time.

Many traders fail not because they don’t make a profit, but because they ignore drawdown rules or overtrade. Managing drawdown is just as important as achieving profit targets.

Maximum & Minimum Trading Days

Prop firms set time limits to balance risk and ensure that traders do not trade too quickly or take too long.

- Minimum Trading Days: Some companies require traders to trade for at least 5-10 days to prove that they are not passing the challenge just by a few lucky trades.

- Maximum Trading Days: Others impose a deadline of 30-90 days, forcing traders to complete the challenge within a fixed timeframe.

Traders need to plan their trading wisely – being too hasty can lead to wrong decisions, while being too slow may result in not achieving the goals on time.

Consistency Rules

To prevent traders from passing the evaluation through high-risk trades, many prop firms implement consistency requirements:

- Profit allocation limits: No single trade should account for more than 30-50% of total profits.

- Steady Position Sizing: Traders are required to maintain relatively uniform position sizes, avoiding small trades at the beginning followed by “big bets” later on.

For example: A trader achieves a profit target of $10,000, but $8,000 of that comes from a single trade that may be excluded due to a violation of consistency.

These rules ensure that the trader demonstrates a stable, repeatable strategy rather than relying solely on luck.

Markets & Trading Rules

Prop trading firms often control the asset classes and trading strategies that traders are allowed to use to limit excessive risk.

Common restrictions:

- Trading tool restrictions: Only allows trading of certain forex pairs, stocks, or commodities.

- Scalping restrictions: Requires a minimum time interval between trades (1–3 minutes) to avoid ultra-fast trading.

- News trading rules: Prohibits trading around the time of important economic news releases (usually within 2–10 minutes before and after the event).

- Automated trading (HFT) restrictions: Some companies prohibit the use of bots or high-speed trading algorithms.

- Overnight or weekend position holding regulations: Some require closing all positions before the market closes to reduce overnight risk.

For example: A trader using a news trading strategy might achieve their profit target, but still fail if the company prohibits trading during the release of important news. Therefore, carefully reading the company’s regulations is extremely important.

Leverage & Position Sizing

Prop firms often limit leverage and order size to prevent traders from taking excessive risks.

- Leverage limits: Usually set at 1:10 or 1:30, especially in forex trading.

- Maximum order size: Limits the maximum number of lots per order to ensure traders do not bet too large.

- Scaling Rules: Some firms only allow increasing order size when traders demonstrate stability.

For example: A $100,000 account is only allowed to trade a maximum of 5 lots at a time, helping to limit risk and comply with drawdown rules.

These restrictions force traders to prioritize risk management rather than using large orders to achieve quick profit targets.

Essential Prop Firm Evaluation Tips for Success

To pass the evaluation of prop firms, traders need to achieve profit targets while staying within the allowed risk limits. Success depends not only on profitability but also on risk management, consistency, and trading discipline.

Start with a clear trading plan that includes entry/exit strategies, stop-loss levels, and position size management rules. Always strictly adhere to drawdown limits and avoid excessive leverage. Consistency is a key factor. Prop firms often value traders who demonstrate stable performance over time, rather than relying solely on a few big winning trades.

Use a trading journal to track performance, adjust strategies, and eliminate weaknesses. Avoid trading based on emotions. Trying to recover losses or overtrading often leads to failure. The most effective method is to execute strategies in a controlled manner, focusing on risk-adjusted profitability.

Common Mistakes Traders Make During Prop Firm Evaluations

The challenges of prop firms are truly worth participating in for traders with good risk management skills, a clear trading strategy, and stable performance. Passing the evaluation of prop firms will help traders access larger trading capital, with profit-sharing ratios typically ranging from 70% to 90%.

However, traders who lack discipline in risk management or struggle to adhere to the company’s rules, such as drawdown limits, may find it difficult to succeed. Success depends on controlled trading, following a structured plan, and effectively managing risk.

Final thoughts

Through the Prop Firm Evaluation Tips shared above, Tiptrade.org hopes you have grasped how to prepare your mindset, build a trading plan, and manage your capital wisely to achieve the best results during the evaluation period. Success lies not only in trading skills but also in perseverance and discipline. Apply these experiences to maximize your chances of being funded and get closer to your goal of becoming a professional trader.

Read more: