Private equity funds have become one of the most influential forces in global finance, shaping industries, accelerating company growth, and delivering significant returns to institutional and high-net-worth investors. These funds pool capital from accredited investors and allocate it into privately held businesses or public companies targeted for buyouts. This guide provides a detailed, expert-based overview to help readers understand how PE funds work, their structure, strategies, benefits, risks, and how investors can evaluate them. Explore the detailed article at tipstrade.org to be more confident when making important trading decisions.

What Are Private Equity Funds?

Private equity funds are investment vehicles that purchase ownership stakes in private companies or conduct buyouts of public companies that later become private. These funds operate under a limited partnership structure, where General Partners (GPs) manage the investments and Limited Partners (LPs) supply the capital.

The primary objective is to acquire undervalued or high-potential businesses, improve their performance, and eventually exit at a profit. PE funds generally invest across a 7–12 year lifecycle, with capital deployed during the early years and returns realized through exits such as IPOs, mergers, or secondary buyouts.

A study by Bain & Company indicates that private equity consistently outperforms public equities, delivering an average net IRR of 12–18%, depending on fund strategy and economic cycles.

PE funds differ from hedge funds because they prioritize long-term value creation rather than active trading.

They also differ from venture capital by focusing on mature companies with proven cash flows. In short, private equity funds provide investors with structured, strategic exposure to high-growth potential businesses.

How Private Equity Funds Work

Private equity funds work through a structured investment process: fundraising, capital deployment, portfolio management, and exit strategy.

During the fundraising phase, GPs approach institutional investors such as pension funds, sovereign wealth funds, endowments, and family offices to commit capital.

Once commitments are secured, the fund enters its investment period, typically lasting 3–5 years. During this phase, the fund identifies target companies using rigorous due diligence—financial analysis, operational assessments, and market studies—to ensure realistic value-creation opportunities.

After acquiring a company, the fund’s operational team collaborates with management to implement performance improvements: cost restructuring, digital transformation, leadership optimization, and revenue expansion.

According to Harvard Business Review, value creation in PE has shifted from financial engineering to operational enhancement over the past decade.

The final step is the exit, where the fund seeks to sell its stake at a profitable multiple. These exits often occur via IPO, strategic sale, or secondary sale to another PE fund.

Each step reflects a combination of financial expertise, strategic planning, and long-term management.

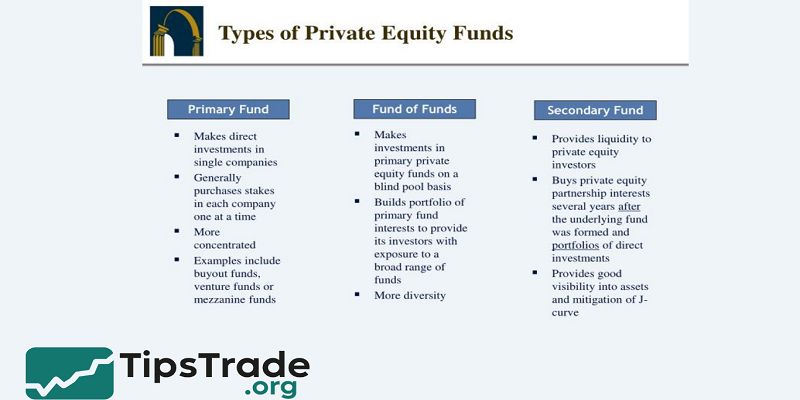

Types of Private Equity Funds

Private equity funds vary widely depending on investment stage, risk level, and strategic goals. The most common types include:

Buyout Funds

- Buyout funds acquire majority stakes in mature companies with stable revenues and strong assets. They often use leverage—known as a Leveraged Buyout (LBO)—to enhance returns.

- These funds focus on operational improvement, EBITDA expansion, and strategic repositioning.

- For example, a PE fund might buy a manufacturing company, streamline its supply chain, upgrade technology, and then sell it at a higher valuation.

- Historical data from PitchBook shows that buyout funds produce some of the highest returns within the PE ecosystem.

Venture Capital Funds

- Although sometimes grouped separately, venture capital is a subset of private equity that invests in early-stage startups with high growth potential.

- These funds focus on innovation, technology, and disruptive business models.

- Venture investments carry higher risk but can deliver outsized returns, especially in sectors like AI, biotech, or fintech.

- Crunchbase data indicates that global venture investments exceeded $445 billion in 2023, driven by advancements in emerging technologies.

Growth Equity Funds

- Growth equity funds target companies that are profitable but require capital to expand.

- Unlike venture capital, these firms typically have proven business models and validated revenue streams.

- Growth equity offers lower risk compared to early-stage venture investing, while still providing significant upside.

- A typical example is investing in a fast-growing SaaS company that needs capital to scale internationally.

Distressed or Turnaround Funds

- These funds acquire companies undergoing financial distress, debt issues, or operational decline.

- The strategy involves restructuring, debt reduction, and turnaround management.

- While high risk, distressed investing can generate substantial returns if the company successfully recovers.

- According to S&P Global, distressed investing saw increased activity during economic downturns when undervalued assets become more accessible.

The Structure of a Private Equity Fund

Private equity funds operate under a limited partnership (LP) structure, a model that clearly defines responsibilities, incentives, and profit distribution.

General Partners (GPs)

- General Partners manage the fund, source deals, execute investments, and oversee portfolio companies.

- They typically commit 1–3% of the fund’s total capital, ensuring alignment with investors.

- GPs receive a management fee—usually 2% of assets under management—and performance-based compensation called carried interest, commonly set at 20% of profits.

Limited Partners (LPs)

- Limited Partners are passive investors who provide most of the capital but do not participate in day-to-day management.

- LPs include pension funds, insurance companies, university endowments, sovereign wealth funds, and accredited individuals.

- LPs benefit from limited liability and gain access to private investment opportunities that would otherwise be inaccessible.

Fund Lifecycle

A typical PE fund follows a clearly defined lifecycle:

- Fundraising (Year 0–1)

- Investment Period (Year 1–5)

- Holding & Value Creation (Year 3–10)

- Exit & Distribution (Year 5–12)

This structure ensures transparency, disciplined capital allocation, and predictable timelines for both GPs and LPs.

Investment Strategies in Private Equity

Private equity funds employ various strategies depending on their expertise and market conditions.

Leveraged Buyouts (LBOs)

- In an LBO, a fund acquires a company using a combination of equity and debt.

- This approach magnifies returns because debt financing reduces the equity required from investors.

- However, excessive leverage increases risk, which is why funds conduct thorough cash-flow analysis before proceeding.

Minority Growth Investments

- Funds take a minority stake in a high-growth company, providing capital and strategic support without assuming full control.

- This strategy is popular in technology and consumer markets.

Operational Turnaround

- Funds target underperforming companies with potential for improvement.

- This strategy requires specialized operational skills—supply chain optimization, digital transformation, leadership restructuring, and cost control.

Sector-Specific Investing

- Some PE firms specialize in industries like healthcare, real estate, renewable energy, or logistics.

- Industry expertise often leads to better deal sourcing and superior performance.

Benefits of Investing in Private Equity Funds

Private equity offers a number of advantages that attract institutional and sophisticated investors.

Higher Return Potential

- Long-term data from Cambridge Associates shows that private equity has historically outperformed public equities by 300–500 basis points annually, making it a powerful vehicle for long-term wealth creation.

Low Correlation With Public Markets

- Private equity returns are less affected by short-term market fluctuations. This provides diversification and stability to large portfolios such as pension funds.

Access to Exclusive Deals

- PE investors gain exposure to high-quality private businesses that are not available in public markets.

- These opportunities often include family-owned companies, industry leaders, or high-growth startups.

Active Value Creation

- Unlike passive public investors, PE funds actively improve the companies they buy.

- This hands-on approach often leads to stronger long-term value generation.

Risks and Challenges of Private Equity Funds

Despite its advantages, private equity comes with notable risks that investors must evaluate carefully.

Illiquidity

- PE investments lock capital for 7–12 years. Investors cannot easily withdraw funds, which may be unsuitable for those needing short-term liquidity.

Higher Minimum Investment

- Most PE funds require commitments ranging from $250,000 to $10 million, limiting participation to accredited investors.

Market and Operational Risk

- Investments may underperform due to industry shifts, economic downturns, or management failures.

- Distressed or turnaround strategies carry even greater risk.

Fee Structure

- Management fees and carried interest can reduce net returns.

- Investors must analyze the “fee drag” when evaluating expected performance.

Leverage Risk

- LBO strategies rely heavily on debt. If cash flows decline, the company may default, causing losses for the fund.

How to Evaluate a Private Equity Fund

Evaluating a private equity fund requires analyzing the following factors:

Track Record

Review the GP’s historical performance across market cycles. Metrics to consider:

- IRR (Internal Rate of Return)

- TVPI (Total Value to Paid-In Capital)

- DPI (Distributions to Paid-In Capital)

Investment Strategy

- Check whether the strategy aligns with your risk tolerance, investment horizon, and financial goals.

Team Experience

- Experienced GPs with deep operational expertise deliver stronger results.

- Look for stable leadership and industry specialization.

Fees and Terms

Understand:

- Management fees

- Carried interest

- Hurdle rate

- Clawback provisions

Portfolio Construction

- Evaluate diversification across sectors, geographies, and company sizes.

Conclusion

Private equity funds play a crucial role in global finance, fueling business growth and delivering strong returns to long-term investors. Understanding their structure, strategies, benefits, and risks allows investors to make informed decisions. While private equity offers attractive upside, it also requires patience, expertise, and a willingness to embrace long-term commitments. For investors who meet the eligibility requirements and seek diversification beyond public markets, private equity can be a powerful portfolio component.