The primary vs secondary market plays an important role in mobilizing and circulating capital, contributing to sustainable economic development. Although there is a reciprocal relationship, these two markets have different natures and functions. So, what are the differences between primary vs secondary market? Let’s explore this in detail in the article below.

What is the primary market?

Definition of the primary market

The primary market is the market for buying and selling newly issued securities by companies or governments. The main purpose of this market is to raise direct investment capital for businesses or government projects.

>>See more:

- What is Stock Liquidity? Why It’s Important for Investors

- How Do Interest Rates Affect the Stock Market?

- How To Buy Stocks in 4 Steps: Quick-Start Guide for Beginners

- Common Stock Risk Management Strategies for Investors

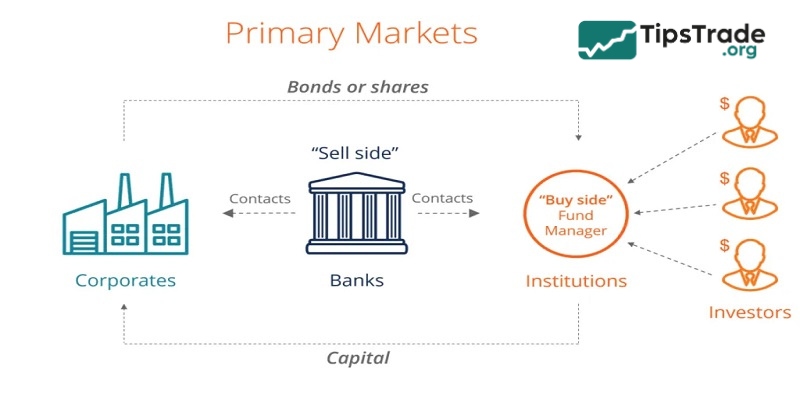

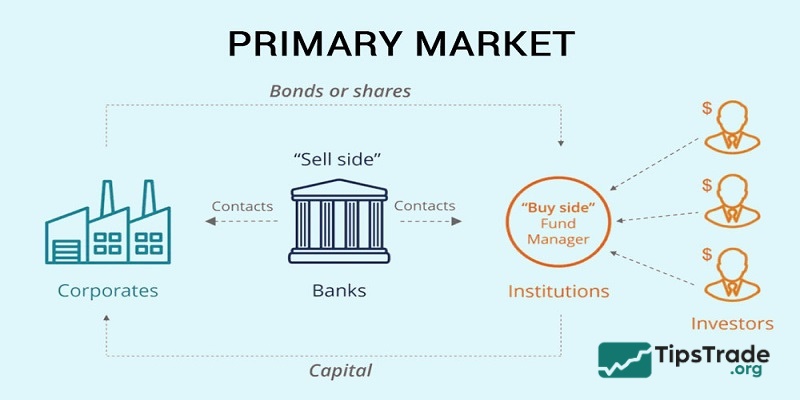

How does the primary market work?

Here’s how the primary market works:

- Prepare and submit the offering documents: The offering document contains necessary information about the company, its financial situation, the terms of the issue and the purpose of raising capital. Any company that wants to raise money from the public must prepare and submit this offering document.

- Open issue: After completing the necessary legal procedures, the issuing company will publish advertisements announcing the issue. The issue will then be open to public subscription. If potential investors are interested in purchasing shares of the issuing company based on the information in the offering documents, they can do so by completing the subscription form and paying the required amount before the issue closes.

- Share allocation after the issuance ends: After the subscription period ends, shares will be allocated to investors who have applied. If the number of subscriptions exceeds the number of shares issued (oversubscription), the allocation may be done by random drawing or proportional allocation, depending on the regulations and the level of subscription.

Pros and cons of the primary market

Pros:

- The securities issued in the primary market have high liquidity since they can be sold in the secondary market.

- Primary markets play a crucial role in an economy’s ability to mobilize savings.

- The primary market has much lower odds of price manipulation than the secondary market.

Cons:

- Each stock has a different level of risk, but since the company is issuing its shares through an IPO for the first time, there is no previous trading data for IPO shares to analyse.

- It might not always be advantageous for small investors. If a share is oversubscribed, allocations to small investors might not be made.

What is the secondary market?

Definition of the secondary market

The secondary market is where stocks that have already been issued in the primary market are traded – ensuring liquidity for issued securities. This is where investors buy and sell securities for profit or transfer ownership of investment assets.

How does the secondary market work?

Here’s how the secondary market works:

Investors in the secondary market trade with each other rather than with the original issuer. The secondary market helps bring the price of a stock closer to its true value through a series of independent but related transactions. A secondary transaction occurs when shareholders of a private company backed by a venture capital fund sell their shares to another investor. The value of this transaction is determined by calculating Net Asset Value (NAV) of that stock.

Secondary trading can take place in various forms, such as:

- An initial investor sells his shares in the company to a third party;

- Liquidation of founder shares in the event of company insolvency, as part of a funding round;

- When a company grants stock options to employees, these options need to be exercised to convert into actual shares.

Pros and cons of the secondary market

Pros:

- Secondary markets assist businesses in determining their worth.

- The secondary market is an excellent indicator of a company’s current fair valuation.

- When new information about the company becomes available, the price of securities adjusts quickly.

- The secondary market promotes economic efficiency.

Cons:

- Cash flows for Secondary Market loans may be irregular.

- Understanding the Premium Cost may be challenging.

- Recognizing opportunity costs is also a tough task.

>>See more:

- Long-Term Stock Investing: Benefits and Key Principles to Understand

- ETF Investing: The Ultimate Guide for Beginners

- Day Trading Stocks: Benefits, Risks, and Effective Investing Strategies

- What are Blue Chip Stocks? Features of Blue-chip Stocks

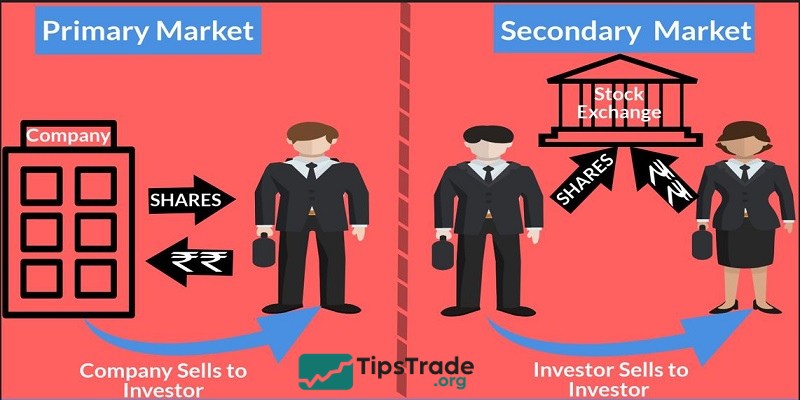

Key difference between primary vs secondary market

The primary vs secondary markets play integral roles in the overall health and function of the financial system, each serving distinct but complementary purposes. Here’s a side-by-side comparison to clarify the key differences:

|

Basis of Distinction |

Primary Market |

Secondary Market |

|

Definition |

The market where securities are created for novice investors is referred to as a primary market. |

The secondary market, on the other hand, is described as a location where investors trade issued shares. |

|

Alternate name |

Primary market is also known as ‘New Issue market’. |

The secondary market is also known as the ‘After Issue Market’. |

|

Purchasing type |

Direct transactions are made in the primary market. |

No part of the purchasing procedure involves the firm issuing the shares. |

|

Financing |

The primary market offers to finance businesses that wish to expand and flourish. |

The companies do not receive financing from the secondary market. |

|

Security selling |

The investors and companies deal directly. |

Without the issuer’s involvement, investors and traders engage in sale transactions. |

|

Transactional entities |

A corporation or government entity is a transactional entity in a primary market. |

Since transactions in a Secondary market occur between investors (shareholders), the investors are the transactional entities in this market. |

|

Intermediary |

Investment banks, Underwriters are involved in the intermediary process of a primary market. |

In a secondary market, brokers act as intermediaries. |

|

Price |

Prices in the primary market are fixed, and not subject to change. |

On the other hand, due to supply and demand, there are significant price fluctuations in the secondary market. |

|

Organizational difference |

Companies that issue shares and debentures are required to abide by all laws. |

Investors in the secondary market abide by the regulations set forth by the government and stock exchanges. |

Primary vs secondary market offerings

The diverse mechanisms of the primary vs secondary market together create an ecosystem that supports capital formation, provides liquidity, determines value, and manages risk across the global economy.

Primary market offerings

Primary market issuance occurs when new stocks are issued directly by organizations needing to raise capital. The main forms include:

- Initial Public Offering (IPO): Is the first time a private company issues shares to the public, turning the business into a public company through a process that includes legal documents, underwriters’ appraisal, and investor roadshows.

- Public offering (FPO) : Is a listed company issuing additional shares, which can create new shares (dilutive) or allow existing shareholders to sell shares (non-dilutive), usually for the purpose of expanding business, acquiring other businesses or paying off debt.

- Rights issue: This is a form in which existing shareholders have the right to buy new shares at a preferential price based on their current ownership ratio, helping businesses raise capital while maintaining investor rights.

- Private placement: Is the sale of securities directly to a limited number of qualified investors, bypassing many of the requirements of a public offering, helping to raise capital more quickly and less expensively, often used by startups or small businesses.

- Preferred stock offering: Is the issuance of shares with priority in receiving dividends and assets, with hybrid characteristics between equity and debt, often used by businesses to raise capital without affecting the voting rights of common shareholders.

- Debt issuance: Includes a variety of fixed income securities such as corporate bonds, government bonds, municipal bonds, and convertible bonds that can be converted into shares under certain conditions.

Secondary market offerings

Secondary market issuance occurs when investors resell previously issued securities. The main forms include:

- Exchange-traded Securities: Traded on regulated exchanges such as the NYSE or NASDAQ, subject to standard regulations and reporting requirements, are the most visible form of secondary market activity.

- Over-the-counter (OTC) markets: Trading off-exchange through a network of brokers and electronic systems, often used for small companies, low-priced stocks and some types of bonds.

- Dark pools: Are private exchanges where trades take place anonymously, primarily used by institutional investors to execute large volume trades without affecting the market price until after completion.

- Alternative trading systems (ATS): Are electronic platforms that connect buyers and sellers outside of traditional exchanges, but are still subject to regulatory oversight; include electronic communication networks (ECNs) and Crossing Networks.

- Secondary private placements: The sale of shares of private companies between qualified investors through specialized platforms, is increasingly important as more businesses choose to stay private longer before going public.

- Repurchase agreements (Repos): Are short-term loans using securities as collateral, playing a key role in maintaining liquidity for financial institutions in transactions between dealers or between dealers and customers.

- Derivatives markets: A market where contracts whose value depends on an underlying asset, including futures, options, swaps and forwards, are traded on both exchanges and over-the-counter markets.

Final thoughts

Thus, this article has shared some basic information about the two main markets in the stock market: primary vs secondary market. We hope you understand and can differentiate between them, and apply them to your own investment strategies!