Performance fee is a compensation structure commonly used in hedge funds, private equity, and investment management, designed to reward managers based on investment performance rather than asset size alone. Often discussed alongside terms such as incentive fee, management fee, high-water mark, hurdle rate, fund returns, and investor alignment, performance fees play a critical role in shaping how investment funds operate. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Is a Performance Fee?

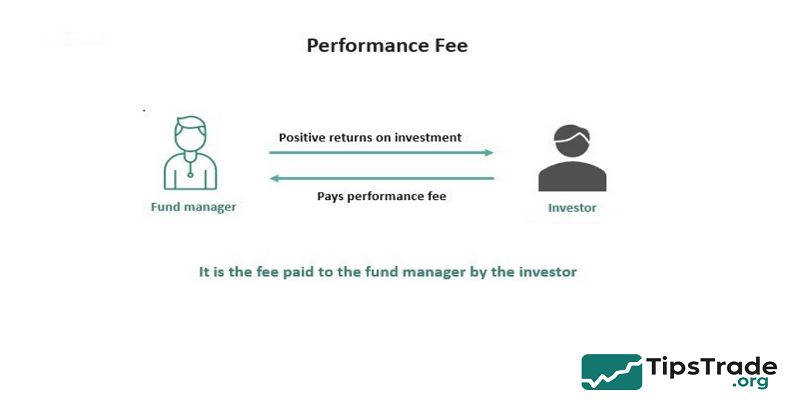

A performance fee is a variable fee paid to an investment manager based on the profits generated by a fund, rather than the total assets under management. Unlike fixed management fees, performance fees are designed to align the interests of fund managers with those of investors by linking compensation directly to results.

In professional asset management, performance fees are most commonly associated with hedge funds and private equity funds, although they also appear in some mutual funds and alternative investment products. According to the CFA Institute, the rationale behind performance-based compensation is to encourage skill-based returns, often referred to as alpha, rather than returns driven purely by market movements.

From an investor’s perspective, performance fees can appear attractive because managers only earn additional compensation when returns exceed a defined benchmark. However, critics argue that such fees may also incentivize excessive risk-taking, especially if safeguards are not in place.

See more

- Hedge Funds Report: A Comprehensive Analysis of Performance, Strategies, and Industry Trends

- Index Funds vs Mutual Funds: Understanding the Key Differences Before You Invest

- Top Index Funds to Consider for Long-Term Investing

- Risks in Index Funds: What Every Investor Should Understand

Where Performance Fees Are Commonly Used

Performance fees are not applied uniformly across the investment industry. They tend to appear in strategies where active decision-making plays a significant role.

Common areas include:

- Hedge funds (long/short equity, global macro, event-driven)

- Private equity and venture capital

- Certain alternative mutual funds

- Structured investment products

Traditional index funds and passive ETFs typically avoid performance fees, relying instead on low, fixed management fees. Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) closely monitor performance fee structures to ensure transparency and investor protection.

How Performance Fees Are Calculated

Performance fee calculations vary by fund, but the underlying principle remains consistent: managers receive a percentage of profits generated above a defined threshold.

The most basic formula can be summarized as:

Performance Fee = Profit × Performance Fee Rate

For example, if a fund generates $10 million in profit and charges a 20% performance fee, the manager earns $2 million in incentive compensation. However, real-world calculations are often more complex, incorporating mechanisms such as high-water marks and hurdle rates to protect investors.

According to Investopedia, these mechanisms are critical in preventing managers from earning performance fees during periods of underperformance or recovery from losses.

High-Water Mark Explained

A high-water mark is a risk-control mechanism ensuring that performance fees are only charged on new profits, not on gains that merely recover past losses. It represents the highest historical value of a fund’s net asset value (NAV).

For example, if a fund peaks at $100, falls to $80, and then recovers to $95, no performance fee is charged until the NAV exceeds $100. Only profits above the previous peak are eligible for incentive fees.

From an investor protection standpoint, high-water marks are widely viewed as best practice. Research from Morningstar suggests that funds using strict high-water mark policies tend to exhibit stronger long-term investor trust, even during volatile market cycles.

The Role of a Hurdle Rate

A hurdle rate sets a minimum return that a fund must achieve before performance fees apply. This rate is often tied to a benchmark, such as a risk-free rate or a market index.

Hurdle rates serve two purposes:

- They prevent managers from earning fees on returns that merely reflect market appreciation.

- They encourage skill-based performance rather than passive exposure.

For example, if a fund has a hurdle rate of 5% and generates a 7% return, performance fees apply only to the excess 2%. According to academic studies published in The Journal of Portfolio Management, hurdle rates significantly reduce investor dissatisfaction during low-return environments.

Performance Fee vs. Management Fee

Performance fees are often discussed alongside management fees, but the two serve different functions.

| Feature | Performance Fee | Management Fee |

| Basis | Investment profits | Assets under management |

| Variability | Variable | Fixed |

| Investor alignment | High (in theory) | Moderate |

| Risk of overpayment | Medium | Low |

Management fees are intended to cover operational costs such as research, staffing, and compliance. Performance fees, by contrast, reward investment skill. Many hedge funds historically followed the “2 and 20” model—2% management fee and 20% performance fee—although this structure has evolved in recent years.

Advantages of Performance Fees

Supporters of performance fees argue that they create stronger alignment between managers and investors. When compensation depends on results, managers are incentivized to focus on long-term value creation rather than asset gathering.

Key advantages include:

- Motivation for active risk management

- Encouragement of alpha generation

- Reduced incentive to grow assets unnecessarily

- Potential for lower total fees during underperformance

Industry surveys from Preqin indicate that institutional investors often prefer performance-linked compensation when investing in high-skill strategies such as distressed debt or event-driven investing.

Risks and Criticisms of Performance Fees

Despite their theoretical benefits, performance fees are not without controversy. One major concern is that they may encourage managers to take excessive risk in pursuit of higher short-term returns.

Common criticisms include:

- Asymmetric payoff structures (managers share gains but not losses)

- Incentives to increase volatility

- Complexity and lack of transparency

- Fee erosion of net investor returns

According to research cited by the Financial Stability Board, poorly designed incentive structures can amplify systemic risk, particularly during speculative market phases. As a result, regulators increasingly emphasize disclosure and investor education.

Performance Fees in Hedge Funds

Hedge funds are the most prominent users of performance fees. Historically, the “2 and 20” fee structure became an industry standard, although competitive pressure has led many funds to lower fees or adopt tiered models.

In hedge funds, performance fees are often combined with:

- High-water marks

- Annual crystallization periods

- Lock-up requirements

Data from Hedge Fund Research (HFR) shows that average performance fees have declined over the past decade as investors demand greater transparency and cost efficiency. Nonetheless, top-performing managers continue to command premium fees due to strong track records.

Performance Fees in Private Equity and Venture Capital

In private equity, performance fees are typically referred to as carried interest. While conceptually similar, carried interest is usually calculated over the life of a fund rather than annually.

Private equity performance fees:

- Are realized upon exit events

- Depend on internal rate of return (IRR)

- Often include preferred returns for investors

According to research from the Institutional Limited Partners Association (ILPA), carried interest structures have a significant impact on net investor outcomes, particularly in long-duration funds. Transparency and alignment remain central concerns for limited partners.

Are Performance Fees Fair to Investors?

The fairness of performance fees depends largely on structure and context. When combined with strong safeguards—such as high-water marks, hurdle rates, and transparency—performance fees can support investor interests.

However, poorly designed fee structures may lead to misaligned incentives. Studies by the CFA Institute emphasize that investors should evaluate performance fees alongside:

- Risk-adjusted returns

- Fee transparency

- Manager behavior during drawdowns

In practice, sophisticated investors conduct extensive due diligence to assess whether a fund’s fee structure is justified by its strategy and historical performance.

Regulatory Oversight and Disclosure

Performance fees are subject to regulatory scrutiny in many jurisdictions. In the United States, the SEC requires detailed disclosure of fee structures, including examples of how fees are calculated under different scenarios.

Regulators aim to ensure that:

- Investors understand how fees affect returns

- Conflicts of interest are disclosed

- Marketing materials are not misleading

Educational resources from organizations such as FINRA and the SEC emphasize the importance of fee awareness, particularly for non-institutional investors exploring alternative investments.

Historical Impact of Performance Fees on Returns

Empirical research on performance fees presents mixed results. Some studies suggest that performance-based compensation improves alignment and performance, while others find limited evidence of persistent alpha after fees.

A widely cited study by academic researchers at Yale University found that while top-tier managers may justify high performance fees, average funds often underperform low-cost alternatives on a net basis. This highlights the importance of manager selection and realistic expectations.

Conclusion

Performance fees are a defining feature of many active and alternative investment strategies, designed to reward managers for generating profits rather than simply managing assets. When structured thoughtfully, they can align incentives and support long-term value creation.

However, performance fees also introduce complexity, cost, and potential conflicts of interest. Investors evaluating funds with performance-based compensation should focus on transparency, safeguards, and risk-adjusted returns. Understanding how performance fees work is essential for making informed investment decisions in today’s increasingly complex financial landscape.