Pension Funds Report highlights the critical role of pension funds in securing retirement income worldwide. This comprehensive Pension Funds Report examines the structure, performance, and future challenges of pension systems across key markets. It analyzes investment strategies, regulatory frameworks, and demographic trends shaping long-term sustainability. By providing data-driven insights, this report equips investors, policymakers, and stakeholders with actionable recommendations to enhance pension fund resilience in an aging global population. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions

What Is a Pension Funds Report?

Definition and Purpose of Pension Fund Reports

A pension funds report is a structured analytical document that examines the financial condition, performance, and strategic direction of pension funds over a defined period. These reports are typically produced by governments, international organizations, regulators, consulting firms, or pension fund managers themselves.

Their core purpose is to provide transparency around assets under management (AUM), investment returns, funding status, and long-term liabilities. From a reporting perspective, pension funds reports are not marketing documents; they are designed to support evidence-based decision-making.

In practice, analysts use these reports to assess whether pension systems are financially sustainable under current economic assumptions. For example, actuarial projections included in pension funds reports often estimate future obligations based on life expectancy, contribution rates, and expected investment returns.

According to long-standing reporting standards referenced by institutions such as the OECD, a high-quality pension report balances historical data with forward-looking risk analysis, ensuring stakeholders understand both strengths and vulnerabilities.

Who Uses Pension Funds Reports and Why They Matter

Pension funds reports serve a wide range of stakeholders, each with different objectives. Policymakers use them to evaluate the effectiveness of pension reforms and to forecast future fiscal pressures.

Pension trustees rely on reports to monitor governance quality, asset allocation decisions, and risk exposure. Meanwhile, academics and financial researchers analyze pension reports to study long-term capital markets and institutional investment behavior.

From an experiential standpoint, global consulting firms often review hundreds of pension funds reports annually to identify best practices. These reports matter because pension funds collectively manage tens of trillions of dollars globally, making them among the largest institutional investors in the world.

A well-prepared pension funds report enhances trust by disclosing assumptions, explaining investment decisions, and highlighting risks. Without such reporting, beneficiaries would have limited visibility into how their retirement savings are managed.

See more

- Public Pension Funds Explained: How Government Retirement Systems Work

- Pension Funds Fees Explained: What You Pay and Why It Matters for Retirement

- Pension Funds Management: How Retirement Assets Are Managed for Long-Term Stability

- Defined Benefit Pension Funds: How Guaranteed Pension Plans Work and What They Mean for Retirement Security

Overview of the Global Pension Funds Industry

Size of the Global Pension Fund Market

The global pension fund industry represents one of the largest pools of long-term capital in the financial system. According to widely cited international research, pension fund assets globally exceed USD 50 trillion, with the majority concentrated in advanced economies.

The United States, Canada, Japan, the Netherlands, and Australia collectively account for a significant share of total pension assets. This scale gives pension funds enormous influence over capital markets, infrastructure financing, and corporate governance.

From an expert perspective, pension fund growth has been driven by mandatory contributions, demographic trends, and the shift from pay-as-you-go systems to funded pension arrangements.

Pension funds reports consistently show that assets under management have grown faster than GDP in many countries, highlighting the increasing financial importance of retirement systems. However, size alone does not determine success; governance quality and funding discipline are equally critical.

Key Types of Pension Funds Worldwide

Pension funds reports typically classify funds into several categories based on structure and sponsorship. The most common types include public pension funds, occupational pension funds, and private or individual pension arrangements.

Public pension funds are usually sponsored by governments and serve large populations, such as civil servants or national workforces. Occupational pension funds are linked to employers and may be either defined benefit or defined contribution plans.

In addition, some countries operate sovereign pension reserve funds, which act as buffer funds to support future pension liabilities. Reports from international organizations often emphasize that while structural differences exist, all pension funds share a common objective: meeting long-term retirement obligations.

Understanding these categories is essential when interpreting a pension funds report, as performance metrics and risk profiles vary significantly across fund types.

Pension Fund Assets and Growth Trends

Global Assets Under Management (AUM)

Assets under management (AUM) are a central focus of any pension funds report because they reflect both historical contributions and investment performance. Over the past two decades, global pension AUM has expanded steadily, supported by capital market growth and increased participation in funded pension schemes.

Reports frequently highlight that equity markets, private assets, and real estate have contributed significantly to asset growth.

From an analytical standpoint, AUM growth is not inherently positive if liabilities grow faster than assets. Experienced pension analysts often caution that strong nominal asset growth may mask underlying funding challenges.

Therefore, pension funds reports typically present AUM data alongside funding ratios and liability projections to provide a balanced assessment of financial health.

Regional Breakdown of Pension Fund Assets

Pension funds reports commonly segment AUM by region to highlight structural differences across pension systems. North America remains the largest pension market, driven by the United States’ extensive public and private pension arrangements.

Europe follows closely, with well-funded occupational pension systems in countries such as the Netherlands and Denmark. Asia-Pacific markets, led by Japan and Australia, have experienced rapid growth in pension assets over recent decades.

Regional analysis in pension funds reports reveals that regulatory frameworks and cultural attitudes toward retirement savings significantly influence asset accumulation.

For example, mandatory superannuation contributions in Australia have resulted in high pension asset coverage relative to GDP. These regional insights help readers understand why pension outcomes vary widely across countries.

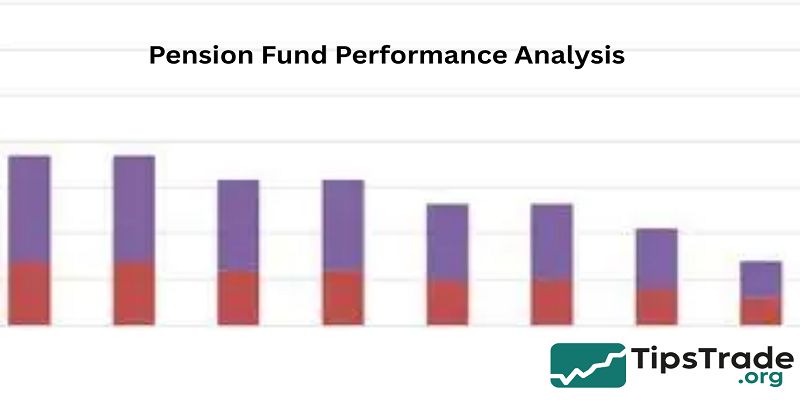

Pension Fund Performance Analysis

Long-Term Returns vs Short-Term Volatility

Performance analysis is a core component of any pension funds report, but it must be interpreted within a long-term context. Pension funds are long-horizon investors, often targeting investment returns over decades rather than quarters.

As a result, reports emphasize long-term real returns rather than short-term volatility.

Experience from global pension fund reviews suggests that diversified portfolios combining equities, bonds, and alternative assets tend to deliver more stable outcomes over time.

Pension funds reports often include rolling return analyses to demonstrate how performance varies across economic cycles. This approach helps beneficiaries understand that short-term losses do not necessarily indicate long-term failure.

Risk-Adjusted Performance Metrics Used in Reports

Beyond headline returns, pension funds reports increasingly rely on risk-adjusted performance metrics. Measures such as volatility, drawdown, and Sharpe ratios provide a more nuanced view of investment effectiveness.

Experts emphasize that high returns achieved through excessive risk-taking can undermine pension sustainability.

Modern pension reporting frameworks encourage transparency around risk management practices. By disclosing asset allocation ranges, stress testing results, and scenario analyses, pension funds reports enhance trust and accountability.

These practices align with international governance principles promoted by organizations such as the OECD and the World Bank.

Funding Status and Financial Sustainability

Understanding Pension Funding Ratios

Funding ratios are among the most closely watched indicators in pension funds reports. A funding ratio compares a pension fund’s assets to its projected liabilities, providing a snapshot of financial adequacy.

A ratio above 100% indicates surplus assets, while a ratio below 100% signals underfunding.

From an expertise perspective, funding ratios depend heavily on actuarial assumptions, including discount rates and longevity estimates.

Pension funds reports often explain these assumptions in detail to avoid misinterpretation. Analysts frequently caution that funding ratios should be evaluated over time rather than at a single point, as market fluctuations can temporarily distort results.

Key Challenges Affecting Pension Fund Solvency

Pension funds reports consistently identify several structural challenges affecting solvency. Demographic aging increases the number of retirees relative to contributors, placing pressure on cash flows.

Low interest rates raise the present value of liabilities, making it harder for funds to remain fully funded.

In addition, economic shocks such as financial crises or pandemics can reduce asset values while increasing fiscal stress.

Experienced pension professionals emphasize that solvency challenges require long-term policy responses, including contribution adjustments, benefit reforms, and improved investment governance.

Investment Strategies Highlighted in Pension Funds Reports

Asset Allocation Trends

- Asset allocation is a recurring theme in pension funds reports because it directly influences risk and return outcomes.

- Over time, many pension funds have shifted away from traditional fixed-income-heavy portfolios toward more diversified allocations.

- Equities, real assets, and alternatives now play a larger role in long-term return generation.

- From a practical standpoint, pension funds reports often document gradual changes rather than abrupt shifts in asset allocation.

- This reflects the need for stability and predictability in retirement systems. Asset allocation decisions are typically guided by liability profiles, risk tolerance, and regulatory constraints.

Role of Alternative Investments

- Alternative investments such as private equity, infrastructure, and real estate have gained prominence in pension funds reports.

- These assets are valued for their potential to deliver long-term returns and diversification benefits.

- For example, infrastructure investments often provide inflation-linked cash flows that align well with pension liabilities.

- However, pension funds reports also acknowledge the challenges of alternative investments, including illiquidity and valuation complexity.

- Trustworthy reporting requires transparent disclosure of fees, risks, and performance attribution to ensure stakeholders understand both benefits and limitations.

Governance and Regulatory Frameworks

Governance Structures in Top Pension Systems

Governance quality is a defining feature of successful pension systems, and pension funds reports devote significant attention to this topic. Strong governance structures typically include independent boards, clear fiduciary duties, and robust internal controls. Reports often highlight governance as a key differentiator between well-performing and struggling pension funds.

From an experiential perspective, comparative studies show that countries with professionalized pension governance tend to achieve better long-term outcomes. Pension funds reports reinforce the idea that governance is not merely an administrative function but a critical driver of financial sustainability.

Regulatory Differences Across Countries

Regulation shapes how pension funds operate, invest, and report. Pension funds reports frequently compare regulatory frameworks across jurisdictions to illustrate their impact on funding outcomes. Some countries impose strict funding requirements, while others allow greater flexibility in contribution and benefit adjustments.

These regulatory differences explain why pension systems respond differently to economic shocks. By documenting regulatory contexts, pension funds reports help readers understand the broader institutional environment influencing pension performance.

ESG and Sustainability in Pension Funds Reports

ESG Integration Trends in Global Pension Funds

Environmental, social, and governance (ESG) considerations have become increasingly prominent in pension funds reports. Many funds now integrate ESG factors into investment decision-making to manage long-term risks and align with beneficiary values.

Reports often describe ESG integration as a tool for enhancing risk management rather than sacrificing returns.

Research cited in pension funds reports suggests that ESG-aware strategies can improve resilience to climate and governance risks. Leading pension systems disclose their ESG frameworks, voting policies, and engagement activities to demonstrate accountability.

Climate Risk and Long-Term Responsibility

Climate risk is now a standard topic in pension funds reports, reflecting its potential impact on long-term asset values. Physical risks, transition risks, and regulatory changes all affect pension portfolios.

Experienced analysts emphasize that ignoring climate risk can undermine long-term returns.

Trustworthy pension funds reports address climate risk candidly, outlining both mitigation strategies and remaining uncertainties. This balanced approach supports informed decision-making without overstating ESG benefits.

Key Findings from Major Global Pension Reports

Insights from OECD and World Bank Reports

- Global organizations such as the OECD and the World Bank regularly publish pension funds reports that synthesize data across countries.

- These reports highlight common challenges, including aging populations and funding pressures, while identifying best practices in governance and investment.

- From an authoritative standpoint, these international reports serve as benchmarks for national pension systems.

- They emphasize the importance of transparency, diversification, and long-term planning in achieving sustainable retirement outcomes.

Lessons from Leading Pension Fund Systems

- Case studies in pension funds reports often focus on countries with strong pension performance.

- For example, systems with automatic enrollment, diversified investments, and independent governance structures tend to score well in comparative assessments.

- These lessons provide practical guidance for policymakers and fund managers seeking to improve pension outcomes.

Risks and Challenges Identified in Pension Funds Reports

Demographic Aging and Longevity Risk

- Demographic aging remains one of the most significant risks highlighted in pension funds reports.

- As life expectancy increases, pension systems must pay benefits for longer periods, increasing total liabilities.

- Longevity risk is difficult to hedge and requires careful actuarial planning.

- Reports emphasize that addressing demographic risk often involves trade-offs, such as higher contributions or adjusted benefit formulas.

- Transparent reporting helps stakeholders understand these difficult policy choices.

Market Risk, Inflation, and Interest Rates

- Market volatility, inflation, and interest rate changes also feature prominently in pension funds reports.

- Inflation erodes purchasing power, while low interest rates increase liability valuations. Pension funds must balance growth-oriented investments with inflation protection.

- Experienced pension managers rely on diversification and scenario analysis to manage these risks.

- Pension funds reports document these strategies to enhance credibility and trust.

Future Outlook of Global Pension Funds

Expected Industry Trends

- Looking ahead, pension funds reports anticipate continued growth in funded pension arrangements, increased ESG integration, and greater reliance on alternative assets.

- Digital reporting and enhanced data analytics are also expected to improve transparency and governance.

- Experts caution that future success will depend on adaptability and policy coordination.

- Pension systems that proactively address demographic and economic challenges are more likely to remain sustainable.

Policy and Structural Reforms Ahead

- Many pension funds reports conclude with discussions of potential reforms. These may include adjusting retirement ages, strengthening governance frameworks, and improving contribution adequacy.

- Structural reforms are often politically sensitive, but reports emphasize their importance for long-term stability.

Conclusion

The Pension Funds Report underscores the urgent need for adaptive strategies in pension fund management. Key findings reveal that diversified investments and robust governance are essential to counter risks like market volatility and longevity. Policymakers must prioritize reforms to boost contribution rates and innovation. Ultimately, this Pension Funds Report calls for collaborative action to ensure pension funds deliver secure, sustainable retirement outcomes for future generations.