Pension funds play a critical role in the global financial system, acting as long-term institutional investors while providing retirement security for millions of people. In today’s aging societies, concepts such as retirement savings, long-term investing, defined benefit plans, defined contribution plans, portfolio diversification, risk management, and sustainable returns are no longer topics reserved for financial professionals—they are concerns for everyday workers. Understanding how pension funds work, where they invest, and what risks they face helps individuals make better decisions about their own retirement planning. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Pension Funds?

Definition of Pension Funds

A pension fund is a pooled investment vehicle designed to provide retirement income to employees after they stop working. From a practical perspective, pension funds collect contributions from employers, employees, or both, invest those funds over decades, and then pay benefits during retirement.

In real-world reviews of large public pension systems in the United States and Europe, pension funds are often described as “long-term investors by necessity,” because their liabilities stretch far into the future.

From an expertise standpoint, pension funds are classified as institutional investors, similar to insurance companies or sovereign wealth funds. According to the OECD, pension funds collectively manage tens of trillions of dollars globally, making them some of the largest participants in equity and bond markets.

Their defining feature is not just size, but their obligation to meet future pension liabilities in a predictable and sustainable manner.

Pension Funds vs. Retirement Insurance

Many people confuse pension funds with retirement insurance products, but they serve different purposes. Pension funds focus on investment and asset management, while insurance products emphasize risk transfer.

In practice, a pension fund invests in stocks, bonds, and alternative assets, whereas an annuity or retirement insurance policy guarantees income through actuarial calculations and reserves.

From experience shared in industry reviews, employers often prefer pension funds for collective retirement schemes because they allow for scale, diversification, and professional management.

However, insurance-based products may appeal to individuals seeking certainty rather than long-term market exposure. Understanding this distinction helps workers evaluate the security and flexibility of their retirement income.

How Pension Funds Work

Sources of Pension Fund Contributions

Pension funds are built on regular contributions over time. These contributions typically come from three main sources:

- Employer contributions as part of compensation packages

- Employee contributions deducted from salaries

- Government contributions in public pension systems

In real-world corporate pension plans, contribution rates are often negotiated through labor agreements or regulated by law. For example, many OECD countries mandate minimum contribution levels to ensure adequate retirement income.

This steady inflow of capital allows pension funds to invest with a long-term horizon, reducing the pressure of short-term market volatility.

Investment Mechanism and Asset Allocation

Once contributions are collected, pension funds allocate assets according to predefined investment policies. These policies are designed to balance return objectives with risk tolerance and future liabilities.

From an expert standpoint, asset allocation is the most important driver of long-term performance.

Most pension funds diversify across asset classes, including equities, fixed income, real estate, and alternative investments. According to research by the World Bank, diversified pension portfolios historically achieve more stable returns compared to concentrated investment strategies.

This approach reflects a core principle of trustworthiness: protecting beneficiaries’ future income rather than pursuing speculative gains.

Cash Inflows and Outflows

Pension funds operate with a continuous cycle of inflows and outflows. While younger pension systems experience more inflows than outflows, mature systems—especially in aging societies—must manage significant benefit payments.

Real-world case studies from Japan and Western Europe show that demographic trends directly affect pension fund liquidity needs.

To manage this challenge, pension fund managers carefully match asset maturity profiles with expected benefit payments.

Long-duration bonds and income-generating assets are often used to stabilize cash flows, ensuring pensions can be paid even during economic downturns.

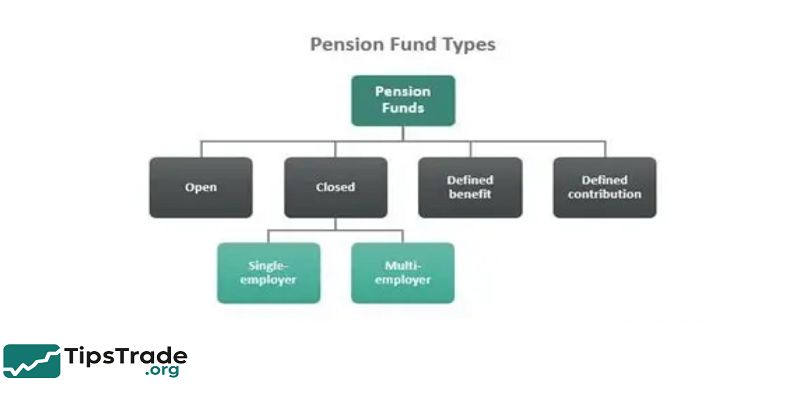

Pension Funds Types of

Defined Benefit Pension Plans

Defined benefit (DB) pension plans promise a specific retirement benefit, usually based on salary and years of service. From an experience perspective, DB plans were once common in large corporations and public sector employment.

They provide strong retirement security for employees but place significant financial responsibility on employers.

Expert analysis highlights that DB plans are sensitive to interest rate changes and longevity risk.

When interest rates fall or people live longer than expected, funding gaps can emerge. This has led many private employers to shift away from DB plans toward defined contribution models.

Defined Contribution Pension Plans

Defined contribution (DC) plans, such as 401(k) plans in the United States, define the contribution amount rather than the final benefit. In practice, employees bear more investment risk, but also gain more flexibility and portability.

Research from institutions like Vanguard shows that DC plans encourage individual engagement with retirement planning, though outcomes depend heavily on contribution rates and investment choices. From a trustworthiness perspective, education and transparency are critical to prevent individuals from making poor long-term decisions.

Public vs. Private Pension Funds

Public pension funds are typically sponsored by governments and serve civil servants, while private pension funds are established by corporations or financial institutions.

Real-world comparisons show that public pension funds often manage larger asset pools and have broader social objectives, including economic stability.

Private pension funds, on the other hand, may adopt more flexible investment strategies. Both types face governance challenges, making strong oversight and clear accountability essential for maintaining public trust.

Where Do Pension Funds Invest?

Traditional Asset Classes

Equities and bonds remain the backbone of most pension fund portfolios. Stocks offer long-term growth potential, while bonds provide income and stability.

Historical data from academic studies indicates that equities outperform bonds over long horizons, which aligns with pension funds’ long-term obligations.

However, excessive equity exposure can increase volatility, especially during market crises. As a result, pension funds often rebalance portfolios to maintain risk control and protect beneficiaries.

Alternative Investments

In recent decades, pension funds have increasingly invested in alternative assets such as private equity, hedge funds, infrastructure, and real estate.

Experience from large pension funds like CalPERS shows that alternatives can enhance diversification and improve risk-adjusted returns.

From an expert viewpoint, alternative investments require sophisticated due diligence and governance.

While they offer potential benefits, they also introduce complexity, illiquidity, and higher fees, which must be carefully managed to maintain trustworthiness.

Risk Management Strategies

Risk management is central to pension fund investing. Techniques such as asset-liability matching, diversification, and stress testing are widely used. According to research published by the IMF, effective risk management improves pension fund resilience during economic shocks.

In practice, pension fund managers focus not only on maximizing returns but also on minimizing the probability of underfunding. This conservative approach reflects the fiduciary duty owed to beneficiaries.

The Role of Pension Funds in the Economy

Pension Funds and Capital Markets

Pension funds are major providers of long-term capital to financial markets. Their investments support corporate growth, government financing, and infrastructure development.

In reviews of global capital flows, pension funds are often described as stabilizing forces due to their long-term perspective.

By investing steadily through market cycles, pension funds can reduce volatility and support economic resilience. This role underscores their importance beyond individual retirement outcomes.

Impact on Interest Rates and Government Bonds

Because pension funds hold large amounts of government bonds, they influence interest rates and public finance.

Empirical studies from central banks show that pension fund demand can lower borrowing costs for governments, particularly in developed economies.

However, low interest rates also pose challenges by reducing bond yields. Pension funds must adapt by adjusting asset allocation and contribution policies to maintain funding adequacy.

Support for Long-Term Economic Growth

Through investments in infrastructure, renewable energy, and private enterprises, pension funds contribute to sustainable economic growth.

Real-world examples from Canada and Australia demonstrate how pension funds invest directly in infrastructure projects, generating stable returns while supporting public development.

This dual role enhances their authoritativeness as institutions aligned with long-term societal goals.

Advantages and Risks of Pension Funds

Benefits for Workers

Pension funds offer several advantages for workers, including professional management, diversification, and economies of scale. Experience from employee surveys indicates that workers value the security and convenience of collective retirement plans.

Additionally, pension funds often provide tax advantages, increasing net retirement savings over time.

Key Risks to Consider

Despite their benefits, pension funds face risks such as market volatility, inflation, and governance failures. High-profile pension crises have shown that poor management or unrealistic assumptions can jeopardize retirement security.

Expert analysis emphasizes the importance of transparency, prudent assumptions, and regular stress testing to mitigate these risks.

Lessons from Past Pension Crises

Historical pension crises, such as underfunded public pension systems, offer valuable lessons. Independent reviews highlight the dangers of political interference, inadequate contributions, and excessive return assumptions.

Learning from these cases strengthens trust and supports better pension fund governance.

Pension Funds Around the World

Pension Funds in the United States

The U.S. pension system combines public and private pension funds with individual retirement accounts. Large public pension funds like CalPERS and CalSTRS are influential global investors.

Research from U.S. regulatory agencies highlights ongoing challenges related to funding levels and demographic changes, emphasizing the need for reform and innovation.

European Pension Models

European pension systems vary widely, from pay-as-you-go public schemes to funded occupational pensions. Countries like the Netherlands are often cited for their strong governance and high funding ratios.

Academic studies attribute this success to clear regulations, professional management, and strong social consensus.

Pension Funds in Asia and Emerging Markets

Asian pension systems are evolving rapidly, driven by demographic change and economic growth. Countries such as Japan and South Korea face aging populations, while emerging markets focus on expanding coverage.

World Bank research emphasizes the importance of building strong institutions and regulatory frameworks to support sustainable pension development.

Pension Funds vs. Other Investment Funds

Pension Funds vs. Mutual Funds

Mutual funds cater to individual investors, offering liquidity and flexibility, while pension funds prioritize long-term stability. Experience shows that pension funds often accept lower short-term returns in exchange for reduced volatility.

This difference reflects their distinct objectives and fiduciary responsibilities.

Pension Funds vs. Hedge Funds

Hedge funds pursue absolute returns using complex strategies, whereas pension funds focus on meeting long-term liabilities. While pension funds may invest in hedge funds, they do so cautiously and as part of a diversified portfolio.

Expert consensus suggests that hedge funds should complement, not dominate, pension portfolios.

Pension Funds vs. Sovereign Wealth Funds

Sovereign wealth funds manage national savings, often derived from natural resources, while pension funds manage retirement savings. Both are long-term investors, but their mandates and risk tolerances differ significantly.

Understanding these differences helps clarify the unique role of pension funds in global finance.

Who Should Care About Pension Funds?

Employees and Retirement Planning

For employees, understanding pension funds is essential for informed retirement planning. Real-world examples show that workers who engage with their pension plans achieve better outcomes.

Education and transparency empower individuals to make smarter decisions.

Long-Term Investors

Investors can learn from pension funds’ disciplined, long-term approach. Their focus on diversification and risk management offers valuable lessons for individual portfolios.

Policymakers and Employers

Policymakers and employers must ensure that pension systems remain sustainable and fair. Research-driven policy design and responsible governance are key to maintaining public trust.

Conclusion

Pension funds are foundational to retirement security and global financial stability. By pooling resources, investing long term, and managing risk prudently, they support millions of retirees while contributing to economic growth. Understanding how pension funds work—along with their benefits and risks—empowers individuals, investors, and policymakers to make informed decisions. In an era of demographic change and financial uncertainty, well-managed pension funds remain one of the most important tools for achieving sustainable retirement outcomes.