If you’re learning about what Nonfarm Payrolls are and why it has such a significant impact, as well as the NFP forex strategy that works,…The answer will be revealed right below, so stay tuned!

What is the Non-Farm Payroll (NFP)?

Non-Farm Payroll (NFP) explained

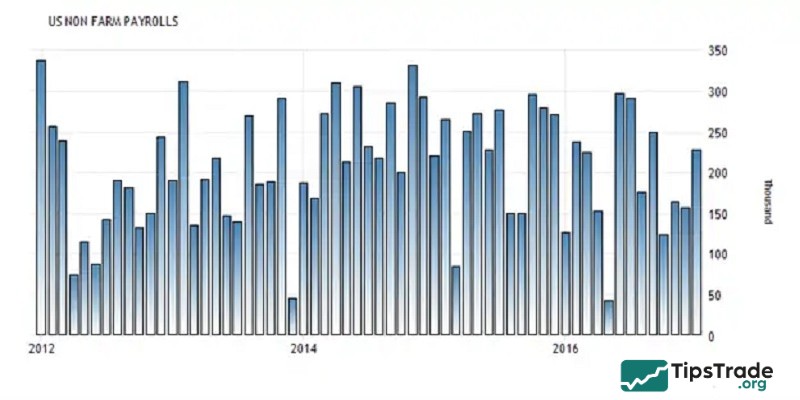

Nonfarm, commonly known by traders as Non-Farm Payrolls (NFP), is described as a report whose essential function is to provide important information related to the labor force and employment – factors that have a major impact on the U.S. economy in particular and the global economy in general.

By examining the Nonfarm report, traders can also easily observe and estimate the unemployment rate alongside the number of people with stable employment. In this sense, Nonfarm serves as a valuable benchmark for measuring the overall state of the U.S. economy, offering more objective insights into the nation’s economic strength through concrete employment data.

In general, if a country has a strong and stable economy, the number of employed people will significantly outweigh the number of unemployed. Conversely, if a country has an excessively high unemployment rate, it may be a sign that the nation is heading toward an economic crisis.

See more:

- Guide to using TradingView chart for beginners

- How to read and use the economic calendar for forex in trading

- The 5 Best Forex Volatility Indicators Every Technical Trader Should Know

- Draw Trendline MT5: A Detailed A–Z Guide to Help Traders Capture Price Trends

When are Non-Farm Payrolls released?

Non-Farm Payrolls data is released on the first Friday of every month by the U.S. Bureau of Labor Statistics. The report typically comes out at 8:30 AM Eastern Time (ET) and includes key employment data, such as the number of jobs added or lost in the previous month, the unemployment rate, and changes in average hourly earnings.

Where to see the Nonfarm news?

Nowadays, tracking and updating Nonfarm news is very simple, and this is something that every trader in the forex market is well aware of. Most websites that provide economic calendar information also include Nonfarm data. Some of the most popular platforms commonly used by traders to follow the Nonfarm Payroll report include Investing.com, Fxstreet, ForexFactory, and others.

By accessing these websites and selecting the Economic Calendar section, you can quickly and easily obtain important information closely related to economic conditions. From there, you can better understand the U.S. economy through data on currency pairs,

How does Non-Farm Payrolls impact the Forex markets?

Nonfarm is not merely a single employment figure but a comprehensive gauge of the health of the U.S. economy. In addition to job numbers, the NFP report provides detailed information on the unemployment rate and wages, helping to forecast future trends in GDP growth and production.

Moreover, the U.S. dollar is considered the world’s “reserve currency” and is the most actively traded currency in the forex market, especially in pairs such as EUR/USD, GBP/USD, and USD/CHF. Therefore, any information from the NFP report can directly affect the value of the USD, thereby influencing other currency pairs.

When NFP figures are released above market expectations, the U.S. dollar typically strengthens due to increased demand. Conversely, an NFP reading below forecasts reduces the attractiveness of the USD and puts downward pressure on exchange rates.

NFP acts as a “compass” guiding the Federal Reserve’s monetary policy. When this compass points upward, the Fed may raise interest rates to curb inflation; when it points downward, the Fed may ease policy to stimulate economic growth. These Fed decisions have a direct impact on the value of the U.S. dollar and the entire financial market.

How to read Nonfarm Payrolls report

The Nonfarm Payroll report consists of three key columns:

- Previous: The figure from the previous reporting period.

- Forecast: The projected figure, representing estimates made by experts.

- Actual: The official figure released by the U.S. Department of Labor.

In addition, it is important to understand the following components of the Nonfarm Payroll report:

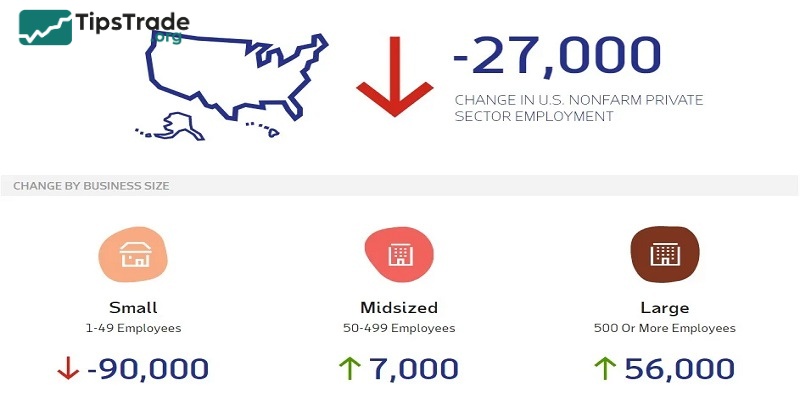

- Payroll numbers: The change in the number of jobs compared to the previous month.

- Unemployment rate: The percentage of people actively seeking work but not employed.

- Average hourly earnings: A key measure of wage growth and inflationary pressure.

NFP Forex strategy that works

There are several strategies traders can use to trade Non-Farm Payrolls data, but two of the most popular methods are:

Pre-NFP Trading Strategy

Traders analyze expectations for the Non-Farm Payrolls report by studying economic forecasts, market sentiment, and previous trends. Their goal is to position trades before the report is released, making buy or sell decisions based on predictions of the number of jobs created.

Strategy:

- Buy USD: If you expect the NFP data to be more positive than forecast (indicating a strong economy and the possibility of a Fed interest rate hike), you can place a buy (long) order for USD against other currencies.

- Sell USD: If you anticipate lower-than-expected NFP figures, reflecting economic weakness and the possibility of interest rate cuts, you can short USD.

However, the market sometimes reacts unpredictably to economic news. If the actual NFP figures differ significantly from expectations, the market can experience sharp and sudden fluctuations, making this strategy potentially risky.

Post-NFP Trading Strategy

Using an appropriate strategy to trade immediately after the Nonfarm news is released is not particularly difficult; however, it requires traders to have a certain level of experience as well as solid knowledge of the market.

Below, Tipstrade.org will introduce an effective strategy that involves placing two opposing orders at the same time. This strategy is especially suitable for sideways (range-bound) market conditions.

Steps to implement the strategy:

- About 30 minutes before the Nonfarm news is released, traders should open the chart using the 5-minute timeframe.

- Next, identify a market that is moving sideways and determine its support (low) and resistance (high) levels.

- Then place two pending orders: a Buy Stop and a Sell Stop.

- The Buy Stop order should be placed at least 5–10 pips above the highest price level.

- The Sell Stop order should be placed 5–10 pips below the lowest price level within the sideways market.

- After that, set stop-loss orders for both the Buy Stop and Sell Stop positions.

- Finally, wait for the Nonfarm news to be released. Immediately after the announcement, one of the two orders will be triggered. At this point, you should promptly cancel the order that was not activated.

- Once the trade is running smoothly, simply set a take-profit level to secure your gains and complete the trade.

Conclusion

Thus, through this article, Tipstrade.org has shared with you knowledge about the NFP forex strategy that works. Hopefully, what we have just presented will be helpful to you in your Forex trading and investment process. Wishing you success in your trading career!