News trading forex is a trading method in the foreign exchange market based on exploiting important news and economic events. This strategy is popular in the trading community, as news can cause significant short-term volatility, creating opportunities for quick profits. Today’s article will help you better understand the concept of news trading forex: What is it? What are effective forex news trading strategies? Let’s get started!

What is news trading forex?

News trading forex is a strategy where traders focus on taking advantage of market volatility caused by economic news announcements. When an important economic announcement is released, such as a jobs report, interest rates, or GDP, it can create strong volatility in the Forex market. News traders try to predict the impact of the news on prices and make trades to profit from these fluctuations.

For example, if the US jobs report shows higher-than-expected job growth, the USD may appreciate against other currencies. A news trader could buy USD/JPY before the report is released and sell it afterward to profit from the USD’s appreciation.

>>Read more:

- What is Forex? The Complete Guide for Beginners

- Essential Forex Orders every trader must know

- What is forex trading? A detailed guide to forex trading from A – Z

- Forex strategy: Top 10 most effective strategies for beginners

Why do traders choose to trade news trading forex?

The financial market is like a vast ocean, where news waves are constantly rolling. Every economic, political or social information can become a powerful “wind”, pushing these waves up or sinking them into the abyss.

Investors choose news trading forex because they want to “surf” on these waves. By capturing information about GDP, inflation, government policies or even unexpected events such as natural disasters and crises, they can predict the direction of the market and seek to profit from price fluctuations.

However, “riding the wave” is not easy. It requires investors to have solid knowledge, extensive experience and careful preparation. Otherwise, they are very easy to be “thrown off” the board and face the risk of heavy losses. News trading forex is like a double-edged sword, sharp but also full of danger. Only those who are truly knowledgeable and alert can conquer it.

News trading forex strategies

Here are 3 news trading forex strategies you can apply:

Pre-news release trend following strategy

Trading news before it happens or before the release of economic data is often considered less interesting than trading after the news is released. This is because the market may be less active at that time. However, that does not mean that great opportunities do not arise during this time.

The pre-news release trend trading strategy focuses on short-term trends and requires traders to use a daily time frame chart with a 10-day simple moving average (SMA).

Traders turn to this strategy when the data release is expected to be in line with expectations. Data that comes out in line with expectations often reduces the impact of the news release. It also reduces the likelihood of the news breaking an existing trend.

With this strategy, traders have the opportunity to enter when the trend starts to accelerate. This helps them catch as much of each market growth as possible.

The risk of using this strategy arises when news comes out contrary to expectations. As it has the potential to send the market in the opposite direction with increased volatility.

The strategy can be implemented in the following steps:

- Short-term trend setting:Use the 10-day moving average to assess whether the market is in a short-term uptrend (price is moving above the 10-day MA) or in a short-term downtrend (price is moving below the 10-day MA)

- Join the transaction:Enter trade 5 minutes before news release in trend direction

- Risk management:Place stop-loss and limit orders while adhering to a positive risk:reward ratio

- Transaction management:If the volatility created after the news pushes the market towards the profit target, traders can consider taking half of the position. If there is still more momentum in the market, move the stop up to the target level.

Note: When the market is volatile before the release, the above strategy is no longer viable. This highlights the importance of analyzing the market before applying the strategy. In this case, it may be better for traders to monitor the market after the release; when the market has emerged and choose a direction or range to trade.

Forex trading when news releases

There are two popular strategies for trading forex news:

- Initial Spike Fade Strategy

- News Straddle Strategy

Each strategy provides a solid plan for traders to follow, depending on the market conditions at the time of the news release and the best method for them to approach that particular market.

Initial Spike Fade Strategy

This strategy is aimed at taking advantage of short-term market overreactions. The advantage is that it ignores the initial move. This strategy is suitable for swing traders, scalpers, and day traders. The reason is because of the fast, erratic price movements that occur after news releases.

Overtrading and subsequent reversals are common in the forex market. Large institutions add to the volatility of the initial move. The market as a whole often spikes as an overreaction; then pushes prices back to pre-news release levels.

Once the market stabilizes and spreads return to normal, the reversal could signal a potential new trend.

The downside to the strategy is that the initial spike can be the start of a longer trend. This highlights the importance of using stops. They are clearly defined to limit the risk of loss; allowing you to exit the trade quickly.

How to deploy the Initial Spike Fade strategy:

- Choose the right currency pair:Make sure the important news event corresponds to the desired currency pair to trade. This means that Non-Farm Payrolls will affect USD trading.

- Switch to the five-minute chart:After selecting the desired market, switch to the 5-minute chart right before the news release.

- Look at the close of the first five-minute candle:The first five minute candle is usually quite large. When the price approaches the high or low, trade in the opposite direction.

- Stops and limits:Stops can be placed 15 pips above the high for sell trades or 15 pips below the low for entry orders. Take profit targets can be placed two or three times the distance of the stop.

News Straddle Strategy

The News Straddle strategy is suitable for traders who expect a large move but are uncertain about the direction. This strategy takes its name from the typical straddle strategy in the options trading market. Because it uses the same core strategy of taking advantage of increased volatility when the direction is uncertain.

The disadvantage of the News Straddle method is that when the price breaks support or resistance and then reverses immediately after. Likewise, the price may trigger an entry and move towards your target only to reverse until it hits the stop.

Implementing the News Straddle strategy:

- Set up a range with support and resistance levels.

- Place two pending orders:A buy order is triggered if the price breaks above the resistance level; a sell order if the price trades below the support.

- Remove remaining orders after price direction confirmation:The market is likely to break out of the set range. When this happens, an entry order will be triggered and the trade will be opened. At this point, immediately delete the order that was not triggered.

- Stop and Take Profit:Stop losses can be placed at a nearby low for buy orders and a nearby high for sell orders. Limits can be set to suit a positive risk-reward ratio.

Trading strategies after news release

After the pre- and post-news trading strategies, Tipstrade.org will continue to introduce to you the post-news trading strategies.

The Dual Spike Breakout strategy involves waiting for market volatility to occur, identifying the range before trading the breakout, and using a five-minute chart. To illustrate this, we will use the Nonfarm Payout news as an example, as it has the greatest potential to move the market.

After the NFP release, wait 15 minutes for three 5-minute candles to close. Note the high and low of the three candle closes. Next, place a buy order at the highest price and a sell order at the lowest price. When the order is triggered, targets can be placed at twice the distance of the high/low; while stops can be placed above resistance for sell trades and below support for buy trades.

The downside to the strategy is that volatility can push the price above/below the short-term range. This triggers an entry and then immediately reverses until the stop loss is hit.

This strategy can be applied in the following way:

- Customize chart settings to show 5 minute chart

- Note the highs and lows of the first three candles

- Place entry when price breaks above or below the range

- Set stops and profit targets

- Delete pending orders

Important news to pay attention to when news trading forex

When learning how to trade the news, traders must know the major news events that affect the forex market. This can be closely monitored by using the economic calendar.

US economic data has a wide impact on global currency markets. And it has such a strong impact that it is often considered the most important news.

It is important to note that not all news releases lead to price movements. Instead, a limited number of news releases often lead to strong market movements.

The table below summarizes major US economic news releases along with some of the most important non-US data releases from around the world.

Major news (US and world):

|

DATA RELEASE ECONOMY |

TIME (EST) |

DESCRIBE |

|

NFP – Non-Farm Payrolls Data |

8:30 AM – First Friday of the month |

Represents net changes in employment status |

|

US GDP – US Gross Domestic Product |

8:30 am – quarterly |

A measure of the monetary value of all goods and services produced in the United States during a specific period of time |

|

US Federal Interest Rate FED |

1pm – 8 times a year |

The interest rate at which depository institutions lend and borrow to other institutions |

|

Australian cash exchange rate |

8:30 am – First Friday of the month (except January) |

Interest rate charged on overnight loans between financial intermediaries |

|

Australian employment data |

7:30 PM – monthly (published approximately 15 days after the end of a month) |

Change in the number of employed people last month |

|

European Central Bank – refinancing rate |

7:45 am – 8 times a year |

Interest rates on major refinancing operations to provide liquidity to the financial system |

|

Bank of England – official bank rate |

7am – monthly |

The Bank of England’s overnight lending rate to financial institutions |

|

Bank of Canada – Overnight Rate |

10am – 8 times a year |

The overnight interest rate at which large financial institutions borrow and lend among themselves |

|

Canada employment data |

8:30 AM – monthly (approximately 8 days after the month ends) |

Measures the change in the number of employed people over the previous month |

|

Reserve Bank of New Zealand official cash rate |

9pm – 7 times a year |

Interest rates on bank loans and other bank loans, overnight interest rates |

News trading forex support tool

Here are the top3 powerful tools that are indispensable when traders trade on forex news:

- Economic calendar: Helps track when news comes out and how much it affects

- Real-time financial news: Bloomberg, ForexLive, TradingView

- Fast trading software:MT4, MT5, or a platform that supports fast order execution, without excessive spread expansion

Risks that can be encountered when news trading forex

No matter what trading strategy you use, there are always risks that you should be aware of. Here are some of them:

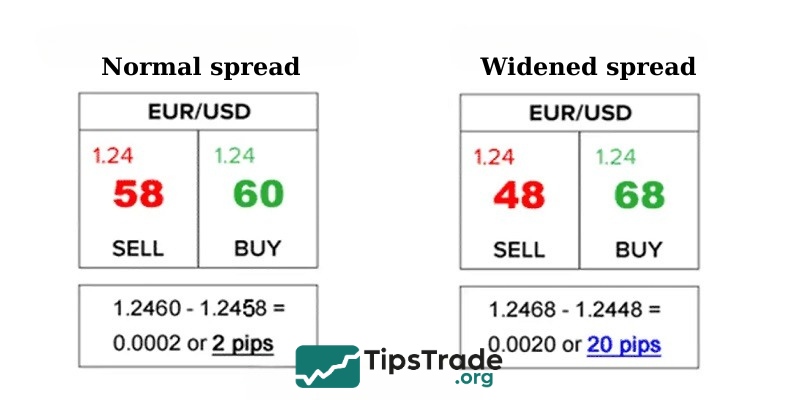

Spread expansion

Because the Forex market is very volatile during important news periods; many forex brokers widen their forex spreads during this time.

This increases your trading costs and can hurt your profits. You may also be “locked out” meaning your trade may be executed at the right time but may not appear on your trading platform for a few minutes.

This is not beneficial because you will not be able to make any adjustments if the market moves against your expectations.

Imagine you thought your order wasn’t triggered; so you tried to enter at market price and then realized that your previous order was actually triggered. Now you’re risking twice as much.

Slippage

You may also experience slippage.

Slippage in forex occurs when you want to enter an order at a specific price; but due to the extreme volatility during the time of those events, the price you actually receive is completely different.

News events that cause major market movements are often not one-way. Oftentimes, the market may start moving in one direction but then move in the other direction.

Finding the correct direction can sometimes be a headache!

Trading Forex news profitably is not an easy thing. It takes a lot of practice, practice and practice.

The most important thing is, you should always have a trading plan in place so that you are ready for any eventuality.

Conclusion

Through this article, we hope to help readers understand what is news trading forex; the methods of news trading forex; the risks involved in news trading forex; and which are the best news trading forex strategies to choose for trading. In reality, news trading forex is not suitable for every trader as it carries significant risks. Especially for new traders, the advice is to keep updated with the daily economic calendar to avoid trading at the time of news releases; this will help protect your capital. Wishing you good luck and success!

>>Read more: