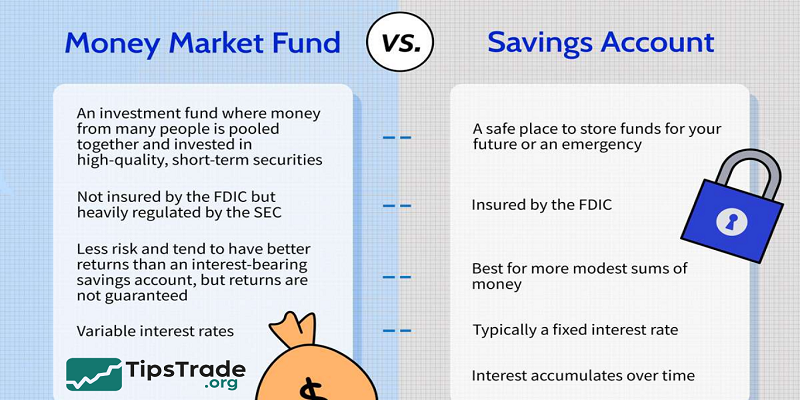

Money market funds vs savings accounts, cash management strategies, low-risk investments, capital preservation, interest rate environment, liquidity needs, FDIC insurance, yield comparison, and conservative portfolios are among the most common collocations investors search when comparing money market funds vs savings accounts. Both options are widely used to store cash safely, yet they operate under very different financial structures. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

Money Market Funds vs Savings Accounts: Which Is Better for Your Cash?

Choosing where to keep cash is no longer a trivial decision. In an environment of fluctuating interest rates and increased financial awareness, investors are asking deeper questions about safety, yield, and accessibility.

Money market funds and savings accounts both aim to protect capital while providing liquidity, but they do so through very different mechanisms.

This article compares the two options across risk, returns, liquidity, cost, and real-world use cases, helping readers understand not just which option pays more, but which one aligns best with their personal financial priorities.

See more

- How Money Market Funds Work: A Complete, Practical Guide for Cash-Focused Investors

- Money Market Fund Assets: A Detailed Guide to What These Funds Really Invest In

- Best Money Market Funds: How to Choose the Right Option for Your Cash

- Money Market Funds NAV Explained: How Net Asset Value Really Work

Why Investors Compare Money Market Funds and Savings Accounts

Money market funds and savings accounts are often grouped together because both are used for cash storage rather than long-term growth. Investors typically turn to these options when they want stability, easy access to funds, and modest returns without exposure to stock market volatility.

The confusion arises because both products are marketed as “safe” and “liquid.” However, safety can mean different things depending on whether it refers to government insurance, market risk, or volatility.

Yield comparisons further complicate the decision, especially during periods when money market fund yields exceed bank savings rates.

Understanding the differences matters because cash plays a strategic role in financial planning. Cash is not just idle money; it supports emergencies, short-term goals, and investment flexibility.

Choosing the wrong vehicle can mean lower returns, reduced access, or misunderstood risk exposure.

Quick Overview of Each Option

What Is a Money Market Fund?

A money market fund (MMF) is a type of mutual fund that invests in short-term, high-quality debt instruments such as U.S. Treasury bills, government agency securities, certificates of deposit, and commercial paper. The primary objectives are capital preservation, liquidity, and modest income.

Money market funds are regulated investment products, overseen by authorities such as the U.S. Securities and Exchange Commission (SEC). Regulations limit maturity, credit quality, and diversification to reduce risk. Most funds aim to maintain a stable net asset value (NAV), typically $1 per share.

In practice, money market funds are commonly used within brokerage accounts as cash sweep vehicles, allowing uninvested cash to earn interest. They are popular with individual investors, institutions, and businesses managing large cash balances.

What Is a Savings Account?

A savings account is a bank deposit product designed to hold money securely while earning interest. Banks use deposited funds to make loans and investments, paying depositors a portion of that income as interest.

The defining feature of savings accounts is deposit insurance, such as FDIC insurance in the United States, which protects deposits up to a specified limit per account holder. This insurance provides strong principal protection, even if the bank fails.

Savings accounts are widely accessible, easy to understand, and deeply integrated into everyday banking. They are commonly used for emergency funds, short-term savings goals, and general financial stability.

Key Differences Between Money Market Funds and Savings Accounts

Safety and Risk Level

Safety is often the first concern when choosing between money market funds and savings accounts. Savings accounts benefit from government-backed deposit insurance, which virtually eliminates the risk of loss within coverage limits. This makes them one of the safest financial products available.

Money market funds, by contrast, are not insured. Their safety relies on diversification, credit quality, and regulatory oversight rather than explicit guarantees. While losses are rare, they are theoretically possible under extreme market conditions.

From a risk perspective, savings accounts offer absolute principal protection, while money market funds offer relative safety compared to other investments. The difference is subtle but important for highly risk-averse individuals.

Returns and Yield Potential

Yield is one of the main reasons investors consider money market funds. Because MMFs invest in market-based short-term instruments, their yields often track prevailing interest rates more closely than savings accounts.

In rising rate environments, money market funds frequently outperform traditional savings accounts. Banks may delay raising savings rates, while MMF yields adjust as portfolios roll into higher-yielding securities.

However, yields on money market funds are variable and can change daily. Savings accounts typically offer more stable but often lower interest rates. For investors seeking yield efficiency, money market funds often have an edge, though without guarantees.

Liquidity and Access to Cash

Both options provide high liquidity, but access mechanisms differ. Savings accounts allow immediate withdrawals through ATMs, transfers, or branch visits. This makes them highly practical for everyday cash needs.

Money market funds offer liquidity through share redemptions, usually settling within one business day. In brokerage accounts, funds can often be used directly for trades or transfers.

While both are liquid, savings accounts are slightly more convenient for frequent transactions, whereas money market funds are better suited for strategic cash management rather than daily spending.

Fees and Costs

Savings accounts typically do not charge explicit management fees, although some impose minimum balance requirements or transaction limits. The cost to the depositor is often implicit in the form of lower interest rates.

Money market funds charge expense ratios, which reduce gross yields. However, these fees are usually low and transparent. In many cases, net yields remain competitive despite expenses.

Understanding costs requires looking beyond headline rates to evaluate net returns after fees and restrictions.

Money Market Funds vs Savings Accounts – Side-by-Side Comparison

| Feature | Money Market Funds | Savings Accounts |

| Safety | Low risk, not insured | FDIC-insured (limits apply) |

| Yield | Market-based, often higher | Usually lower, more stable |

| Liquidity | Daily redemption | Immediate access |

| Insurance | None | Government-backed |

| Best Use | Cash management, investing | Emergency funds, daily savings |

Which One Is Better for Different Financial Goals?

Emergency Fund

- Emergency funds prioritize access and certainty. Savings accounts are often preferred because insured principal reduces anxiety during crises.

- Money market funds may supplement emergency funds but are rarely used as the sole vehicle by highly conservative savers.

Short-Term Savings

- For goals within one year, both options can work. Money market funds may offer higher returns, while savings accounts provide predictability.

- The choice depends on comfort with uninsured risk versus desire for yield.

Parking Cash Between Investments

- Money market funds excel as temporary parking places for cash.

- Investors waiting to reallocate funds into stocks, bonds, or real estate often use MMFs to earn interest without locking up capital.

Conservative Investors

- Highly conservative investors often prefer savings accounts for peace of mind.

- Moderately conservative investors may split funds between savings accounts and money market funds to balance safety and yield.

Pros and Cons Summary

Pros and Cons of Money Market Funds

Pros

- Competitive yields

- High liquidity

- Professional management

- Ideal for brokerage accounts

Cons

- Not insured

- Yields fluctuate

- Rare but real risk events

Pros and Cons of Savings Accounts

Pros

- Government-insured

- Simple and familiar

- Immediate access

Cons

- Lower yields

- Rate changes lag markets

- Opportunity cost during high-rate periods

Common Misconceptions

Many investors believe money market funds and savings accounts are interchangeable. In reality, they serve similar purposes through different risk frameworks.

Another misconception is that higher yield automatically means higher risk. In money market funds, yield differences often reflect market mechanics rather than aggressive risk-taking.

Finally, some assume savings accounts always outperform during crises. While insured safety remains intact, purchasing power can erode if interest rates fail to keep pace with inflation.

Conclusion

The choice between money market funds vs savings accounts depends on how you define safety, return, and flexibility. Savings accounts offer unmatched insured security and simplicity, making them ideal for emergency funds and peace of mind. Money market funds, while not insured, provide higher yield potential, professional management, and seamless integration with investment accounts. Rather than viewing the decision as an either-or choice, many investors benefit from using both strategically. By understanding the strengths and limitations of each option, you can design a cash strategy that supports stability, liquidity, and long-term financial efficiency.

See more

- Money Market Funds vs Savings Accounts: Which Is Better for Your Cash in 2026?

- Risks of Money Market Funds: A Complete Guide for Conservative Investors

- Government Money Market Funds Explained: Safety, Liquidity, and Cash Management

- Treasury Money Market Funds Explained: A Safe Option for Cash Management