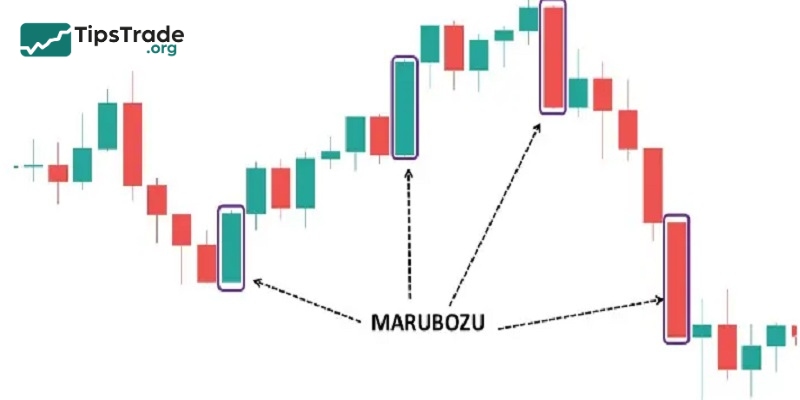

The Marubozu candlestick is one of the special candle patterns favored by traders due to their ability to reflect market sentiment clearly. In this article, we will explore the meaning and role of the Marubozu candlestick, how to identify it, and trading strategies with this candle pattern.

What is a Marubozu candlestick?

The Marubozu candlestick is a special type of Japanese candlestick that consists almost entirely of a real body, with no shadows or only very short ones. The term “Marubozu” in Japanese means “round head,” symbolizing the continuity and uniformity of the candle’s body. This characteristic also reflects the nature of the Marubozu pattern, where the closing price is at or very near the highest or lowest level of the trading session.

Marubozu candlesticks can appear in both bullish and bearish forms. However, this pattern is often regarded as a strong signal of a potential trend reversal. When a Marubozu forms during periods of high market volatility or at a turning point in the trend, it can serve as an important signal for stock market traders.

See more:

- Spinning Top Candlestick and How to Apply It in Technical Analysis

- How to Use the Hammer Candlestick for the Most Effective Trading

- Shooting Star Candlestick Pattern: How to Identify and Trade It Effectively

- What is a Doji candlestick pattern? Common Doji candlestick patterns in investing

Identifying characteristics of the Marubozu candlestick

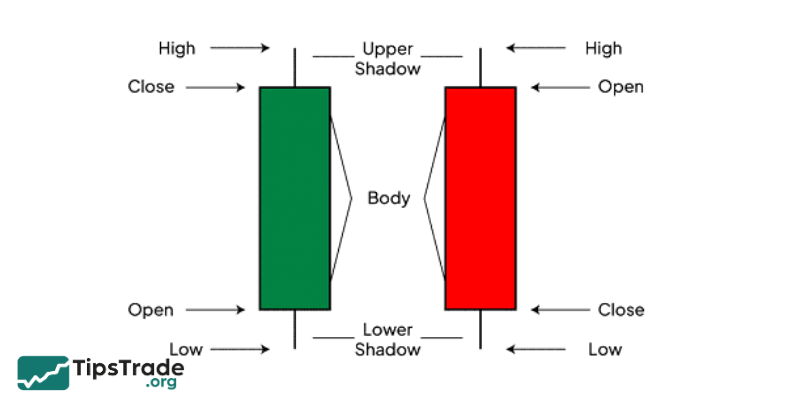

To identify a Marubozu candlestick pattern, the following characteristics should be considered:

- It has a long, solid real body with no shadows or only very short shadows.

- The color of the candle body can be green (bullish) or red (bearish).

- Marubozu candlesticks often appear during periods of strong market volatility or at trend reversal points.

- A green Marubozu indicates strong bullish momentum, while a red Marubozu typically appears during sharp declines, reflecting the dominance and control of buyers or sellers in the market.

Marubozu candlestick and its variations

The Marubozu candlestick has several different variations, each carrying a distinct meaning. Let us explore the most common types of Marubozu candlesticks.

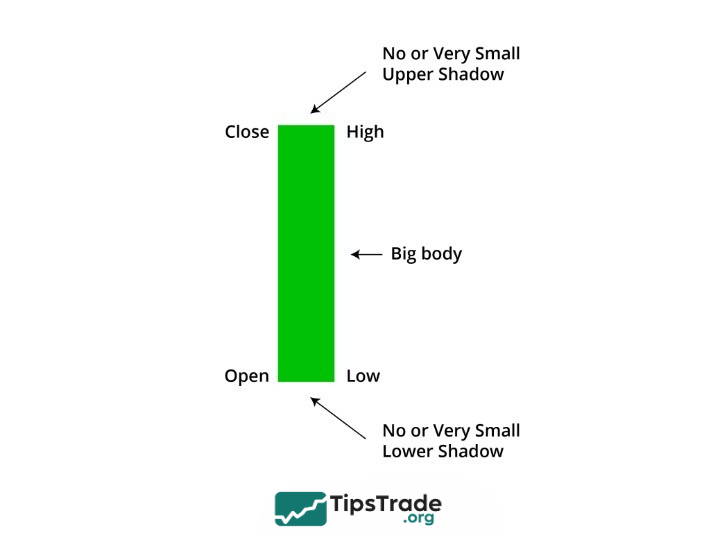

Bullish Marubozu

Bullish Marubozu indicates that buyers are in control of the market. This candle can appear at any point within a trend and may signal either the continuation of an uptrend or a reversal from a downtrend to an uptrend.

Bullish Marubozu with no shadows

This is the most ideal form of a bullish Marubozu, showing complete dominance by buyers throughout the trading session. The opening price equals the lowest price, and the closing price equals the highest price, indicating that buyers consistently pushed prices higher during the entire session.

Meaning:

- Confirms a strong uptrend

- May signal a reversal from a downtrend to an uptrend

Trading strategy:

- Enter a buy position when a Bullish Marubozu appears

- Place a stop-loss order below the candle’s low

- Take profit when the uptrend shows signs of ending

Bullish Marubozu with a lower shadow

This variation shows that buyers remain in control, although sellers have made some response. The opening price is lower than the closing price, indicating that buyers pushed prices higher, despite a slight pullback during the session.

Meaning:

- Confirms an uptrend

- May signal the continuation of the uptrend

Trading strategy:

- Buy when a Bullish Marubozu with a lower shadow appears

- Place a stop-loss order below the candle’s low

- Take profit when the uptrend ends

Bullish Marubozu with an upper shadow

This type indicates that buyers are facing strong resistance from sellers. Although buyers initially pushed prices higher, selling pressure later forced prices down, resulting in an upper shadow.

Meaning:

- The uptrend may be losing strength

- May signal a reversal from an uptrend to a downtrend

Trading strategy:

- Exercise caution when a Bullish Marubozu with an upper shadow appears

- Consider additional factors to confirm the trend

- Place a stop-loss order close to the closing price

- Take profit when the uptrend ends

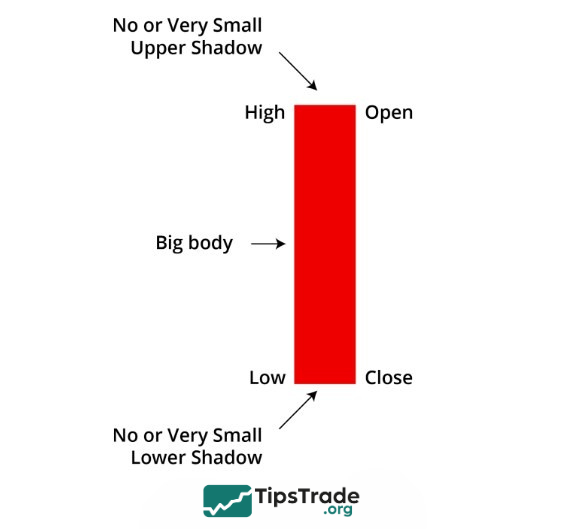

Bearish Marubozu

A Bearish Marubozu indicates that sellers are in control of the market. This candle can appear at any point within a trend and may signal either the continuation of a downtrend or a reversal from an uptrend to a downtrend.

Bearish Marubozu with no shadows

This is the most ideal form of a bearish Marubozu, showing complete dominance by sellers throughout the trading session. The opening price equals the highest price, and the closing price equals the lowest price, indicating that sellers continuously pushed prices lower during the entire session.

Meaning:

- Confirms a strong downtrend

- May signal a reversal from an uptrend to a downtrend

Trading strategy:

- Enter a sell position when a Bearish Marubozu appears

- Place a stop-loss order above the candle’s high

- Take profit when the downtrend ends

Bearish Marubozu with an upper shadow

This variation indicates that sellers remain in control, although buyers have shown some reaction. The opening price is higher than the closing price, suggesting that sellers pushed prices lower, followed by a slight pullback.

Meaning:

- Confirms a downtrend

- May signal the continuation of the downtrend

Trading strategy:

- Sell when a Bearish Marubozu with an upper shadow appears

- Place a stop-loss order above the candle’s high

- Take profit when the downtrend ends

Bearish Marubozu with a lower shadow

This type suggests that sellers are encountering strong support from buyers. The opening price is lower than the closing price, indicating that sellers pushed prices down but were later driven back up by buying pressure.

Meaning:

- The downtrend may be at risk

- May signal a reversal from a downtrend to an uptrend

Trading strategy:

- Exercise caution when a Bearish Marubozu with a lower shadow appears

- Consider additional factors to confirm the trend

- Place a stop-loss order close to the closing price

- Take profit when the downtrend ends

Importance of the Marubozu candlestick in trading

The Marubozu candlestick can carry different meanings depending on the context of the price chart. However, some common meanings of the Marubozu candle include:

Providing entry signals

The Marubozu candlestick can offer entry signals for traders. For example, a bullish Marubozu with a short lower shadow or no lower shadow at all may signal a buying opportunity. Conversely, a bearish Marubozu with a short upper shadow or no upper shadow may indicate a selling opportunity.

One way to strengthen entry signals from the Marubozu candlestick is to combine it with other candlestick patterns such as Doji, Hammer, Shooting Star, Engulfing, or Harami. When a Marubozu forms alongside one of these patterns, it can provide a stronger and more reliable buy or sell signal.

Confirming support and resistance levels

The Marubozu candlestick can also be used to confirm support and resistance levels. For instance, a bullish Marubozu forming at a support level may indicate that the support is holding firm. In contrast, a bearish Marubozu forming at a resistance level may suggest that the resistance is being broken.

It is essential to accurately identify key support and resistance zones in order to effectively use the Marubozu candlestick for confirmation. One common method for identifying these levels is by using technical indicators such as moving averages or trendlines.

How to trade effectively with the Marubozu candlestick

There are various ways to trade using the Marubozu candlestick. However, three of the most popular trading strategies include the following:

Trend-following trading strategy

The trend-following strategy is based on the idea that prices tend to continue moving in the direction of the current trend. This means that when the market is in an uptrend, traders look for buying opportunities, and when the market is in a downtrend, they look for selling opportunities.

- Step 1: Identify the current trend

To determine the current trend, traders can use technical indicators such as moving averages or trendlines. If the price is moving above a moving average or above a trendline, the current trend is bullish. Conversely, if the price is moving below a moving average or below a trendline, the current trend is bearish.

- Step 2: Identify the position of the Marubozu candlestick

After identifying the current trend, the next step is to determine where the Marubozu candlestick forms. If the Marubozu appears at a support or resistance level, it may provide a strong entry signal.

- Step 3: Enter trades in the direction of the trend

If a Marubozu candlestick forms at a support level while the price is in an uptrend, traders may enter a buy position when the price breaks above the high of the Marubozu candle. Conversely, if a Marubozu forms at a resistance level while the price is in a downtrend, traders may enter a sell position when the price breaks below the low of the Marubozu candle.

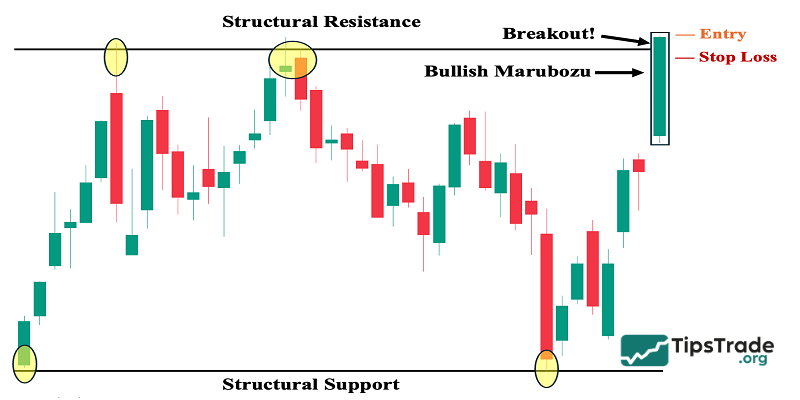

Marubozu candlestick forming at support/resistance levels

Another trading strategy using the Marubozu candlestick is to identify entry points at support and resistance levels.

- Step 1: Identify support and resistance levels

To determine support and resistance levels, traders can use technical indicators such as moving averages or trendlines. These zones may be defined by significant historical price levels or by trendlines.

- Step 2: Identify the Marubozu candlestick

After identifying the support and resistance levels, the next step is to check whether a Marubozu candlestick forms at these zones. If a Marubozu forms at a resistance level, it may provide a strong sell signal. Conversely, if a Marubozu forms at a support level, it may indicate a strong buy signal.

- Step 3: Place the trade

If a Marubozu candle forms at a resistance level, we can place a sell order when the price drops below the lowest point of the Marubozu candle. Conversely, if a Marubozu candle forms at a support level, we can place a buy order when the price rises above the highest point of the Marubozu candle.

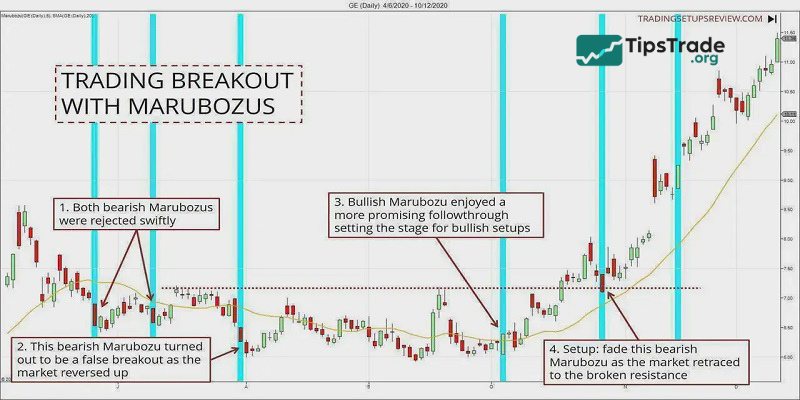

Breakout trading strategy using the Marubozu pattern

The breakout trading strategy with the Marubozu pattern uses Marubozu candlesticks to identify breakout points where price breaks through support or resistance levels, thereby providing buy or sell opportunities.

- Step 1: Identify strong support or resistance zones

This is the most critical step in the strategy. Strong support or resistance zones are areas where price is likely to be halted and potentially reversed. Traders can use technical analysis tools such as trendlines, moving averages, and Fibonacci retracements to identify these zones.

- Step 2: Place trades when signals appear

Buy signals:

- A bullish Marubozu appears at a strong support level

- The Marubozu has a large real body with short or no shadows

- Trading volume increases significantly

Sell signals:

- A bearish Marubozu appears at a strong resistance level

- The Marubozu has a large real body with short or no shadows

- Trading volume increases significantly

Trade execution:

- Place a buy or sell order immediately after the Marubozu candle closes

- Set a stop-loss below the low of the Marubozu candle for buy orders, and above the high of the Marubozu candle for sell orders

- Take profit when the price reaches the target level or when reversal signals appear

Advantages and disadvantages when trading with the Marubozu candlestick

Advantages when trading with the Marubozu candlestick

- Easy to identify: With its distinctive shape, the Marubozu candlestick is very easy to recognize on a price chart.

- Provides valuable information: The Marubozu candlestick offers traders important insights into price trends as well as key support and resistance levels in the market.

- Signals the start of a new trend: Marubozu candles often signal the beginning of a new trend, helping traders make more accurate trading decisions and improve profit potential.

Disadvantages when trading with the Marubozu candlestick

- Not suitable for ranging markets: The Marubozu candlestick is generally effective only in clearly trending markets and may perform poorly in sideways or ranging conditions.

- Requires confirmation from other tools: To improve the accuracy of trading strategies using the Marubozu candlestick, it should be combined with other tools such as technical indicators or price action patterns.

Final thoughts

The article above hopes that Tipstrade.org has provided useful knowledge for readers about the Marubozu candlestick pattern. Through this, we hope that readers can apply it in their investment process and achieve profits. Please regularly update your knowledge with Tipstrade.org!