In foreign exchange trading, identifying market trends in Forex is a core skill that helps traders optimize profits and minimize risk. The forex market is constantly fluctuating, but if you can grasp the direction of the price, you will have a significant advantage. So how can you accurately identify market trends in Forex? This article will provide you with the foundational knowledge, supporting tools, and practical strategies to help you understand the trend clearly. Let’s get started!

What is the market trend in forex?

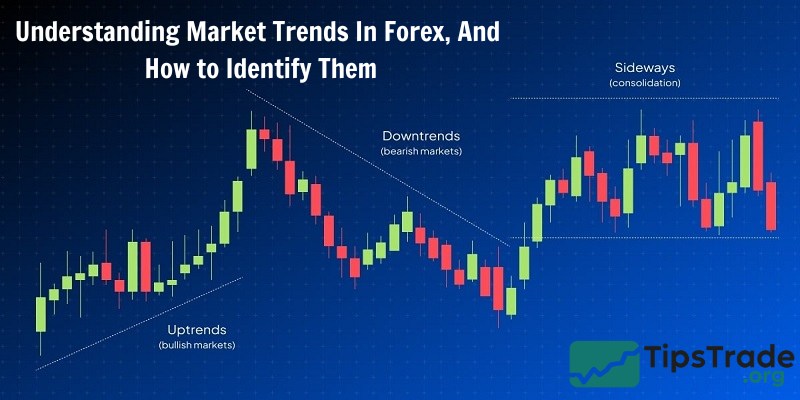

Market trends in Forex are the main direction of price movement over a given period of time. There are three basic types of market trends in Forex:

- Uptrend: The price continuously creates higher highs and higher lows. This is an ideal time to buy.

- Downtrend: The price creates lower highs and lower lows. This is an opportunity to sell short.

- Sideways Trend: The price fluctuates within a narrow range, with no clear direction. Traders often avoid trading during this period or apply a range trading strategy.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Top 10 best forex currency pairs to trade in 2025

- List of Top forex brokers in 2025 – Most Trusted and Reliable

- Forex Regulatory Organization: Understand It For Safer Trading

The importance of identifying market trends in forex

The forex market operates 24/5, with thousands of factors influencing prices such as economic news, interest rates, and market sentiment. If you do not recognize the trend, you can easily fall into the situation of “price chasing” or trading against the trend, leading to losses.

- Optimizing profits: Trend trading increases your chances of success because you go with the “flow” of the market.

- Reduce risk: Avoid “price traps” when the market suddenly reverses.

- Strategy Building: Trends are the basis for applying technical analysis tools such as moving averages (MA) or Fibonacci.

Remember the famous saying in the trading world:“The trend is your friend”. But to make trends your “friends,” you need to know how to recognize them.

How to identify market trends in forex

Below are common and effective methods for identifying market trends in Forex, from basic to advanced.

Observe the price action chart

Price Action is the simplest way to identify market trends in Forex without complicated tools. You just need to look at a candlestick chart and answer the questions:

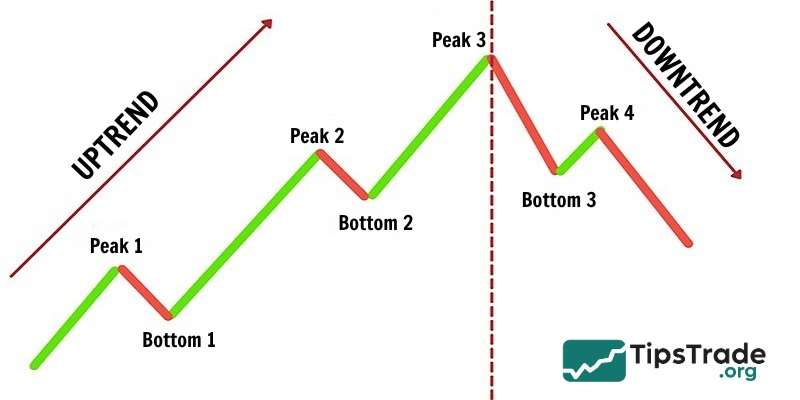

- Is price making higher highs and higher lows? → Uptrend.

- Is price making lower highs and lower lows? → Downtrend.

- Price fluctuates within a narrow range? → Sideways trend.

Tips: Use the larger timeframes (H4, D1) to identify the main trend, then switch to the smaller timeframes (M15, H1) to find entry points.

Using moving average (MA)

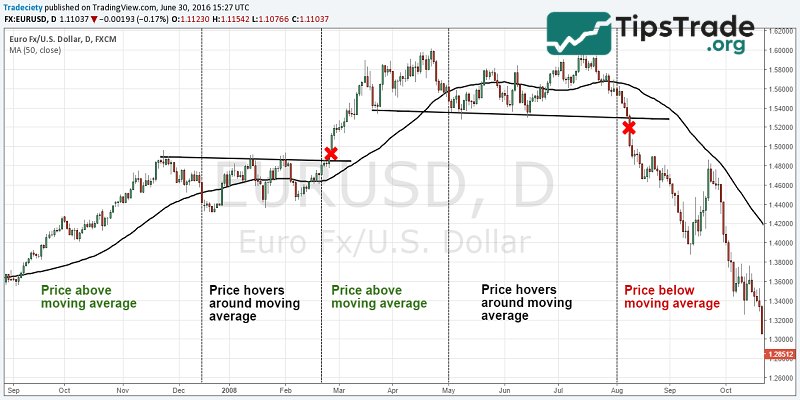

Moving average is a popular tool for smoothing price data and identifying trends. There are two main types:

- Simple Moving Average (SMA): Average price over a fixed period of time.

- Exponential Moving Average (EMA): Focus more on recent price data, more sensitive to volatility.

How to use:

- When the price is above the MA line and the MA line is sloping up → Uptrend.

- When the price is below the MA line and the MA line is sloping down → Downtrend.

- Combining two MA lines (short-term and long-term): If the short-term MA cuts up the long-term MA → buy signal; otherwise, it is a sell signal.

Using trendlines

Drawing a trendline is a manual way but very effective. You just connect the peaks or troughs on the chart:

- Uptrend: Connect the higher bottoms with a straight line sloping upwards.

- Downtrend: Connect the lower peaks with a downward sloping line.

When the price touches the trendline and bounces back, it is a confirmation signal that the trend is continuing. If the price breaks the trendline, the trend may have ended or reversed.

Using average directional index (ADX)

ADX is an indicator that measures the strength of a trend, usually ranging from 0 to 100:

- ADX > 25: Strong trend.

- ADX < 25: Weak trend or sideways market.

Combine ADX with +DI and -DI lines to determine trend direction (up or down). This is an ideal tool for traders who want to trade in volatile markets.

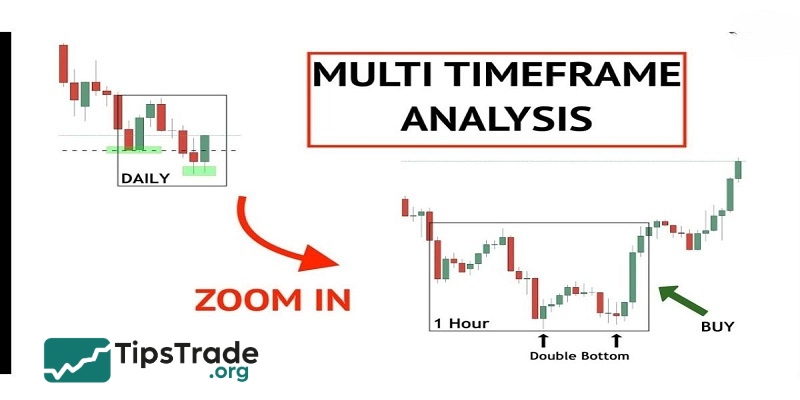

Multi-timeframe analysis

To identify market trends in Forex accurately, traders should combine multiple time frames:

- Long-term frame (D1, W1): Identify the main trend.

- Medium term (H1, H4): Find entry point.

- Short term frames (M5, M15): Adjust the trading time.

Common mistakes when identifying market trends in Forex

Although there are many tools to help traders identify Forex market trends, traders are still prone to making mistakes. Here are some common mistakes and how to fix them:

- Confusing trends and short-term volatility: Don’t jump to conclusions about an uptrend just because of a big green candle. Check on a larger time frame.

- Skip the economic news: A Non-Farm Payrolls report can reverse the trend immediately. Always keep an eye on the economic calendar.

- Counter-trend trading: Many traders try to catch the bottom or sell the top without clear signals, leading to losses.

Solution: Be patient and wait for confirmation signals and always set stop-loss to protect capital.

Market trend following strategies in forex

Once you have identified a trend, you need a specific strategy to capitalize on it. Here are two popular strategies:

Pullback trading

- Wait for the price to pullback to the MA or trendline in an uptrend/downtrend.

- Enter the order when the price bounces from the support/resistance zone.

- Place stop-loss below the nearest bottom (uptrend) or above the nearest top (downtrend).

Breakout trading

- Identify consolidation zones within a trend.

- Place a buy order when the price breaks resistance (in an uptrend) or a sell order when it breaks support (in a downtrend).

- Wait for retest to confirm valid breakout.

Advice from experienced traders when trading following the trend

With over a decade of forex trading, I have found that patience and discipline are the keys to success when trading trends. Here are some practical tips:

- Take your time: Don’t try to trade every move. Wait for a clear trend.

- Capital management: Risk only 1-2% of your account per trade.

- Transaction Logging: Track your orders to learn from your mistakes.

Conclusion

Identifying market trends in Forex is not an easy task, but with practice and the right tools, you can master this skill. Start by practicing on a demo account, observing charts, and applying what you have learned from this article. The forex market is always challenging, but if you go in the right direction – following the trend – success will not be far away.

See more: