When entering the stock market, market cap stocks is one of the concepts that beginners need to know. This is a factor commonly used to select suitable investment stocks. So, what are market cap stocks and why do they matter for investors? Let’s explore in the article below!

What are market cap stocks?

Market cap stocks (also known as Market Capitalization) is the total current value of all shares currently outstanding on the market. It can also be understood that the market capitalization of a business is determined by the total amount of money needed to buy that business at the market price at the time of purchase.

The value of market cap stocks will depend on the number of outstanding shares and the market price of the shares. In which, the price of shares is affected by many different factors such as supply and demand, interest rates, inflation,… Therefore, the market capitalization value of a business can fluctuate up and down at different times without depending entirely on the real value or business of that business.

>>See more:

- What is Stock Liquidity? Why It’s Important for Investors

- Primary vs Secondary Market: Key Differences Explained

- IPO Process: Step-by-Step Guide to Going Public

- How Do Interest Rates Affect the Stock Market?

Why are market cap stocks important?

Market cap stocks are important to businesses and investors today, specifically:

- Company valuation: Market cap stocks help to assess the value of a company in the stock market. It shows the importance of that company in the market and the financial strength of the company.

- Compare values between companies: With Market cap stocks, investors can compare the values of different companies. For example, if Company A has a higher market capitalization than Company B, it can be said that Company A is more important and financially stronger than Company B.

- Stock price trend prediction: Market capitalization also shows the trend of a company’s stock price. If the market capitalization increases, the company’s stock price will also tend to increase.

- Basis for calculating other indicators: Market capitalization is one of the bases for calculating other indexes such as P/E ratio, P/B ratio, ROE,… For example, P/E ratio is calculated by dividing the stock price by the earnings per share. Therefore, to calculate P/E ratio, you need to know the stock price and earnings per share of the company, which are both related to market capitalization.

Types of market cap stocks

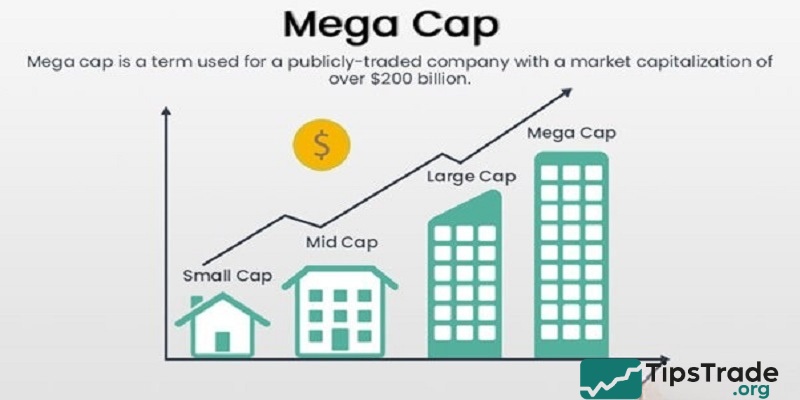

There is no fixed global standard for classifying market cap stocks, but according to common practice, international markets typically divide market cap stocks into five main groups based on capitalization value as follows:

Large-cap companies: $10 billion or more

Large-cap companies are typically long-established, well-run, and consistently profitable businesses. These are often familiar names such as:

- Microsoft Corp.

- Johnson & Johnson.

- JPMorgan Chase & Co.

- Exxon Mobil.

- General Mills.

- AutoZone.

Because of their solid foundations, large-cap companies are generally more stable. They are reliable in paying dividends and do not attract as much media attention as other “flashy” stocks. However, this “monotony” is what attracts investors. Accordingly, large-cap stocks are often less volatile than mid- or small-cap stocks.

There are many mutual funds that track large-cap stocks, including the iShares S&P 100 ETF, Vanguard Value ETF, and Schwab U.S. Large-Cap Value ETF. Many brokerages also offer search and screening tools for funds that track companies with specific market capitalizations.

>>See more:

- What are Blue Chip Stocks? Features of Blue-chip Stocks

- What Are Penny Stocks? How to Invest in Penny Stocks Safely

- ADR Stocks: A Complete Guide for Global Investors

- Growth Stocks – Definition, Examples, Characteristics

Mid-cap companies: $2 billion to $10 billion

While large-cap companies have experienced strong growth, mid-cap companies are often in the middle of it. This growth offers the opportunity for higher and faster returns, but also comes with a greater risk of a sharper decline.

Mid-cap companies are also often household names, but they typically do not have the national or international scale of the larger corporations listed above. Some examples of mid-cap stocks include:

- Boston Beer Company (brewers of Samuel Adams)

- Wyndham Hotels and Resorts

- Harley-Davidson

- Asana

- American Airlines

Small-cap companies: $250 million to $2 billion

Small-cap stocks are typically young companies with high growth potential. They have the potential to generate large profits (as small-cap companies grow into mid- or large-cap companies), but they also carry the risk of significant losses.

Small-cap companies typically have only a few revenue streams, are dependent on U.S. economic growth, and are more exposed to taxes and regulations than larger, established companies. If large-cap companies are like giant cruise ships that can weather storms, small-cap companies are like sailboats that can be tossed about by a single wave.

However, the growth opportunities they offer can help an investor’s portfolio generate profits, as long as the potential risk is balanced by the relative stability of large-cap stocks. Some examples of small-cap stocks include:

- Utz Brands Inc.

- Lionsgate Studios

- Steve Madden

- GoodRx

The Russell 2000 index tracks small-cap companies. Some investment funds that track this index include the iShares Russell 2000 ETF and the Vanguard Russell 2000 ETF.

Micro- and mega-cap companies

There are two other market capitalization groups, often referred to as micro-cap (under $250 million), and mega-cap (the largest companies on the stock market). Some of which may overlap with the large-cap group.

Micro-cap stocks are considered some of the riskiest investments. Many have little to no track record, may not even own assets, have no operations or revenue to report.

Meanwhile, mega-cap companies represent the most resilient businesses, often with large cash reserves, making them better able to withstand economic downturns.

How to calculate market cap stocks

Investors can calculate a company’s market cap by using the market capitalization formula.

Market cap = number of outstanding shares × price per share

For example, say a company has 12 million shares currently selling at $32 per share, which comes out to a market cap of $384 million, putting this company in the small-cap category. Now, if the company grows and its share price increases to $184, then its market cap increases to $2.208 billion. At that point, it might be considered a mid-cap company.

Difference between Enterprise value vs. Market cap stocks

Enterprise value (EV) is the total value of a company, while market capitalization only refers to the value of the company’s equity. Essentially, market capitalization is a portion of a company’s enterprise value. Here’s how to calculate market cap stocks and enterprise value:

- Market cap = Current share price × number of shares

- EV = market cap + total debt − cash

Factors that impact market cap stocks

There are many factors that influence market cap stocks, here are the main ones:

- Stock price fluctuations: The most direct impact on market cap comes from changes in the current share price of the company’s stock. A rising share price increases the market cap, while a falling share price decreases it.

- Additional read: Factor affecting increase or decrease in stock market.

- Number of outstanding shares: The total number of shares of a company’s stock that are currently held by investors also affects the market cap, as seen earlier.

- Stock buybacks: In this process, the company repurchases its own shares and decreases the number of outstanding shares. It can potentially lead to an increase in the share price (fewer shares available for the same demand) and a relatively stable or even higher market cap.

Investment strategies based on market cap stocks

Small-cap strategy

The small-cap stock investment strategy focuses on buying and holding stocks of companies with market capitalizations of less than $2 billion. The goal of this strategy is to take advantage of potential growth opportunities in this segment.

However, applying this strategy requires more in-depth research as there are often few analytical reports on these companies. Investors also need to be able to accept a certain amount of risk, as liquidity and trading volume of small-cap stocks are often low, while price volatility is high.

Large-cap value strategy

The large-cap value equity strategy targets stable, long-established companies and focuses on dividend income and sustainable growth. When applying this strategy, investors often look for market-leading businesses with solid financial foundations.

The goal of this strategy is to preserve and grow wealth. However, the profits come not only from selling stocks at higher prices in the long run, but also from passive income from regular dividend payments from large-cap stocks.

Market cap rotation

Market cap rotation requires active management. It can help investors control overall portfolio risk through diversification, as groups of stocks by capitalization often perform differently over time.

You can use a capital rotation strategy to diversify your portfolio by shifting between groups of stocks by capitalization based on the economic cycle. For example, you could invest in small-cap stocks during the early stages of economic recovery, then switch to large-cap stocks when the market becomes more volatile.

To execute this strategy effectively, you need to keep an eye on economic indicators to determine the right timing, and closely monitor investment performance.

Index-based approach

By taking an index-based approach, you invest in ETFs that track groups of stocks with specific capitalizations, such as IWM (small cap) or SPY (large cap). This approach combines different capitalization groups to diversify your portfolio, but does not require the active management of a market capitalization rotation strategy. Each index is rebalanced periodically to maintain its target capitalization weighting.

No matter which strategy you choose, careful risk management is important. For example, consider the correlations between asset classes. In addition, you should combine fundamental and technical analysis in your due diligence to make more accurate decisions.

Limitations of relying solely on market cap stocks

While market cap stocks is a useful metric, it does not tell the whole story. It does not take into account a company’s earnings, debt, or cash flow. Therefore, it should be used in conjunction with other financial metrics such as earnings per share (EPS), return on equity (ROE), and price-to-earnings (P/E) ratios.

Conclusion

The above is Tipstrade.org’s sharing about market cap stocks. Hopefully, through this article, you have understood what market cap stocks are and the corresponding market capitalization groups. To stay updated with interesting stock market knowledge, please visit Tipstrade.org frequently!

FAQs about market cap stocks

- Are higher market cap stocks always better?

Not necessarily. Higher market cap stocks indicate a larger company, but investment potential also depends on financial health, growth prospects, and stock valuation.

- How often should I check a company’s market cap stocks?

Although market cap stocks change daily with stock price movements, investors should monitor it periodically, especially before making new investment decisions.

- Can market cap stocks predict future performance?

Market cap stocks reflect the current value of a company in the market, but do not guarantee future profits. It is just one of many analytical tools used in investing.