Investing in IPOs marks the first opportunity for investors to purchase shares of a company as it becomes publicly traded on the stock market. An initial public offering (IPO) is a complex but pivotal step for businesses to raise capital by issuing new shares to the public. This process opens doors for investors to gain early access to companies with high growth potential while enabling the company to enhance its capital base. However, IPO investing requires careful research and consideration due to the regulatory requirements, valuation uncertainties, and the possibility of price volatility after listing.

Why Investing in IPOs?

IPOs are gateways to early ownership in emerging or rapidly scaling companies. Historically, IPOs tend to generate positive initial returns due to “underpricing,” but their long-term performance varies widely.

The IPO Underpricing Phenomenon

- Academic research, notably by Prof. Jay Ritter (University of Florida), has documented average first-day returns of 15–20% in U.S. IPOs since the 1980s.

- Underpricing ensures full subscription and compensates early investors for risk and uncertainty.

- However, short-term success doesn’t guarantee long-term performance.

- Ritter’s long-run studies show that three-year post-IPO returns typically underperform the market by 20–30%, especially when valuations are inflated by hype.

- In essence, while IPOs can deliver impressive day-one “pops,” sustainable profits depend on post-listing fundamentals.

Access to Innovation and Growth

- IPOs often represent cutting-edge industries — fintech, AI, biotech, and green energy.

- For instance, Nvidia’s 1999 IPO and Tesla’s 2010 IPO offered investors early exposure to future industry leaders.

- These examples underscore the potential of IPOs as strategic long-term investments rather than speculative trades.

Diversification Benefits

- Adding IPOs to a portfolio can diversify exposure across new sectors and growth cycles.

- According to Morningstar, moderate IPO exposure (around 5–10% of a portfolio) can improve long-term return potential without significantly raising volatility — assuming proper selection discipline.

See more:

- IPO Process: Step-by-Step Guide to Going Public

- How To Buy Stocks in 4 Steps: Quick-Start Guide for Beginners

- Long-Term Stock Investing: Benefits and Key Principles to Understand

- Day Trading Stocks: Benefits, Risks, and Effective Investing Strategies

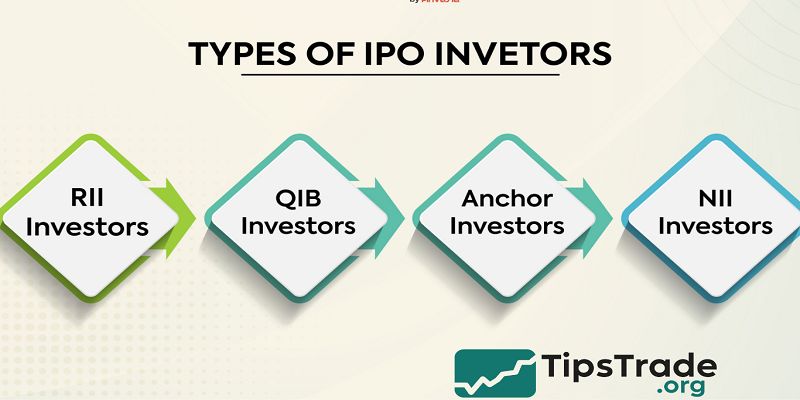

Types of IPO Investors and Allocation Mechanisms

Institutional vs. Retail Investors

The IPO market has traditionally favored institutional investors — mutual funds, pension funds, and hedge funds — who commit large capital and help stabilize pricing.

Retail investors often receive smaller allocations, though online brokerage platforms such as Robinhood, Fidelity, and Charles Schwab are gradually democratizing access.

| Investor Type | Typical Allocation | Advantages | Disadvantages |

| Institutional | 70–90% of total shares | Priority access, negotiated pricing | Requires high capital commitment |

| Retail | 10–30% of shares | Access to high-demand issues via brokers | Limited allotment, lower odds of allocation |

Book-Building and Price Discovery

- Modern IPOs employ the book-building process, where underwriters gauge investor demand before setting the final offer price.

- Orders from large investors help determine both price range and allocation tiers.

- Retail investors usually fall into lower tiers and receive allocations based on demand and broker policies.

- Some jurisdictions (like Hong Kong and Singapore) use partial lotteries to ensure fairness among small investors.

How to Improve Allocation Chances

Retail participants can enhance access by:

- Maintaining high account balances with partner brokers

- Participating early in the indication-of-interest period

- Targeting smaller-cap IPOs with lower institutional demand

- Joining IPO-focused ETFs or funds, such as the Renaissance IPO ETF (ticker: IPO)

Key Considerations Before Investing in an IPO

Reviewing the Prospectus

Every U.S. IPO must file a prospectus (Form S-1) with the Securities and Exchange Commission (SEC).

This document details the company’s business model, financial statements, risk factors, and intended use of proceeds.

Investors should analyze:

- Revenue trends and growth sustainability

- Competitive advantages and market share

- Legal risks, pending litigation, and intellectual property issues

- Insider ownership and governance structure

A thorough review of the S-1 filing helps investors distinguish between legitimate growth opportunities and overhyped offerings.

Analyzing Financial Health and Valuation

Valuation is central to IPO investing. Common metrics include:

- Price-to-Sales (P/S) and Price-to-Earnings (P/E) ratios

- EBITDA margins and operating cash flow

- Year-over-year revenue growth

Comparing these metrics to industry benchmarks reveals whether an IPO is fairly priced.

For example, during the 2021 boom, tech IPOs traded at an average P/S ratio above 20x, compared to historical norms of 5–8x — a sign of excessive optimism.

Assessing Management and Market Timing

- Strong leadership and transparent governance often separate successful IPOs from failures.

- Look for management teams with credible track records and independent boards.

- Market timing also matters: companies going public during bull markets (e.g., 2020–2021) benefit from liquidity inflows, while those listing in downturns may struggle to attract demand.

IPO Investment Strategies and Approaches

Short-Term Flipping vs. Long-Term Holding

- Many investors pursue the “IPO pop” — buying at the offer price and selling on day one. While this can yield double-digit returns, it’s rarely sustainable.

- Data from Renaissance Capital shows that IPOs delivering >40% on debut often correct within three months.

- Long-term investors, in contrast, focus on companies with profitable growth models and clear competitive moats.

- Historical winners — Apple, Visa, and Alphabet — all rewarded patience rather than speculation.

Diversification and Risk Management

- Investors should treat IPOs as a high-risk, high-reward asset class. Experts suggest capping IPO exposure at 5–10% of total portfolio value, diversified across sectors and listing years.

- Dollar-cost averaging into IPO ETFs or mutual funds can also moderate volatility.

Indirect Participation via Funds or SPACs

- Indirect investing — via IPO-focused funds, venture capital vehicles, or SPACs (Special Purpose Acquisition Companies) — offers exposure without requiring direct IPO allocations.

- However, SPAC investors should assess sponsor credibility and post-merger performance, as many SPACs underperform traditional IPOs over time.

Common Risks and Pitfalls in IPO Investing

Volatility and Lock-Up Expirations

- Newly listed shares can experience extreme volatility as early investors adjust positions.

- Lock-up periods (90–180 days) prevent insiders from selling shares immediately after listing. Once expired, large insider sales can depress prices.

According to CNBC data, stocks often fall 5–10% in the month following lock-up expiry.

Information Asymmetry and Overvaluation

- Retail investors typically rely on public filings, while insiders and underwriters have deeper insight.

- This imbalance often leads to mispriced offerings. Overvaluation was a key factor in the WeWork IPO collapse (2019), where investor sentiment reversed once governance flaws became public.

Dilution and Governance Concerns

- Future share issuances or employee stock options can dilute shareholder value. Watch for dual-class share structures, where founders retain disproportionate voting control.

- Poor governance — as seen in the early years of Facebook and Snap — can magnify post-IPO volatility.

Conclusion

Investing in IPOs refers to the process of buying shares offered by a private company to the public for the first time. This opportunity allows investors to become early shareholders in companies that may have significant growth potential. The process typically presents benefits such as gaining from listing price gains, enhanced liquidity allowing easy buying and selling of shares, and fair opportunities ensured for retail investors through regulations. However, investing in IPOs also carries risks including stock price volatility, limited historical data on company performance, and the possibility that the company may not meet market expectations after going public.

>>See more: