Financial statements are an important concept in the field of stock investment. So, what are financial statements? How do you read financial statements? Everything will be answered in detail by Tipstrade.org in the article below!

What are financial statements?

In stock invesment, financial statements are official records that summarize a company’s financial performance and position over a specific period. They provide essential information about how money flows in and out of a business, helping stakeholders understand the company’s financial health. In simple terms, financial statements show what a company owns, what it owes, and how much profit or loss it has made.

These statements are typically prepared at the end of each accounting period (monthly, quarterly, or annually) to present a clear picture of the company’s operations. They are used by management, investors, creditors, and regulators to assess whether a business is performing efficiently and making sound financial decisions.

>>See more:

- How to Read Stock Charts Like a Professional

- What is Industry Comparison and How to do it?

- Impact of Macroeconomic Factors on Stocks

- Key Stock Valuation Ratios and When to Use Which One

Why is reading financial statements important?

When you don’t know how to read financial statements, all the information you get about a company comes from stock quotes and news in the media, word of mouth, and social media. This is often indirect information, highly likely to be inaccurate, and in the end, you still don’t have a clear understanding of the company’s operations.

Learn to read financial statements to get information directly from the business, verified by independent auditors, helping you make investment decisions based on official, reputable sources of information.

Even if the investment results are not as expected, you will understand why you were wrong, and gradually avoid investing emotionally, without a plan, and taking risks blindly.

How to read financial statements?

There are four primary types of financial statements that provide valuable insights into a company’s financial position and performance. Next, we will guide you in detail on how to read each type of financial statement.

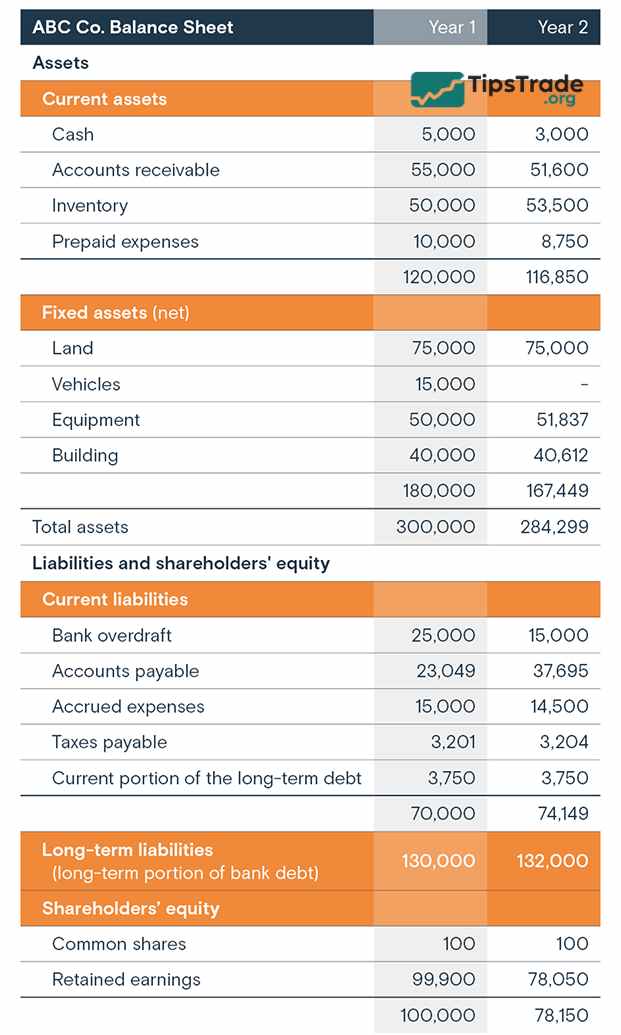

How to read a balance sheet

The balance sheet represents the “book value” of a company. It allows you to see the resources a company owns and how they are financed at a given point in time. The balance sheet shows a company’s assets, liabilities, and equity (basically, what the company owes, what it owns, and how much it has invested by shareholders).

The balance sheet also provides information that can be used to calculate profitability and evaluate capital structure, based on the accounting equation: Assets = Liabilities + Owners’ Equity.

In there:

- Assets is anything that a company owns that has a quantifiable value.

- Liabilities refers to amounts a company owes to creditors, such as outstanding payroll costs, debt payments, rent and utilities, bonds payable, and taxes.

- Equity is the net worth of a company, meaning the amount of money that would remain if all assets were sold and all debts were paid. This money belongs to the shareholders, who can be private owners or public investors.

However, the balance sheet alone cannot provide information about financial trends, so it is necessary to consider other financial statements such as the income statement and cash flow statement to better understand the company’s overall financial position.

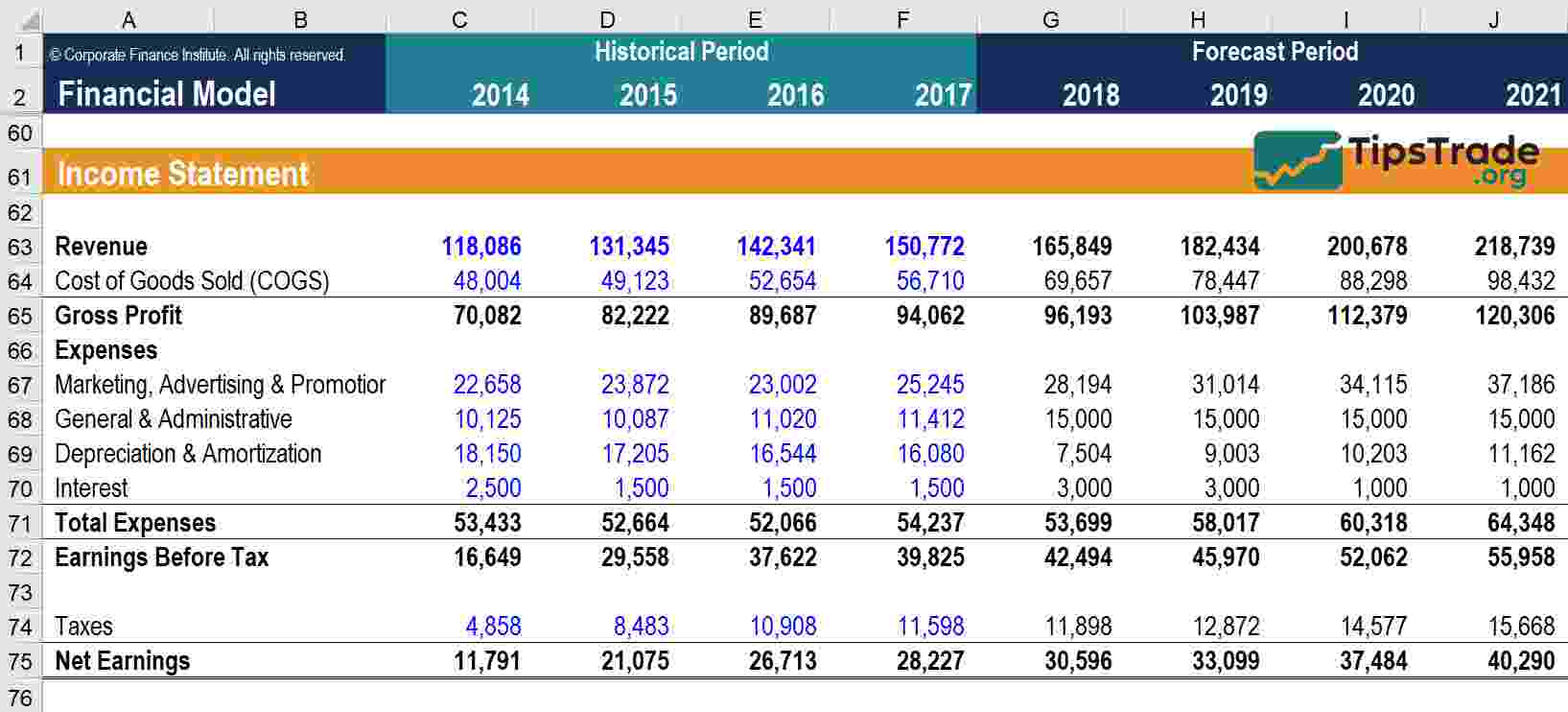

How to read an income statement

The income statement, also known as the profit and loss statement (P&L), summarizes the aggregate impact of sales, profits, expenses, and losses over a given period of time. This document, typically published in quarterly and annual reports, helps to show financial trends, business activities (revenues and expenses), and compares results between different periods.

The income statement typically includes the following information:

- Revenue: The amount of money a business takes in

- Expenses: The amount of money a business spends

- Costs of goods sold (COGS): The cost of component parts of what it takes to make whatever a business sells

- Gross profit: Total revenue less COGS

- Operating income: Gross profit less operating expenses

- Income before taxes: Operating income less non-operating expenses

- Net income: Income before taxes less taxes

- Earnings per share (EPS): Division of net income by the total number of outstanding shares

- Depreciation: The extent to which assets (for example, aging equipment) have lost value over time

- EBITDA: Earnings before interest, taxes, depreciation, and amortization

Accountants, investors, and business professionals regularly review income statements to:

- Understand business performance: Is the company profitable? How much does it cost to produce a product? Is there enough cash to reinvest in the business?

- Identify financial trends: When are costs highest? When are they lowest?

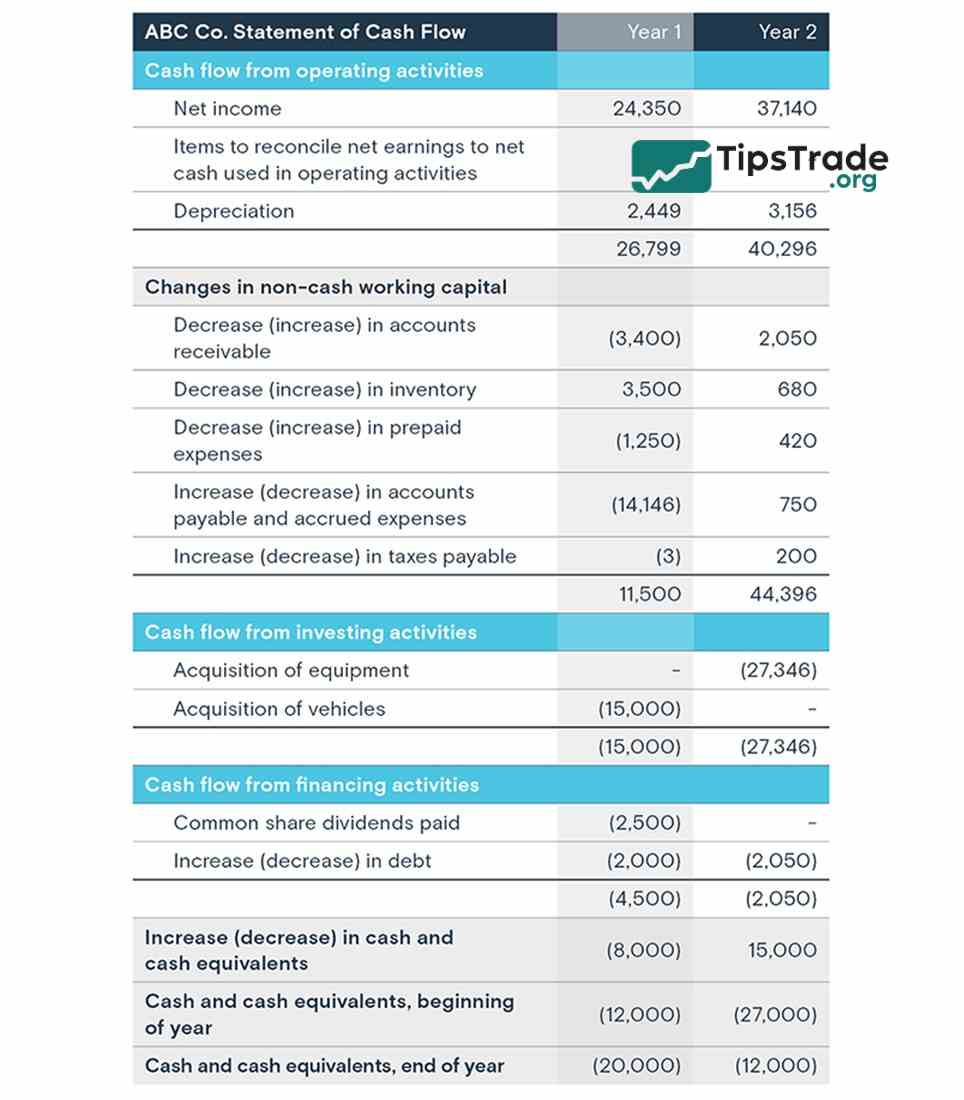

How to read a cash flow statement

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash flow over a specific period of time, known as the accounting period. This report shows the short-term and long-term performance of an organization, based on the amount of cash generated and spent during the period.

The cash flow statement is divided into three main parts:

- Operating activities: Represents the cash flow generated when a company provides goods or services on a regular basis, including both revenues and expenses.

- Investing activities: Reflects cash flows from the purchase or sale of assets, typically tangible assets (such as real estate, vehicles) or intangible assets (such as patents) using available cash, not debt.

- Financing activities: Describe the cash flows from financing sources.debt or equity.

It is important to note that cash flow and profit are two different concepts. Accordingly:

- Cash flow shows the actual amount of money going in and out of the business.

- Profit is the amount remaining after all expenses have been subtracted from revenue. Both of these ratios are important in assessing the financial health of a business.

Through a cash flow statement, you can see which activities are generating cash and use that information to make sound financial decisions.

Ideally, cash flow from operations should consistently be higher than net profit, because positive cash flow reflects the financial stability and ability of a company to expand its operations. However, having positive cash flow does not mean the company is profitable, so further analysis of the balance sheet and income statement is needed for a more comprehensive view.

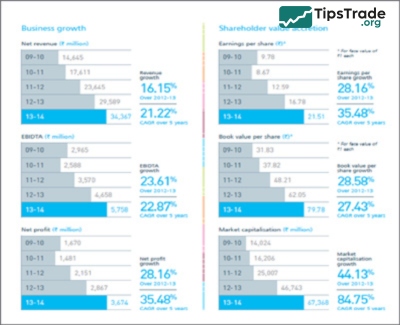

How to read an annual report

An annual report is a publication that public companies are required to publish annually to shareholders, describing the business’s operations and finances.

Annual reports often combine editorial content and storytelling through images, infographics, and a letter from the CEO to present a company’s activities, milestones, and achievements. Compared to individual financial reports, annual reports provide investors, shareholders, and employees with more insight into a company’s mission and goals.

In addition to the presentation section, the annual report summarizes financial data and includes the company’s income statement, balance sheet, and cash flow statement. It also provides industry analysis, management discussion and analysis (MD&A), accounting policies, and additional information for investors.

In addition to the annual report, the U.S. Securities and Exchange Commission (SEC) requires public companies to file a 10-K report, a longer and more detailed document that gives investors a full view of a company’s financial condition before they buy or sell shares.

The 10-K report is prepared in accordance with SEC regulations and includes a complete description of financial performance, corporate agreements, risks, opportunities, current operations, executive compensation, and market performance. In addition, the report contains a detailed analysis of the year’s performance and a comprehensive assessment of the industry and market.

Both the annual report and the 10-K provide a better understanding of a company’s financial condition, position, and growth goals. While the annual report is narrative and reflects management’s vision, the 10-K reinforces and expands that narrative with more detailed and in-depth information.

What financial statements don’t show

Financial statements are important, but they don’t tell the whole story. They focus on past performance and measurable data, which means key risks and context are often overlooked:

- Timing risk: An income statement prepared using the accrual method of accounting records revenue when it is earned, not when the cash is actually received. If customers are slow to pay, the numbers will not reflect the resulting cash gap, even though it may impact day-to-day operations.

- Business background: Financial statements show what has changed, but do not explain why. For example, a spike in expenses may come from a planned investment rather than an overspending. Without context, it is easy to misinterpret positive or negative trends.

- The assumptions behind the numbers: Many items in the report rely on internal estimates, such as depreciation, cost allocation, or revenue recognition. These choices affect the results of the report but are often not obvious unless you look closely at the notes or disclosures.

- External risks: A company’s financial statements cannot reflect factors such as supply chain disruptions, pending litigation, or lost customers unless these events have already impacted the financial figures. That makes it harder to identify future threats.

- Sustainability of performance: A business may report high profits but rely on temporary cost cutting or short-term borrowing to stay afloat. Financial statements may show that the business is profitable, but they do not indicate whether that success is sustainable.

- Market conditions and reputation: Financial statements do not reflect factors such as changing industry trends, competitive pressures, or customer confidence. A business may be performing well now, but still be at risk of falling demand or a reputational crisis that threatens its long-term success.

Common mistakes in reading financial statements

Financial statement analysis is a highly technical art, requiring a deep understanding of financial concepts as well as the ability to grasp the true meaning behind the numbers in the report. However, in this process, investors often make some common mistakes such as:

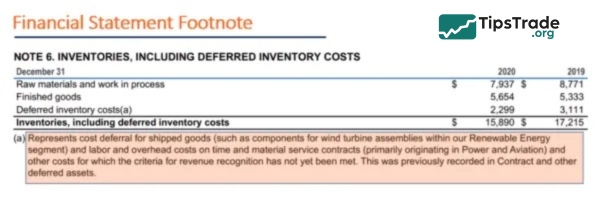

- Overlooking footnotes and disclosures

- Focusing only on profits without looking at the big picture

- Ignoring non-financial factors

- Depends entirely on financial ratios

- Lack of comparative analysis between periods or between businesses

- Misunderstanding of unusual items

- Not paying attention to potential risks

- Ignore adjustments when there is a change in accounting policy

Tips for reading financial statements

Financial statements can be intimidating documents, filled with numbers and jargon. However, with a little effort, you can uncover valuable information about your business’s financial health and overall performance. Here are some key tips to help you navigate the process.

Always read the footnotes

The financial statements themselves provide a lot of information, but the real treasure trove is the notes. These seemingly dry pages contain important details that can significantly impact how you understand a company’s financial health.

Pay attention to the following in the description:

- Accounting policy: Each business may use different accounting policies. The notes explain how the business records revenue, values inventory, and depreciates assets. Understanding these policies will help you interpret the numbers presented more accurately.

- Income tax: The notes usually detail tax expenses and potential tax-related provisions. This information is essential to accurately assess the actual profit of the business after deducting tax liabilities.

- Stock options and pension funds: Many companies grant stock options or contribute to retirement plans to their employees. The notes will disclose the financial impact of these programs, which directly affect reported expenses and net income.

By taking a close look at the notes, you’ll get a more comprehensive view of your business’s financial health, beyond the surface numbers on the report.

Look for patterns, not just numbers

Financial statements are a record of the past, but they also provide a glimpse into the future. Don’t get too caught up in analyzing individual numbers. Instead, focus on observing trends and patterns in the data over different reporting periods.

Is revenue increasing steadily year over year? Are operating costs well controlled? Are profit margins stable or declining? Identifying these trends will help you identify the strengths and weaknesses of your business and help you predict its future direction.

Always keep context in mind when analyzing

Financial statements should not be viewed in isolation. When interpreting the data, you need to consider both internal and external factors that may affect the company’s performance. Internally, is the company undergoing a management change or restructuring? Externally, are there industry trends or economic factors that are impacting the company’s performance?

For example, a sharp drop in sales at a retail company could be due to an internal issue like a product recall. However, it could also be due to a general economic downturn, which causes consumers to cut back on spending, affecting the entire retail industry.

Conclusion

The above are detailed instructions on how to read financial statements, so that whether you are an investor or someone interested in finance, you can follow along. Understanding financial statements is one of many steps in valuing a business, and of course, there are still many other important steps needed. Hopefully, the above guide to reading financial statements from Tipstrade.org has provided you with additional information and knowledge for your investment process.

Related posts: