You’re just starting to get interested in the stock market and want to learn about how to buy stocks? Let’s follow this article with Tipstrade.org to gain some useful knowledge!

Basic knowledge about stocks before investing

Before exploring how to buy stocks, investors need to understand basic knowledge about stocks before investing:

What are stocks?

Stocks are evidence of ownership of assets or capital by an issuing organization, such as a company or government, and are traded in financial markets to raise capital or earn profits. Common types of stocks include: share, bonds, and fund certificates.

>> See more:

- What is Stock Liquidity? Why It’s Important for Investors

- What is Stock Market Index? Top 8 Stock Market Index You Should Know About

- What Is a Stock Broker? Essential Skills and Average Salary of Being a Stock Broker

- How To Read A Stock Chart: Exploring Key Types & Pro Tips

What is stock investment?

Basically, stock investing is the process of buying and selling stocks and other types of stocks in the financial markets. It is not just about making transactions. It is also a calculated strategy to take advantage of market fluctuations to make a profit.

Stock market trading hours

Below is the typical trading schedule of some major international stock exchanges, presented in local time (the time zone of each respective country) that investors should be aware of for effective trading.

| Stock Exchange | Main Trading Hours | After-Hours Trading | Notes |

| NYSE (U.S.) | 09:30 – 16:00 | Pre-market: 04:00 – 09:30 After-hours: 16:00 – 20:00 | One of the most influential exchanges in the world |

| NASDAQ (U.S.) | 09:30 – 16:00 | Pre-market: 04:00 – 09:30 After-hours: 16:00 – 20:00 | Particularly strong in technology stocks |

| Tokyo Stock Exchange (Japan) | 09:00 – 11:30 12:30 – 15:00 | No official after-hours session | Orders can be entered starting from 08:00 (morning) and 12:05 (afternoon) |

| London Stock Exchange (U.K.) | 08:00 – 16:30 | Pre-market: 05:05 – 07:50 After-hours: 16:40 – 17:15 | The most important financial center in Europe |

| Australian Securities Exchange (Australia) | 10:00 – 16:00 | Pre-opening auction: 07:00 – 10:00 Grouped closing: 16:00 – 16:12 | Each stock has a random closing time within the 12-minute window |

Stock order types

Some commonly used stock trading order types include:

| Order type | What it is | Use it if… |

| Market order | A request to buy or sell a stock ASAP at the best available price. | You want to unload the stock at any price. |

| Limit order | A request to buy or sell a stock only at a specific price or better. | You’re fine with keeping the stock if you can’t sell at or above the price you want. |

| Stop (or stop-loss) order | A market order that is executed only if the stock reaches the price you’ve set. | You want to sell if a stock drops to or below a certain price. |

| Stop-limit order | A combination of a stop order and a limit order: A limit order is executed if your stock drops to the stop price, but only if you can sell at or above your limit price. | You want to sell if a stock drops to a certain price, but only if you can sell for a minimum amount. |

How do you make a profit from stocks?

Stock players have 2 ways to make profit from stock investment. Including:

- Profit from the difference in buying and selling prices

Profit from this method is calculated by the following formula:

Profit/Loss = (Selling price – Buying price) x Number of shares – (Tax + Transaction fee if any)

So, if the transaction fee is too high, your profit will be lower or your loss will be higher. So, look for a brokerage firm with low transaction fees.

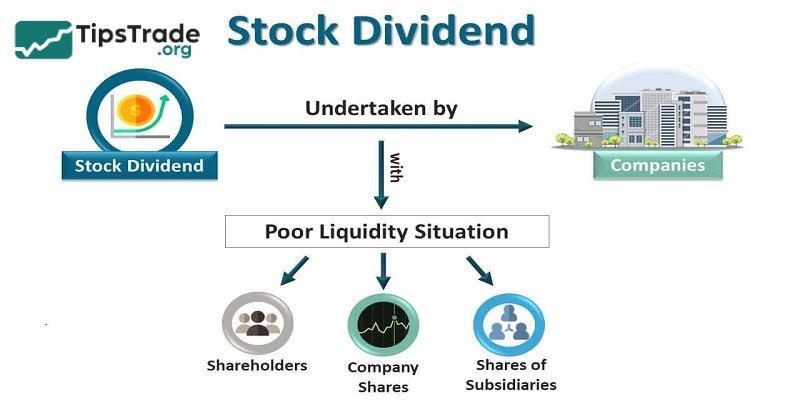

- Profit from dividends

When you own shares of a corporation, you are considered a common shareholder (ordinary shareholder) of that company. If the company makes a profit, shareholders receive dividends. Dividends can be paid in cash, shares, or options.

How to buy stock for beginners

Below are the steps to guide you on how to buy stocks. Specifically, here we are talking about shares – the most popular product in the stock market.

Step 1: Select a stock you want to buy

Each stock has its own advantages and risks, and the right choice will affect your investment results. To choose stocks, you need to understand the company’s business report. This includes: charter capital, net revenue in the most recent period and operating report (weekly, monthly, quarterly). You should buy stocks in industries that you have a certain understanding of. To help you quickly predict the market, avoid risks.

>>See more:

- Stock Issuance: A Detailed A-to-Z Guide for Investors

- What are stock exchanges and how do they work?

- Understanding Dividend stocks and how to invest in them

- What Is Stock Valuation? Notes When Valuation Of Stocks

Step 2: Open a stock trading account

Opening an investment account to learn how to buy stocks is an extremely important step. Accordingly, you need to choose a reliable exchange and complete the relevant procedures to be able to trade. Note,To open a securities account, you will have to fill in all the information required by the exchange.

Step 3: Determine the amount to buy stocks

After opening an account on the stock exchange, investors can deposit money into the account to start buying stocks. Before deciding how many stocks to buy, many people worry that investing in stocks requires a large amount of capital. In fact, stock exchanges do not stipulate a minimum capital. If you are new to the market, you should buy a small or minimum amount. This will be a test to help you know how to handle the market fluctuations and the stocks you own are at risk.

Step 4: Place an order to buy stocks

Once you have deposited funds and decided how many shares to buy, you can start trading to buy shares on the stock exchange.

You should place a purchase order in 2 ways:

- Market Orders: Buying at market price will help you match orders immediately.

- Limit Orders: Enter the price you want to buy at and only match the order when the stock price equals the level.

How to determine what stocks to buy?

To invest in stocks, investors should choose stocks that have the potential to increase in price in the future to bring profits. Here are some criteria:

- Regular dividend payments: A company that pays good and regular dividends shows that it is operating efficiently and providing income to investors.

- Debt ratio < 1.1: Total debt to current assets is less than 1.1. A low debt ratio shows that the company’s finances are secure when the economy turns bad.

- Current ratio > 1.5: Current assets divided by current liabilities is greater than 1.5. A high ratio indicates a company’s good ability to pay debts under 1 year.

- EPS >0: Positive EPS growth in the last 5 years helps investors stay away from high-risk stocks.

- P/E < 9: Stocks with a P/E of less than 9 are considered bargains and should be bought. However, investors should be careful when some growing stocks have quite high P/E.

- P/B ratio < 1.2: The P/B ratio compares the market price of a stock with its book value. Using both the P/E and P/B ratios at the same time will help investors filter safe stocks.

Best stocks for beginners with little money

In the case of the best stocks for beginners with little money, the market is full of options that blend good affordability with growth potential. Here’s a further look into the different types of categories suitable for any stock market beginner looking to invest:

Affordable stocks

Affordable stocks, like Ford, trading at about $12 per share, are great picks. Besides the growth potential, they boast a notable dividend yield, making them appealing for steady income and growth. Similarly, NiSource (NI) has shares below $30 and offers stability through its utility services and regular dividends, making it an excellent choice for investment if looking for stocks for little money.

ETFs & Index Funds

ETFs and index funds are perfect for beginners who want to diversify on a small budget. They give broad market exposure because they are spread across various sectors, reducing risk. Examples include the First Trust NASDAQ Cybersecurity ETF (CIBR) and the iShares Treasury Floating Rate Bond (TFLO), each in the $50-$60 range. These options provide accessibility at an affordable cost while targeting sectors such as cybersecurity or government securities, aligning with cheap stocks to buy now strategies.

Dividend stocks

Dividend stocks offer a dual benefit: potential price appreciation and a fixed, steady income through dividends. For instance, Verizon (VZ), with a high dividend yield, is effectively positioned in the telecommunications industry. This makes it suitable, especially when searching for a steady investment with regular income, aligning perfectly with the best stocks for beginners.

Blue-chip stocks

Blue-chip stocks are generally safer but also more costly investments. However, platforms offering fractional shares make investing in companies like Apple and Microsoft possible without needing to purchase full shares. Such stocks become accessible to those with limited means, aligning with the small-cap stock index approach by enabling investments in significant companies at a fraction of the cost.

Investing in stocks involves careful selection to balance growth potential, affordability, and risk. Diversifying with ETFs, focusing on stable dividend payers, and taking positions in blue-chip companies through fractional shares are effective strategies to build a resilient portfolio. This approach aligns with stock investing tips by advocating diversified and strategic investments to minimize risk and maximize returns.

Stock investing tips for beginners

Here are 3 important tips on how to invest in stocks for beginners:

- Anyone can see how a stock has performed in the past, but predicting how a stock will perform in the future is much more difficult. If you want to be successful by investing in individual stocks, you have to be prepared to do a lot of work analyzing a company and managing your investments.

- Avoid individual stocks if you’re just starting out. One solution is an index fund, which can be a mutual fund or an exchange-traded fund (ETF). These funds hold dozens or even hundreds of stocks. And each share you buy from the fund owns all the companies in the index.

- Diversification is important. Because it reduces the risk of any one stock in your portfolio greatly affecting overall performance. That actually improves your overall returns. Conversely, if you only buy one individual stock, you really have all your eggs in one basket.

Conclusion

How to buy stocks? Hopefully, the above guide will help you have an overview and be more confident in how to buy stocks. Investing in the stock market can bring many great opportunities, but also requires understanding and caution. Therefore, always grasp the information, research carefully before making an investment decision. In addition, you can learn more useful knowledge in the section Stocks belong to Tipstrade.