How Hedge Funds Work is a central question for investors, financial professionals, and anyone seeking to understand how sophisticated investment vehicles operate behind the scenes. Hedge funds represent one of the most flexible, complex. Unlike traditional investment funds, hedge funds are designed to pursue absolute returns through diverse strategies, including long/short equity, global macro, arbitrage, derivatives, and high-leverage positions. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Hedge Funds?

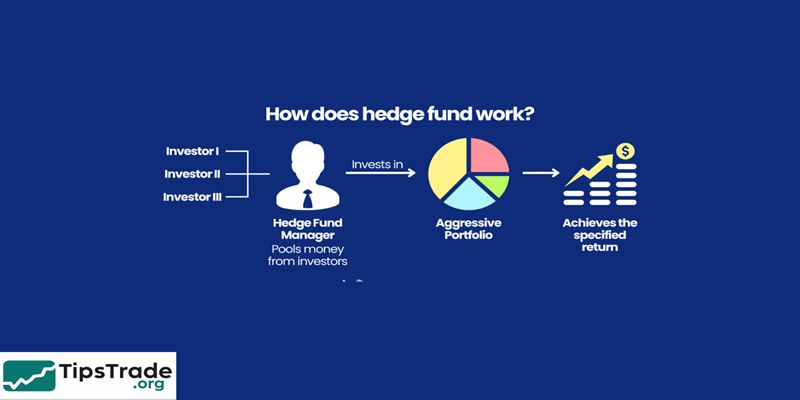

To fully understand how hedge funds work, it is essential to begin with what hedge funds actually are. A hedge fund is a privately pooled investment fund that uses a wide range of trading strategies to outperform the market or deliver positive returns regardless of economic conditions.

Unlike mutual funds, hedge funds are minimally regulated, giving fund managers the freedom to employ sophisticated trading techniques such as short selling, leverage, and derivatives.

Hedge funds are typically open only to accredited investors and institutional investors, meaning that ordinary retail investors have limited access. The rationale is that hedge fund strategies are complex, risky, and require investors who understand financial markets at a deeper level.

Investors contribute to a pool of capital that the fund manager uses to execute investment strategies aimed at outperforming traditional markets.

The term “hedge” originally referred to strategies used by early hedge funds to protect portfolios from downside risk. Today, however, hedge funds use far more diverse strategies and are not limited to hedging. Still, the name persists, reflecting the industry’s origins.

How Does Hedge Funds Work

Capital Raising and Investor Qualifications

A major part of how hedge funds work involves raising capital from qualified investors. To invest in most hedge funds, individuals must meet minimum income or net worth requirements. In the United States, this typically means:

- Net worth above $1 million (excluding primary residence), or

Annual income above $200,000 for individuals or $300,000 for joint households.

Institutional investors—such as pension funds, university endowments, family offices, and insurance companies—are major contributors to hedge fund capital.

Hedge funds often require high minimum investment amounts, commonly starting from $100,000 to several million dollars depending on the fund’s reputation and strategy. Investors contribute as Limited Partners (LPs), while the management company operates as the General Partner (GP).

Fund Structure

Understanding fund structure is crucial to understanding how hedge funds work. The most common structure is the master-feeder structure. This setup typically includes:

- Feeder Funds: Accept capital from investors worldwide.

- Master Fund: Aggregates assets from all feeders to execute a centralized investment strategy.

This structure offers tax efficiency, streamlined management, and regulatory convenience.

Inside a hedge fund, several key roles exist:

- Fund Manager / Portfolio Manager: Responsible for investment decisions and strategy execution.

- General Partner (GP): Owns the fund management company and governs decision-making.

- Limited Partners (LPs): Investors who provide capital but do not manage the fund.

- Prime Brokers: Investment banks providing leverage, trade execution, and asset lending.

- Custodians, Auditors, and Administrators: Maintain transparency, compliance, and operational efficiency.

This governance structure ensures that the fund manager has the authority to make fast, complex trading decisions while maintaining accountability to investors.

Strategy Execution

Strategies define how hedge funds work in practice. They are the heart of the hedge fund model, designed to capture opportunities across markets.

Long/Short Equity

- This strategy involves buying undervalued stocks (long) and short-selling overvalued stocks. The goal is to generate returns while minimizing market exposure. Even if the market declines, gains on the short positions can offset losses. This is one of the earliest and most common hedge fund strategies.

Global Macro

- Global macro hedge funds analyze macroeconomic trends across currencies, commodities, bonds, and equities. They focus on factors such as central bank policy, inflation, interest rates, geopolitical events, and economic cycles. Positions can last days or months and often involve derivatives.

Event-Driven Strategies

These strategies capitalize on market inefficiencies caused by corporate events such as:

- Mergers and acquisitions

- Bankruptcies

- Restructuring

- Spin-offs

One common form is merger arbitrage, where funds profit from the price differences between the current target stock price and the proposed acquisition price.

Arbitrage Strategies

Hedge funds often use statistical or algorithmic models to identify price discrepancies between related securities. Examples include:

- Statistical arbitrage

- Convertible arbitrage

- Fixed-income arbitrage

These strategies rely on large volumes of trades and may require significant leverage to generate meaningful returns.

Multi-Strategy Funds

- Some hedge funds combine several strategies to enhance diversification and reduce reliance on a single market condition.

Leverage and Risk Management

Leverage is a core component of how hedge funds work. By borrowing capital from prime brokers, hedge funds can amplify returns from successful trades. However, this also magnifies losses, making risk management essential.

Hedge funds use multiple risk management tools:

- Value at Risk (VaR) models

- Stress testing and scenario analysis

- Portfolio hedging using options, futures, and swaps

- Position limits and stop-loss mechanisms

Sophisticated quantitative models are often used to detect correlations, volatility shifts, and systemic risks. A strong risk management framework is considered a hallmark of reputable funds.

Performance and Fee Structure

The famous “2 and 20” model illustrates how hedge funds work from a compensation perspective:

- 2% management fee: Charged annually on assets under management, regardless of performance.

- 20% performance fee: Charged on profits, subject to conditions.

To protect investors, many funds use:

- High-water marks: Ensures performance fees are only charged on new gains.

- Hurdle rates: Performance fee applies only if returns exceed a minimum benchmark.

This fee structure incentivizes fund managers to pursue strong returns while aligning with investor interests.

How Hedge Funds Use Technology and Data

Innovative technology is transforming how hedge funds work. Many modern hedge funds, especially quantitative funds, rely on advanced analytics and automated systems.

Algorithmic Trading and Quant Models

Quant hedge funds use statistical models to detect market patterns, price inefficiencies, and arbitrage opportunities. Trades are executed in milliseconds using:

- Time-series analysis

- Machine learning models

- Statistical probability algorithms

High-Frequency Trading (HFT)

- Some funds use high-frequency trading systems to execute thousands of trades within seconds, capitalizing on minuscule price discrepancies.

AI and Machine Learning

Artificial intelligence helps hedge funds process alternative data:

- Satellite imagery

- Credit card transaction data

- Social media sentiment

- Supply chain data

These tools enhance forecasting, improve risk models, and provide competitive advantages.

Big Data & Alternative Data

- A significant part of how hedge funds work today involves gathering and analyzing massive datasets to gain insights beyond traditional market information.

Why Hedge Funds Make (or Lose) Money

The ability to generate high returns is a major appeal of hedge funds. Their success depends on:

- Superior market insight

- Faster execution

- Talent and expertise of the fund manager

- Access to institutional-level research and technology

- Ability to invest in any asset class

However, hedge funds can also lose money due to:

- High leverage

- Incorrect macro assumptions

- Liquidity crises

- Systemic market events

Historical cases such as Long-Term Capital Management (LTCM) highlight the risks of excessive leverage and poor risk controls.

Advantages of Hedge Funds

Hedge funds offer various benefits:

- High return potential: Flexibility allows strong performance even in downturns.

- Diversification: Strategies reduce correlation with traditional markets.

- Access to niche opportunities: Arbitrage, distressed assets, and private deals.

- Active risk management: Sophisticated models and hedging techniques.

For institutional investors, hedge funds are essential tools for achieving risk-adjusted performance.

Risks and Criticisms of Hedge Funds

Despite their advantages, hedge funds face scrutiny:

- High fees decrease net investor returns.

- Transparency issues limit visibility into strategy.

- High leverage increases systemic risk.

- Illiquidity due to lock-up periods.

- Regulatory concerns over market influence.

Critics argue that many hedge funds underperform benchmarks after accounting for fees, though top-tier funds continue to deliver strong results.

How Hedge Funds Are Regulated

Regulation affects how hedge funds work, though less intensely than mutual funds. In the U.S., hedge funds must register with the Securities and Exchange Commission (SEC) if they exceed certain asset thresholds.

Requirements include:

- Filing Form ADV

- Periodic disclosures

- Compliance programs

- Restricted marketing practices

Global regulation varies, with major jurisdictions including the UK, EU, Hong Kong, and Singapore each imposing their own standards.

Conclusion

How Hedge Funds Work is a complex yet fascinating subject that reveals the sophistication, innovation, and influence of the global hedge fund industry. Hedge funds operate through dynamic strategies, advanced technology, and flexible investment mandates that differentiate them from traditional funds. While they offer high return potential, they also carry significant risks, including leverage, limited transparency, and elevated fees.