Hedge funds vs mutual funds, many investors want a clear comparison, not marketing promises. These two investment vehicles are often mentioned together, yet they serve very different purposes within a diversified portfolio. Understanding the key differences, risk profiles, fee structures, and regulatory frameworks can help investors make more informed decisions. In the first 100 words, it is essential to naturally introduce collocations such as investment strategies, risk management, portfolio diversification, active management, long-term returns, alternative investments, market volatility, and asset allocation. These concepts are central to how hedge funds and mutual funds operate in real-world financial markets. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Hedge Funds?

Structure and Investment Approach

Hedge funds are privately pooled investment vehicles that use a wide range of strategies to generate returns. Unlike traditional funds, hedge funds often pursue absolute returns, meaning they aim to make money in both rising and falling markets. To achieve this, managers may use leverage, short selling, derivatives, and complex trading strategies.

From an experiential perspective, institutional investors often view hedge funds as flexible problem solvers within a portfolio. For example, during periods of market stress, hedge fund managers may shift rapidly between asset classes, hedge currency exposure, or short overvalued securities. According to industry data published by the CFA Institute, hedge funds are commonly used to reduce portfolio correlation rather than maximize raw returns.

Expert analysis shows that hedge fund strategies vary widely, including long/short equity, global macro, event-driven, and relative value. This flexibility can be beneficial, but it also introduces higher complexity and risk, making due diligence essential.

Typical Investors and Accessibility

Hedge funds are generally available only to accredited investors or institutions. In the United States, this classification typically includes individuals with a net worth exceeding $1 million (excluding primary residence) or high annual income. This restriction exists because hedge funds face lighter regulatory oversight compared to mutual funds.

From a trust perspective, regulators such as the U.S. Securities and Exchange Commission (SEC) emphasize that hedge funds are not designed for the general public. Investors often commit capital for extended periods, sometimes with lock-up clauses that limit withdrawals.

In practice, hedge fund investors tend to be pension funds, endowments, family offices, and high-net-worth individuals. These investors usually have access to professional advisors and risk management frameworks, which aligns with the complex nature of hedge fund strategies.

See more

- Hedge Funds Report: A Comprehensive Analysis of Performance, Strategies, and Industry Trends

- Index Funds vs Mutual Funds: Understanding the Key Differences Before You Invest

- Top Index Funds to Consider for Long-Term Investing

- Risks in Index Funds: What Every Investor Should Understand

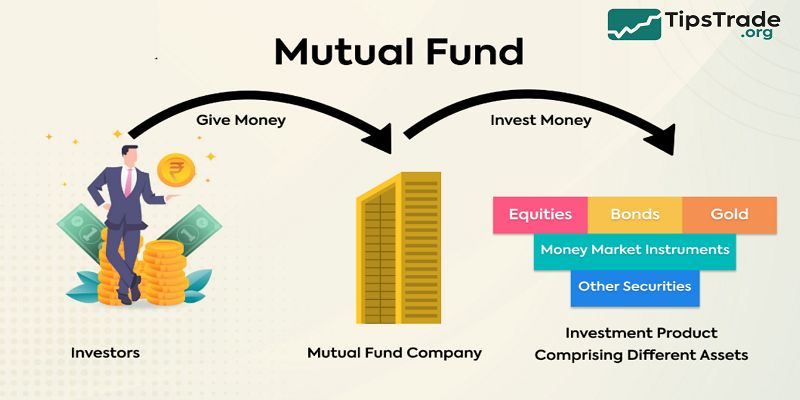

What Are Mutual Funds?

Structure and Investment Approach

Mutual funds are publicly available investment vehicles that pool money from many investors to invest in stocks, bonds, or other securities. Most mutual funds follow a relative return approach, aiming to outperform a benchmark such as the S&P 500 or a bond index.

From a practical standpoint, mutual funds are designed for simplicity and transparency. Fund managers typically invest in long-only positions and follow clearly defined mandates. According to data from Morningstar and the Investment Company Institute, mutual funds remain one of the most widely used tools for long-term investing and retirement planning.

Expert consensus suggests that mutual funds are particularly effective for investors who prioritize steady growth, diversification, and low barriers to entry. While they may not offer the same flexibility as hedge funds, they provide a predictable structure that many investors find reassuring.

Retail Investor Focus and Accessibility

One of the defining features of mutual funds is their accessibility. Retail investors can typically invest with modest minimum amounts, and shares can usually be bought or sold daily at net asset value (NAV).

From an experiential angle, financial advisors often recommend mutual funds to beginner investors because they are regulated under the Investment Company Act of 1940, which imposes strict disclosure and governance requirements. This level of oversight enhances investor trust and reduces the likelihood of unexpected risks.

Mutual funds are widely used in retirement accounts, such as 401(k) plans, making them a cornerstone of long-term financial planning for millions of households.

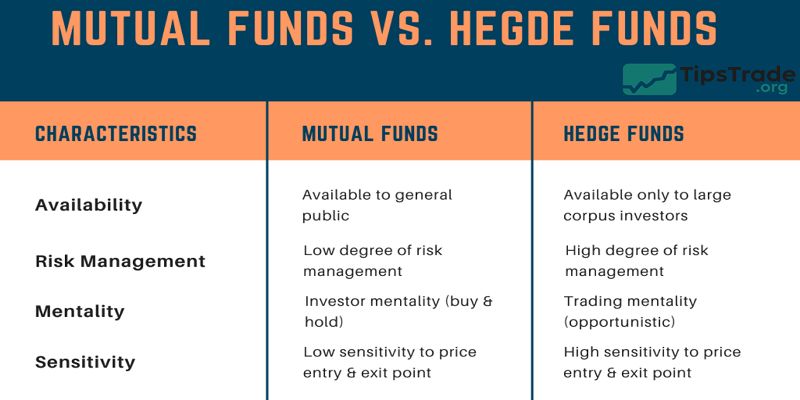

Hedge Funds vs Mutual Funds: Core Differences

Investment Strategies and Flexibility

The most significant difference between hedge funds and mutual funds lies in investment flexibility. Hedge funds can invest across asset classes, use leverage, and actively hedge risk. Mutual funds, by contrast, operate within predefined constraints.

In real-world portfolio construction, this means hedge funds can adapt rapidly to market conditions, while mutual funds emphasize consistency and discipline. Research from academic finance journals indicates that flexibility can improve risk-adjusted returns, but only when combined with skilled management.

Use of Leverage and Short Selling

Hedge funds frequently use leverage and short selling to amplify returns or hedge downside risk. Mutual funds are typically restricted from using these tools extensively.

From a risk perspective, leverage can magnify losses as well as gains. Regulatory authorities often cite leverage as a primary reason hedge funds are limited to sophisticated investors.

Risk and Volatility

Hedge funds often exhibit higher strategy-specific risk, while mutual funds generally track broader market risk. Studies published by Financial Analysts Journal suggest that hedge fund volatility varies significantly by strategy, whereas mutual fund volatility closely mirrors market indices.

Fees and Cost Structure

Hedge funds are known for higher fees, often following a “2 and 20” model. Mutual funds usually charge lower expense ratios.

| Feature | Hedge Funds | Mutual Funds |

| Management Fee | ~2% | 0.1%–1% |

| Performance Fee | ~20% | None |

| Transparency | Limited | High |

Liquidity and Redemption Terms

Mutual funds offer daily liquidity, while hedge funds may restrict withdrawals. This difference can significantly impact cash flow planning for investors.

Transparency and Disclosure

Mutual funds must disclose holdings regularly. Hedge funds provide less frequent disclosure, which increases reliance on trust and due diligence.

Regulation and Oversight

Mutual funds are heavily regulated, while hedge funds operate under exemptions that allow greater flexibility but less oversight.

Performance and Risk-Adjusted Returns

How Performance Is Measured

Performance should be evaluated using risk-adjusted metrics such as Sharpe ratios, not just raw returns. Research from CFA Institute shows that hedge funds can improve portfolio efficiency, but results vary widely.

Risk-Return Trade-Offs

While hedge funds may outperform in certain conditions, mutual funds often deliver more consistent outcomes over long horizons.

Which Is Better for Portfolio Diversification?

Role of Mutual Funds in Diversified Portfolios

- Mutual funds provide broad exposure at low cost, making them ideal for core holdings.

Role of Hedge Funds as Alternatives

- Hedge funds can reduce correlation, particularly during market downturns, but require careful selection.

Who Should Invest in Hedge Funds vs Mutual Funds?

Individual and Retail Investors

- Most retail investors benefit more from mutual funds due to simplicity and regulation.

Accredited and Institutional Investors

- Institutions may allocate to hedge funds for diversification and downside protection.

Advantages and Limitations of Each Option

Hedge Funds – Advantages

- Flexible strategies

- Potential downside protection

Hedge Funds – Limitations

- High fees

- Limited transparency

Mutual Funds – Advantages

- Low cost

- Strong regulation

Mutual Funds – Limitations

- Limited flexibility

- Market-dependent returns

Conclusion

The comparison between hedge funds vs mutual funds is not about determining a single winner. Each serves a distinct role within the investment landscape. Mutual funds prioritize accessibility, transparency, and long-term growth, making them suitable for most investors. Hedge funds, on the other hand, offer flexibility and diversification potential, but only for those who understand and can tolerate higher complexity and risk.