Hedge Funds have long been one of the most influential and sophisticated investment vehicles in global finance. Known for their flexibility, aggressive strategies, and potential to outperform the broader market, hedge funds attract institutional investors, high-net-worth individuals, and financial professionals seeking advanced portfolio optimization. This comprehensive guide provides a deep examination of hedge funds, including how they work, their investment strategies, benefits, risks, regulatory landscape, and future trends shaping the industry. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

Definition and Importance in Global Markets

Hedge Funds are privately pooled investment funds that employ a wide range of sophisticated strategies to achieve absolute returns, regardless of market direction. Unlike traditional mutual funds, which aim to track or outperform market benchmarks, hedge funds seek asymmetric performance through flexibility, leverage, derivatives, and active management.

Hedge funds derive their name from the original concept of “hedging” risk—using long and short positions to minimize exposure. Over time, the industry has expanded far beyond simple hedging, evolving into a multi-trillion-dollar global ecosystem spanning equities, bonds, derivatives, commodities, currencies, private markets, and algorithmic strategies.

The importance of hedge funds lies in their ability to:

- Enhance market liquidity

- Promote price efficiency

- Absorb risk that traditional players avoid

- Provide alternative sources of return

- Innovate with new investment methodologies

While hedge funds remain exclusive to accredited or institutional investors, their impact on markets is far-reaching, influencing volatility, price discovery, and capital flows worldwide.

How Hedge Funds Work

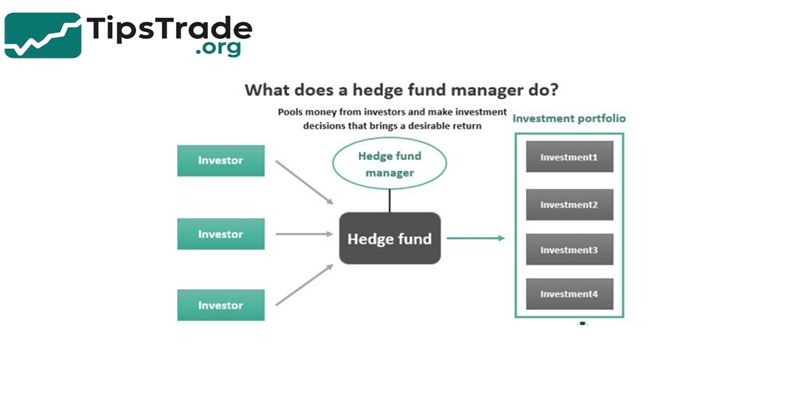

How Hedge Funds Work is rooted in a unique organizational structure designed for maximum strategic freedom. Typically, a hedge fund consists of three core components:

- The Fund

- The Investment Manager

- The General Partner (GP)

The fund pools money from investors, known as Limited Partners (LPs), who commit capital in exchange for proportional shares. The General Partner or Management Company is responsible for executing strategies, managing risk, and operating the fund.

Capital Flow and Investment Operations

- Investors commit capital during subscription periods.

- Managers allocate capital across chosen strategies.

- Returns are distributed based on performance, net of fees.

- Withdrawals are typically subject to restrictions such as lock-up periods, redemption windows, or gates.

Key Features of Hedge Fund Operations

- Leverage: Amplifies returns (and risks).

- Short selling: Enables profit in declining markets.

- Derivatives: Enhance hedging and speculative opportunities.

- Concentrated bets: Higher conviction compared to mutual funds.

Compared to mutual funds and ETFs, hedge funds enjoy far greater discretion. They are not bound to specific sectors, indices, or liquidity requirements, giving them the freedom to pursue unconventional opportunities and generate alpha.

Hedge Fund Strategies

Hedge Fund Strategies are incredibly diverse, allowing funds to tailor risk-reward profiles to specific market conditions. The most common strategy categories include the following:

Long/Short Equity

- Long/Short Equity is one of the foundational hedge fund strategies.

- Managers buy undervalued stocks (long positions) and sell overvalued ones (short positions), aiming to profit from both upward and downward movements.

- Advantages: Risk mitigation and consistent returns.

- Disadvantages: Requires precise analysis and timing.

Global Macro

- Global Macro funds analyze macroeconomic factors such as interest rates, inflation, GDP, and geopolitical risks.

- They often trade currencies, commodities, bonds, and global equity indices

- Advantages: High profit potential from major macro trends.

- Disadvantages: Vulnerable to unexpected geopolitical events.

Event-Driven

Event-Driven strategies capitalize on corporate events like mergers, bankruptcies, earnings surprises, or restructurings. Sub-strategies include:

- Merger arbitrage

- Distressed securities

- Activist investing

- Advantages: Returns driven by identifiable catalysts.

- Disadvantages: Deals can collapse, creating volatility.

Relative Value Arbitrage

- This strategy exploits price discrepancies between similar securities, utilizing quantitative models to identify mispricing.

- Advantages: Low correlation with the broader market.

- Disadvantages: High leverage exposure.

Quantitative and Algorithmic Strategies

- Quant hedge funds like Renaissance Technologies use AI, machine learning, and big data to analyze patterns and execute trades automatically.

- Advantages: Extremely high speed and efficiency.

- Disadvantages: Model risk during unusual market conditions.

- These strategies allow hedge funds to remain competitive across various economic cycles, making them highly attractive to sophisticated investors.

Hedge Fund Investors Who Can Invest and Why

Hedge Fund Investors are primarily required to meet regulatory criteria to ensure they have the financial capacity and knowledge to assume higher risks. These investors include:

- Accredited investors

- High-net-worth individuals

- Pension funds

- Insurance companies

- Endowments

- Family offices

- Sovereign wealth funds

The barrier to entry is intentionally high to protect inexperienced retail investors. Most hedge funds require minimum investments ranging from $100,000 to several million dollars.

Investors choose hedge funds because of their potential to generate superior returns, diversify risk, and provide protection during market downturns. This exclusive access makes hedge funds particularly appealing to institutions seeking long-term stability and alpha generation.

Why Investors Choose Hedge Funds

Hedge Fund Benefits revolve around performance enhancement and strategic flexibility. The most notable advantages include:

Strong Performance Potential

- Hedge funds aim for absolute returns, meaning they seek profit in both bull and bear markets.

- Their ability to use leverage, derivatives, and short positions boosts profit potential significantly.

Portfolio Diversification

- Hedge funds employ strategies with low correlation to traditional assets, helping investors reduce portfolio volatility.

Downside Protection

- While not risk-free, hedge funds often hedge market exposure, offering better downside protection than other active funds.

Access to Exclusive Opportunities

- Funds may invest in private deals, emerging markets, distressed assets, or niche strategies unavailable to retail investors.

- Hedge funds serve as powerful tools for investors seeking enhanced performance that goes beyond index tracking or traditional investment patterns.

Hedge Fund Risks

Hedge Fund Risks are substantial and require careful evaluation. Despite their sophisticated nature, hedge funds can expose investors to unique vulnerabilities.

Leverage Risk

- High leverage magnifies losses during adverse market movements, sometimes leading to catastrophic failures.

Liquidity Risk

- Many hedge funds invest in illiquid assets, limiting investors’ ability to redeem capital quickly.

Transparency Issues

- Hedge funds are not required to disclose detailed positions regularly, creating an opaque environment that may concern risk-averse investors.

Strategy Complexity

- Complex strategies such as derivatives trading or quant models can behave unpredictably during market turbulence.

- These risks underscore the importance of due diligence and proper risk management before committing significant capital.

The 2 and 20 Model Explained

Hedge Fund Fees follow the famous “2 and 20” model, consisting of:

- 2% management fee: Charged annually based on assets under management.

- 20% performance fee: Charged on generated profits, often subject to high-water marks and hurdle rates.

Some elite funds charge higher performance fees, while newer funds may lower fees to attract investors. Though hedge fund fees are higher than traditional funds, investors often tolerate them in exchange for high potential returns and specialized expertise.

Legal Framework and Compliance Requirements

Hedge Fund Regulations vary across regions but generally aim to protect investors while preserving innovation.

United States – SEC Regulation

SEC rules classify hedge funds under exemptions within the Investment Company Act and Investment Advisers Act, allowing them to operate more freely than mutual funds. However, they must:

- Register as investment advisers (if large enough)

- Disclose risks

- Follow anti-fraud regulations

- Maintain compliance structures

European Union – MiFID II and AIFMD

- European regulations impose stricter reporting, transparency, and capital requirements, especially for funds marketed across borders.

- Overall, the regulatory framework tries to balance investor protection with operational flexibility.

Hedge Funds vs. Mutual Funds vs. Private Equity

- Hedge Funds vs. Mutual Funds differ primarily in strategy flexibility, regulatory oversight, and investor base. Hedge funds can short, use leverage, and invest globally without strict constraints, whereas mutual funds face limits on leverage and eligible assets.

- Hedge Funds vs. Private Equity differs in liquidity and investment horizon.

- Hedge funds invest in tradable assets with short-term strategies, while private equity focuses on long-term acquisition and restructuring of private companies.

- Each serves different investor needs, and the choice depends on liquidity preference, risk appetite, and return expectations.

Conclusion

Hedge Funds play a vital role in global financial markets by offering sophisticated investment strategies, high return potential, and risk management benefits. Despite their exclusivity, complexity, and inherent risks, hedge funds remain an attractive option for institutions and accredited investors seeking enhanced diversification and superior performance. Understanding how hedge funds work—from their strategies and fee structures to their regulatory environment—is essential for evaluating whether they fit into a broader investment portfolio. As financial technology evolves, hedge funds will continue to innovate, adopt quantitative methodologies, and adapt to new market realities, ensuring their place as a cornerstone of advanced financial management.