Whether you are an experienced trader or a newcomer to the market, you can still make forex trading mistakes. To correct those mistakes, traders need to clearly recognize the shortcomings of those who came before them and build lessons learned for themselves. Below are 8 forex trading mistakes that almost all new traders make.

Top 8 forex trading mistakes beginners make

Trading without a plan

One of the biggest forex trading mistakes is trading without a plan. Many beginners open trades based on gut feeling or hearsay without having a clear entry point, exit point, or desired profit level. For example, they may buy EUR/USD because “they heard it’s going up” without knowing when to sell.

Consequences: Lack of planning makes you easily get carried away by emotions, leading to uncontrolled losses. The forex market is constantly changing, and without a clear strategy, you will quickly lose your way.

Solution: Create a trading plan before you start. This plan should include profit targets, maximum risk, entry and exit points.

Using excess leverage

Leverage is an attractive tool in Forex, allowing you to trade large volumes with small capital. However, many beginners abuse high leverage to maximize profits without understanding that it also amplifies risk. For example, with a $100 account and 1:500 leverage, you can trade a volume equivalent to $50,000, but if the market moves against you by just 0.2%, your account will be “evaporated”.

Consequences: When the market fluctuates strongly, high leverage can easily lead to “burning your account” in just a few minutes.

Solution: Use a safe level of leverage, especially when you are just starting out. A ratio like 1:10 or 1:20 is good to control your risk. Once you have experience and a stable strategy, you can consider increasing it gradually.

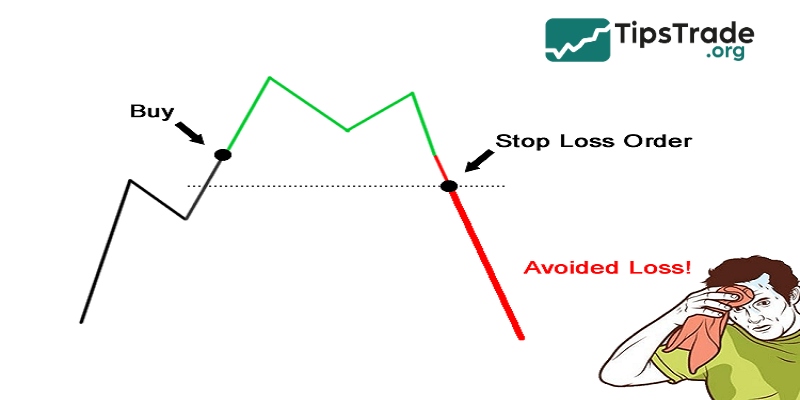

Skipping stop-loss protection

Many newbie traders do not set Stop Loss orders because they believe the market will turn back in their favor. For example, when buying USD/JPY at 110.00 and the price drops to 109.50, they do not cut their losses but hold the position in the hope that the price will rise again.

Consequence: If the market continues to decline, the losses will exceed their tolerance, even wiping out their capital.

Solution: Always set a Stop Loss for every trade. Determine the stop-loss level based on technical analysis (below support levels) or the desired risk ratio (1-2% of the account).

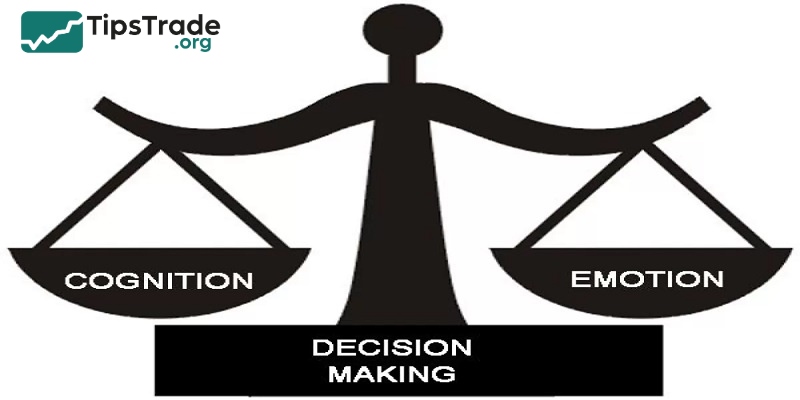

Letting emotions impair decision making

Emotions such as greed for quick profits or fear of losses often influence new traders. For example, when they see the EUR/USD pair rise from 1.1000 to 1.1050, they rush to buy out of fear of “missing the opportunity,” but then the price reverses down to 1.0950.

Consequences: Emotional decisions lead to buying at peaks, selling at troughs, or holding losing positions for too long.

Solution: Maintain discipline by adhering to the trading plan established. If feeling emotionally unstable, take a break from trading to regain composure.

Not understanding market analysis

New traders often overlook the importance of learning technical analysis or fundamental analysis. They may trade without understanding why prices fluctuate, such as when the FED raises interest rates, causing the USD to strengthen.

Consequences: Blind trading decisions without a basis lead to random losses.

Solution: Spend time learning how to read charts and monitor economic calendars. Combine both methods to make more accurate decisions.

Overtrading

Many new traders open dozens of orders every day to “recover losses” or make extra profit, especially after losing a large order.

Consequences: Overtrading increases trading fees (spread), causes exhaustion and lack of focus, leading to poor performance.

Solution: Only trade when there is a clear signal from the analysis. Set a maximum limit (e.g., 2-3 orders/day) to maintain quality over quantity.

Following unverified advice

Some new traders blindly trust signals from social media, chat groups, or self-proclaimed experts without checking the source. For example, they buy the NZD/USD pair just because a Twitter post says “it’s about to rise sharply.”

Consequences: Losses due to a lack of understanding of the market context and the strategy behind that signal.

Solution: Conduct your own research and verify all information. Use a demo account to test signals before applying them to real money.

Testing new strategies on a live account

Many beginners are so eager to make money that they skip the demo account and trade directly with real money. They are not familiar with the platform (such as MT4, MT5) or how the market operates.

Consequences: Rapid financial loss due to lack of practical experience and technical errors.

Solution: Spend at least 1-2 months practicing on a demo account. Consider this a place to familiarize yourself with the interface, test strategies, and build confidence.

Why do beginners easily make Mistakes in Forex?

Why do beginners easily make forex trading mistakes? Lack of basic knowledge is a big problem. New traders often do not understand how the forex market works, from the mechanics of supply and demand to the factors that influence currency prices. For example, they may not know that when the European Central Bank (ECB) cuts interest rates, the euro often falls against the dollar. This lack of understanding leads them to make bad decisions.

Unrealistic expectations also play a role. Many people believe that forex is a way to get rich quickly, investing a few hundred dollars and making thousands in a few weeks. But in reality, even professional traders take years to achieve consistent profits. This unreasonable expectation leads them to take excessive risks and fail.

Crowd psychology has a strong influence on beginners. Social networks and forums often create a feeling of “opportunities everywhere”. When people see others boasting about their profits, they easily get carried away without analyzing the situation themselves. As a result, they blindly copy or trade without a solid foundation.

So, take the time to learn and build a foundation of knowledge. Set realistic goals, like earning 5-10% per month, instead of dreaming of getting rich instantly. Most importantly, develop an independent mindset so you don’t blindly follow the crowd.

How to avoid mistakes and succeed in Forex?

How to avoid forex trading mistakes? To overcome the initial difficulties and achieve success in forex, you need to build the right habits and strategies. These steps will not only help you avoid mistakes but also create a solid foundation.

Building good trading habits is the first step. Keep a trading journal to track and learn from each trade. At the same time, stay disciplined by sticking to your plan and not changing your decisions based on emotions. This will help you maintain consistency and minimize unnecessary risk.

When you start trading, continuous learning is essential. Read specialized books or watch reputable tutorial channels to improve your knowledge. Practice what you have learned on a demo account to test its effectiveness. This not only increases your knowledge but also builds your confidence before trading for real.

Starting small and gradually increasing the size is the safe way. Use a small account to reduce risk when you are starting out. Only increase your capital when you have been making consistent profits for a while. This method allows you to get used to the market without the pressure of large losses.

Lastly, patience is key. Forex is not a quick road, but a long journey that requires perseverance. A combination of good habits, solid knowledge and caution will help you avoid mistakes and go far. Success will come if you do not give up halfway.

Conclusion

The Forex market is not only a place to test your ability to make money but also a test of your patience and discipline. Common forex trading mistakes can be corrected if you understand the reasons behind them and apply the right solutions. By continuously learning, starting with small steps, and maintaining an independent mindset, you will gradually overcome the initial challenges.