In the volatile foreign exchange market, having an effective Forex strategy is the key to success. This strategy not only helps you identify potential trading opportunities but also supports you in making informed trading decisions, optimizing profits, and minimizing risks. Let’s explore the most popular Forex trading strategies today with Tipstrade.org, from which you can find the method that best suits your trading style and goals.

What is a forex strategy?

Forex strategy is a systematic trading plan that helps you clearly identify when to enter and exit trades, as well as manage risk consistently. This strategy is not based on intuition but is built on specific principles that can be verified through real data. Each strategy is suitable for different trading styles (short-term or long-term) depending on time, capital, and personal goals.

>>Read more:

- What is Forex? The Complete Guide for Beginners

- What is forex trading? A detailed guide to forex trading from A – Z

- What is Pip in Forex? Accurate calculation guide for traders

- Essential Forex Orders every trader must know

Key elements of an effective forex strategy

An effective Forex strategy must meet the following criteria:

- Accurate market prediction: The strategy must be based on thorough analysis to reliably predict market trends.

- Profit optimization: The strategy should help traders generate stable and sustainable profits.

- Risk control: The strategy must include measures to control risks, minimizing potential losses.

To build an effective forex strategy, you need to consider the following factors:

- Choose a currency pair: Select a currency pair that you are interested in and understand well.

- Determine lot size: Identify a trading volume that is suitable for your financial capacity and risk tolerance.

- Set a stop-loss point: A stop-loss is a price level at which you will automatically exit a trade to limit losses.

- Develop a trading strategy: A trading strategy needs to clearly define the rules for entering and exiting trades, as well as for capital and risk management.

Top 10 effective forex strategies for beginners

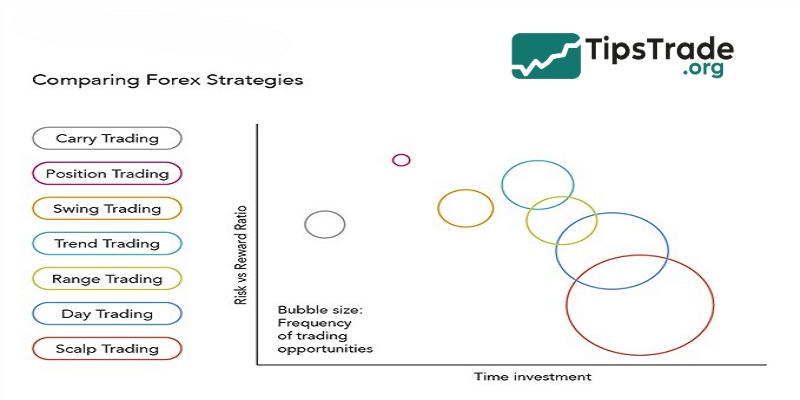

In the forex market, there is no single strategy that works best for everyone; rather, the most effective strategy is the one that suits each individual. Below is a summary table of effective forex strategies:

|

Trading Strategy |

Holding Time |

Suitable For |

|

Scalping |

A few seconds – minutes |

Traders who prefer fast-paced trading with multiple orders |

|

Day Trading |

Within the day |

Those who have time to monitor the market |

|

Swing Trading |

Several days – weeks |

Working individuals who cannot sit at the screen continuously |

|

Position Trading |

Several weeks – months |

Long-term traders who place fewer trades |

|

Trend Trading |

Depends on the trend |

Traders who prefer following clear market trends |

|

Price Action |

Depends on the timeframe |

Traders who focus on understanding market behavior |

|

Range Trading |

A few hours – days |

Traders who operate in sideways markets |

|

News Trading |

Very short or a few hours |

Traders who capitalize on market reactions to news |

|

Hedging |

Depends on market conditions |

Traders who want to hedge against risks |

After reviewing the summary table of effective forex strategies above, you can continue exploring each strategy in detail below.

Scalping

Scalping is a style for traders who prefer quick trading, entering and exiting positions in just a few seconds or minutes. The goal of scalping is to accumulate small profits from many trades throughout the day.

Advantages:

- Take advantage of many trading opportunities during the day

- Quick profits if the market is favorable

- Limit news risks by not holding positions for long

Disadvantages:

- High risk due to the fast-paced nature of trading

- Significant psychological pressure, easy to lose control

- Requires a platform with low costs due to frequent trading

Day Trading

Day trading is an effective short-term trading strategy where traders open and close positions within the same day, without holding positions overnight. This strategy often relies on technical analysis, price patterns, and short-term news to find precise entry points.

Advantages:

- Reduces swap fees by not holding positions overnight

- Can take advantage of daily fluctuations to generate profits

- Does not require large capital like long-term trading

Disadvantages:

- Requires a lot of time for continuous monitoring throughout the day

- Easily affected by unexpected news fluctuations

- May require market analysis skills and quick decision-making

Swing Trading

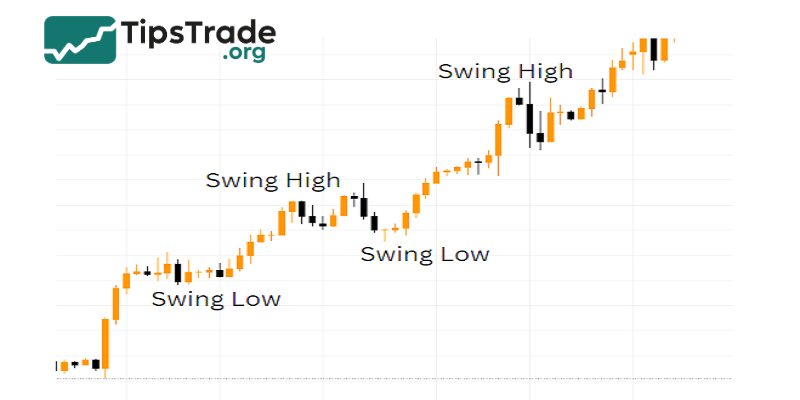

Swing trading is an effective medium-term forex strategy, in which traders hold positions for several days to weeks to take advantage of price fluctuations that occur. This strategy often relies on technical analysis to identify trends and potential entry points, while also observing price behavior at important price levels on the chart.

Advantages:

- No need to constantly monitor the market

- Requires less time, suitable for working individuals with busy schedules

- Can take advantage of large price waves, high profit potential

Disadvantages:

- Requires patience and a strong mindset to hold positions for a long time

- Easily influenced by news if risk management is not handled well

- Additional costs may arise due to overnight fees

Position Trading

Position Trading is a long-term trading strategy where traders hold positions for several weeks to several months, or even longer. Traders often base their decisions on long-term trend analysis and long-term macroeconomic factors.

Advantages:

- Less affected by short-term fluctuations

- No need to monitor the market every day

- Suitable for long-term investment style

Disadvantages:

- Requires a long time to achieve profit goals

- Difficult to maintain composure when the market temporarily goes against

- Highly dependent on fundamental factors

Trend Trading

Trend Trading is a forex strategy based on identifying and trading according to the main market trend – either upward or downward. Traders will hold their positions until there are signs of the trend ending, rather than taking profits early. This strategy often combines with simple technical analysis methods.

Advantages:

- Potential profits when the market has a clear trend

- No need for continuous trading

- Easy to combine with many other analysis tools

Disadvantages:

- Ineffective when the market is sideways

- May enter trades late if the trend is not recognized in time

- Requires time to monitor and confirm a clear trend

Price Action

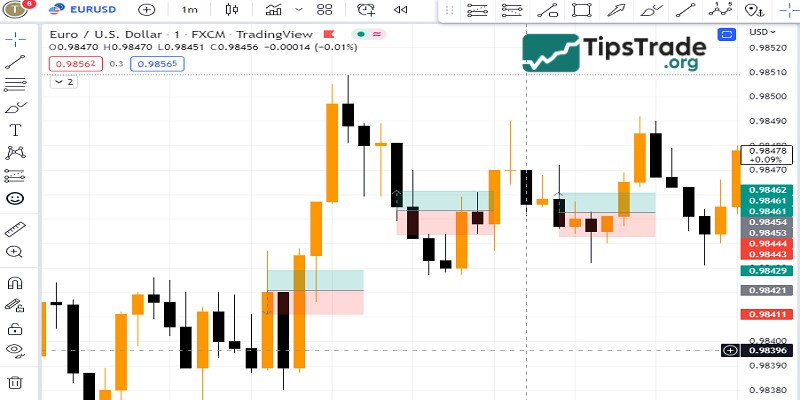

Price Action relates to the analysis of price movements of currency pairs, without relying on complex technical indicators. Traders use candlestick patterns, support and resistance zones, and price structures to determine entry and exit points.

Advantages:

- Simple in the process of analyzing transactions

- Does not rely on other complex technical indicators

- Helps improve the ability to read charts and grasp market psychology

Disadvantages:

- Requires practice time to accurately read price behavior

- Cannot automate trading

- Price Action is subjective

Range Trading

Range Trading is used when the market does not have a clear trend and fluctuates within a certain price range. Traders will buy at the support level and sell at the resistance level, aiming to take advantage of the repeated price movements in a sideways market. This strategy is particularly evident in markets with a stable and predictable economy.

Advantages:

- Easy to apply, especially for beginners

- Limited risk

- Clear entry and exit points

Disadvantages:

- Ineffective when the market starts trending

- Requires accurate identification of entry and exit points

- Demands quick decision-making

News Trading

News Trading is a trading strategy based on important news related to the forex market. This strategy takes advantage of the strong market volatility immediately after significant economic news is released, such as interest rates, non-farm payrolls (NFP), or inflation data. Traders often enter positions quickly based on expectations before the news is released and react to the actual outcome after the news is published.

Advantages:

- Can generate profits in a very short time

- Effectively take advantage of strong volatility moments

- Focus only on news events

Disadvantages:

- Strong volatility can easily cause slippage and widen spreads

- Difficult to control risk if lacking experience

- Need to regularly monitor the economic calendar and react very quickly

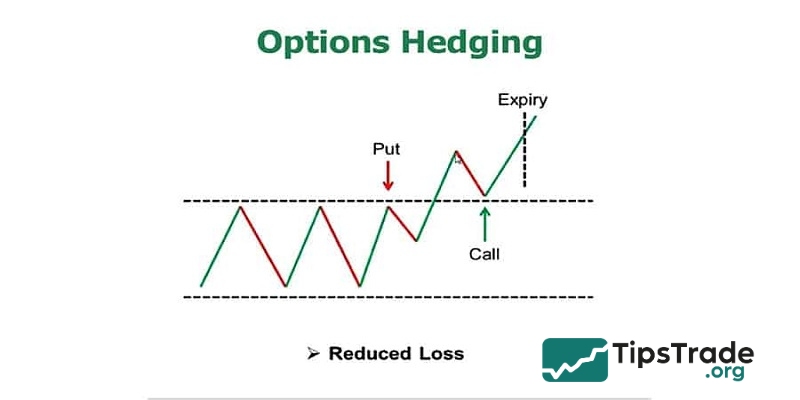

Hedging

Hedging is used to mitigate risk by opening opposing positions (buying and selling simultaneously) to minimize losses when the market fluctuates significantly. The main goal of hedging is not to maximize profits, but to protect capital in unpredictable situations – especially when there is major news or the market unexpectedly reverses.

Advantages:

- Minimizes risk when the market moves against expectations

- Maintains profitable positions while still hedging risk

- Hedging offers many flexible methods to choose from

Disadvantages:

- May incur additional costs

- Complex and requires specialized knowledge

- Some exchanges do not allow opening opposing positions in the same currency pair

Which effective forex strategy is suitable for you?

Each trader has their own trading style and goals. Therefore, choosing an effective forex strategy should be based on personal time, personality, and experience. Here are some suggestions to help you identify the most suitable strategy:

- Scalping is a suitable choice for those who often sit at the computer and want to practice quick processing skills in the market.

- Day Trading is a strategy suitable for part-time or full-time traders who can focus and respond promptly to market developments.

- Swing Trading is a reasonable choice for traders who enjoy a balance between trading time and profit potential.

- Position Trading is suitable for patient traders who have a macro perspective and do not want to be caught up in daily short-term fluctuations.

- Trend Trading is suitable for those who want to trade safely, closely following the main trend to increase the chances of success.

- Price Action is suitable for traders who focus on understanding the market rather than chasing signals from technical indicators.

- Range Trading is suitable for traders who enjoy stability and trading based on clear scenarios in sideways market conditions.

- News Trading is a suitable choice for traders with experience who understand how the market reacts to economic data.

- Hedging is suitable for experienced traders who want to protect their accounts in unpredictable market conditions while still maintaining their current positions.

Note when applying effective forex strategies

Here are some important points to remember when choosing and applying a forex strategy:

- Before selecting a strategy, you need to take the time to thoroughly research the different types of strategies.

- Test on a demo account to evaluate the performance of the strategy in a risk-free environment.

- Assess the time frame that best suits your trading style.

- Don’t rush to change your strategy just because you encounter a few losing trades.

- Choose a strategy that aligns with your risk tolerance.

Conclusion

In general, each forex strategy has its own advantages, suitable for different styles and personal goals. The article above has shared an overview of effective forex trading strategies, helping you choose the right strategy. Hopefully, this information will support you to feel more confident on your trading journey.

Read more: