In the foreign exchange market, forex risk limits are always considered a “vital” factor to help traders preserve capital and improve trading efficiency. Accordingly, no matter how good a trading strategy is, if it lacks risk management principles, traders can easily fall into big losses. So, how to effectively limit Forex risks? Let’s find out the details with Tipstrade.org through the following article!

What is the risk limit in forex?

Forex risk limits is the pre-determining of the maximum loss that a trader accepts for each transaction or in a certain period of time (day, week, month). This is an important capital management principle to help traders control losses and protect their accounts from the risk of “burning” capital.

In the Forex market, exchange rates fluctuate constantly and are unpredictable. Without a forex risk limitation plan, traders can easily fall into a state of uncontrolled trading, leading to large losses after just a few wrong orders. Therefore, limiting forex risk not only helps maintain the safety of your account but also creates a foundation for long-term development.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Top 10 best forex currency pairs to trade in 2025

- Top 8 Forex Trading Mistakes Beginners Make & How To Avoid Them

- Forex strategy: Top 10 most effective strategies for beginners

The importance of forex risk limits in trading

For forex traders, forex risk limits plays a particularly important role as follows:

- Capital preservation – The trader’s top goal is not to make a lot of money immediately, but to keep capital to be able to survive long-term in the market.

- Psychological stability – Once the maximum loss level is determined, traders will worry less and make more informed decisions.

- Planned trading – Risk limits force traders to strictly adhere to their trading strategies and have discipline, thereby avoiding making emotional decisions.

- Accumulate sustainable profits – By limiting large losses, traders have the opportunity to increase capital gradually and more stably in the long term.

Major elements affecting risk levels in forex

Traders will be able to build more effective and solid trading strategies once they understand the factors that affect the level of risk in Forex:

Leverage

In forex trading, leverage is like a double-edged sword. Accordingly, it can help traders double profits, but at the same time, it can also increase losses rapidly. For example, with a leverage of 100:1, a small fluctuation in the market is enough to cause you to suffer significant losses if you do not have a suitable forex risk limiting strategy.

Liquidity

The Forex market is known for its high liquidity. This allows traders to enter and exit positions quickly. However, not all Forex currency pairs have the same level of liquidity. If you choose less popular currency pairs, you may have difficulty getting your orders filled at the right price, increasing your risk of unwanted risks.

Trading habits

Some common dangerous trading habits often found in traders, especially newbies, are: trading without a clear plan, not using stop-loss orders, or hoping the market will “turn around” when losing,… These are the root causes of your trading failures because you do not know how to limit forex risks at the right time.

How to set effective forex risk limits

To trade forex effectively and survive in this market for a long time, traders need to have methods to reasonably forex risk limits. Thereby minimizing risks and protecting their investment capital. Below are valuable experiences for you:

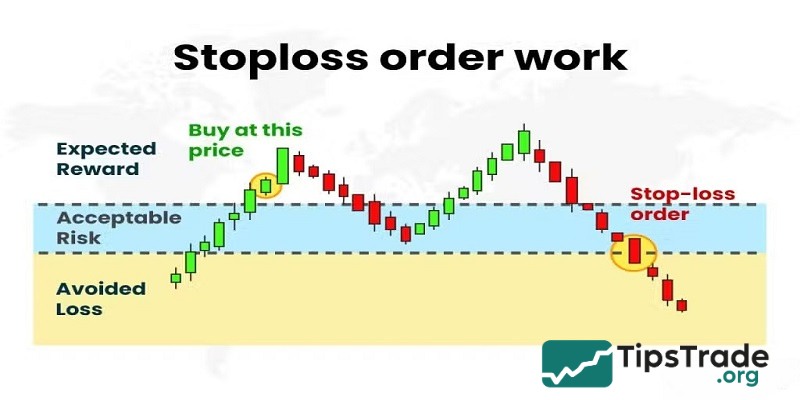

Always use Stop Loss orders

To effectively limit forex risks, the Stop Loss order is an indispensable and effective tool. For those who do not know, this order helps traders automatically close orders at a certain loss level, avoiding being swept away by emotions.

- For example, let’s say a trader enters a Buy order on the EUR/USD pair at 1.1000 and sets a stop loss at 1.0950, then the risk you face is 50 pips.

- In the case of trading 1 mini lot (1 pip = 1 USD), the risk level is 50$. This is a specific number, easy to control.

Determine the risk level per trade

Apply a common rule that: you should only risk a maximum of 2% of your capital per trade.

- For example, with a $5,000 account, the maximum risk a trader should set is $100 per order.

- By doing so, even if you lose several orders in a row, your account still has a certain amount of capital to maintain long-term trading activities.

Know the Risk/Reward ratio

Traders should only trade when the Risk/Reward ratio is at least 2:1. To put it simply, if you accept a loss of $50, then your profit target should be $100 or more. By calculating the Risk/Reward ratio correctly, traders will be able to filter out potential trading opportunities and limit forex risks logically.

Choose the appropriate trading volume

Many traders have the misconception that trading with large volumes is really effective. This is not 100% true. For example, if the risk per trade is 50 pips, you should determine the order volume so that the total risk does not exceed 2% of the investment capital.

Advice:Traders can use the position size calculator to determine the number of lots that are appropriate for the level of risk they can tolerate.

Move Stop Loss to break-even point when profit is reached

Once a position has started to gain, the trader can move the stop loss to breakeven or higher. This is a proactive risk management strategy that protects the results while maintaining profit potential.

Frequently asked questions about forex risk limits

What percentage of capital should forex risk limits be set at?

Most experts recommend not risking more than 1-2% of your capital per trade. For example, if your account has $100,000, your risk per trade should be between $100-200. This will help you avoid large losses and give you enough “room” to recover from a losing streak.

Is it okay to trade without stop-loss?

No. Stop Loss is a mandatory tool to forex risk limits. It helps traders automatically cut orders when the price goes against their prediction, avoiding losses beyond control. Professional traders always place stop loss as soon as they open an order and never remove it just because they hope the market will reverse.

Do forex risk limits change across currency pairs?

Yes, because the volatility of each currency pair is different. For example:

- Currency pairs like GBP/JPY or XAU/USD are generally more volatile than EUR/USD.

- Traders should proactively reduce trading volume or increase Stop Loss distance for volatile currency pairs to ensure that total risk does not exceed the allowable level.

How to determine entry points that fit your risk levels?

Traders can use one of the following methods:

- Technical analysis to identify resistance/support levels or price patterns.

- Calculate the distance from the entry point to the stop loss

- Use the position size calculator to ensure the risk level is correct at 1-2% of capital.

In case the entry point does not allow the trader to place a reasonable stop loss while keeping the risk low, it is best not to trade that order.

Is there any tool to support risk management?

Regarding tools and software to support traders in limiting forex risks, there are many types on the market today such as:

- Position Size Calculator (Myfxbook, BabyPips…)

- Trade Journal (Edgewonk, Tradervue…)

- Risk Management Scripts trên MT4/MT5

In short, forex risk limits are not only a necessary skill but also a smart trading habit that helps traders survive and succeed in the market. By applying capital management tools, setting reasonable stop losses and maintaining trading discipline, you will minimize risks and maximize profit opportunities. This is the key to sustainable and long-term forex trading. Good luck!