Identifying the correct forex influencing factors will provide a basis for investors to make more informed choices. So, which factors are worth paying attention to, and why do they affect the foreign exchange market? Follow this article from Tipstrade.org to find out more detailed information!

Major Forex Influencing Factors

Central Bank Monetary Policy

The central bank of each country plays a key role in managing monetary policy, which directly affects the value of its currency. Decisions such as changing interest rates, buying or selling government bonds, and implementing quantitative easing can all cause fluctuations in the foreign exchange market.

- Interest Rates: When a central bank raises interest rates, the country’s currency typically becomes more attractive to foreign traders due to higher returns. This often leads to an appreciation of the currency. Conversely, lowering interest rates generally decreases the currency’s value.

- Monetary Easing or Tightening Policies: Expansionary monetary policies (printing more money or lowering interest rates) usually weaken the national currency, while tightening policies (reducing money supply or raising interest rates) can strengthen it.

For example, the U.S. Federal Reserve (Fed) frequently makes decisions regarding interest rates and monetary policy, each of which has a significant impact on the value of the U.S. dollar against other currencies.

>>See more:

- What is Forex? The Complete Guide for Beginners

- The Impact of Central Bank vs Forex – Understand to Invest Effectively

- Interest rate forex impact: How it affects currency value

- Important Economic Indexes Every Trader Needs To Know

Economic Growth and Economic Indicators

A country’s economic performance is one of the most important factors influencing exchange rates. Traders often closely monitor economic indicators to assess the health of an economy and make investment decisions.

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country. An economy with strong GDP growth is often associated with a stronger currency.

- Inflation Rate: High inflation typically erodes the purchasing power of a currency, thereby reducing its value in the foreign exchange market. Conversely, low or stable inflation usually supports the currency’s value.

- Unemployment Rate: An economy with a low unemployment rate is generally viewed as stable and well-developed, which can contribute to a stronger currency.

- Trade Balance: If a country exports more than it imports (a trade surplus), demand for its currency tends to rise, helping to increase its value.

Political and Geopolitical Events

Politics and geopolitics are unpredictable factors that can have a powerful impact on the foreign exchange market. Events such as elections, government changes, or military conflicts can all trigger significant volatility.

- Elections and Government Policies: An election can create uncertainty about future economic policies. If a candidate with economic views unfavorable to the market wins, the national currency may depreciate.

- Conflicts and Crises: Military conflicts or political crises often drive investors toward safe-haven assets such as gold or the U.S. dollar, thereby influencing exchange rates.

- Trade Agreements: The signing or termination of trade agreements can also greatly affect a currency’s value, as they directly influence trade flows between countries.

For example, the Brexit event led to a prolonged and sharp decline in the British pound (GBP) against the USD and the EUR.

Market Sentiment and Speculation

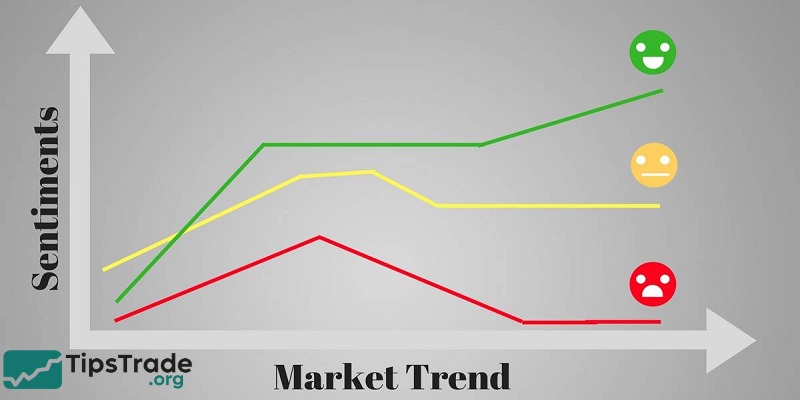

Market sentiment plays a crucial role in shaping short-term exchange rate trends. Investors’ expectations and emotions can lead to herd behavior or speculative trading.

- Risk Sentiment: When risk sentiment in the market rises (due to economic or political instability), investors often move toward safe-haven assets such as the USD, CHF (Swiss franc), or JPY (Japanese yen). Conversely, when risk sentiment declines, they tend to invest in higher-risk assets such as stocks or emerging market currencies.

- Speculation: Professional forex traders often rely on technical analysis and news to forecast exchange rate movements. Such speculative activities can increase market volatility.

International Commodity Prices

For countries that rely heavily on commodity exports such as oil, gold, or agricultural products, international commodity prices have a significant impact on their currency values.

- Oil Prices: Major oil-exporting countries such as Russia or Saudi Arabia often see their currencies appreciate when oil prices rise and depreciate when oil prices fall.

- Gold Prices: Gold is considered a safe-haven asset during times of economic uncertainty. When gold prices increase, currencies linked to gold, such as the AUD (Australian dollar) or ZAR (South African rand), also tend to benefit.

Other Global Factors

In addition to the factors mentioned above, there are several other global elements that influence the foreign exchange market:

- Global Financial Crises: A major financial crisis can lead to the collapse of weaker currencies while strengthening stronger ones.

- Pandemics and Natural Disasters: The COVID-19 pandemic is a prime example of how a global event can disrupt the forex market.

- International Capital Flows: When investment capital flows into a country due to attractive opportunities, demand for its currency increases, thereby boosting its value.

Why Traders Should Pay Attention to Forex Influencing Factors

Paying attention to the forex influencing factors is essential for any trader, because:

- Forex is strongly impacted by many economic and political variables

Currency exchange rates are not only determined by supply and demand but are also influenced by interest rates, inflation, monetary policy, geopolitical news, and even investor sentiment. Ignoring these factors can easily lead to poor trading decisions.

- More effective risk management

Understanding which events can trigger strong market volatility (e.g., Non-Farm Payrolls release, Fed interest rate decisions) allows traders to adjust position sizes and place stop-loss orders wisely to reduce risks.

- Better trading opportunities

Macroeconomic factors and news events can create large market movements in a short time. If anticipated correctly, traders can take advantage of these opportunities instead of being caught off guard.

- Building a sustainable long-term strategy

Observing global economic and political trends helps traders shape long-term strategies rather than chasing short-term moves without a solid basis.

In short, forex influencing factors are like the “weather map” of the market. Those who understand this map will know when to “set sail” (enter trades) and when to “anchor” (stay out).

Conclusion

In the article above, Tipstrade.org has provided you with detailed information about forex influencing factors. We hope that investors will gain more knowledge and accumulate lessons about Forex to invest more effectively. Wishing you successful trading!

See more: