After choosing a reputable Forex broker to trade with, the next important step you need to take is to open a forex account. Different brokers will offer different types of trading accounts. So, how many types of forex accounts are there? Which Forex account is best for you? Let’s explore the common types of forex trading accounts together!

What is a forex account?

Forex, or the foreign exchange market, is where different currencies are bought and sold. To participate in this market, one of the most important factors is opening a forex account.

A Forex account is considered a bridge between the trader and the foreign exchange market. Furthermore, this is also a tool to help you manage risk. And apply your strategy and monitor your trading activity.

Forex accounts can be opened with regulated brokers or financial institutions. They facilitate currency transactions. For profit or risk prevention purposes.

>>See more:

- List of Top forex brokers in 2025 – Most Trusted and Reliable

- Learn Forex – Beginner’s Guide to Start Trading Successfully

- Revealing 5 Tips To Forex Account Protection Safe For Traders

- Top 10 best forex currency pairs to trade in 2025

Types of forex accounts

There are many types of forex accounts, each with a specific purpose that can serve the trader. Here are the common types of forex accounts today:

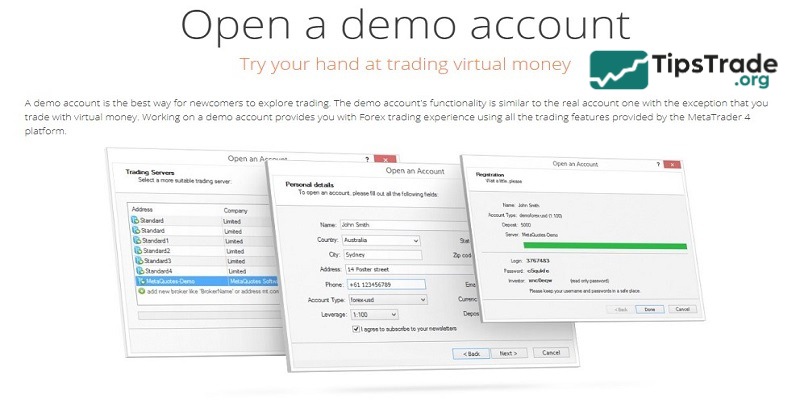

Demo account

Demo Forex account is a risk-free account. Because it helps beginners and experienced traders have the opportunity to practice trading in a real environment. The only point of a Demo account is that you will not be able to withdraw money. In other words, the profits you trade are virtual profits.

This will help you get familiar with the trading platform. It will also help you grasp the necessary knowledge and skills. With a Demo account, you can try out trading strategies, technical analysis and even fundamental analysis without facing financial risks.

CENT account

CENT account is a popular type of Forex account, specially designed for beginners to help them get used to the real market.

This account places orders using an account that is calculated in Cents, not USD. Therefore, winning and losing orders, including spread fees, are calculated in Cents. This helps to minimize the risks that may be encountered and can participate in real forex trading with a fairly modest capital. According to the conversion, 1 USD will be equivalent to 100 Cents. So when you deposit 15 USD into your account, the amount displayed will be 1500 Cents.

Standard account

The Standard account is the most popular type of forex account. It is the choice of many traders. It offers access to standard market liquidity and often comes with competitive spreads.

This account type will be calculated in USD. The Standard account has full features and analytical tools. It provides a diverse and flexible trading environment. Suitable for many different trading strategies.

This account offers standard trading conditions with typical contract (lot) sizes and leverage. Traders can trade standard lot sizes which typically represent 100,000 units of the base currency.

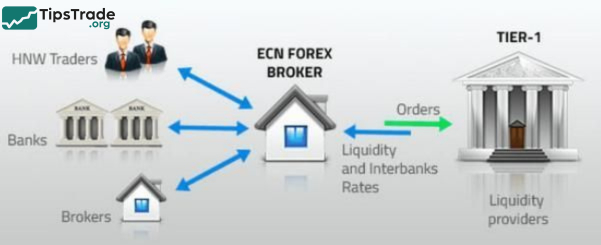

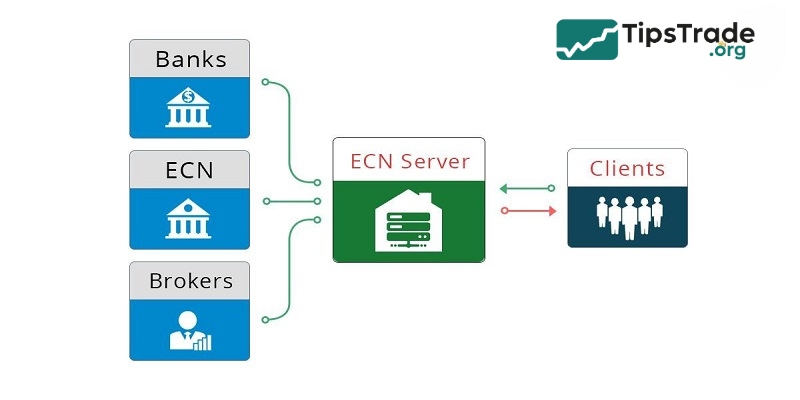

ECN account

ECN stands for Electronic Communication Network. This is a type of Forex account suitable for professional traders with many years of experience in the Forex market. Because ECN accounts often require a high minimum deposit, at least $300 or more to make a transaction. Moreover, it also offers low leverage, the highest is only 1:1000 and usually 1:300 to 1:500. And requires traders to pay a commission fee, usually 7 USD/lot.

ECN accounts use technologies that help users participate and combine liquidity sources into a centralized system. Therefore, this type of account has a transparent, easy to understand and fast pricing environment that will be established when the bid is reasonable.

Islamic account

An Islamic Forex account is a legal Islamic trading account for Muslims who want to invest. Since this is an account created in Islamic countries, the trading conditions are different from other types of accounts:

- No overnight fees or other interest charges.

- Islamic account trading orders will be executed immediately after order execution.

- Islamic law prohibits gambling but Forex trading is not classified as gambling.

Pro/VIP account

Pro/VIP account is an upgraded version of Standard account. It is guaranteed to support better trading conditions. This account is for professional traders and traders with large trading needs.

This type of account usually requires a fairly large minimum deposit, from 10,000 USD or more. However, you will receive many VIP services from the exchange such as personal account management, exclusive market analysis and even consulting services.

Other special accounts

In the Forex market, in addition to the above account types, there are also a number of other special accounts. To suit the targeted customer segments. For example, other special accounts such as PAMM accounts, CopyTrade accounts and many other types.

Advantages and disadvantages of a forex account

The allure of high potential returns and the flexibility of trading 24/5 makes forex trading an attractive investment option. However, like any financial investment channel, forex trading has its own advantages and disadvantages. Here are the main advantages and disadvantages of a forex account:

Advantages of a forex account

- Accessibility: The forex market is open 24/5. This allows traders to participate at any time that suits them. This flexibility is especially attractive to individuals who have day jobs.

- Liquidity: It is the most liquid market in the world, with trillions of dollars traded daily. High liquidity makes it easy for traders to enter and exit trading positions without affecting the price.

- Leverage: Forex trading accounts offer leverage. This allows traders to control larger positions with less capital. While leverage can increase profits, it also increases the risk of loss. Traders must be cautious when using leverage and have a solid risk management strategy in place.

- Various trading tools: Forex trading accounts provide access to a wide range of currency pairs. To allow traders to diversify their portfolios and take advantage of global economic trends.

Disadvantages of a forex trading accounts

- High volatility: While volatility can provide lucrative trading opportunities, it also increases the risk of significant losses. The forex market is known for its fast-paced and unpredictable nature. Therefore, it is advisable to have an understanding of technical and fundamental analysis.

- Emotional stress: Forex trading can be emotionally taxing, especially during times of market turmoil. Traders may experience fear, greed, and anxiety, which can lead to impulsive trading decisions.

- Risk of financial loss: Forex trading carries a high level of risk. Traders may lose a significant portion or even all of their invested capital. It is essential that traders understand risk management techniques.

- Market manipulation: Since the forex market is susceptible to manipulation, traders must be vigilant and informed.

Which forex account should you choose to open?

Choosing the right forex account type depends on your trading style and goals.

- If you’re a beginner, a demo account or a cent account might be the best option for you.

- If you are an experienced trader, a standard or ECN account may be more suitable.

- Managed accounts and Islamic accounts are options for investors with specific needs or preferences.

Important notes when opening a forex account

- Choose a reputable platform: Prioritize platforms licensed by international financial authorities such as the FCA, ASIC, CySEC, etc.

- Check transaction costs: Including spread, commission, swap fees, etc.

- Check the trading platform: Does MT4, MT5, or cTrader support you?

- Customer support: Multilingual support, 24/7 transactions, easy withdrawals…

Conclusion

In summary, a forex account is a financial account that allows individuals or businesses to participate in the forex market. They provide access to trade different currency pairs. Furthermore, forex accounts offer various costs such as leverage, spreads, and overnight fees. It is essential to research and compare different forex brokers and their account services before opening the right type of forex account. Hopefully, traders can choose a forex account type that suits them.