Foreign exchange trading, often called forex trading, is the process of buying and selling currencies on a global market. It involves exchanging one currency for another in pairs, such as EUR/USD, where traders speculate on the value fluctuations between two currencies. This market is the largest and most liquid financial market in the world, operating 24 hours a day, five days a week, across major financial centers globally. Forex trading allows participants—from individual retail traders to large institutions—to profit from the changes in exchange rates while also serving as a vital mechanism for international trade and investment hedging. The decentralized nature and high liquidity make forex a unique and dynamic market for investors worldwide.

What Is Foreign Exchange Trading?

At its core, foreign exchange trading involves exchanging one currency for another at agreed prices.

Traders speculate on whether a currency will strengthen or weaken relative to another. For example, if a trader believes the euro will rise against the U.S. dollar, they buy EUR/USD.

Unlike centralized exchanges, forex operates over the counter (OTC) through electronic networks, connecting banks, brokers, corporations, and individual traders worldwide.

This decentralized structure allows unparalleled flexibility and liquidity.

The forex market serves various purposes:

- International trade: Businesses exchange currencies to pay for goods and services.

- Hedging: Corporations and investors manage risk from currency fluctuations.

- Speculation: Traders profit from price movements by buying low and selling high.

This mix of participants ensures constant activity, making forex both dynamic and unpredictable.

Major Currency Pairs & Crosses

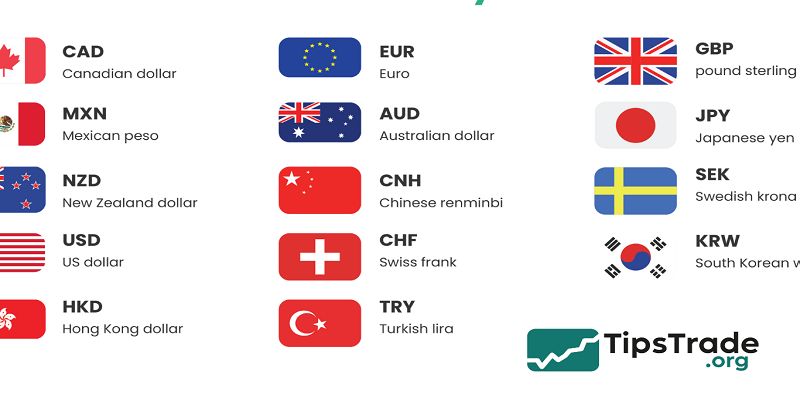

Currencies are traded in pairs, such as EUR/USD or GBP/JPY, where one is the base and the other is the quote. Traders focus on three main categories:

- Major pairs: The most traded, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF. They involve the U.S. dollar and account for over 80% of forex volume.

- Minor pairs: Currency pairs without the U.S. dollar, such as EUR/GBP or AUD/JPY.

- Exotic pairs: A major currency paired with one from an emerging economy, like USD/TRY (Turkish lira) or USD/ZAR (South African rand).

Each category comes with unique liquidity and volatility characteristics.

For example, EUR/USD typically has lower spreads due to high trading volume, while exotic pairs carry wider spreads but offer higher volatility. Traders often start with majors before exploring minors and exotics.

How Forex Prices Are Quoted (Bid, Ask, Spread)

In forex trading, prices are quoted with two numbers: bid (the price at which you sell) and ask (the price at which you buy). The difference between them is called the spread, which represents transaction costs and broker profits.

For instance, if EUR/USD is quoted as 1.1000/1.1003, the bid is 1.1000 and the ask is 1.1003. The spread is 3 pips (percentage in points).

Key concepts traders must know:

- Pip: The smallest unit of currency movement (usually 0.0001 for most pairs).

- Lot size: The standardized trade size (1 standard lot = 100,000 units of currency).

- Leverage: Allows traders to control larger positions with smaller capital but increases risk.

Understanding these basics ensures that traders know the real costs of trading and can evaluate broker competitiveness.

How to Get Started in Foreign Exchange Trading

Choosing a Reputable Forex Broker

The first step in forex trading is selecting a trusted broker. Since forex is decentralized, brokers act as gateways to the market. A reliable broker ensures transparency, fair execution, and security of funds.

Criteria for choosing a broker:

- Regulation: Look for brokers licensed by authorities such as the FCA (UK), ASIC (Australia), or NFA/CFTC (USA).

- Trading costs: Spreads, commissions, and overnight swaps.

- Platforms offered: MetaTrader 4/5, cTrader, or proprietary apps.

- Deposit & withdrawal methods: Speed, fees, and accessibility.

- Customer support: 24/7 multilingual support is vital.

Many traders share experiences on forums such as Forex Factory, emphasizing that regulated brokers not only protect against fraud but also provide more reliable trading conditions.

Opening an Account: Demo vs Live

Brokers typically offer two types of accounts: demo and live.

- Demo accounts: Allow traders to practice with virtual money in real market conditions. This is invaluable for beginners testing strategies without risk.

- Live accounts: Require a deposit of real funds. They offer authentic trading experience, including emotional pressure and risk management.

A practical approach is to begin with demo trading for at least 1–3 months. Once confident, traders can open a live account with small capital, gradually scaling as they gain consistency.

Tip: Many successful traders stress that discipline learned in demo trading must be carried over to live trading, where real money and emotions come into play.

Understanding Leverage and Margin

Leverage is a double-edged sword in forex. It allows traders to open larger positions with less capital. For instance, a leverage ratio of 1:100 means you can control $100,000 with just $1,000.

However, leverage magnifies both profits and losses. Regulatory bodies limit leverage for retail traders to reduce risks:

- ESMA (EU) caps leverage at 1:30.

- ASIC (Australia) limits to 1:30.

- NFA (USA) allows up to 1:50.

Margin refers to the collateral required to open and maintain leveraged trades. If account equity falls below a broker’s requirement, a margin call may force positions to close.

Effective traders use leverage conservatively, often risking only 1–2% of account equity per trade. This ensures sustainability during volatile market swings.

Key Strategies in Forex Trading

Technical Analysis Strategies

Technical analysis focuses on price charts and indicators to forecast future movements. Popular approaches include:

- Trend following: Using moving averages to identify market direction.

- Breakout trading: Entering trades when prices move beyond support/resistance.

- Range trading: Profiting within sideways markets using oscillators like RSI.

- Scalping: Executing many small trades for incremental gains.

For example, a trader may use a 50-day and 200-day moving average crossover to identify bullish or bearish signals. According to research by the CFA Institute, trend-following remains one of the most widely applied strategies across financial markets, including forex.

Fundamental Analysis Strategies

Fundamental analysis evaluates currencies based on economic, political, and financial factors. Key indicators include GDP, unemployment, inflation, and central bank policies.

Examples:

- A strong U.S. jobs report (Non-Farm Payrolls) often boosts the dollar.

- Rising inflation may push central banks to raise rates, strengthening the currency.

Long-term investors combine macroeconomic trends with sentiment analysis. For instance, during the 2008 financial crisis, traders flocked to safe-haven currencies like the Swiss franc, reflecting how fundamentals influence demand.

Hybrid & Algorithmic Approaches

- Modern traders often combine technical and fundamental analysis to refine decision-making.

- For example, they may use technical charts to identify entry points but rely on fundamental news for confirmation.

- Additionally, algorithmic trading and expert advisors (EAs) have become popular. These systems automate strategies based on pre-programmed rules, reducing emotional influence.

- Hedge funds and institutional investors increasingly use AI and machine learning to predict currency trends.

While automation offers efficiency, traders must regularly test strategies against historical data (backtesting) and adapt to changing conditions. Blind reliance on algorithms without oversight can lead to unexpected losses.

Risk Management & Psychological Factors

Forex trading is as much about psychology as it is about analysis. Many traders fail not because of strategy but due to poor risk control.

Core principles of risk management:

- Limit risk per trade to 1–2% of account balance.

- Use stop-loss and take-profit orders.

- Diversify across multiple currency pairs.

- Avoid overleveraging.

Equally important is emotional discipline. Fear and greed often lead traders to abandon strategies, overtrade, or chase losses.

Research by the Journal of Behavioral Finance shows that cognitive biases play a significant role in trading failures.

Experienced traders recommend keeping a trading journal to track decisions, emotions, and outcomes. Over time, this builds consistency and resilience.

Advanced Concepts & Techniques

Arbitrage & Covered Interest Arbitrage

- Arbitrage in forex involves exploiting price discrepancies between different brokers or markets.

- For example, triangular arbitrage leverages differences among three currency pairs to lock in risk-free profit.

- Covered interest arbitrage occurs when traders use forward contracts to exploit interest rate differentials while hedging exchange rate risk.

- Although opportunities are rare due to advanced technology and high competition, arbitrage ensures market efficiency.

Predictive Models & Machine Learning

- The rise of AI has introduced new possibilities in forex forecasting. Models like ARIMA (AutoRegressive Integrated Moving Average) and LSTM (Long Short-Term Memory neural networks) are applied to predict exchange rates.

- While academic studies (e.g., papers published in Elsevier and IEEE journals) show promising results, practical application remains challenging due to market complexity and sudden geopolitical events.

- Traders must view machine learning tools as complementary, not foolproof.

Market Structure & Microstructure

- The forex market’s microstructure explains how trades are executed, spreads are set, and liquidity is provided.

- Unlike stock exchanges, forex operates OTC, relying on market makers and interbank networks.

- Events like the 2010 flash crash or the Forex scandal of 2013, where traders colluded to manipulate benchmarks, highlight both the risks and importance of transparency.

- Understanding market structure allows traders to anticipate liquidity gaps and slippage, especially during news releases.

Conclusion

Foreign exchange trading is a vast, dynamic, and accessible market that offers both opportunities and risks. By understanding how currency pairs work, choosing a reliable broker, applying proven strategies, and mastering risk management, traders can build a sustainable path toward profitability. The forex market rewards discipline, patience, and continuous learning. Whether you are starting with a demo account or refining advanced strategies, remember that success comes from knowledge, practice, and resilience. The article above from Tipstrade.org has just provided you . We hope that you find it useful. Wishing you successful trading!