ETFs vs Mutual Funds are two of the most commonly chosen investment vehicles for individuals building long-term portfolios. For someone who wants hands-off investing, Mutual Funds may feel familiar. Meanwhile, investors who appreciate flexibility and lower expense ratios often lean toward ETFs. This article explains how each product works, uses simple comparisons, and includes real-world examples, just like a financial advisor would explain to a beginner. Explore the detailed article at tipstrade.org to be more confident when making important trading decisions.

What Are ETFs?

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges just like individual stocks. An ETF typically holds a basket of assets—stocks, bonds, commodities, or index-based securities—allowing investors to gain diversified exposure without buying each asset individually.

From a structural standpoint, most ETFs are designed to track an underlying index such as the S&P 500 or NASDAQ-100.

ETFs are known for lower expense ratios, intraday trading flexibility, and high transparency, as many publish their holdings daily. According to research from Morningstar and the Investment Company Institute (ICI), ETFs often have lower costs than actively managed mutual funds, making them attractive for long-term passive investors.

From a user experience perspective, investors value ETFs because they can buy or sell them at any time during market hours, place limit orders, and observe price changes throughout the day. This makes ETFs suitable for people who prefer more control over trade execution.

Who should consider ETFs?

- Investors wanting passive, low-cost diversification

- Traders who prefer intraday liquidity

- People with long-term goals who want tax-efficient growth

How ETFs Work

ETFs operate through a creation and redemption mechanism handled by Authorized Participants (APs), typically large financial institutions. When demand for an ETF rises, APs create new shares by delivering a basket of underlying assets to the fund provider.

When demand decreases, they redeem ETF shares for the underlying assets. This helps keep ETF prices close to their net asset value (NAV).

Because ETFs trade like stocks, the buying and selling occur between investors on the secondary market, not directly with the fund.

This process reduces capital gains events, making ETFs more tax-efficient than most mutual funds. Research from Vanguard and Fidelity confirms that index-based ETFs typically trigger fewer taxable distributions.

In real-world usage, a new investor might buy an S&P 500 ETF to instantly gain exposure to 500 companies. Rather than researching each firm, the ETF provides automatic diversification.

This simplicity is one reason ETFs have become popular for retirement portfolios and systematic investing strategies.

Fees, Taxes & Liquidity of ETFs

ETFs generally offer some of the lowest expense ratios in the investment world. Many index ETFs charge under 0.10%, according to BlackRock’s iShares industry averages.

Lower fees mean investors retain more of their returns over time, especially in long-term compounding scenarios.

Tax efficiency is another major advantage. Because ETFs use the “in-kind” creation and redemption process, they rarely distribute capital gains compared with mutual funds. For U.S. investors, this makes ETFs very appealing for taxable accounts.

Liquidity is closely tied to trading volume and the liquidity of the underlying assets. ETFs with high daily volume, such as SPY or QQQ, offer extremely tight bid-ask spreads, making them easy to enter or exit.

For smaller niche ETFs, spreads may widen, but they generally remain more flexible than mutual funds, which only trade once per day.

In practice, many investors appreciate the ability to buy fractional shares (depending on the broker), rebalance instantly, and control trade timing during market swings.

Who Should Invest in ETFs?

ETFs are ideal for investors who value simplicity, low cost, and flexibility. A passive investor building a diversified long-term portfolio may prefer ETFs because they track major indexes with minimal fees.

Someone who wants to dollar-cost average into the market can easily use ETFs without worrying about load fees or high minimum investment requirements.

ETFs also suit investors who appreciate transparency—most ETF providers disclose their holdings daily.

For individuals who want to execute trades during market volatility, ETFs offer real-time pricing and the ability to use advanced order types.

On the other hand, ETFs may be less suitable for investors seeking hands-on professional management or those who prefer automatic dividend reinvestment without additional steps.

Still, for people aiming for tax-efficient, low-maintenance growth, ETFs remain one of the most efficient options available.

What Are Mutual Funds?

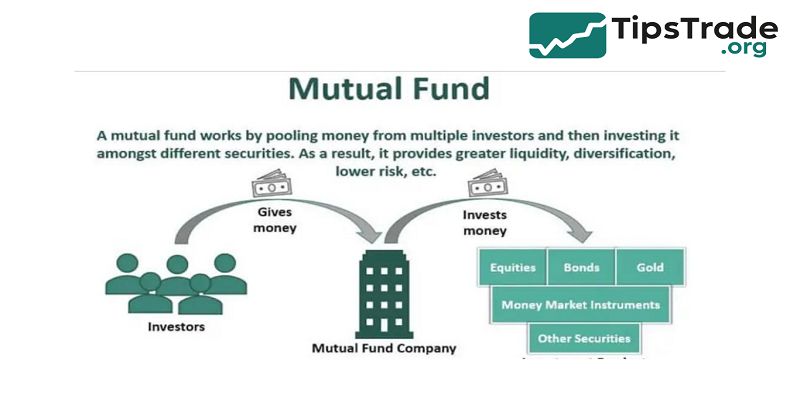

Mutual Funds are investment vehicles that pool money from many individuals to purchase a diversified portfolio of stocks, bonds, or other assets.

Unlike ETFs, Mutual Funds do not trade throughout the day; instead, they settle once daily after the market closes. The price at which investors buy or sell mutual fund shares is based on the Net Asset Value (NAV).

Many mutual funds are actively managed, meaning professional fund managers make buying and selling decisions to outperform an index.

Research from the ICI shows that while active management adds expertise, these funds typically come with higher expense ratios due to research, trading, and operational costs.

For new investors, mutual funds offer a comforting structure: automatic reinvestment, straightforward contribution methods, and simple long-term strategies. Investors don’t need to worry about trade timing—everything is handled automatically.

Mutual funds can be beneficial for retirement accounts, long-term saving plans, or investors who simply prefer expert oversight rather than managing trades themselves.

How Mutual Funds Work

Mutual Funds issue and redeem shares directly with investors, not through secondary market trading.

Every transaction happens at the day’s closing NAV. This means investors cannot react instantly to market changes.

While this may feel limiting to active traders, it helps long-term investors stay disciplined.

Most actively managed mutual funds aim to outperform benchmarks through research-driven decisions.

Fund managers analyze economic data, financial statements, and market trends to build portfolios. According to S&P Dow Jones Indices, however, a majority of active funds underperform their benchmarks over long periods, especially after accounting for fees.

Still, Mutual Funds remain valuable for investors who want full professional management.

For example, a beginner with little time to research might choose an actively managed fund because the portfolio manager handles asset selection and rebalancing. This convenience factor explains why mutual funds continue to be widely used in retirement plans such as 401(k)s.

Fees, Taxes & Flexibility of Mutual Funds

Mutual funds tend to have higher operating costs, especially actively managed ones. Expense ratios of 0.50%–1.00% are common, according to Morningstar.

Some funds also charge front-end or back-end loads, increasing the overall cost of ownership.

Tax efficiency can be less favorable. Because mutual funds must distribute capital gains each year, investors in taxable accounts may receive unexpected tax liabilities—even if they didn’t sell their shares. ETFs typically avoid this issue.

Flexibility is also more limited. Investors can only buy or sell at end-of-day NAV, making trade timing unpredictable.

For example, during volatile market conditions, an investor might want to sell immediately, but mutual fund rules require waiting until the market closes.

However, mutual funds excel in features like automatic reinvestment and systematic investment plans, which make them convenient for hands-off savers.

Who Should Invest in Mutual Funds?

Mutual funds are ideal for investors who prefer professional management, structured guidance, and long-term discipline.

If someone does not want to monitor the market or execute trades, an actively managed mutual fund provides a “set it and forget it” approach.

These funds also suit retirement savers who rely on employer-sponsored plans like 401(k)s, where mutual funds remain the default investment option.

Investors who value automatic rebalancing and reinvestment will appreciate the convenience built into mutual fund systems.

However, mutual funds may not appeal to investors who prioritize low fees, tax efficiency, or intraday trading.

For those goals, ETFs often perform better. Still, mutual funds remain a good choice for people who trust professional fund managers to manage risk and choose winning assets over time.

ETFs vs Mutual Funds – Key Differences

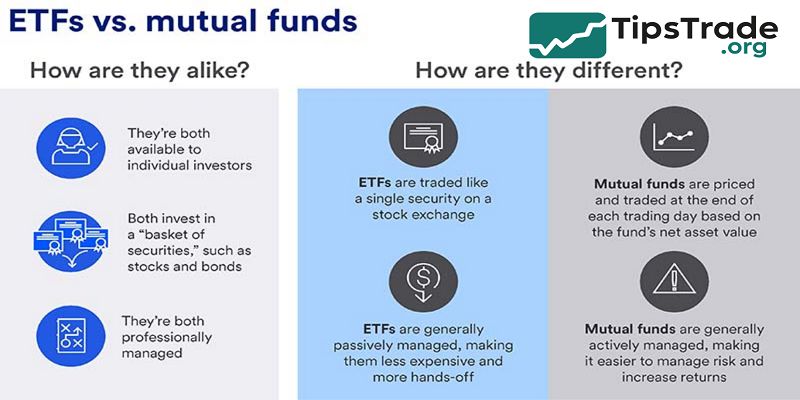

Although ETFs and mutual funds share the goal of diversified investing, they differ across cost structure, tax treatment, management style, and trading mechanism.

Understanding these differences helps investors choose the right option for their financial objectives.

A passive investor may prefer ETFs for their low fees and strong tax efficiency, while someone who values professional oversight or active management may gravitate toward mutual funds.

The table below summarizes the core differences:

| Feature | ETFs | Mutual Funds |

| Trading | Intraday | End of day |

| Management | Mostly passive | Often active |

| Expense ratios | Very low | Higher |

| Tax efficiency | High | Moderate/low |

| Minimum investment | Low/no minimum | Often required |

| Flexibility | High | Moderate |

| Transparency | Daily holdings | Monthly/quarterly |

These distinctions shape how investors use each product in their portfolios.

Fees & Trading Costs

ETFs generally have lower expense ratios because most of them follow a passive index-tracking approach. According to Vanguard, ETF expenses can be as low as 0.03%, allowing investors to compound their returns more efficiently. Mutual funds, especially actively managed ones, involve research teams and higher operational costs, which translate into expense ratios of 0.50%–1.00% or more.

Trading costs also differ. ETFs may incur brokerage commissions depending on the platform, although most brokers now offer zero-commission trading.

Mutual funds may charge front-end loads (sales fees when buying) or back-end loads (when selling).

For long-term investors, lower costs often correlate with stronger net returns. Multiple studies,

including research from Morningstar, show that funds with lower expenses tend to outperform higher-cost alternatives over long horizons.

Because of this, cost-conscious investors often lean toward ETFs, while those seeking professional management might accept higher mutual fund fees.

Risk & Transparency

Risk levels depend more on the underlying assets than on whether the product is an ETF or mutual fund. However, the transparency and trading mechanics can influence perceived risk.

ETFs publish their holdings daily, allowing investors to see exactly what they own at any time. Mutual funds usually disclose holdings monthly or quarterly, creating a slight information delay.

Liquidity risk also differs. ETFs can be traded instantly during market hours, reducing the uncertainty of market timing. In contrast, mutual funds trade only once per day, which may create anxiety for investors during volatile market conditions.

For example, during a market downturn, an ETF investor can sell immediately, while a mutual fund investor must wait until the NAV is calculated after closing. This structural difference may influence investors’ risk comfort levels.

Still, both products diversify risk across many securities, making them suitable for long-term wealth building.

Performance Differences

- Historically, many ETFs perform in line with their benchmark indexes because they are passively managed.

- Their performance tends to be consistent and predictable. Mutual funds, particularly active ones, vary significantly depending on the skill of the fund manager.

- S&P Dow Jones SPIVA reports consistently show that over 80% of active managers underperform the S&P 500 over 15 years.

- The combination of higher fees and trading costs makes long-term outperformance difficult.

- However, there are exceptions. A small percentage of active funds do beat the market, especially in specialized areas like emerging markets or small-cap equities.

- For investors who believe in active management, mutual funds provide an opportunity to outperform the market—though with higher risk and uncertainty.

- ETFs, on the other hand, appeal to investors who prefer tracking the market reliably rather than attempting to beat it.

Tax Comparison

- Tax efficiency is one of the biggest advantages ETFs hold over mutual funds. Because ETFs use the in-kind creation and redemption mechanism, they can avoid realizing capital gains during most transactions.

- This means investors rarely receive capital gains distributions unless they sell the ETF themselves.

- Mutual funds must distribute realized capital gains annually. If the fund manager sells appreciated assets during the year, investors receive a taxable distribution—even if they did not sell any shares.

- For people with taxable brokerage accounts, this can create unexpected tax bills.

- Investors relying on tax-efficient long-term growth often choose ETFs, while mutual funds may still be suitable inside tax-advantaged accounts such as IRAs or 401(k)s.

Flexibility & Trading Control

- ETFs offer significantly more trading flexibility. Investors can buy them at any time during market hours, use limit orders, stop-loss orders, or even perform short-term tactical trades.

- This makes ETFs ideal for investors who value execution control.

- Mutual funds do not provide this flexibility. All orders execute at the end-of-day NAV. While this is simpler, it removes the ability to react strategically to market movements.

- Investors who appreciate simplicity often find this structure reassuring, while experienced traders may find it restrictive.

- Overall, ETFs provide higher flexibility, while mutual funds offer a more controlled, hands-off experience.

Funds ETFs vs Mutual Funds– Which Should You Choose?

Choosing between ETFs and mutual funds depends on your investment goals, risk tolerance, and personal preferences. Investors who value low fees, tax efficiency, and trading flexibility typically prefer ETFs.

Someone who wants professional management or participates in employer retirement plans may lean toward mutual funds.

A practical approach is to use both. For example, a retirement saver may rely on actively managed mutual funds inside a 401(k) but build a taxable brokerage account with low-cost ETFs. This combination leverages the strengths of each product.

Based on Investment Style

- Passive investors → ETFs are likely superior due to low costs and index tracking

- Active investors → mutual funds may appeal due to professional management

- Hands-off savers → mutual funds offer automatic reinvestments and stability

- Tactical traders → ETFs provide real-time trading capabilities

Understanding your style ensures you pick the product that lowers stress and improves long-term outcomes.

Based on Financial Goals

Short-term investors who value liquidity and precise execution typically prefer ETFs. Long-term retirement savers may choose mutual funds for their structured and disciplined framework. Someone focusing on tax efficiency for a taxable account will benefit more from ETFs.

Your goals influence the ideal investment vehicle. For example:

- Wealth growth → ETFs (low cost)

- Professional guidance → Mutual funds

- Stable contributions → Mutual funds

- Tax optimization → ETFs

Conclusion

ETFs and Mutual Funds both offer diversified, long-term investment opportunities, but they serve different needs. ETFs provide low costs, tax efficiency, and trading flexibility, making them ideal for hands-on investors who want more control. Mutual funds offer professional management and structured investing, making them beneficial for retirement accounts and hands-off savers.