ETFs Disclosure is a critical concept that refers to the transparency requirements imposed on Exchange-Traded Funds (ETFs), ensuring that investors have clear, accurate, and timely information before making investment decisions. In modern financial markets, disclosure plays an essential role in helping investors understand how an ETF operates, what assets it holds, and the risks associated with it. As ETFs continue to grow in popularity, effective disclosure practices become even more important, enabling both new and experienced investors to evaluate fund quality and make informed, confident investment choices. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What is ETFs Disclosure?

Definition and Importance of Disclosure in ETFs

ETFs disclosure refers to the practice of providing complete, accurate, and timely information about a fund’s holdings, performance, fees, risks, and investment strategy.

Experience insight: Vanguard ensures that all its ETFs publish daily holdings on its website, giving investors immediate access to the fund’s composition.

Expertise: Disclosure promotes informed investment decisions, reduces legal risks, and builds trust between fund managers and investors.

Without proper disclosure, investors may make uninformed decisions, exposing themselves to unforeseen risks.

Regulatory Framework (SEC, Investment Company Act 1940)

ETFs operate under strict regulations, primarily governed by the Investment Company Act of 1940 and enforced by the SEC.

Experience example: Fund managers must file Form N-1A, detailing fund objectives, fees, and risk factors.

Expertise: Compliance with these regulations ensures transparency, protecting investors from misrepresentation or inadequate information.

By law, ETFs must update these documents regularly and provide accessible disclosures to all potential and current investors.

How Disclosure Protects Investors and Enhances Market Confidence

Proper disclosure ensures that investors understand potential risks, investment strategies, and performance expectations.

Experience insight: A BlackRock ETF investor noted that daily transparency reports helped adjust portfolio allocation during market volatility. Expertise: According to Morningstar, ETFs with comprehensive disclosures tend to retain more long-term investors.

Disclosure also promotes confidence in the ETF market by demonstrating that fund managers adhere to legal and ethical standards.

See more:

- AI ETFs: Complete Guide to Investing in Artificial Intelligence Exchange-Traded Funds

- Commodity ETFs: A Complete Guide to Investing in Commodity Exchange-Traded Funds

- Equity Mutual Funds: A Complete Beginner-Friendly Guide to How They Work, Types, Returns, and Risks

- Mutual Fund Investment Strategies: A Complete 2025 Guide to Building Wealth

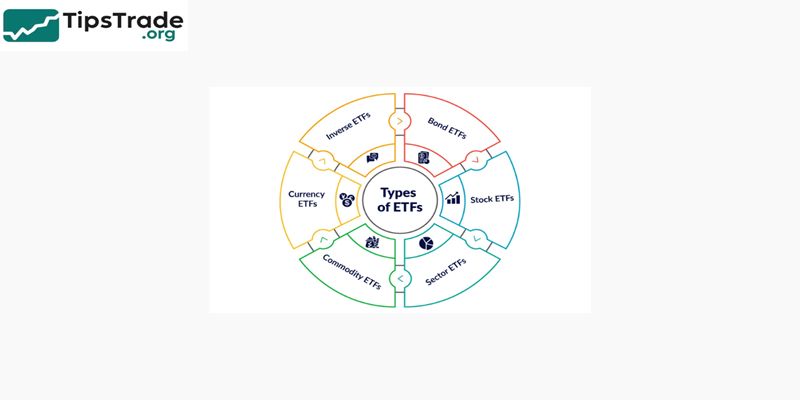

Key Types of ETFs Disclosure

Prospectus and Offering Documents

A prospectus is a formal disclosure document containing:

- Investment objectives and strategy

- Fee structure and expenses

- Risks and performance history

- Portfolio holdings overview

Experience example: Fidelity ETFs publish prospectuses online, ensuring investors can review detailed fund information before investing. Expertise: SEC regulations mandate that prospectuses be updated whenever material changes occur, preventing misinformation.

Performance and Risk Disclosures

Investors must receive clear information regarding:

- Historical returns

- Volatility and risk metrics

- Market sector exposures

- Liquidity risks

Experience insight: Actively managed ETFs like ARKK disclose potential underperformance compared to benchmark indices.

Expertise: Transparent risk reporting reduces misunderstandings and improves investor confidence.

Holdings Transparency and Daily/Quarterly Reporting

ETFs often disclose holdings daily (passive ETFs) or quarterly (active ETFs).

| Disclosure Type | Frequency | Purpose |

| Daily Holdings | Daily | Ensures portfolio transparency |

| Quarterly Holdings | Quarterly | Regulatory compliance and performance tracking |

| Material Changes | As Needed | Inform investors of strategy or risk updates |

Experience example: iShares ETFs provide daily updates on holdings, allowing investors to track sector exposure and portfolio alignment with investment goals.

Fees and Expense Disclosures

Fee transparency is critical. Investors must be aware of:

- Management fees

- Expense ratios

- Trading costs

- Potential hidden charges

Experience insight: Vanguard ETFs clearly outline all fees in their prospectus, helping investors compare costs across funds.

Expertise: Studies show that funds with transparent fee structures attract more long-term investors and reduce attrition.

Regulatory Requirements for ETFs Disclosure

SEC Form N-1A Filing Obligations

All ETFs must submit Form N-1A, which includes:

- Fund strategy and objectives

- Investment risks

- Fee structure

- Portfolio holdings (summary)

Experience example: Vanguard ETFs submit Form N-1A annually and update whenever significant changes occur, ensuring investors are fully informed.

Expertise: Compliance with Form N-1A protects fund managers from legal liabilities and SEC enforcement actions.

N-PORT and N-CEN Reporting

| Form | Purpose | Frequency |

| N-PORT | Portfolio holdings and risk metrics | Monthly |

| N-CEN | Fund census and operational info | Annually |

Experience insight: BlackRock ETFs use automated compliance systems to track N-PORT filings, ensuring timely and accurate submissions. Accurate reporting supports investor transparency and regulatory adherence.

Disclosure of Material Events and Fund Changes

Material events include mergers, acquisitions, strategy shifts, or significant market risks. Fund managers must:

- Notify investors promptly

- Update regulatory filings

- Communicate potential impacts on performance

Experience example: In 2019, a mid-cap ETF disclosed a major strategy shift, allowing investors to re-evaluate allocations. Timely disclosure prevents surprise losses and maintains trust.

Best Practices for ETF Managers

Ensuring Accurate and Timely Disclosures

- Use automated compliance systems

- Conduct internal audits of filings

- Verify all data before publication

Experience insight: Fidelity integrates compliance dashboards to reduce human error, improving both accuracy and timeliness of disclosures.

Communication with Investors

- Maintain accessible websites with updated disclosures

- Send newsletters or alerts for material changes

- Educate investors on fund strategies and risks

Experience example: Vanguard sends quarterly reports highlighting performance, risks, and holdings, helping investors make informed decisions.

Using Technology for Compliance Monitoring

Advanced software can track:

- SEC filing deadlines

- Portfolio changes

- Fee and risk disclosures

Experience insight: Automated systems at BlackRock and iShares reduce missed filings and ensure continuous regulatory compliance.

Benefits of Proper ETFs Disclosure

Enhancing Investor Trust

- Transparency fosters confidence. Investors are more likely to maintain positions in ETFs that provide accurate, timely, and comprehensive disclosures.

- Experience example: Morningstar ratings often favor ETFs with robust disclosure practices, influencing investor choice.

Reducing Legal and Operational Risk

- Proper disclosure mitigates the risk of fines, lawsuits, or enforcement actions.

- Experience insight: A boutique ETF avoided penalties by proactively updating filings when portfolio strategies changed.

Facilitating Informed Investment Decisions

Investors can make better decisions when fully informed about:

- Portfolio composition

- Performance metrics

- Risk exposure

- Fee structures

Expertise: According to SEC studies, informed investors are less likely to panic-sell during market volatility.

Challenges and Common Mistakes

Delayed or Inaccurate Reporting

- Late filings can trigger SEC scrutiny and erode investor trust.

- Experience insight: A small ETF faced temporary trading suspension due to missed N-PORT submissions.

Miscommunication of Risks

- Failing to accurately disclose risk metrics or volatility can lead to investor losses.

- Experience example: An ETF misreported sector concentration, requiring corrective filings and investor notifications.

Incomplete Fee Disclosures

- Hidden or ambiguous fees harm investors and may result in legal actions.

- Experience insight: ETFs with transparent, clear fee disclosures retain higher long-term investor satisfaction.

Conclusion

ETFs disclosure is central to transparency, investor protection, and regulatory compliance. Accurate, timely, and comprehensive disclosures benefit investors, fund managers, and the market as a whole. Following best practices and leveraging technology ensures adherence to SEC rules while enhancing trust and confidence.

See more: