In the foreign exchange market, the economic calendar for forex is an essential tool for traders. So, what does the economic calendar for forex mean for traders? And how can you read and use it effectively? The answers are right in the article below!

What is the economic calendar for forex?

The economic calendar for forex is an important information table about upcoming economic data releases. It includes information such as: Inflation (CPI), Gross Domestic Product (GDP), Number of unemployment benefit claims, House Price Index (HPI), and many other economic indicators. The necessity of the Forex economic calendar for Forex traders cannot be denied.

In fact, there are many factors that influence the Forex market, and traders need to grasp them in order to have good trading opportunities. In addition, news will have different levels of importance such as low, medium, or high. With news that carries significant meaning, there will be major impacts on the Forex market.

Not only that, this information has a significant impact on the prices of currency pairs. Therefore, Forex traders often check the economic calendar for forex to anticipate upcoming economic data releases and prepare their trading mindset accordingly.

On the other hand, traders can easily search for and use the economic calendar for forex from various places on the internet. Some brokers provide the Forex economic calendar for traders to analyze, such as ForexFactory, Investing.com, or Fxstreet….

Why should traders look at the economic calendar for forex?

The economic calendar for forex helps traders stay updated and catch important news in the Forex market. This allows them to prepare suitable trading strategies. Here are some clear reasons why a trader should use the economic calendar for forex:

- Update news quickly and accurately: You can search for information from anywhere on the internet, but the information will be updated slowly and may not be complete. In contrast, you can be assured of the information from the economic calendar for forex. Because this calendar will quickly and fully update the information in the Forex market.

- News trading requires using the economic calendar for forex: Clearly, news trading needs a lot of information from the Forex market. With the economic calendar for forex, when important economic data is released, traders can quickly enter the market to trade according to the general trend of the market. This helps increase the success rate in news trading.

- Better emotional control when trading Forex: By being aware of upcoming economic data releases and the market’s reactions, traders will not be caught off guard and will not react too strongly. This helps them maintain cool trading decisions and not be influenced by emotions.

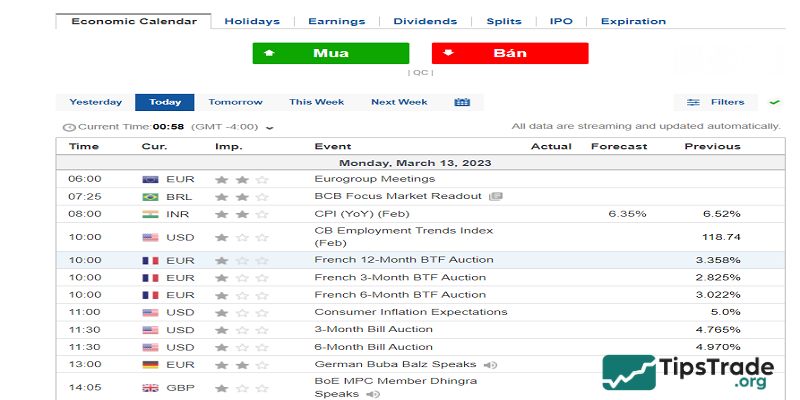

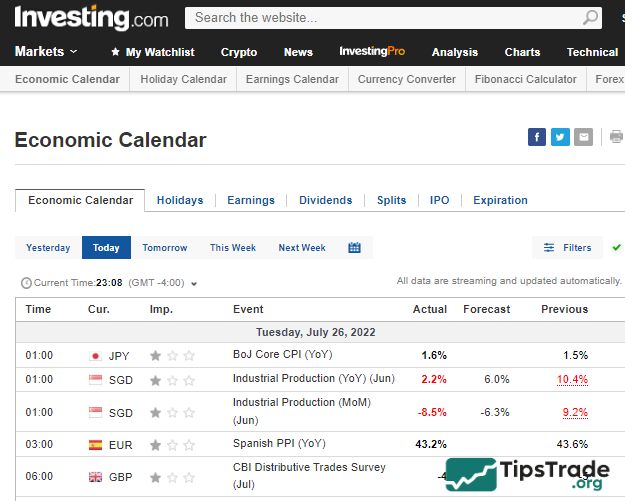

How to read the economic calendar for forex

Reading the economic calendar for forex is extremely simple and does not take much time for traders. Below is the clear structure of an economic calendar for forex, which is presented in a single table:

- Date – the scheduled release date of relevant news

- Time Remaining – the countdown to the event

- Event – the name of the event. If you want to view detailed information, left-click on the event

- Impact – the level of influence, showing how specific news affects currencies

- Previous – the previous value

- Forecast – the expected value

- Actual – the current value

- Time Zone – where Forex traders can select their preferred time zone.

These are the key pieces of information traders should pay attention to when checking the economic calendar for forex. Depending on their trading plan and market conditions, each trader will view and use this information differently.

How to use the economic calendar for forex effectively

To use the economic calendar for forex effectively, traders need to:

Identify important data

Traders must determine which economic indicators have the greatest impact on the Forex market they are focusing on, such as GDP, inflation, unemployment rate, and more. To make monitoring easier, they can mark these key indicators on the economic calendar for forex.

Closely follow the economic calendar for forex

After identifying the important data, traders should closely track the economic calendar for forex to know the exact release time of these indicators. This helps them prepare mentally and plan appropriate trading strategies.

Analyze economic data thoroughly

Once the information on the economic calendar for forex is released, traders need to carefully analyze the economic figures to assess their impact on the market. They should also adjust their trading strategies accordingly. If the actual data is higher than the forecast, prices are likely to rise; if it is lower, prices may fall.

Enter the market promptly

After analyzing the data and identifying market trends, traders should quickly enter the market to take advantage of opportunities. This is an important step in profiting from news-based trading using the economic calendar for forex.

Monitor market movements closely

In reality, traders must keep a close eye on market movements to see whether the market reacts as expected. If the reaction is stronger than anticipated, they should consider exiting early to protect capital; if the reaction is more stable, they can maintain the position to maximize profits.

Set a Stop Loss

When trading, traders must set a Stop Loss order to limit risks. The Stop Loss will automatically close the trade if the market moves against the initial prediction. This is an essential method for protecting capital when trading news.

Set a Take Profit

When the market moves as predicted, traders should set a Take Profit order to automatically close the trade at the desired profit level. This helps control emotions and prevents missed profit opportunities.

Evaluate trading results

After completing a trade, traders should evaluate the outcome to learn from the experience for future trades. Key aspects to assess include data analysis, market monitoring, and risk management. This reflection helps traders improve their news-trading skills.

Additionally, you can explore different news-trading methods and the level of impact news events have on trading to better understand the importance of economic releases in the Forex market.

Top events to watch on the economic calendar for forex

Not all economic data is created equal. Here are the most impactful indicators to monitor:

|

Indicator |

Description |

Currency Pairs Affected |

|

Non-Farm Payrolls (NFP) |

U.S. employment report |

USD pairs |

|

Interest Rate Decisions |

Central bank policy |

All major currencies |

|

Consumer Price Index (CPI) |

Inflation measure |

EUR, GBP, USD, etc. |

|

GDP Growth Rate |

Economic performance |

JPY, AUD, CAD, etc. |

|

Retail Sales |

Consumer spending |

USD, GBP |

|

Unemployment Rate |

Labor market strength |

EUR, AUD |

Tools and platforms offering the economic calendar for forex

Forex traders and investors can access a trading calendar forex tool on many popular platforms and financial websites. Some trusted sources include:

- Investing.com

- Forex Factory

- DailyFX

- Trading Economics

- MetaTrader (with calendar plugin)

Each of these platforms provides real-time updates, customizable filters, and historical data to help you analyze market behavior over time.

Real-world example: How economic calendar for forex help avoid a losing trade

Imagine you are preparing to enter a short position on the EUR/USD pair based on technical signals indicating a downtrend. Before executing the trade, you check the economic calendar for forex and notice that the European Central Bank (ECB) will announce its interest rate decision in just a few hours.

Instead of rushing into a trade, you decide to wait. The ECB unexpectedly announced a dovish policy. The EUR is weakening, confirming your trading signal. At this point, you enter the order after the news is released, with better confirmation – and avoid the strong volatility before the news that could cause your order to be stopped out.

This is the power of aligning trades with the economic calendar.

Tips for maximizing your use of the economic calendar for forex

- Customize your view: Filter by currency and impact level to avoid clutter.

- Use notifications: Set alerts before major releases.

- Track results: Maintain a trading journal and log how news events influenced your trades.

- Avoid overtrading: Don’t feel compelled to trade every news event—focus on quality over quantity.

- Learn event patterns: Over time, you’ll notice patterns; how the USD reacts to NFP, or how the AUD responds to Chinese GDP. Use this historical behavior to your advantage.

Conclusion

Here is the information about the economic calendar for forex that everyone needs to know. Through Tipstrade.org’s article, readers will have a clearer view of the economic calendar for forex. It brings many benefits to traders. Therefore, traders need to always update information in a timely manner as well as thoroughly research information to enhance their position in the market and seize opportunities.