Copy trade forex is a popular trading method that allows traders to automatically mirror the trades of experienced professionals in the forex market. Copy trade forex provides a unique opportunity for beginners to enter the market without deep knowledge or complex analysis, leveraging the expertise of skilled traders. Through this article, let’s explore in detail with tipstrade.org the advantages, potential risks, and essential tips for successful copy trading in forex, helping you make informed decisions and improve your trading journey.

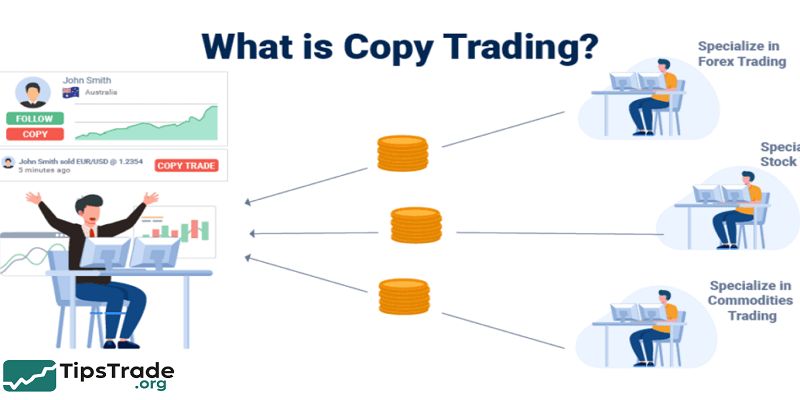

What Is Copy Trade Forex?

Copy trade forex (also called forex copy trading) is a form of social trading where one trader (the follower) copies the trades of another trader (the provider). When the provider opens a trade, the same order is executed in the follower’s account, scaled according to balance or lot size.

Example: If a provider with $10,000 buys EUR/USD at 1 lot, a follower with $1,000 will automatically open 0.1 lots, keeping the same risk ratio.

Copy trading differs from manual trading:

- Manual trading requires analyzing charts, reading economic data, and making independent decisions.

- Copy trading delegates this responsibility to an experienced trader, saving time but increasing dependency.

It is also distinct from mirror trading or signal services. Mirror trading replicates algorithmic strategies, while signals only suggest trades that followers must place manually.

Copy trading, in contrast, is usually automatic.

With platforms like eToro, ZuluTrade, and MQL5, copy trade forex has become accessible to anyone with internet access.

>>See more:

- What is Forex? The Complete Guide for Beginners

- What are exchange rates? How to read and analyze rates in Forex

- Top 10 best forex currency pairs to trade in 2025

- Essential Forex Orders every trader must know

- What is forex trading? A detailed guide to forex trading from A – Z

How Does Copy Trading Work in Forex?

The process of copy trading in forex is straightforward:

- Trader (Provider): An experienced trader opens or closes trades.

- Platform: The system transmits these orders in real time.

- Follower: The follower’s account executes the same orders proportionally.

Technology Behind Copy Trading

Modern copy trading relies on APIs, cloud servers, and integrations with platforms like MetaTrader 4/5. Followers can usually choose:

- Automatic copying – every trade is mirrored instantly.

- Semi-automatic copying – trades appear for approval.

- Manual copying – followers review and place trades themselves.

Example

- A provider with a consistent 65% win rate enters a GBP/USD long position.

- The follower’s account copies it automatically, adjusted for account balance.

- Results may differ slightly due to execution speed, broker slippage, or internet latency.

This mechanism makes forex copy trading attractive but also highlights the importance of selecting the right provider and platform.

Benefits of Copy Trade Forex

The main appeal of copy trading lies in its convenience and accessibility.

Key benefits include:

- Time efficiency: No need to spend hours analyzing charts.

- Access to expertise: Learn from experienced traders with proven track records.

- Suitable for beginners: Even with little forex knowledge, investors can participate.

- Diversification: Copying multiple providers spreads risk across strategies.

- Reduced emotional stress: Automated execution minimizes impulsive decisions.

For example, a full-time professional who cannot watch the market can still profit from forex movements by copying traders with steady performance.

Research from Finance Magnates shows that over 40% of beginner forex investors start with copy trading due to its low learning curve.

While returns vary, many report gaining both profits and valuable education.

In short, forex copy trading allows you to invest like a pro — without becoming one overnight.

Risks and Drawbacks of Copy Trade Forex

Despite its advantages, copy trading has limitations and risks.

Main drawbacks include:

- Dependence on providers: If the trader loses money, so do you.

- Selection risk: Choosing a provider with only short-term success can lead to heavy losses.

- Overconfidence: Some beginners assume copy trading guarantees profits.

- Costs: Platforms may charge spreads, commissions, or subscription fees.

- Technical risks: Slippage, delayed execution, or system downtime can reduce accuracy.

Example: A trader who gained 80% in one year may suddenly lose 40% due to market shifts. Followers copying this trader without diversification could face significant losses.

According to Investopedia , many new investors fail not because providers are unskilled, but because they misunderstand the risks.

Copy trading should be seen as a supportive tool — not a guaranteed path to wealth.

Best Copy Trading Platforms for Forex

The rise of copy trading has led to numerous platforms. The most popular include:

- eToro – The largest social trading platform, offering transparency, regulation, and user-friendly design.

- ZuluTrade – Known for advanced filtering and ranking systems to evaluate traders.

- MQL5 Signals – Integrated into MetaTrader 4/5, connecting traders directly.

- Broker-based platforms – Such as Exness Social Trading, FBS CopyTrade, OctaFX CopyTrading.

Quick Comparison Table:

| Platform | Strengths | Weaknesses | Best For |

| eToro | Regulated, easy to use, strong social features | Higher spreads/fees | Beginners & casual traders |

| ZuluTrade | Detailed analytics, many traders to choose from | Results vary by broker | Intermediate traders |

| MQL5 Signals | Direct MT4/MT5 integration, transparent | Requires technical setup | Experienced MT4/5 users |

| Broker Platforms | Low entry cost, integrated | Limited trader pool | Broker clients |

When selecting a platform, ensure it is regulated in your region and offers clear data on provider performance.

How to Choose the Right Trader to Copy

Success in copy trade forex depends largely on picking the right trader.

Evaluation criteria:

- Performance history: Look for consistent gains over 1–2 years, not just short-term spikes.

- Drawdown: A low drawdown indicates good risk control.

- Trading style: Scalping, swing, or long-term strategies may suit different investors.

- Risk management: Check if the trader uses stop-losses and proper position sizing.

- Transparency: Reliable providers openly share their track record and strategy.

Example: A trader with a steady 12% annual return and 8% drawdown may be safer than one with 80% annual returns but 50% drawdowns.

Tip for beginners: Start small, monitor performance, and diversify by copying multiple traders instead of putting all funds into one.

Money Management Strategies in Copy Trading

Capital allocation is crucial for long-term success.

Best practices include:

- Diversify: Spread funds across 3–5 traders with different strategies.

- Set maximum loss levels: Many platforms allow setting limits to stop copying after a certain drawdown.

- Proportional allocation: Copy trades based on percentage of your balance, not fixed lots.

- Regular reviews: Adjust allocations if a provider’s performance declines.

Example portfolio with $5,000:

- 40% in a conservative swing trader.

- 30% in a moderate day trader.

- 20% in a high-risk scalper.

- 10% in reserve.

A study by TradingView found that followers using diversification and strict risk controls outperformed those who copied only one provider by up to 25% annually.

Copy Trading vs Manual Trading

Both copy trading and manual trading aim for forex profits but differ in approach.

| Aspect | Copy Trading | Manual Trading |

| Time Required | Low | High |

| Knowledge Needed | Minimal | Extensive |

| Control | Limited | Full |

| Risk | Dependent on provider | Self-managed |

| Best For | Beginners, passive investors | Active, experienced traders |

Copy trading offers ease and accessibility but limits independence. Manual trading requires deep knowledge but builds long-term expertise.

Experts recommend combining both: start with copy trading to learn, then gradually practice manual trading to gain autonomy. This hybrid approach balances learning with profitability.

Conclusion

Copy trade forex is a popular method that enables traders to replicate the strategies of experienced investors, making it easier for beginners to enter the market. This approach helps reduce the learning curve and allows users to benefit from the expertise of successful traders. In conclusion, copy trade forex offers a practical way to participate in forex trading with less effort, but it still requires careful selection of reliable signal providers to manage risks effectively.